Mexico Medical Gas Market Size, Share, Trends and Forecast by Gas Type, Application, End User, and Region, 2026-2034

Mexico Medical Gas Market Summary:

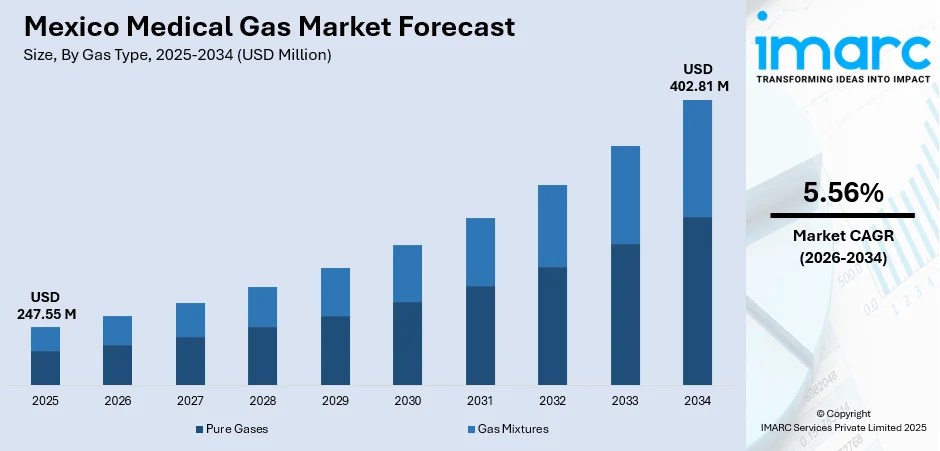

The Mexico medical gas market size was valued at USD 247.55 Million in 2025 and is projected to reach USD 402.81 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034.

The Mexico medical gas market is experiencing steady expansion driven by significant government investments in healthcare infrastructure and rising demand for respiratory therapies. The growing prevalence of chronic respiratory conditions, an aging population requiring long-term oxygen therapy, and increasing surgical procedures across public and private hospitals are strengthening product adoption. Advancements in gas delivery technologies, expanding home healthcare services, and stringent regulatory standards for medical gas purity are further accelerating market dynamics, positioning Mexico as a key growth market for medical gases in Latin America and boosting the Mexico medical gas market share.

Key Takeaways and Insights:

-

By Gas Type: Pure gases dominate the market with a share of 76% in 2025, driven by widespread demand for medical oxygen in respiratory therapies, anesthesia procedures, and critical care applications across healthcare facilities.

-

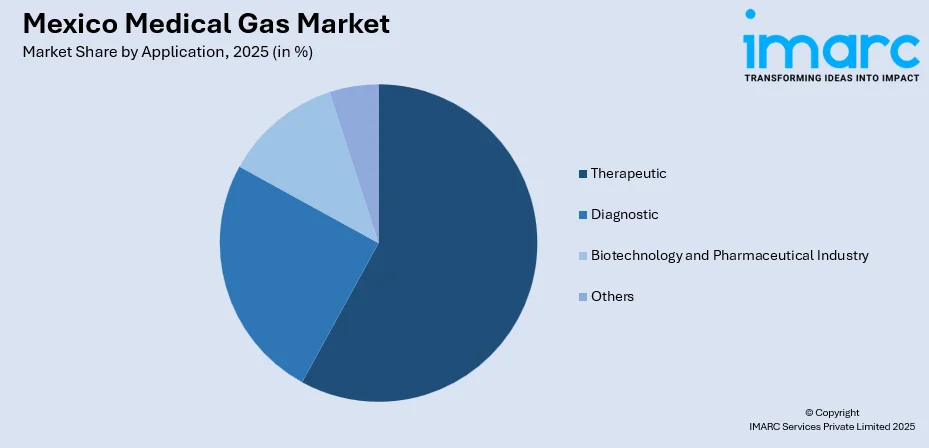

By Application: Therapeutic applications lead the market with a 58% share in 2025, reflecting the essential role of medical gases in respiratory therapy, pain management, and surgical procedures throughout Mexico's expanding hospital network.

-

By End User: Hospitals hold the largest share at 70% in 2025, supported by substantial government investments in public hospital construction and modernization of surgical facilities across the country.

-

Key Players: The Mexico medical gas market features a moderately concentrated competitive landscape with established multinational corporations and domestic manufacturers competing across product segments. Companies are focusing on expanding production capacities, strengthening distribution networks, and investing in advanced gas delivery technologies to capture market share.

To get more information on this market Request Sample

Mexico's medical gas sector is advancing as the government accelerates healthcare infrastructure development and prioritizes universal healthcare access. The federal administration's commitment to inaugurating new hospitals and upgrading surgical facilities is creating sustained demand for medical gas supply systems. In July 2025, the Mexican government announced plans to open 31 new hospitals and 12 healthcare centers by December 2025, with an investment of approximately USD 2.66 billion (50 billion pesos), significantly expanding the country's hospital capacity and medical gas requirements. The integration of modern gas pipeline systems, automated monitoring technologies, and high-purity gas production facilities is enhancing operational efficiency while ensuring compliance with international safety standards, positioning Mexico as an attractive market for medical gas suppliers in the Latin American region.

Mexico Medical Gas Market Trends:

Expansion of Healthcare Infrastructure

Mexico is experiencing significant growth in healthcare infrastructure, fueling strong demand for medical gas systems. Expansion of hospitals and healthcare facilities is driving the need for centralized gas pipelines, storage solutions, and distribution networks. For instance, in April 2025, CHRISTUS Health, a global not-for-profit healthcare organization, commenced construction on a modern, cutting-edge hospital in Cabo San Lucas, Mexico. This project underscores the organization’s strategic dedication to delivering high-quality, compassionate healthcare to a rapidly growing local community and a popular tourist destination. Advanced medical gas infrastructure, including integrated oxygen supply and specialized care units, is becoming a standard feature in modern healthcare facilities. This development is supporting sustained growth in the medical gas market, creating long-term demand for medical oxygen, nitrous oxide, and medical air.

Growth in Home Healthcare and Portable Oxygen Therapy

Home-based oxygen therapy is emerging as a significant growth driver in Mexico's medical gas market, supported by an aging population and rising prevalence of chronic respiratory conditions. Patients increasingly prefer receiving long-term oxygen therapy at home, reducing hospital visits while maintaining treatment continuity. In June 2025, respiratory care brand VARON launched a dedicated oxygen therapy platform tailored for the Mexican market, featuring Spanish-language support, fast local delivery, and educational resources for patients managing chronic respiratory conditions at home. This trend toward decentralized healthcare delivery is expanding the addressable market for portable oxygen concentrators and home medical gas supply systems across Mexico.

Technological Advancements in Gas Delivery Systems

Technological advancements are reshaping medical gas delivery in Mexico’s healthcare facilities, with innovations such as advanced monitoring systems, smart pressure regulators, and automated distribution networks improving safety and operational efficiency. Hospitals are increasingly adopting IoT-enabled gas management solutions that allow real-time tracking of oxygen levels, pressure, and consumption patterns. These developments enhance gas purity, streamline operations, and reduce risks, supporting more reliable and efficient medical gas supply across healthcare settings.

Market Outlook 2026-2034:

The Mexico medical gas market is positioned for sustained growth through 2033, driven by continued healthcare infrastructure investments, demographic shifts toward an aging population, and expanding therapeutic applications. The government's National Health Programme 2024-2030 is expected to drive major scale-ups in hospital capacity and primary care coverage, requiring the installation of on-site oxygen generation units and medical gas pipeline systems across public healthcare facilities. The market generated a revenue of USD 247.55 Million in 2025 and is projected to reach a revenue of USD 402.81 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034.

Mexico Medical Gas Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Gas Type |

Pure Gases |

76% |

|

Application |

Therapeutic |

58% |

|

End User |

Hospitals |

70% |

Gas Type Insights:

- Pure Gases

- Medical Air

- Medical Oxygen

- Nitrous Oxide

- Nitrogen

- Carbon Dioxide

- Helium

- Gas Mixtures

- Aerobic Gas Mixtures

- Anaerobic Gas Mixtures

- Blood Gas Mixtures

- Lung Diffusion Mixtures

- Medical Laser Mixtures

- Medical Drug Gas Mixtures

- Others

The pure gases segment dominates with a market share of 76% of the total Mexico medical gas market in 2025.

Pure medical gases, particularly medical oxygen, constitute the foundation of Mexico's medical gas market due to their essential role in respiratory therapy, surgical anesthesia, and emergency medicine. Medical oxygen remains the most consumed gas, driven by its critical application in treating chronic obstructive pulmonary disease, pneumonia, and post-surgical recovery across hospitals and home healthcare settings.

The segment's dominance is reinforced by Mexico's expanding hospital network and increasing prevalence of respiratory conditions among the aging population. According to PAHO data from 2024, Mexico's population aged 65 and older comprised 8.2% of the total population, representing a 3.2 percentage point increase since 2000, driving sustained demand for oxygen therapy solutions. Additionally, nitrous oxide continues to see steady utilization in dental procedures and surgical anesthesia, while nitrogen and carbon dioxide find applications in cryotherapy and minimally invasive surgical procedures across specialized medical facilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Therapeutic

- Diagnostic

- Biotechnology and Pharmaceutical Industry

- Others

The therapeutic segment leads the market with a share of 58% of the total Mexico medical gas market in 2025.

The therapeutic segment dominates Mexico’s medical gas market, reflecting its critical role in patient care across hospitals and home healthcare settings. This segment includes applications such as respiratory therapy, anesthesia delivery, and pain management, which are essential for managing chronic respiratory diseases, surgical procedures, and post-operative care. The high prevalence of conditions like COPD, asthma, and other pulmonary disorders ensures consistent demand for therapeutic gases, making this segment the primary revenue driver in the market.

In addition to hospital use, the therapeutic segment is expanding into home healthcare as patients increasingly adopt oxygen therapy and respiratory support outside clinical settings. The growth of surgical volumes and enhanced hospital capacities further elevates the need for anesthetic and post-operative gases. Combined, these factors establish the therapeutic segment as the largest portion of the medical gas market, highlighting its vital role in sustaining patient care and supporting Mexico’s healthcare infrastructure.

End User Insights:

- Hospitals

- Home Healthcare

- Academic and Research Institutions

The hospitals segment exhibits clear dominance with a 70% share of the total Mexico medical gas market in 2025.

Hospitals continue to be the main consumers of medical gases in Mexico, fueled by widespread use of oxygen in emergency departments, intensive care units, operating rooms, and general patient wards. Their leading role is reinforced by ongoing hospital expansion and modernization initiatives across public healthcare institutions. Mexico’s extensive hospital network represents a significant infrastructure that relies on a continuous and reliable supply of medical gases to support patient care and operational efficiency.

The opening of new IMSS-Bienestar facilities, regional general hospitals, and specialized maternal and pediatric care centers is expanding the hospital segment's gas consumption footprint. Medical gas pipeline systems, centralized gas manifolds, and on-site oxygen generation units are becoming standard infrastructure components in newly constructed and renovated hospital facilities, ensuring reliable and uninterrupted gas supply for critical medical procedures.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

In Northern Mexico, medical gas demand is driven by growing healthcare infrastructure in urban centers like Monterrey and Tijuana. Expanding hospitals, specialty clinics, and industrial healthcare facilities require reliable oxygen, nitrous oxide, and medical air supplies. The region’s increasing focus on advanced surgical procedures, respiratory therapy, and critical care units, along with rising private healthcare investments, is fueling the adoption of centralized gas systems and modern delivery technologies.

Central Mexico, anchored by Mexico City and Querétaro, sees strong demand for medical gases due to high population density and extensive hospital networks. Rising surgical volumes, chronic respiratory disease prevalence, and investments in upgrading operating rooms and ICU facilities drive oxygen, anesthetic, and therapeutic gas consumption. Both public and private healthcare providers are modernizing infrastructure with advanced pipeline systems and gas monitoring solutions to meet growing clinical requirements.

Southern Mexico’s medical gas market is expanding as regional hospitals, specialty clinics, and public healthcare centers increase service capacity. Investments in upgrading healthcare facilities and establishing new hospitals create demand for centralized gas pipelines and delivery systems. Additionally, the adoption of home-based respiratory therapy for chronic patients and the focus on improving rural healthcare accessibility are supporting long-term growth of oxygen, anesthetic, and medical air supplies across the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Medical Gas Market Growing?

Expanding Healthcare Infrastructure and Hospital Construction

Mexico’s significant investment in healthcare infrastructure is driving sustained demand for medical gas systems across newly built and upgraded facilities. Efforts to strengthen the public healthcare system through institutions like IMSS, ISSSTE, and IMSS-Bienestar are fueling large-scale procurement of medical gas equipment, pipeline networks, and supply solutions. New hospitals, specialized care centers, and family medicine clinics require integrated medical gas infrastructure, including centralized oxygen systems, nitrogen generation, and nitrous oxide distribution to support surgical, emergency, and intensive care services.

Rising Prevalence of Chronic Respiratory Diseases

The rising prevalence of chronic respiratory conditions in Mexico is driving steady demand for medical oxygen and respiratory therapy gases. Diseases such as COPD, asthma, and pulmonary fibrosis affect a significant portion of the population, particularly older adults and individuals exposed to environmental pollutants. With an aging demographic and increasing respiratory disease incidence, healthcare providers are expanding the use of home oxygen therapy, extending medical gas demand beyond hospitals and fostering growth in the home healthcare sector.

Government Regulatory Support and Quality Standards

Stringent regulatory frameworks enforced by COFEPRIS (Federal Commission for Protection against Sanitary Risks) are ensuring high-quality medical gas production and distribution while driving market professionalization. The regulatory authority's updated standards for medical devices and manufacturing practices are compelling suppliers to invest in advanced production technologies and quality management systems. In April 2025, COFEPRIS published NOM-241-SSA1-2025, establishing comprehensive Good Manufacturing Practice requirements for medical devices, including medical gas equipment, with compliance mandatory from November 2025. These regulatory developments are raising entry barriers for unqualified suppliers while creating opportunities for established manufacturers with robust quality assurance capabilities. The alignment of Mexican regulations with international standards, including recognition of ISO 13485 certification, is facilitating market access for global medical gas suppliers while ensuring patient safety across healthcare facilities.

Market Restraints:

What Challenges the Mexico Medical Gas Market is Facing?

High Equipment and Infrastructure Costs

The substantial capital investment required for medical gas infrastructure, including pipeline systems, storage tanks, and monitoring equipment, poses challenges for healthcare facilities operating under budget constraints. Small and medium-sized hospitals, particularly in rural and underserved regions, face difficulties financing comprehensive medical gas systems, potentially limiting market penetration in these areas.

Distribution and Logistics Challenges

Mexico's geographic diversity and infrastructure gaps create distribution challenges for medical gas suppliers, particularly in reaching remote and rural healthcare facilities. Limited availability of cryogenic tanker fleets and extended delivery timelines affect gas supply reliability in certain regions. Supply chain vulnerabilities and transportation logistics continue to challenge timely delivery of medical gases to facilities located in mountainous or isolated areas.

Limited Reimbursement and Insurance Coverage

Inconsistent reimbursement policies for home oxygen therapy and medical gas equipment limit adoption among price-sensitive patients and healthcare providers. The absence of comprehensive insurance coverage for home-based respiratory therapy equipment affects patient access and market growth in the home healthcare segment. Addressing reimbursement frameworks remains essential for expanding medical gas accessibility beyond hospital settings.

Competitive Landscape:

The Mexico medical gas market demonstrates a moderately concentrated competitive landscape, with both multinational and domestic companies actively vying for market share. Key players maintain strong regional presence through local operations and distribution networks, leveraging expertise in gas production and healthcare applications. Market participants are focusing on expanding production capacity, enhancing distribution infrastructure, and strengthening hospital supply contracts. Strategic priorities also include broadening home healthcare services and offering integrated gas management solutions with advanced monitoring and reliable supply.

Mexico Medical Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gas Types Covered |

|

| Applications Covered | Therapeutic, Diagnostic, Biotechnology and Pharmaceutical Industry, Others |

| End Users Covered | Hospitals, Home Healthcare, Academic and Research Institutions |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico medical gas market size was valued at USD 247.55 Million in 2025.

The Mexico medical gas market is expected to grow at a compound annual growth rate of 5.56% from 2026-2034 to reach USD 402.81 Million by 2034.

Pure gases held the largest market share at 76% in 2025, driven by essential demand for medical oxygen in respiratory therapy, surgical anesthesia, and critical care applications across Mexico's expanding healthcare infrastructure.

Key factors driving the Mexico medical gas market include expanding healthcare infrastructure with government investments in new hospitals, rising prevalence of chronic respiratory diseases, growing elderly population requiring oxygen therapy, and stringent regulatory standards ensuring product quality.

Major challenges include high equipment and infrastructure costs, distribution and logistics constraints in reaching remote areas, limited reimbursement policies for home oxygen therapy, and supply chain vulnerabilities affecting delivery timelines.1

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)