Mexico Mattress Market Size, Share, Trends and Forecast by Product, Distribution Channel, Size, Application, and Region, 2026-2034

Mexico Mattress Market Overview:

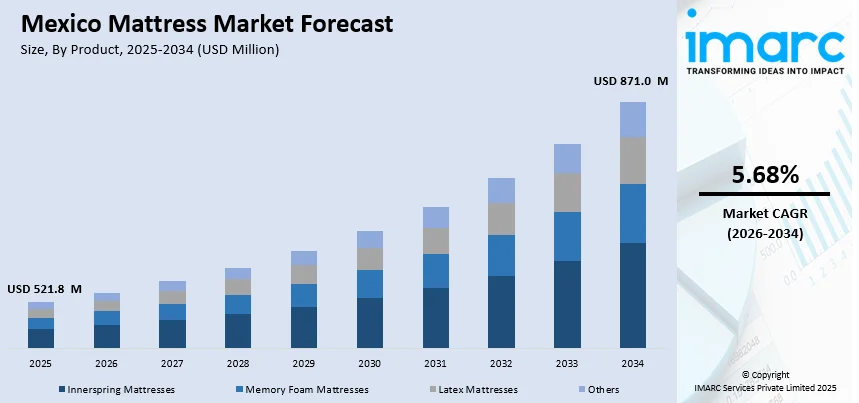

The Mexico mattress market size reached USD 521.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 871.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.68% during 2026-2034. The market is driven by the growth in population, increasing disposable incomes, and increased awareness about sleep health. The growing tourism industry and demand for orthopedic mattresses among the aging population further fuel market growth in Mexico.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 521.8 Million |

| Market Forecast in 2034 | USD 871.0 Million |

| Market Growth Rate 2026-2034 | 5.68% |

Mexico Mattress Market Trends:

Increased Demand for Eco-Friendly and Sustainable Mattresses

Sustainability has emerged as a key consideration for consumers, impacting what they buy, which is also influencing the Mexico mattress market outlook. Recently, in January 2025, the government of the State of Mexico unveiled four significant environmental initiatives designed to turn the area into a leader in sustainability while tackling urgent ecological issues. The initiatives, supported by an investment of MX$54 million (USD 2.6 million), aim to conserve natural resources, decrease pollution, and encourage clean energy projects. Hence, consumers are also following suit by switching their preferences toward environmentally sustainable products. Several consumers are looking for natural, organic, or recycled material products, like latex, organic cotton, and plant-based foams. This is being fueled by increased environmental awareness and indoor air quality and chemical exposure issues. As a response, mattress companies are implementing greener production methods, including minimizing carbon footprints, applying non-toxic adhesives, and providing recyclable packaging. Environmental label certifications and transparency in the supply chain are also becoming more significant, with customers increasingly looking for accountability and responsible practices. Retailers are also emphasizing the eco-friendliness of such products in marketing to appeal to environmentally conscious consumers. As knowledge regarding climate change and individual health persists, demand for environmentally friendly mattresses will continue to steadily impact how products are being designed, manufactured, and merchandised in Mexico.

To get more information on this market Request Sample

Innovation in Mattress Technology and Smart Sleep Solutions

Innovation through technology is reshaping the Mexico mattress market share, with growing interest from consumers in sleep-enabling features and smart technology. Mattresses are no longer viewed as plain sleeping commodities as they have emerged to be perceived as investments in wellness. Memory foam, gel-based products, and zoned support systems are gaining favor due to their potential for enhancing spinal alignment and heat dissipation. In other technology-oriented categories, smart mattresses featuring integrated sensors are picking up popularity. These products can monitor sleep, breathing, and heart rate and deliver targeted insights via mobile apps. Adjustable foundations and temperature control systems are also being launched, targeting consumers who desire a personalized sleeping experience. This emphasis on sleep health and comfort is being fueled by a larger lifestyle trend toward wellness and self-care. With ongoing innovation, brands that invest in R&D and inform consumers about the value proposition of sleep technology will most likely succeed in Mexico's competitive bedding market.

Direct-to-Consumer and E-Commerce Growth

The manner in which mattresses are sold and purchased in Mexico is evolving quickly, with a significant shift toward e-commerce and direct-to-consumer (DTC) business models. Consumers increasingly feel at ease buying items online, particularly with the assurance of free shipping, long trial periods, and hassle-free returns. Online bed companies are riding this trend by providing streamlined product lines, open pricing, and efficient digital shopping experiences. Apart from this, several companies are also embracing "bed-in-a-box" business models, where mattresses are rolled up, boxed, and shipped to the consumer's doorstep. This saves on logistics while also resonating with younger consumers who value convenience and price. Moreover, social marketing, influencer partnerships, and web reviews have a significant impact on brand image and consumer trust. With improving digital infrastructure and payments systems in Mexico, the online-first pattern is likely to expand, challenging traditional retailing channels and providing greater avenues for the Mexico mattress market growth.

Mexico Mattress Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product, distribution channel, size, and application.

Product Insights:

- Innerspring Mattresses

- Memory Foam Mattresses

- Latex Mattresses

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes innerspring mattresses, memory foam mattresses, latex mattresses, and others.

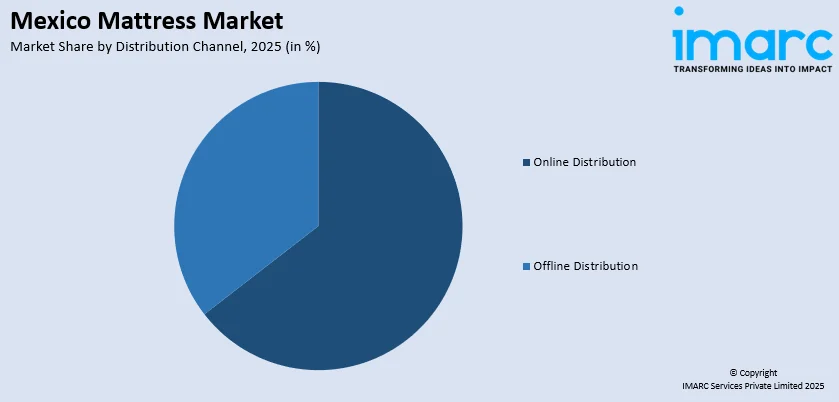

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Distribution

- Offline Distribution

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online distribution and offline distribution.

Size Insights:

- Twin or Single Size

- Twin or XL Size

- Full or Double Size

- Queen Size

- King Size Mattress

- Others

The report has provided a detailed breakup and analysis of the market based on the size. This includes twin or single size, twin or XL size, full or double size, queen size, king size mattress, and others.

Application Insights:

- Domestic

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes domestic and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mattress Market News:

- In October 2023, Luuna, a mattress startup from Mexico, opened its inaugural factory following a USD 25 million investment aimed at increasing production. The firm aimed to produce 1 million mattresses within the upcoming eight months, a strategy that provides it total oversight of its supply chain. Originally launching with only online sales and one showroom, Luuna has now broadened its physical footprint. The current company proudly operates over 70 stores nationwide and is focused on enhancing its omnichannel strategy.

Mexico Mattress Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Others |

| Distribution Channels Covered | Online Distribution, Offline Distribution |

| Sizes Covered | Twin or Single Size, Twin or XL Size, Full or Double Size, Queen Size, King Size Mattress, Others |

| Applications Covered | Domestic, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico and Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mattress market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mattress market on the basis of product?

- What is the breakup of the Mexico mattress market on the basis of distribution channel?

- What is the breakup of the Mexico mattress market on the basis of size?

- What is the breakup of the Mexico mattress market on the basis of application?

- What is the breakup of the Mexico mattress market on the basis of region?

- What are the various stages in the value chain of the Mexico mattress market?

- What are the key driving factors and challenges in the Mexico mattress market?

- What is the structure of the Mexico mattress market and who are the key players?

- What is the degree of competition in the Mexico mattress market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mattress market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mattress market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mattress industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)