Mexico Meat Substitutes Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Mexico Meat Substitutes Market Overview:

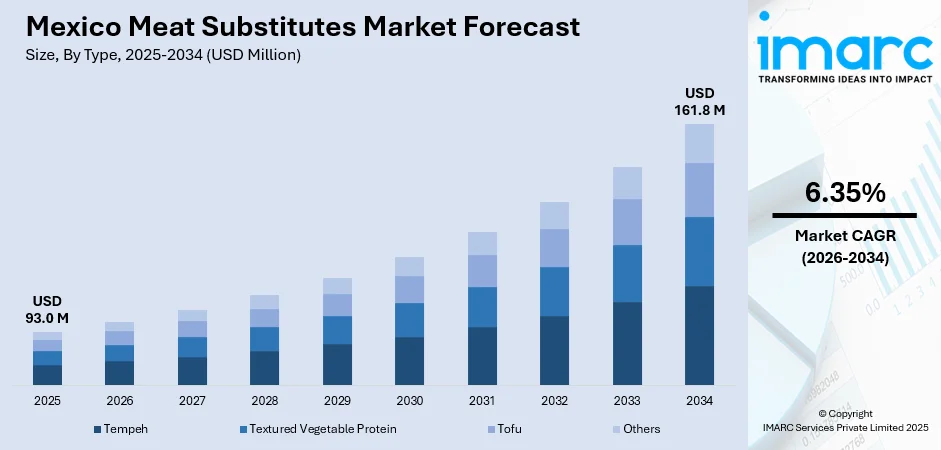

The Mexico meat substitutes market size reached USD 93.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 161.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.35% during 2026-2034. At present, with rising obesity rates and associated health issues like hypertension and heart disease, people are looking for alternatives to conventional high-fat and high-cholesterol meat products. Besides this, the broadening of retail outlets is contributing to the expansion of the Mexico meat substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 93.0 Million |

| Market Forecast in 2034 | USD 161.8 Million |

| Market Growth Rate 2026-2034 | 6.35% |

Access the full market insights report Request Sample

Mexico Meat Substitutes Market Trends:

Growing concerns about obesity and chronic diseases

Rising concerns about obesity and chronic diseases are positively influencing the market in Mexico. As obesity rates and associated health ailments like hypertension and obesity are increasing, individuals are seeking alternatives to traditional high-fat and high-cholesterol meat products. Meat substitutes, often lower in saturated fats and calories, offer a healthier option without compromising on taste and protein intake. Health-conscious consumers are turning to vegan options, such as soy, pea, and lentil-based products, as part of efforts to manage weight and decrease disease risk. As per industry reports, the vegan market in Mexico was valued at USD 389.1 Million in 2024 and is set to grow to USD 714.4 Million by 2030. Nutritionists and healthcare professionals are also promoting reduced meat consumption as a preventive strategy, encouraging the population to consider meat-free meals. Public awareness campaigns and media discussions around diet and lifestyle diseases are further educating people about the health benefits of plant-based alternatives. Consequently, the demand for meat substitutes is increasing in both households and foodservice sectors. Additionally, younger consumers, who are more aware about the link between diet and health, are becoming key drivers of this trend.

To get more information on this market Request Sample

Expansion of retail outlets

The expansion of retail channels is impelling the Mexico meat substitutes market growth. According to the IMARC Group, the Mexico retail market size reached USD 454.5 Billion in 2024. As supermarkets, convenience stores, and specialty health food outlets are rising in number across urban and semi-urban areas, they are offering more shelf space for alternative meat products. This widespread availability makes it easier for health-conscious and environmentally aware shoppers to explore and purchase meat substitutes during their regular grocery visits. Retail chains are also supporting this growth by promoting plant-based options through attractive packaging, in-store promotions, and dedicated sections for vegetarian and vegan items. Additionally, private labels and local brands are entering the market, offering affordable and innovative options that appeal to various income groups. The modern retail environment allows people to compare items, check nutritional content, and try new alternatives, which builds familiarity and trust. As more retail players are responding to shifting dietary preferences, the presence of meat substitutes in everyday shopping routines is growing. This continuous exposure is leading to trial and repeat purchases, making meat substitutes a part of mainstream consumption in Mexico.

Mexico Meat Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Tempeh

- Textured Vegetable Protein

- Tofu

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes tempeh, textured vegetable protein, tofu, and others.

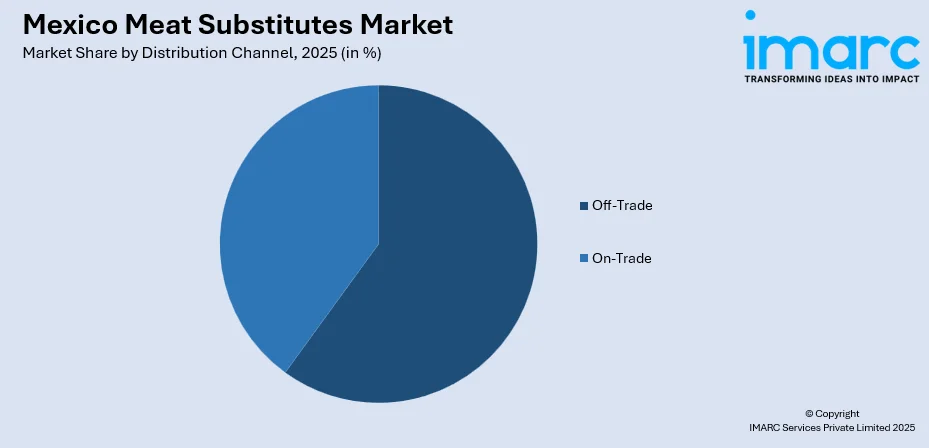

Distribution Channel Insights:

To get detailed segment analysis of this market Request Sample

- Off-Trade

- Convenience Stores

- Online Channels

- Supermarkets and Hypermarkets

- Others

- On-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes off-trade (convenience stores, online channels, supermarkets and hypermarkets, and others) and on-trade.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Meat Substitutes Market News:

- In February 2025, Heura, a plant-based meat brand, introduced its inaugural Mexican-style product, Tex Mex Chunks. This meat-free item was claimed to be free of additives and rich in protein, offering 27% of the daily recommended protein intake. To respond to the rising popularity of Mexican cuisine, the brand developed this product that could meet consumer desires: nutrition, sustainability, and a delightful experience.

Mexico Meat Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tempeh, Textured Vegetable Protein, Tofu, Others |

| Distribution Channels Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico meat substitutes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico meat substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico meat substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meat substitutes market in Mexico was valued at USD 93.0 Million in 2025.

The Mexico meat substitutes market is projected to exhibit a CAGR of 6.35% during 2026-2034, reaching a value of USD 161.8 Million by 2034.

The Mexico meat substitutes market is driven by growing health consciousness, rising vegetarian and flexitarian lifestyles, increasing awareness regarding environmental sustainability, innovation in plant-based proteins, expanding retail availability, and support from government and private initiatives promoting alternative proteins and sustainable food consumption across urban and younger demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)