Mexico Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

Mexico Meat Market Overview:

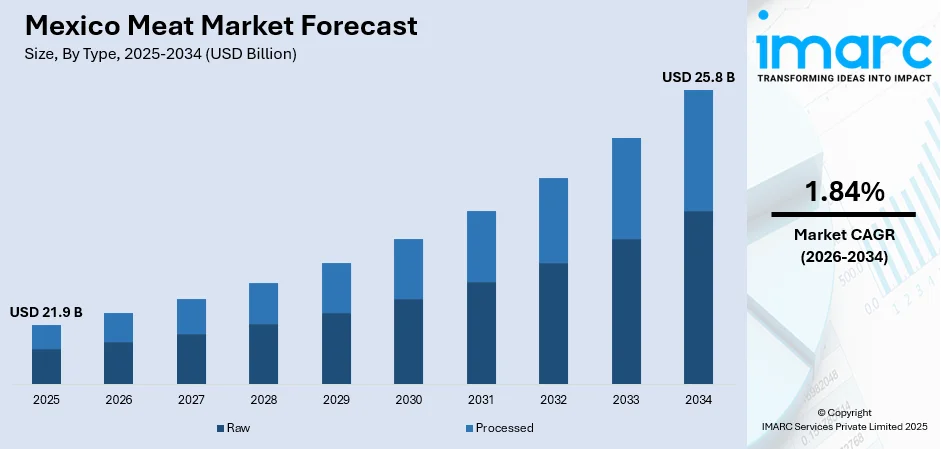

The Mexico meat market size reached USD 21.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 25.8 Billion by 2034, exhibiting a growth rate (CAGR) of 1.84% during 2026-2034. The market is expanding steadily, backed by rising production, changing consumer tastes, and growing distribution networks, while retaining a robust presence in domestic and foreign markets through high-quality standards, regulatory compliance, and an established supply chain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.9 Billion |

| Market Forecast in 2034 | USD 25.8 Billion |

| Market Growth Rate 2026-2034 | 1.84% |

Access the full market insights report Request Sample

Mexico Meat Market Trends:

Rise of Premium and Organic Meat Products

Mexico's meat industry is experiencing a big move towards premium and organic meat products as consumers highly focus on health. There is increasing demand for grass-fed, antibiotic-free, and hormone-free meat, influenced by food safety, nutrition, and wellness concerns. This is highly pronounced among city-dwelling consumers who are ready to pay an extra premium for high-quality, ethically produced meat. Supermarkets and specialty outlets have meanwhile amplified their organic beef, free-range poultry, and pasture-reared pork selections to tap into this new demand. Stricter labeling and certification schemes have continued to back the trend by providing consumers with opportunities to make choice purchasing decisions. Furthermore, this demand is met by higher-quality meat as far upmarket as top-end restaurants and gourmet supermarkets, where these sophisticated buyers pursue richer flavor and texture. As consumer tastes change, the market for high-quality, responsibly sourced meat is anticipated to grow, further driving premiumization of Mexico's meat industry.

To get more information on this market Request Sample

Growth in Processed Meat Consumption

Processed meat consumption in Mexico is seeing significant growth, fueled by convenience and changing dietary patterns. Ready-to-eat (RTE) and convenient meat products like marinated cuts, sausages, and deli meats are gaining popularity among time-conscious consumers who are looking for quick meal options. Fore instance, in October 2024, Grupo BaFar publicly declared a $145.8M investment in Michoacán in October 2024 to construct four new meat plants, increasing the production of sausages, ham, and pork cuts for the domestic and foreign markets. Moreover, urbanization and the mounting number of double-income households have fueled this trend, as busy consumers emphasize convenience without sacrificing taste. In addition, processed meat products are well distributed in several retail channels such as supermarkets, specialty stores, and the internet, and can be accessed by a wide group of consumers. Advances in packaging technologies and preservation of foods have also increased the convenience and accessibility of processed meats, provided longer shelf life and protection of product quality. As consumers' demand boosts, food makers are launching healthier versions with less sodium, natural preservatives, and lean cuts to accommodate shifting consumer tastes while not sacrificing the convenience component.

Expansion of Online Meat Retailing

Mexican meat retailing through online channels is growing at a rapid pace with increased digital adoption and consumers favoring more convenient forms of shopping. The accelerating in e-commerce sites and exclusive online meat stores has revolutionized how consumers are buying fresh meat and processed meats. Home delivery services, meat subscription boxes, and online-specials have increased the popularity of online meat buying. Shoppers welcome the option to compare prices, examine product descriptions, and delve into extensive information regarding sourcing and processing prior to a purchase. Further, technological advances in cold-chain logistics and packaging technologies have upgraded the efficiency of online meat orders, guaranteeing freshness and quality at each destination. For example, in June 2024, APP Group showcased Foopak Anchor Bio and Foopak Natural Grease Resistant for the first time at EXPO PACK Mexico, bringing plastic-free, compostable food packaging solutions to address increasing sustainability needs for the food service industry in Mexico. Moreover, order convenience from home, in combination with focused digital promotion campaigns, will likely accelerate expansion within this segment. As consumer confidence in online buying of food rises and internet penetration continues to grow, Mexico's online meat retailing market is expected to grow immensely.

Mexico Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, product and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

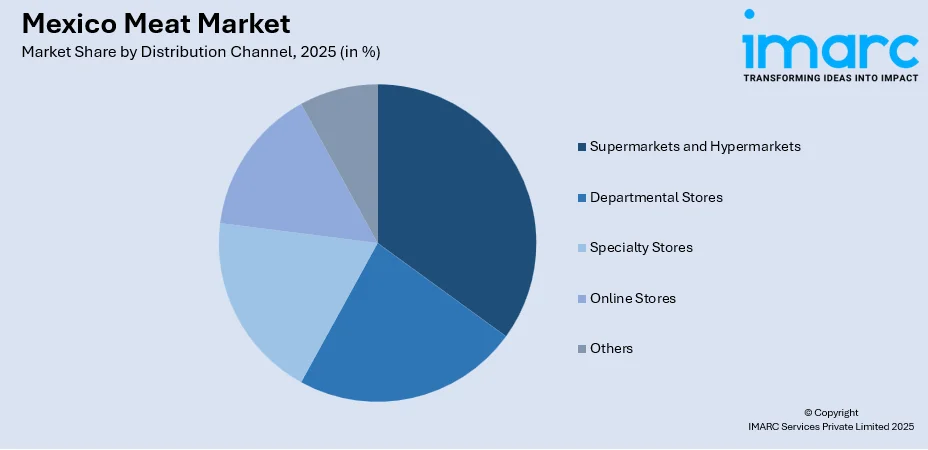

Distribution Channel Insights:

To get detailed segment analysis of this market Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Meat Market News:

- In March 2025, Mexico's meat sector pledged MX$105 billion (US$5.1 billion) to increase processing facilities, optimize meat production efficiency, and become more sustainable, stimulating local growth amidst rising tariffs on meat exports.

- In September 2024, Mexican startup Forma Foods, which was incubated at Tecnológico de Monterrey, created patented 3D printing technology to create plant-based meat mimicking muscle, fat, and connective tissue. The technology is beneficial to sustainability, food security, and environmental conservation and addresses increasing consumer demand for high-quality and ethical meat alternatives.

Mexico Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico meat market on the basis of type?

- What is the breakup of the Mexico meat market on the basis of product?

- What is the breakup of the Mexico meat market on the basis of distribution channel?

- What is the breakup of the Mexico meat market on the basis of region?

- What are the various stages in the value chain of the Mexico meat market?

- What are the key driving factors and challenges in the Mexico meat?

- What is the structure of the Mexico meat market and who are the key players?

- What is the degree of competition in the Mexico meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico meat market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)