Mexico Medical Implants Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

Mexico Medical Implants Market Overview:

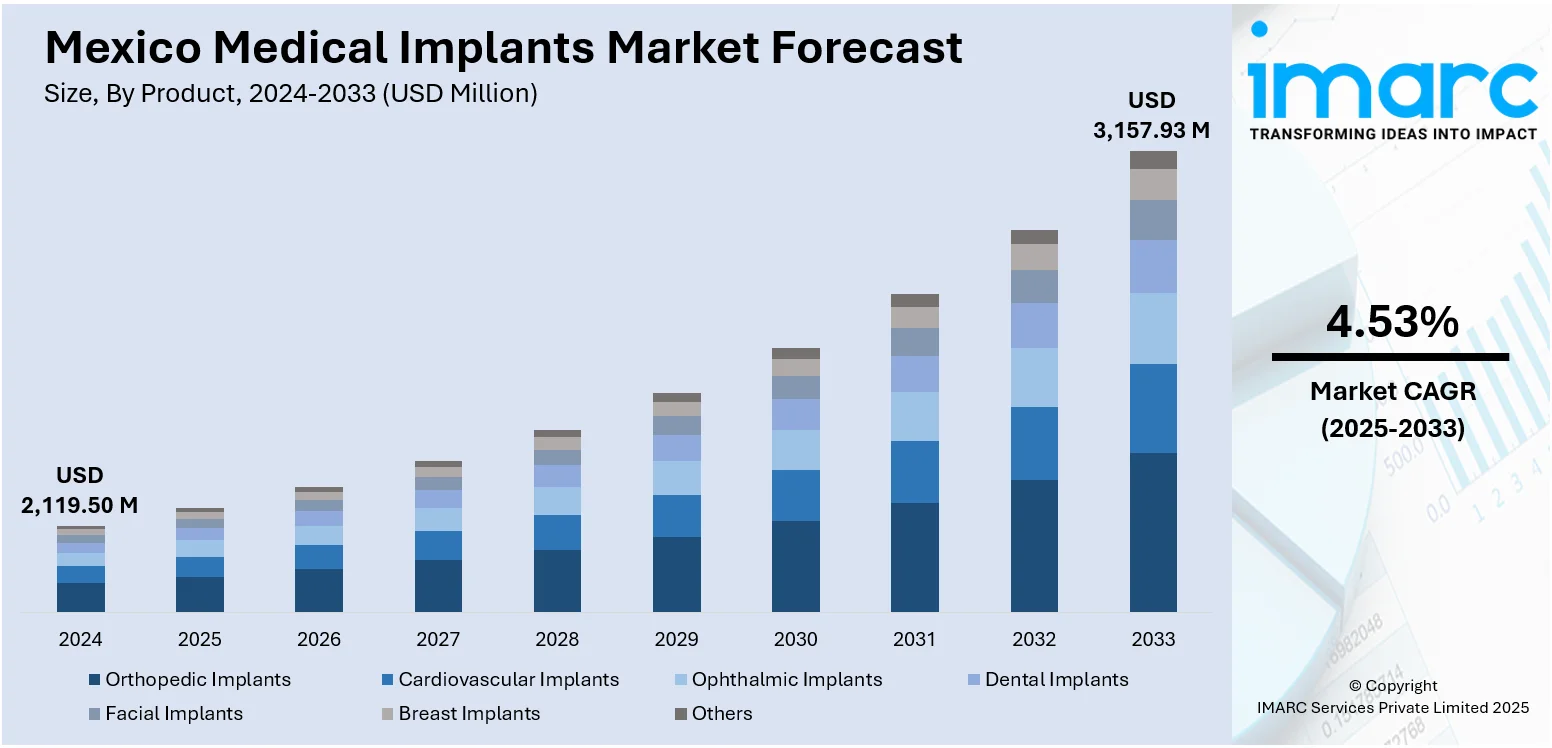

The Mexico medical implants market size reached USD 2,119.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,157.93 Million by 2033, exhibiting a growth rate (CAGR) of 4.53% during 2025-2033. The market is growing due to rising healthcare needs, an aging population, and increased demand for advanced medical technologies and surgical techniques. along with the Expanding healthcare infrastructure and government initiatives to improve access to medical treatments Are also fueling the Mexico medical implants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,119.50 Million |

| Market Forecast in 2033 | USD 3,157.93 Million |

| Market Growth Rate 2025-2033 | 4.53% |

Mexico Medical Implants Market Trends:

Growing Demand for Orthopedic Implants

The growing demand for orthopedic implants in Mexico is largely driven by the aging population and the increasing prevalence of musculoskeletal disorders. According to the data published by PAHO, as of 2024, Mexico's population reached 130,757,097, a 32.7% increase since 2000. Those aged 65 or older comprise 8.2%, up 3.2 percentage points. The dependency ratio is 48.7 per 100 active individuals. Life expectancy rose to 75.3 years, 2.7 years higher than in 2000. As one ages, the risk for degeneration of the joints, arthritis, and fractures of bones increases, necessitating orthopedic implants to enhance mobility and overall well-being. Osteoarthritis, a common disease in the elderly, necessitates treatments like knee and hip replacements, further the demand for implants. Moreover, awareness of newer surgical methods and implant technologies, such as minimally invasive systems, has prompted more individuals to choose these alternatives. Healthcare improvements and improved access to health facilities have made orthopedic treatments more effective, with prolonged outcomes. All these, together with increasing interest in superior-quality and biocompatible implants, are fueling the fast development of the orthopedic implant industry in Mexico.

To get more information on this market, Request Sample

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in Mexico is playing a crucial role in the growth of the medical implants market. Increased investments in hospitals, medical centers, and specialty clinics are improving access to advanced medical treatments, including implant surgeries. For instance, in April 2025, the Mexican government announced its plans to invest 25 Billion Pesos (USD 1.23 Billion) to build seven hospitals, enhancing healthcare for nearly 3 Million people. The initiative will create over 14,000 jobs for healthcare staff and up to 200,000 construction jobs. Three hospitals are set to begin construction first, with various capacities and specialties. As the government and private sectors enhance healthcare facilities, they are also integrating cutting-edge technologies and equipment, which allows for more accurate and efficient implant procedures. The availability of state-of-the-art surgical suites, diagnostic tools, and post-operative care has made it easier for patients to undergo complex procedures such as orthopedic, dental, and cardiac implant surgeries. Moreover, the improved healthcare infrastructure is helping address the demand for better healthcare in underserved regions, offering patients more options for quality care. This expansion is a key driver of Mexico medical implants market growth, contributing to higher adoption rates of medical implants across the country.

Mexico Medical Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and material.

Product Insights:

- Orthopedic Implants

- Hip Orthopedic Device

- Joint Reconstruction

- Knee Orthopedic Devices

- Spine Orthopedic Devices

- Others

- Cardiovascular Implants

- Pacing Devices

- Stents

- Structural Cardiac Implants

- Ophthalmic Implants

- Intraocular Lens

- Glaucoma Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes orthopedic implants (hip orthopedic device, joint reconstruction, knee orthopedic devices, spine orthopedic devices, and others), cardiovascular implants (pacing devices, stents, and structural cardiac implants), ophthalmic implants (intraocular lens and glaucoma implants), dental implants, facial implants, breast implants, and others.

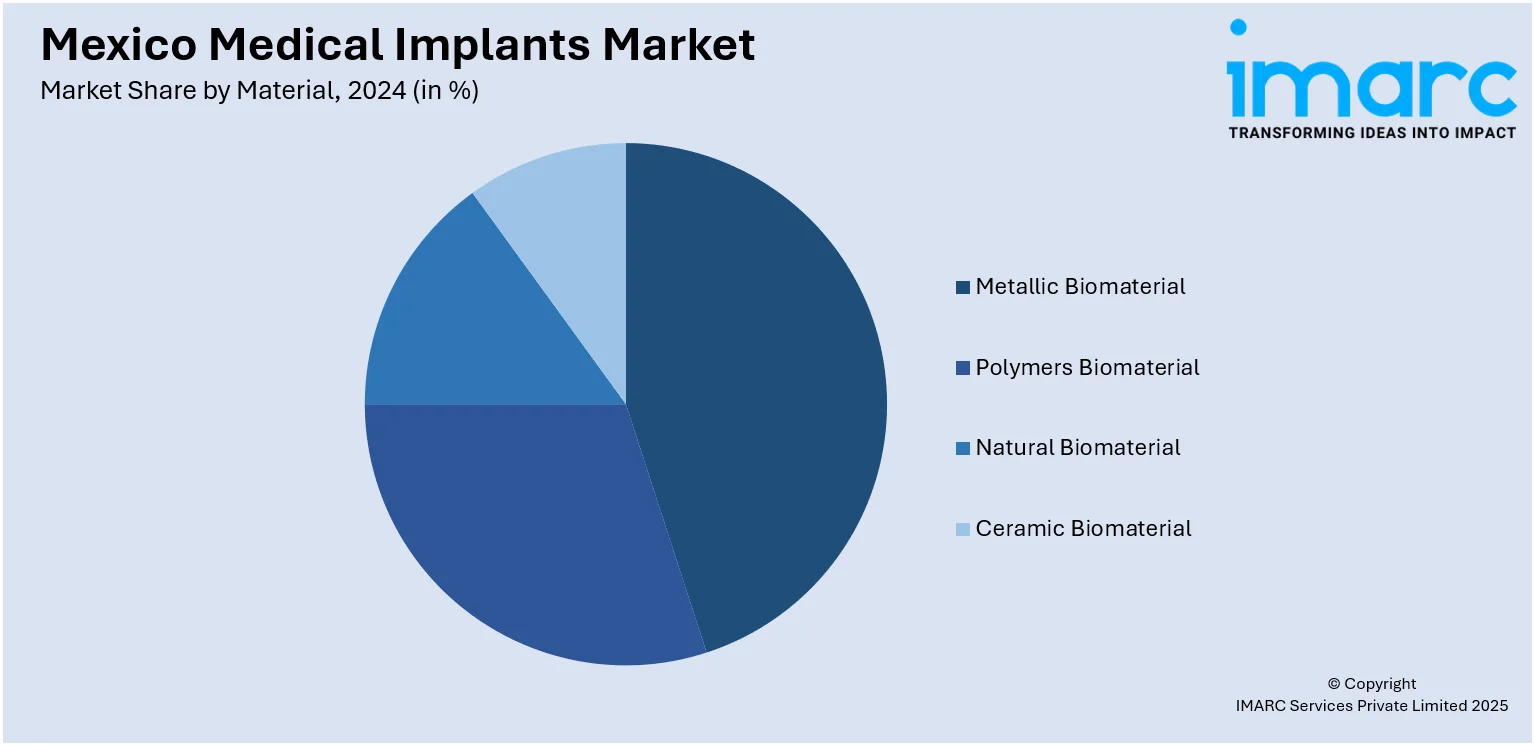

Material Insights:

- Metallic Biomaterial

- Polymers Biomaterial

- Natural Biomaterial

- Ceramic Biomaterial

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic biomaterial, polymers biomaterial, natural biomaterial, and ceramic biomaterial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Medical Implants Market News:

- In February 2025, the PAUL implant officially launched in Mexico City. Professor Keith Barton from Moorfields Eye Hospital conducted a successful introduction at APEC, Hospital de la Ceguera, where 18 doctors participated in a live surgery demonstration, showcasing the implant's capabilities and enhancing local medical expertise.

- In December 2024, Smile4EverMexico announced the launch of a single-visit tooth restoration service using advanced digital dentistry and Neo Dent implants. This efficient option significantly lowers costs, providing comprehensive treatments like the All-on-4 procedure.

Mexico Medical Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Metallic Biomaterial, Polymers Biomaterial, Natural Biomaterial, Ceramic Biomaterial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico medical implants market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico medical implants market on the basis of product?

- What is the breakup of the Mexico medical implants market on the basis of material?

- What is the breakup of the Mexico medical implants market on the basis of region?

- What are the various stages in the value chain of the Mexico medical implants market?

- What are the key driving factors and challenges in the Mexico medical implants market?

- What is the structure of the Mexico medical implants market and who are the key players?

- What is the degree of competition in the Mexico medical implants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)