Mexico Maritime Logistics Market Size, Share, Trends and Forecast by Service Type, Application, Mode of Transport, End-User, and Region, 2025-2033

Mexico Maritime Logistics Market Overview:

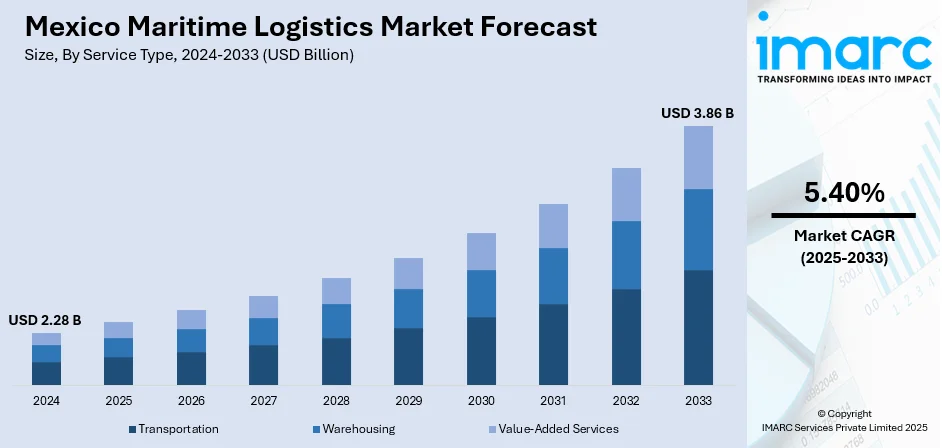

The Mexico maritime logistics market size reached USD 2.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.86 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The growth of e-commerce and direct shipping routes are key drivers of maritime logistics market in Mexico. Increased demand for fast, reliable shipping and efficient port infrastructure supports cross-border trade. Expanded global connectivity through direct routes and reefer services strengthens the position of the country as a logistics hub and contribute to the expansion of the Mexico maritime logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.28 Billion |

| Market Forecast in 2033 | USD 3.86 Billion |

| Market Growth Rate 2025-2033 | 5.40% |

Mexico Maritime Logistics Market Trends:

Increasing Demand for E-commerce and Online Retail

The swift expansion of e-commerce and online retail is a crucial factor influencing Mexico's maritime logistics sector, as changing individual preferences requires quicker and more effective delivery options. The growing volume of goods transported internationally is driving the need for reliable logistics services that can meet these demands. Mexico's developed maritime infrastructure, featuring extensive port facilities and closeness to important international markets, is essential in meeting cross-border shipping requirements. The growing demand for fast and affordable shipping, particularly in the e-commerce industry, necessitates that ports efficiently manage a large volume of smaller deliveries. In reaction to this, firms such as Maersk are investing in strategically situated logistics hubs to accommodate the increase in e-commerce transactions. In 2024, Maersk inaugurated a 30,000-square-meter logistics facility in Tijuana, Mexico, designed to enhance cross-border commerce with the United States. This facility offered IMMEX-compliant services, including warehousing, labeling, and e-commerce fulfillment, which are essential for managing the movement of goods across borders. Situated near major ports and featuring LEED Gold-certified sustainable infrastructure, the Tijuana facility showcased Mexico's growing importance as a logistics hub for e-commerce leaders and global supply networks. This advancement highlights the increasing importance of Mexico's maritime logistics industry in meeting the demands of international trade by leveraging the nation's strategic location and modern infrastructure.

To get more information on this market, Request Sample

Expansion of Direct Shipping Routes and Global Connectivity

Mexico maritime logistics market growth is significantly influenced by the expansion of direct shipping routes and enhanced global connectivity. With the rise in global trade volumes, the demand for faster and more reliable shipping services is becoming more crucial. The creation of direct shipping lanes linking Mexico to key global markets, such as Asia and North America, decreases transit durations and enhances cargo transport efficiency. These new pathways provide companies with easier access to developing markets, thereby strengthening Mexico's position as a key logistics hub. These services offer fixed schedules and dedicated vessels, resulting in more reliable and efficient transportation options, which guarantee timely deliveries and enhance supply chain reliability. Moreover, enhancing reefer connectivity for temperature-sensitive items broadens the range of products that can be exchanged between regions, such as fresh produce, pharmaceuticals, and electronics. The expansion of direct routes further enhances the competitiveness of Mexico's ports, encouraging investment in port facilities and advanced logistics solutions. This enhanced connectivity strengthens Mexico's position as a vital component of the global supply chain, attracting international shipping companies and firms seeking reliable access to the world's largest markets. In 2024, CMA CGM announced the launch of its new M2X (Mexico Express) service to connect the Far East with Mexico’s West Coast. The route includes ports like Tianjin, Qingdao, Busan, and Lazaro Cardenas, using 8 dedicated ships with fixed weekly schedules. The service also enhances reefer connectivity between Mexico, Central America, North China, and Japan.

Mexico Maritime Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, application, mode of transport, and end-user.

Service Type Insights:

- Transportation

- Warehousing

- Value-Added Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, warehousing, and value-added services.

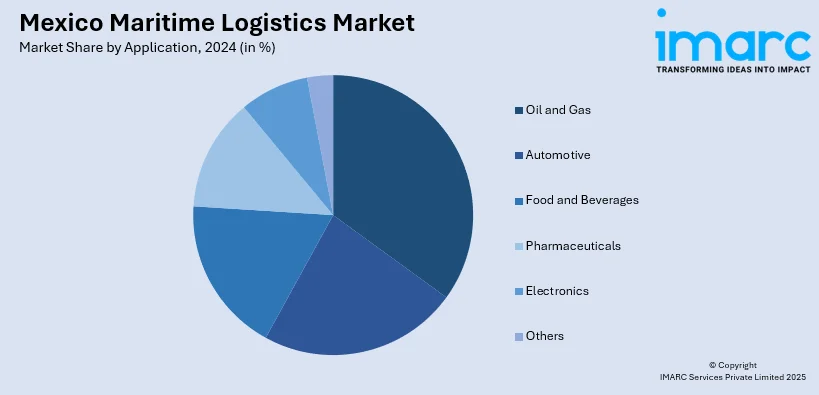

Application Insights:

- Oil and Gas

- Automotive

- Food and Beverages

- Pharmaceuticals

- Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, automotive, food and beverages, pharmaceuticals, electronics, and others.

Mode of Transport Insights:

- Sea

- Inland Waterways

The report has provided a detailed breakup and analysis of the market based on the mode of transport. This includes sea and inland waterways.

End-User Insights:

- Commercial

- Industrial

- Government

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial, industrial, and government.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Maritime Logistics Market News:

- In April 2025, KMTC Line announced a new weekly shipping service to Mexico, launching April 30, to connect Asia, the Middle East, and Latin America via ports like Shanghai, Busan, and Manzanillo. The route includes transshipment through Jebel Ali, strengthening global supply chains. This move expands KMTC’s reach in Mexico’s maritime logistics sector.

- In November 2024, Mexico announced a $3.15 billion expansion of Manzanillo Port, set to be completed by 2030, aiming to become the largest port in Latin America. The upgrade would triple capacity to 10 million TEU, supporting rising trade, especially from Asia.

Mexico Maritime Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Warehousing, Value-Added Services |

| Applications Covered | Oil and Gas, Automotive, Food and Beverages, Pharmaceuticals, Electronics, Others |

| Mode of Transports Covered | Sea, Inland Waterways |

| End-Users Covered | Commercial, Industrial, Government |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico maritime logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico maritime logistics market on the basis of service type?

- What is the breakup of the Mexico maritime logistics market on the basis of application?

- What is the breakup of the Mexico maritime logistics market on the basis of mode of transport?

- What is the breakup of the Mexico maritime logistics market on the basis of end-user?

- What is the breakup of the Mexico maritime logistics market on the basis of region?

- What are the various stages in the value chain of the Mexico maritime logistics market?

- What are the key driving factors and challenges in the Mexico maritime logistics market?

- What is the structure of the Mexico maritime logistics market and who are the key players?

- What is the degree of competition in the Mexico maritime logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico maritime logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico maritime logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico maritime logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)