Mexico Medical Aesthetics Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Mexico Medical Aesthetics Market Overview:

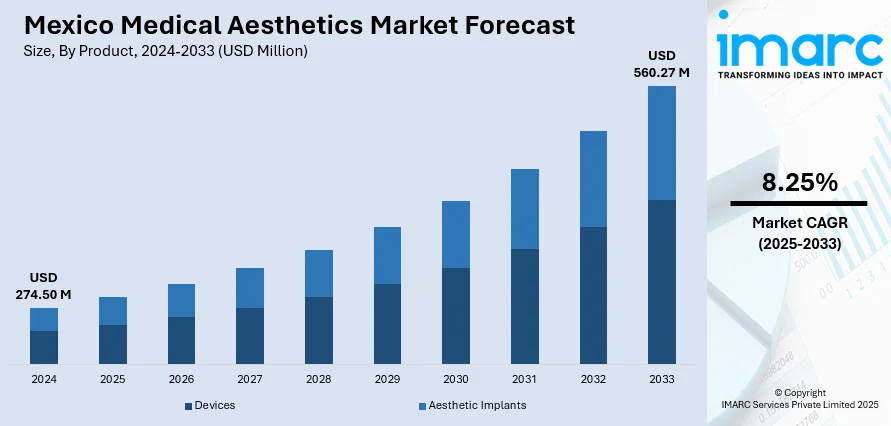

The Mexico medical aesthetics market size reached USD 274.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 560.27 Million by 2033, exhibiting a growth rate (CAGR) of 8.25% during 2025-2033. The market is experiencing robust growth, driven by increasing demand for minimally invasive procedures, rising awareness about aesthetic treatments, and growing number of private clinics offering advanced services. The market benefits from technological advancements and a focus on enhancing physical appearance are some of the other factors that are collectively supporting the Mexico medical aesthetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 274.50 Million |

| Market Forecast in 2033 | USD 560.27 Million |

| Market Growth Rate 2025-2033 | 8.25% |

Mexico Medical Aesthetics Market Trends:

Growing Demand for Minimally Invasive Procedures

Consumers in Mexico are increasingly opting for non-surgical aesthetic treatments like Botox, dermal fillers, chemical peels, and laser therapies. Patients benefit from speedy outcomes and decreased recovery time, and minimal health complications, due to these minimally invasive procedures that draw numerous potential candidates. The appeal of subtle, natural-looking improvements through non-surgical methods has found special popularity among working professionals, who also include younger individuals. Social media platforms, together with aesthetic influencer popularity, created this rising demand. The rising demand for non-invasive aesthetic procedures drives clinic and dermatology center service expansions and supports continued market growth in minimally invasive aesthetics for Mexican urban and emerging regions.

Increasing Aesthetic Awareness and Cultural Acceptance

Cultural norms in Mexico are shifting as aesthetic procedures become more normalized and socially accepted. Enhanced awareness of beauty treatments through digital platforms, influencers, and medical tourism is driving interest among both men and women. Younger generations, in particular, are increasingly open to undergoing cosmetic enhancements as a form of self-expression and personal care. Moreover, there's a growing understanding that aesthetic medicine is not just about vanity but also about improving self-confidence and mental well-being. Clinics are capitalizing on this trend by offering customized, lifestyle-oriented treatments. This cultural shift is encouraging more first-time users and boosting repeat procedures, making aesthetic medicine a routine part of wellness for many in Mexico.

Expansion of Private Clinics and Medical Tourism

Mexico has seen a significant increase in private aesthetic clinics and specialized dermatology centers, particularly in cities like Mexico City, Monterrey, and Guadalajara. These facilities offer affordable yet high-quality treatments, making them attractive not only to residents but also to international patients. Medical tourism plays a substantial role, as people from the U.S., Canada, and Central America travel to Mexico for cost-effective cosmetic procedures. The availability of trained professionals, advanced technologies, and competitive pricing makes the country a hub for aesthetic services. This growth in healthcare infrastructure, combined with tourism marketing, has positioned Mexico as a key destination for aesthetic medicine, fueling the overall Mexico medical aesthetics market growth.

Mexico Medical Aesthetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Devices

- Aesthetic Implants

The report has provided a detailed breakup and analysis of the market based on the product. This includes device and aesthetic implants.

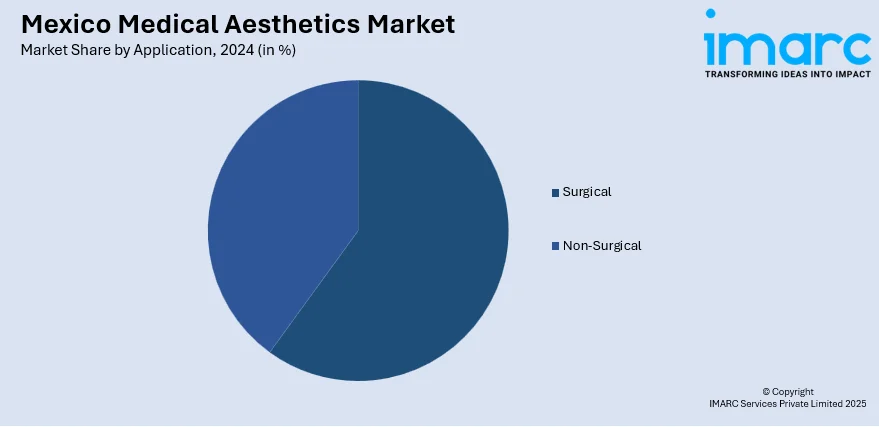

Application Insights:

- Surgical

- Non-Surgical

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes surgical and non-surgical.

End User Insights:

- Hospitals and Clinics

- Medical Spas and Beauty Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics and medical spas and beauty centers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Medical Aesthetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Device, Aesthetic Implants |

| Applications Covered | Surgical, Non-Surgical |

| End Users Covered | Hospitals and Clinics, Medical Spas and Beauty Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico medical aesthetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico medical aesthetics market on the basis of product?

- What is the breakup of the Mexico medical aesthetics market on the basis of application?

- What is the breakup of the Mexico medical aesthetics market on the basis of end user?

- What is the breakup of the Mexico medical aesthetics market on the basis of region?

- What are the various stages in the value chain of the Mexico medical aesthetics market?

- What are the key driving factors and challenges in the Mexico medical aesthetics market?

- What is the structure of the Mexico medical aesthetics market and who are the key players?

- What is the degree of competition in the Mexico medical aesthetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical aesthetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical aesthetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical aesthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)