Mexico Medical Imaging Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Mexico Medical Imaging Market Overview:

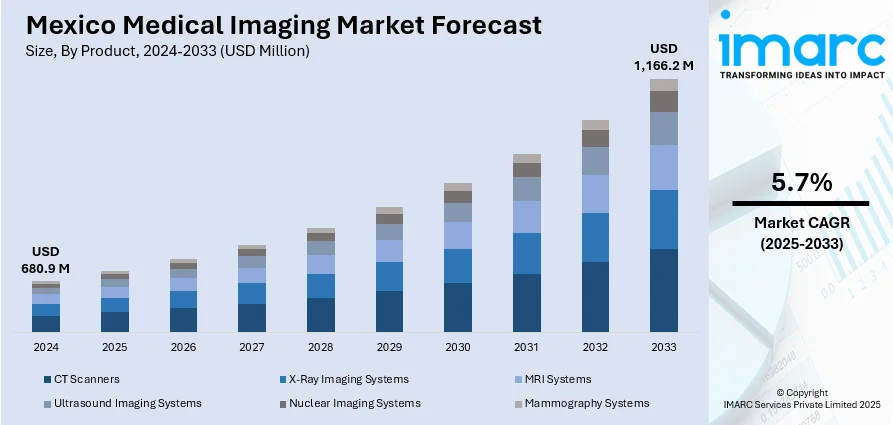

The Mexico medical imaging market size reached USD 680.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,166.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. The market is witnessing robust growth due to the rising healthcare investments and increasing prevalence of chronic diseases. The growing demand for advanced diagnostic technologies, including MRI, CT, and ultrasound systems, supported by public-private partnerships and digital healthcare infrastructure enhancements, are also strengthening the Mexico medical imaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 680.9 Million |

| Market Forecast in 2033 | USD 1,166.2 Million |

| Market Growth Rate 2025-2033 | 5.7% |

Mexico Medical Imaging Market Trends:

Rising Demand for Diagnostic Imaging

The Mexico medical imaging market is driven by the increasing burden of chronic diseases. Conditions such as cancer, cardiovascular disorders, and diabetes are becoming more prevalent due to changing lifestyles, aging population, and urbanization. According to the report published by the OECD, cancer is Mexico's fourth leading cause of death, contributing to one in 14 premature deaths (30%) between 2023 and 2050. Annually, 46,200 premature deaths are projected, reducing life expectancy by 0.9 years. This has led to a heightened need for timely and precise diagnostic tools to improve patient outcomes and reduce healthcare costs. Medical imaging technologies—including MRI, CT scans, and ultrasound—play a crucial role in early detection and treatment planning. Hospitals and diagnostic centers across Mexico are expanding their imaging capabilities to meet this growing demand, often supported by government initiatives and private sector investments. The trend is also fostering the adoption of advanced imaging technologies integrated with AI for improved diagnostic accuracy. This strong demand trajectory underscores a positive market outlook over the next several years.

Technological Advancements

The integration of cutting-edge technologies is reshaping diagnostic capabilities across healthcare facilities in Mexico. AI-enabled imaging tools are now assisting radiologists in detecting abnormalities more accurately and quickly, reducing human error and enabling faster clinical decisions. For instance, in September 2024, InteliMed.ai announced its partnership with deepc to implement the deepcOS platform at Grupo Rio Medical Group in Mexico. This integration into medical imaging workflows will enhance diagnostic accuracy, speed, and operational efficiency, making AI solutions more accessible. The scalable platform supports over 70 radiology AI tools, positioning Grupo Rio for future advancements. Digital radiography is replacing traditional film-based systems, offering higher image quality, quicker processing, and easier data storage and sharing. These advancements are not only enhancing diagnostic accuracy but also optimizing workflow efficiency, particularly in busy urban hospitals and specialized diagnostic centers. Furthermore, cloud-based imaging solutions and PACS (Picture Archiving and Communication Systems) are facilitating remote access to medical images, promoting telemedicine and cross-institution collaboration. As the healthcare sector modernizes, vendors are increasingly offering integrated platforms that combine imaging, analytics, and reporting functions. These innovations are contributing significantly to the Mexico medical imaging market growth.

Mexico Medical Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- CT Scanners

- X-Ray Imaging Systems

- MRI Systems

- Ultrasound Imaging Systems

- Nuclear Imaging Systems

- Mammography Systems

The report has provided a detailed breakup and analysis of the market based on the product. This includes CT scanners, X-ray imaging systems, MRI systems, ultrasound imaging systems, nuclear imaging systems, and mammography systems.

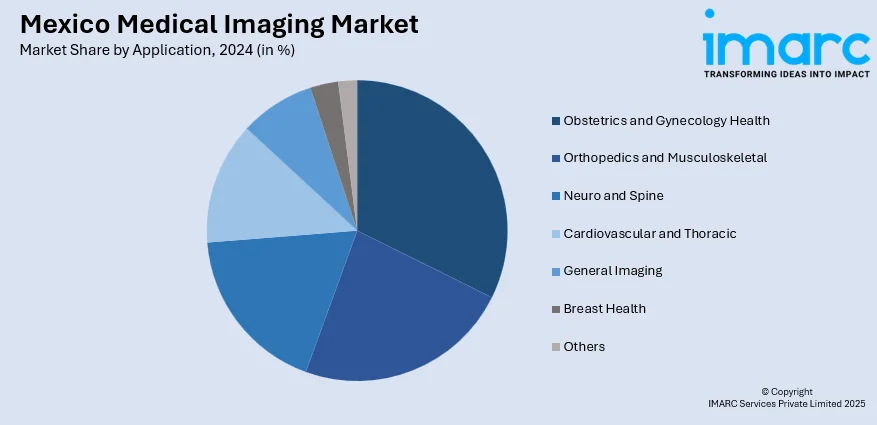

Application Insights:

- Obstetrics and Gynecology Health

- Orthopedics and Musculoskeletal

- Neuro and Spine

- Cardiovascular and Thoracic

- General Imaging

- Breast Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes obstetrics and gynecology health, orthopedics and musculoskeletal, neuro and spine, cardiovascular and thoracic, general imaging, breast health, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Academic Institutes and Research Organizations

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, and academic institutes and research organizations.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Medical Imaging Market News:

- In November 2024, Lunit announced its partnership with Salud Digna, one of Mexico's largest healthcare networks, to deploy its AI-powered medical imaging solutions, including chest X-ray and mammography analysis. This collaboration aims to enhance diagnostic capabilities and improve patient care across over 230 clinics in Mexico and Central America.

- In July 2024, United Imaging installed its uMI 550 PET/CT system at the Instituto Nacional de Pediatría in Mexico, marking a significant advancement in pediatric medical imaging. This technology enhances diagnostic accuracy and treatment planning, aiming to improve healthcare outcomes for children while addressing emerging challenges in the region.

Mexico Medical Imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | CT Scanners, X-ray Imaging Systems, MRI Systems, Ultrasound Imaging Systems, Nuclear Imaging Systems, Mammography Systems |

| Applications Covered | Obstetrics and Gynecology Health, Orthopedics and Musculoskeletal, Neuro and Spine, Cardiovascular and Thoracic, General Imaging, Breast Health, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Academic Institutes and Research Organizations |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico medical imaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico medical imaging market on the basis of product?

- What is the breakup of the Mexico medical imaging market on the basis of application?

- What is the breakup of the Mexico medical imaging market on the basis of end user?

- What is the breakup of the Mexico medical imaging market on the basis of region?

- What are the various stages in the value chain of the Mexico medical imaging market?

- What are the key driving factors and challenges in the Mexico medical imaging market?

- What is the structure of the Mexico medical imaging market and who are the key players?

- What is the degree of competition in the Mexico medical imaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical imaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)