Mexico Material Testing Equipment Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Mexico Material Testing Equipment Market Overview:

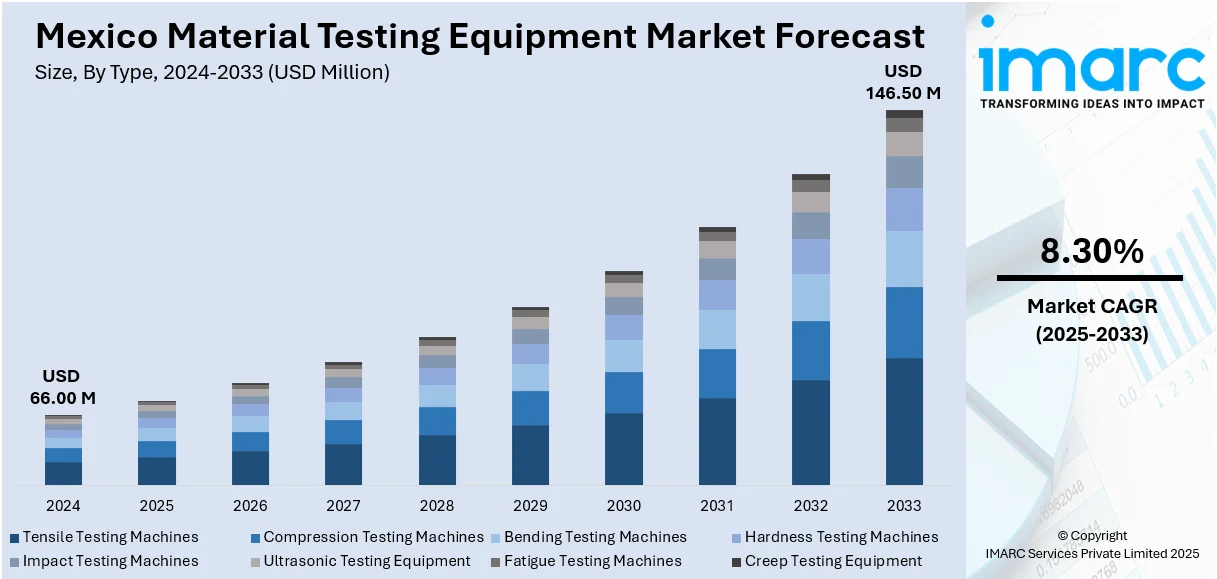

The Mexico material testing equipment market size reached USD 66.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 146.50 Million by 2033, exhibiting a growth rate (CAGR) of 8.30% during 2025-2033. The market is driven by strict enforcement of construction material standards and increasing demand for compliance in seismic-prone areas. Mexico’s role as a global hub for automotive and aerospace manufacturing requires continuous testing for mechanical integrity and international certification, thereby fueling the market. Export-driven industries demand high-precision, multi-standard testing solutions, further strengthening the Mexico material testing equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 66.00 Million |

| Market Forecast in 2033 | USD 146.50 Million |

| Market Growth Rate 2025-2033 | 8.30% |

Mexico Material Testing Equipment Market Trends:

Construction Standards and Regulatory Testing Enforcement

Mexico's national development agenda has prioritized transportation, housing, and commercial real estate expansion, especially across metropolitan hubs like Mexico City, Guadalajara, and Monterrey. The Mexican construction industry is expected to grow by 1.1% in 2023, with a long-term average annual growth of 2.8% through 2032. This growth in construction, particularly in infrastructure and green building projects, will drive demand for advanced material testing equipment in Mexico to ensure quality and compliance with both environmental standards and safety regulations. With the government enforcing NOM (Normas Oficiales Mexicanas) regulations on concrete, steel, and aggregates, construction firms are increasingly adopting certified testing practices to validate material strength and compliance. Public infrastructure tenders, such as rail systems and federal highways, require pre- and post-construction quality checks using compression, tensile, and non-destructive testing (NDT) tools. The private sector, particularly in high-rise residential and commercial construction, also demands on-site testing capabilities to avoid structural liabilities. Laboratories are equipping themselves with automated testing machines for faster throughput and traceable reporting. International firms investing in Mexican infrastructure require ASTM- and ISO-compliant testing protocols, pushing local service providers to upgrade equipment accordingly. Furthermore, seismic risks in various regions mandate strict soil testing and structural integrity assessments during site evaluation. The combination of regulatory reinforcement and international quality expectations contributes significantly to Mexico material testing equipment market growth.

To get more information on this market, Request Sample

Automotive and Aerospace Manufacturing Compliance

Mexico’s prominence in global automotive and aerospace manufacturing has elevated the need for precise material quality validation across production stages. Major automakers and aircraft component suppliers in states like Nuevo León, Guanajuato, and Querétaro require routine tensile, fatigue, impact, and hardness tests on metals, composites, and polymers. To meet OEM requirements and export standards, manufacturers rely on high-precision testing instruments aligned with ISO/IEC and SAE protocols. The push toward lightweight vehicle and aircraft components necessitates dynamic testing of new materials, including carbon fiber and high-strength steel alloys. Unit sales in Mexico’s light commercial vehicles market would reach 883.15k vehicles by 2025, with a compound annual growth rate (CAGR) of 1.87% from 2025 to 2029. The market is further expected to grow with production reaching 3.96 million vehicles by 2029. Automation in manufacturing processes has further driven demand for integrated testing systems that can monitor quality in real time, reducing rejection rates and minimizing supply chain delays. Additionally, government support through programs like Pro-Aéreo and Industry 4.0 incentives has encouraged the installation of advanced metrology and mechanical testing labs. This expansion is expected to drive demand for testing equipment in Mexico, as the growing number of vehicles on the road will require advanced testing for safety, durability, and environmental standards. As manufacturers expand R&D and prototyping capabilities within Mexico, localized material testing becomes essential for certifying safety, durability, and compliance with client and international benchmarks.

Mexico Material Testing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Tensile Testing Machines

- Compression Testing Machines

- Bending Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Ultrasonic Testing Equipment

- Fatigue Testing Machines

- Creep Testing Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes tensile testing machines, compression testing machines, bending testing machines, hardness testing machines, impact testing machines, ultrasonic testing equipment, fatigue testing machines, and creep testing equipment.

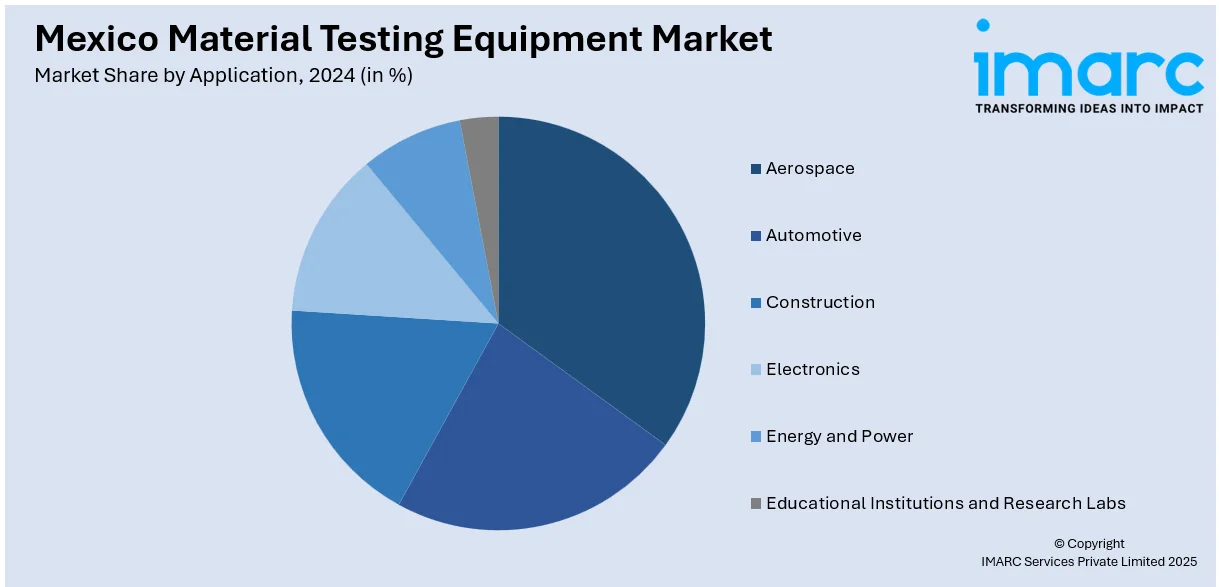

Application Insights:

- Aerospace

- Automotive

- Construction

- Electronics

- Energy and Power

- Educational Institutions and Research Labs

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace, automotive, construction, electronics, energy and power, and educational institutions and research labs.

End User Insights:

- Manufacturers

- Research and Development Laboratories

- Quality Control and Assurance Departments

- Academic Institutions

- Governmental Regulatory Bodies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturers, research and development laboratories, quality control and assurance departments, academic institutions, and governmental regulatory bodies.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Material Testing Equipment Market News:

- On November 12, 2024, UL Solutions announced the expansion of its laboratory in Querétaro, Mexico, to enhance its product testing capabilities for automotive, consumer technology, and wire and cable industries. This expansion aims to meet the increasing demand for safety and performance testing for exports to the U.S., Canada, and Latin America.

Mexico Material Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tensile Testing Machines, Compression Testing Machines, Bending Testing Machines, Hardness Testing Machines, Impact Testing Machines, Ultrasonic Testing Equipment, Fatigue Testing Machines, Creep Testing Equipment |

| Applications Covered | Aerospace, Automotive, Construction, Electronics, Energy and Power, Educational Institutions and Research Labs |

| End Users Covered | Manufacturers, Research and Development Laboratories, Quality Control and Assurance Departments, Academic Institutions, Governmental Regulatory Bodies |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico material testing equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico material testing equipment market on the basis of type?

- What is the breakup of the Mexico material testing equipment market on the basis of application?

- What is the breakup of the Mexico material testing equipment market on the basis of end user?

- What is the breakup of the Mexico material testing equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico material testing equipment market?

- What are the key driving factors and challenges in the Mexico material testing equipment market?

- What is the structure of the Mexico material testing equipment market and who are the key players?

- What is the degree of competition in the Mexico material testing equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico material testing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico material testing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico material testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)