Mexico Material Handling Equipment Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Material Handling Equipment Market Overview:

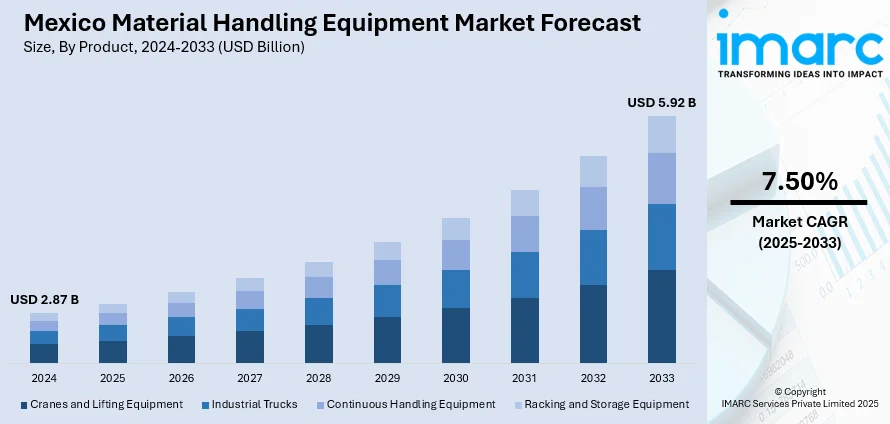

The Mexico material handling equipment market size reached USD 2.87 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.92 Billion by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The market is expanding due to the rising automation in logistics and warehousing, as well as growing investments in industrial infrastructure. Additionally, increasing labor costs and safety concerns continue to strengthen Mexico material handling equipment market share across key manufacturing and distribution sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.87 Billion |

| Market Forecast in 2033 | USD 5.92 Billion |

| Market Growth Rate 2025-2033 | 7.50% |

Mexico Material Handling Equipment Market Trends:

Increased Production Capacity Fueling Growth

The Mexico material handling equipment market growth is being driven significantly by growing production capacity and enlarging manufacturing capabilities. As Mexico's industries, including construction and agriculture, continue to expand, there is an increasing need for advanced-performance material handling equipment. In line with this, in June 2024, Bobcat Company began construction on a new USD 300 Million factory in Salinas, Victoria, Mexico, with an anticipated opening in 2026. This factory will manufacture compact track and skid-steer loaders to meet the growing demand for these machines in the region. The investment in this plant reaffirms Bobcat's commitment to building out production capacity to supply the Mexican and North American markets. Furthermore, by opening this new manufacturing facility in Mexico, Bobcat will be able to reduce logistics expenses and improve lead times, thereby making their equipment more accessible to customers. The expansion will also generate job opportunities in the local area, stimulating the local economy. This development marks the strong demand within the Mexico material handling equipment market and its ongoing growth fueled by infrastructure development and increased demand for flexible, high-performance equipment.

To get more information on this market, Request Sample

Sustainability and Efficiency Shaping Market Trends

Sustainability and operational efficiency are increasingly shaping the market. As businesses worldwide strive to meet environmental goals and lower operational costs, there is a growing preference for eco-efficient material handling solutions. Aligned with this trend, in June 2024, Kalmar, a global leader in cargo handling equipment, launched its electric empty container handler as part of its eco-efficient solutions. The electric handler, which is available in various configurations and battery sizes, is designed to enhance energy efficiency while minimizing operational costs. With a focus on decarbonization, this new model aims to reduce fuel consumption —a challenge that has long been a concern in material handling operations. The introduction of electric container handlers aligns with the growing demand for sustainable equipment that supports both cost savings and environmental responsibility. The launch reflects Kalmar’s commitment to advancing material handling equipment technologies that not only improve operational performance but also reduce environmental impact.

Mexico Material Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Cranes and Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking and Storage Equipment

The report has provided a detailed breakup and analysis of the market based on the product. This includes cranes and lifting equipment, industrial trucks, continuous handling equipment, racking and storage equipment.

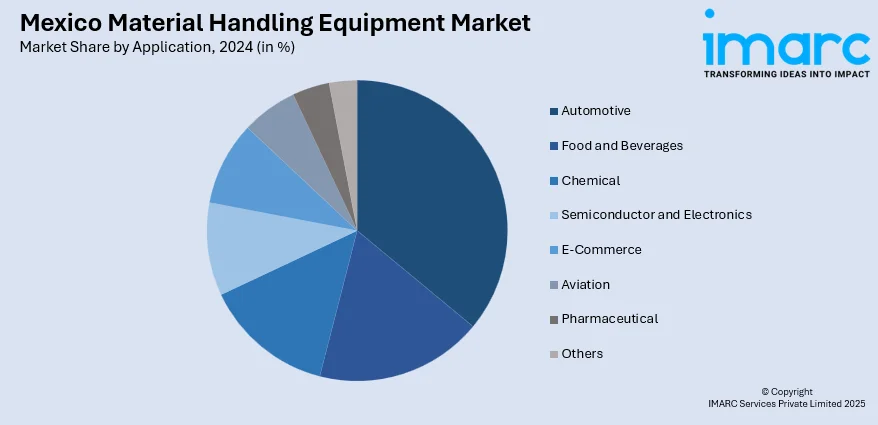

Application Insights:

- Automotive

- Food and Beverages

- Chemical

- Semiconductor and Electronics

- E-Commerce

- Aviation

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, food and beverages, chemical, semiconductor and electronics, e-commerce, aviation, pharmaceutical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Material Handling Equipment Market News:

- June 2025: ProStack launched its new range of tracked conveyors, including the TC 50, TC 60, and TR 60 models. These compact, mobile conveyors are designed for small to medium operations, enhancing stockpiling efficiency and expanding options for material handling in tight spaces and budget-conscious markets.

- March 2025: Gather AI launched MHE Vision, an AI-driven camera system for material handling equipment. This system integrates with forklifts, auto pickers, and pallet trucks to track pallet movements in real-time, improving warehouse efficiency, throughput, and safety, driving innovation in material handling markets.

Mexico Material Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cranes and Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking and Storage Equipment |

| Applications Covered | Automotive, Food and Beverages, Chemical, Semiconductors and Electronics, E-Commerce, Aviation, Pharmaceutical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico material handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico material handling equipment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico material handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The material handling equipment market in Mexico was valued at USD 2.87 Billion in 2024.

The Mexico material handling equipment market is projected to exhibit a CAGR of 7.50% during 2025-2033, reaching a value of USD 5.92 Billion by 2033.

The Mexico material handling equipment market is driven by expansion of manufacturing and e-commerce sectors, increased automation in warehouses, and growing investments in logistics infrastructure. Additionally, rising demand for efficient supply chain operations and government initiatives supporting industrial growth further fuel the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)