Mexico Material Testing Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2025-2033

Mexico Material Testing Market Overview:

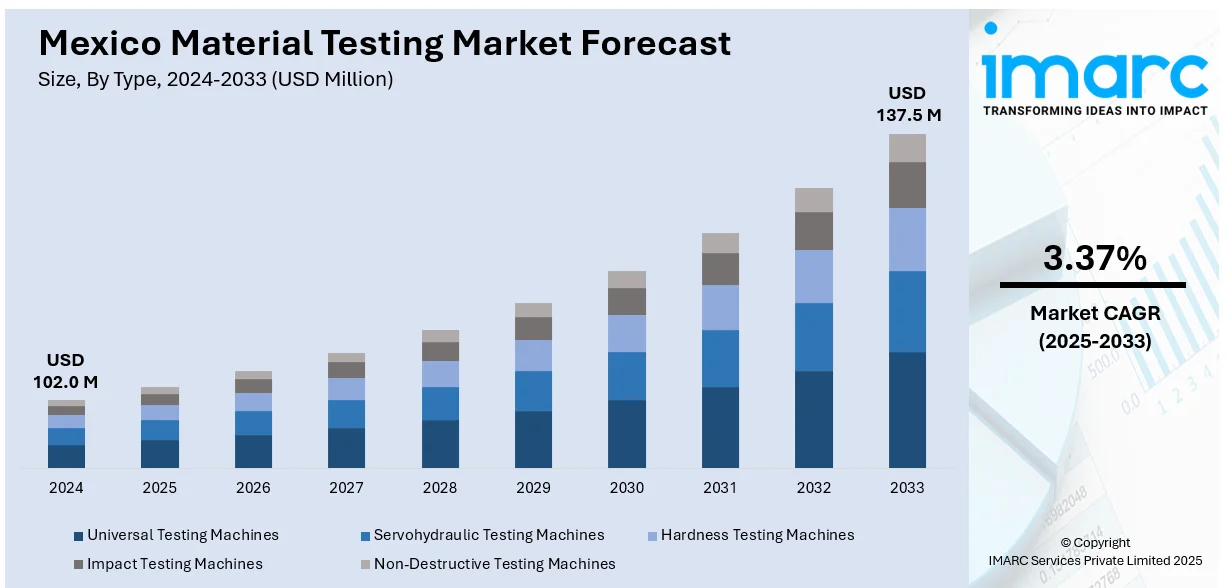

The Mexico material testing market size reached USD 102.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 137.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.37% during 2025-2033. The robust mining and automotive sectors in Mexico are catalyzing the demand for specialized, localized material testing services to ensure quality, safety, and regulatory compliance across supply chains, support new material integration, and enhance the efficiency and sustainability of industrial operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 102.0 Million |

| Market Forecast in 2033 | USD 137.5 Million |

| Market Growth Rate 2025-2033 | 3.37% |

Mexico Material Testing Market Trends:

Expansion of Energy and Mining Sectors

Mexico's mining industry is seeing substantial expansion, leading to an increased need for specialized material testing services. Mining operations, particularly those involving precious and base metals, require rigorous testing to evaluate ore quality, optimize extraction processes, and ensure long-term project viability. Harsh environmental conditions, complex geological formations, and high-value materials all necessitate comprehensive testing, ranging from initial exploration and feasibility studies to full-scale production. Metallurgical testing is essential in assessing how materials react during processing, aiding firms in creating more efficient and sustainable extraction techniques. In 2024, Vizsla Silver Corp. launched a fully funded test mining and bulk sampling program at its Panuco silver-gold project in Sinaloa, Mexico. The project entailed the removal of around 10,000 tons of quality material specifically for metallurgical testing, highlighting the importance of these processes during the initial phases of mine development. Moreover, the firm's 10,000-meter drilling program in the area highlights the necessity of ongoing material evaluation throughout the exploration process. With an increasing number of mining firms participating in comparable initiatives, the demand for both field and lab testing solutions keeps rising. Government backing for mining investments and the worldwide demand for metals further reinforce this trend, establishing material testing as a crucial component of Mexico’s resource development strategy.

Automotive Sector Expansion and Localization

The thriving automotive industry of Mexico remains a powerful factor, which is driving the demand for advanced material testing services. As international automakers expand their footprint and production capacity within the country, there is a rise in the need to ensure that every component, ranging from structural parts to electronic systems, meets strict international standards for strength, fatigue, thermal resistance, and durability. As the localization of supply chains grows, original equipment manufacturers (OEMs) and Tier 1 suppliers depend significantly on local testing to uphold quality control, shorten turnaround times, and adhere to both domestic and export regulations. The growing popularity of electric vehicles (EVs) supports this demand, bringing in new materials like composites, battery parts, and lightweight alloys that necessitate specific testing procedures. A significant instance of this trend is UL Solutions' growth of its testing facility in Querétaro in 2024. The facility was upgraded to meet the increasing demands of the Latin American market, providing advanced testing services for automotive, consumer technology, and wire and cable products. Notably, it achieved certification as a partner lab for Volkswagen de Mexico, underscoring how international brands are incorporating local testing into their processes to maintain consistency and compliance. This progression highlights how the growth of the automotive sector in Mexico is intricately linked to the enhancement of testing capabilities, fostering a strong infrastructure that promotes innovation, supply chain dependability, and competitive production. As automotive manufacturing increases, localized material testing is becoming essential for maintaining quality, safety, and technological progress.

Mexico Material Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, and end use industry.

Type Insights:

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

The report has provided a detailed breakup and analysis of the market based on the type. This includes universal testing machines, servohydraulic testing machines, hardness testing machines, impact testing machines, and non-destructive testing machines.

Material Insights:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals and alloys, plastics, rubber and elastomers, ceramics and composites, and others.

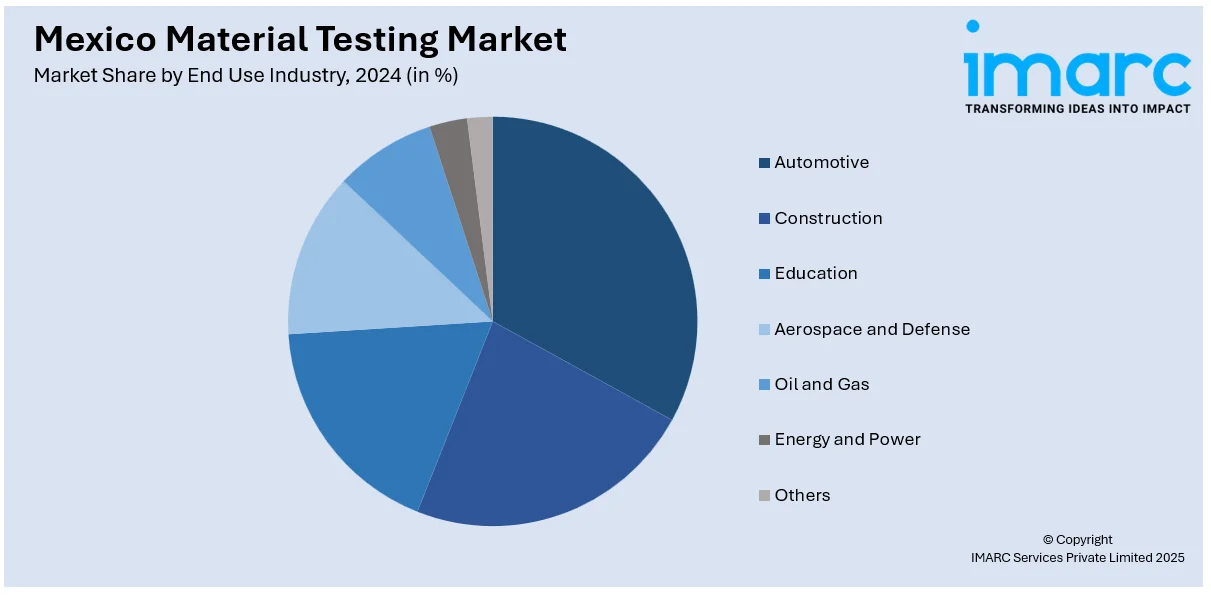

End Use Industry Insights:

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, construction, education, aerospace and defense, oil and gas, energy and power, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Material Testing Market News:

- In February 2025, SGS opened its first VOC testing lab in Naucalpan, State of Mexico, to support the automotive industry's compliance with global vehicle interior air quality standards. The lab offers advanced testing for VOC and SVOC emissions from materials like plastics and adhesives. It also serves sectors like electronics, textiles, and toys.

- In June 2024, SGS opened a new 1,200 m² furniture testing laboratory in Guadalajara, Mexico, to support the domestic and export markets. The facility offered safety, stability, and mechanical testing for various furniture types to meet US and international standards. It complemented SGS’s existing lab in Naucalpan and aligns with nearshoring trends.

Mexico Material Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers, Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico material testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico material testing market on the basis of type?

- What is the breakup of the Mexico material testing market on the basis of material?

- What is the breakup of the Mexico material testing market on the basis of end use industry?

- What is the breakup of the Mexico material testing market on the basis of region?

- What are the various stages in the value chain of the Mexico material testing market?

- What are the key driving factors and challenges in the Mexico material testing market?

- What is the structure of the Mexico material testing market and who are the key players?

- What is the degree of competition in the Mexico material testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico material testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico material testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico material testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)