Mexico Maritime Freight Market Size, Share, Trends and Forecast by Transport Type, Application, and Region, 2025-2033

Mexico Maritime Freight Market Overview:

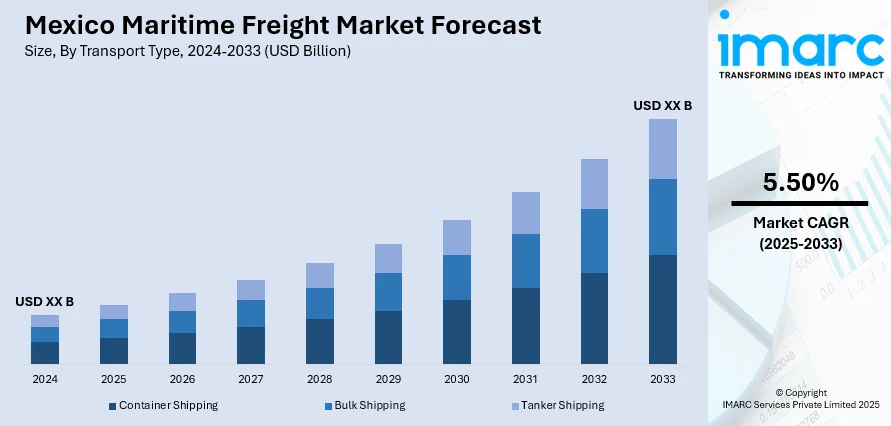

The Mexico maritime freight market size is anticipated to exhibit a growth rate (CAGR) of 5.50% during 2025-2033. The market is driven by strategic geographic positioning, rising U.S. and Latin American trade, and the government's emphasis on port upgrades and infrastructure. All these are enhancing efficiency and driving trade flows, resulting in an enhanced Mexico maritime freight share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.50% |

Mexico Maritime Freight Market Trends:

Growth in Cross-Border Trade

The increasing cross-border trade between Mexico and its neighboring countries is one of the major drivers of the Mexico maritime freight market. With Mexico establishing itself as a global manufacturing hub, there has been tremendous demand for shipping services to transport goods such as vehicles, electronics, and agricultural produce. The impact of agreements such as the US-Mexico-Canada Agreement (USMCA) has further boosted trade, reducing tariffs and simplifying logistics. Furthermore, the shift towards nearshoring, where companies relocate supply chains closer to Mexico, is expanding the volume of cargo passing through its ports. The expansion in cross-border commerce not only expanding maritime volumes of freight but also positioning Mexico as a significant participant within the global logistics, propelling the expansion in its maritime market share of freight. For instance, in July 2024, HMM and Ocean Network Express (ONE) launched a new shipping service connecting Asia and Mexico. The Far East-Latin America Express (FLX) route will have a 42-day round-trip duration, making stops in Shanghai, Busan, and Lázaro Cárdenas, Mexico, to enhance trade and logistics.

To get more information on this market, Request Sample

Increasing Adoption of Sustainability and Green Shipping Initiatives

Sustainability is becoming a critical focus in Mexico maritime freight market growth. To minimize environmental footprint and adhere to international standards on emissions, most shipping firms are embracing green technology and fuel-saving techniques. This involves the use of new fuels, ship retrofitting with green technologies, and logistics optimization for minimized fuel consumption. Besides, Mexico's membership in international environmental conventions further promotes the reduction of emissions and cleaner shipping. Consequently, Mexico is drawing investments in green shipping infrastructure, which will help drive the long-term sustainability and growth of the maritime freight industry, thus having a positive influence on the Mexico maritime freight market share. For instance, in April 2025, Yanmar Power Technology received Approval in Principle (AiP) from DNV for its GH320FC Maritime Hydrogen Fuel Cell System. This innovative system provides a flexible, scalable power solution for marine applications. The hydrogen fuel cell technology supports decarbonisation goals.

Mexico Maritime Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on transport type and application.

Transport Type Insights:

- Container Shipping

- Bulk Shipping

- Tanker Shipping

The report has provided a detailed breakup and analysis of the market based on the transport type. This includes container shipping, bulk shipping, and tanker shipping.

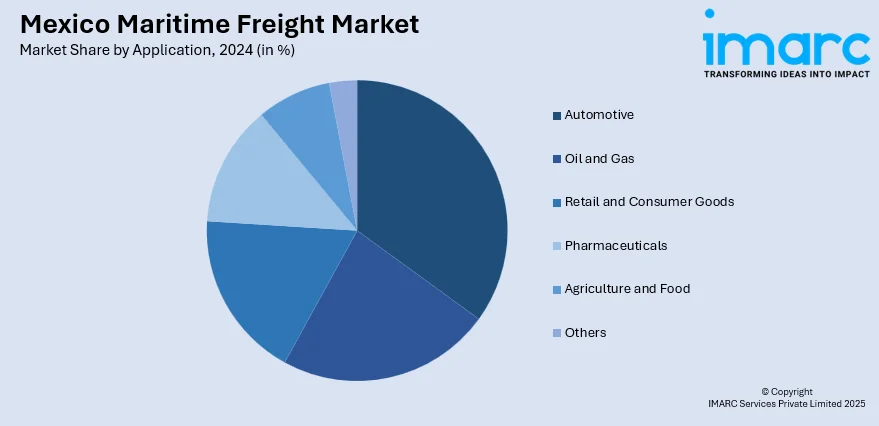

Application Insights:

- Automotive

- Oil and Gas

- Retail and Consumer Goods

- Pharmaceuticals

- Agriculture and Food

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, oil and gas, retail and consumer goods, pharmaceuticals, agriculture and food, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Maritime Freight Market News:

- In December 2024, Freight Technologies (Fr8Tech) got selected by Nestlé Mexico to support domestic logistics services. Fr8Tech will deploy its advanced freight-matching technology to optimize over-the-road shipments across Mexican lanes, enhancing transportation efficiency. This includes addressing maritime freight needs, positioning Fr8Tech as a key player in improving logistics operations in Mexico.

- In May 2024, CMA CGM announced the launch of the Mexico Express (M2X) service, connecting China and Mexico directly. This new service highlights the growing trade between the two countries and is expected to strengthen logistics and shipping operations in the region.

Mexico Maritime Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transport Types Covered | Container Shipping, Bulk Shipping, Tanker Shipping |

| Applications Covered | Automotive, Oil and Gas, Retail and Consumer Goods, Pharmaceuticals, Agriculture and Food, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico maritime freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico maritime freight market on the basis of transport type?

- What is the breakup of the Mexico maritime freight market on the basis of application?

- What is the breakup of the Mexico maritime freight market on the basis of region?

- What are the various stages in the value chain of the Mexico maritime freight market?

- What are the key driving factors and challenges in the Mexico maritime freight market?

- What is the structure of the Mexico maritime freight market and who are the key players?

- What is the degree of competition in the Mexico maritime freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico maritime freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico maritime freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico maritime freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)