Mexico Medical Waste Management Market Size, Share, Trends and Forecast by Treatment Site, Treatment, and Region, 2025-2033

Mexico Medical Waste Management Market Size and Share:

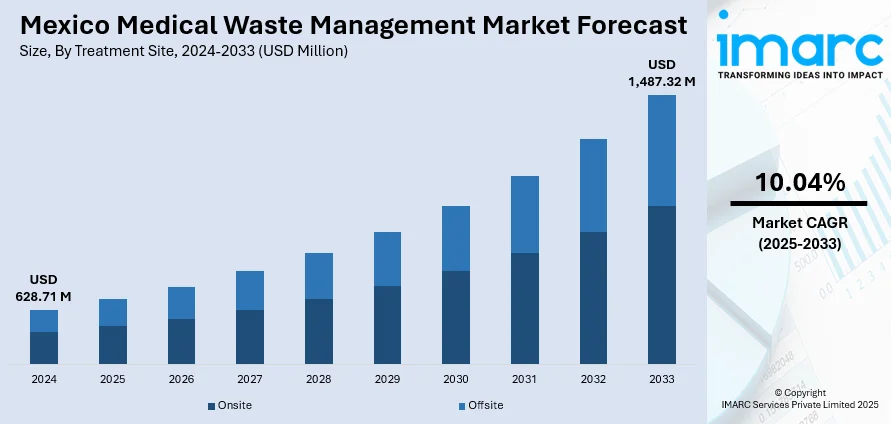

The Mexico medical waste management market size was valued at USD 628.71 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,487.32 Million by 2033, exhibiting a CAGR of 10.04% from 2025-2033. The market is driven by stringent environmental regulations mandating structured medical waste handling, alongside rapid expansion of healthcare infrastructure generating complex waste streams. Hospitals increasingly prefer digitalized, traceable, and scalable services aligned with safety and sustainability goals, thereby fueling the market. Technological upgrades and circular economy initiatives further augment the Mexico medical waste management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 628.71 Million |

| Market Forecast in 2033 | USD 1,487.32 Million |

| Market Growth Rate 2025-2033 | 10.04% |

Mexico’s medical waste management market is strongly influenced by stricter government oversight and rising awareness of public health risks. Regulations require healthcare facilities to adopt safe disposal practices that prevent infection, contamination, and environmental harm. This creates pressure on hospitals, clinics, and laboratories to comply with standards or face penalties. At the same time, growing public concern about improper waste handling, such as exposure to hazardous materials or contamination of water sources, drives demand for professional waste management services. Together, regulations and awareness are compelling the sector to adopt safer, more sustainable solutions.

The rapid growth of healthcare sector is driving Mexico medical waste management market demand. By early 2023, the country witnessed substantial growth in healthcare infrastructure, encompassing hospitals, clinics, and diagnostic centers. This expansion has increased both the volume and diversity of medical waste, ranging from laboratory materials to hazardous patient care byproducts, necessitating careful handling and disposal. The trend is driving investment in advanced treatment, storage, and transport technologies to maintain safety compliance. As healthcare access broadens, effective medical waste management has become a critical service, closely tied to the sector’s sustainable development and public health protection..

Mexico Medical Waste Management Market Trends:

Strengthening Healthcare Regulations and Institutional Oversight

Mexico has significantly enhanced its regulatory framework for medical waste management through institutions such as SEMARNAT (Secretariat of Environment and Natural Resources) and COFEPRIS (Federal Commission for the Protection against Sanitary Risks). These bodies have mandated rigorous classification, treatment, and documentation of hazardous biomedical waste. This is due to growing concerns over environmental pollution and public health risks, which have been exacerbated by improper disposal practices. A recent study revealed that nearly 83.5% of the citizens in Mexico engage in improper disposal practices for unused medications, such as throwing them in municipal trash or flushing them down drains. In total, over 51 different pharmaceutical residues have been identified in the water supply of Mexico City, including commonly disposed drugs like ibuprofen, diclofenac, and hormones, posing potential environmental and public health risks. As a result, legal enforcement mechanisms have tightened, with regular inspections and penalties for non-compliance. This has prompted both public and private healthcare facilities to outsource waste management to licensed operators with proper treatment infrastructure, including autoclaving, chemical disinfection, and incineration technologies. Hospitals, clinics, and laboratories are legally obligated to segregate infectious, pathological, and sharps waste at the source, increasing demand for compliant service providers and containerized collection systems. In addition, increasing emphasis on infection control has pushed small and mid-sized clinics to modernize waste handling protocols. Centralized recordkeeping, chain-of-custody systems, and electronic manifests are becoming standard in metropolitan zones. As more healthcare providers prioritize risk mitigation, demand continues to grow for scalable, certified solutions. These developments are reinforcing long-term demand for integrated, safe, and traceable disposal services, contributing directly to Mexico medical waste management market growth.

To get more information on this market, Request Sample

Growth of Public and Private Healthcare Infrastructure

Mexico's medical infrastructure is expanding rapidly, driven by government-backed programs such as INSABI and continued investments in private hospitals, diagnostic labs, and outpatient centers. This expansion has directly increased the volume and diversity of biomedical waste streams. Facilities now generate higher quantities of pathological, chemical, cytotoxic, and sharps waste that must be properly managed under legal and environmental norms. As reported by the World Health Organization (WHO, 2023), just 25% healthcare facilities in fragile settings have access to fundamental waste management systems. With more surgeries, diagnostic procedures, and pharmaceutical use, the per-bed waste output has risen, particularly in urban hubs such as Mexico City, Guadalajara, and Monterrey. New hospital builds and upgrades are now integrating waste management logistics into facility design, including dedicated zones for temporary waste storage and equipment for on-site decontamination. Additionally, pharmaceutical companies, research labs, and biotechnology centers are also producing specialized biohazardous waste, requiring customized handling. As health service access improves and more patients enter formal care systems, waste volumes and treatment needs continue to rise. On May 3, 2025, Mexico updated its mandatory standards on good manufacturing practices (GMP) for medical devices under NOM 241 SSA1 2025, which now includes more stringent requirements for waste management, including proper storage and disposal of medical waste. The update, effective from November 30, 2025, is aimed at improving environmental sustainability in the medical device sector, with specific amendments for stability studies and good storage practices. This dynamic supports sustained demand for high-capacity treatment facilities, trained personnel, and compliant transport operations, ensuring continuous engagement from waste management firms.

Urbanization, Sustainability Goals, and Technology Adoption

The rapid urbanization of Mexican cities is influencing medical waste disposal strategies, especially as space constraints and landfill restrictions prompt a shift toward more sustainable and tech-driven handling systems. As per estimates by reports, 87.86% of the population of Mexico lives in urban areas in 2025, equating to 115,925,945 individuals. Municipalities and hospital networks are adopting cleaner technologies, such as non-burn sterilization units, reusable containment systems, and hybrid treatment plants that minimize emissions. Moreover, waste-to-energy (WtE) solutions are being explored in larger states, aligning with Mexico’s broader environmental targets under the General Law on Climate Change. As both public and private hospitals seek to demonstrate compliance with ESG goals, they are increasingly demanding digital tracking systems for waste volumes, emissions, and treatment efficacy. Automation in waste segregation, barcoded tracking, and route optimization for transport are being deployed by modern service providers to increase efficiency and transparency. Meanwhile, awareness campaigns and government-supported certifications are promoting the adoption of greener practices within the healthcare ecosystem. These trends are driving sustained market activity, particularly among institutions seeking long-term, cost-effective, and compliant medical waste services in high-density regions.

Mexico Medical Waste Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Mexico medical waste management market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on treatment site and treatment.

Analysis by Treatment Site:

- Onsite

- Collection

- Treatment and Disposal

- Recycling

- Others

- Offsite

- Collection

- Treatment and Disposal

- Recycling

- Others

Based on the Mexico medical waste management market forecast, the onsite treatment involves managing medical waste directly at healthcare facilities. This includes collection, segregation, and temporary storage, followed by treatment and disposal methods such as autoclaving or chemical disinfection. Recycling of certain materials and other specialized processes can also be performed onsite, reducing transport risks and ensuring regulatory compliance.

Besides this, the offsite treatment refers to transporting medical waste from healthcare facilities to specialized external facilities. Collected waste is processed through treatment and disposal technologies, including incineration or advanced sterilization. Offsite recycling and other handling methods allow for centralized, efficient management of hazardous materials, helping healthcare providers comply with regulations while minimizing environmental and public health risks.

Analysis by Treatment:

- Incineration

- Autoclaving

- Chemical Treatment

- Others

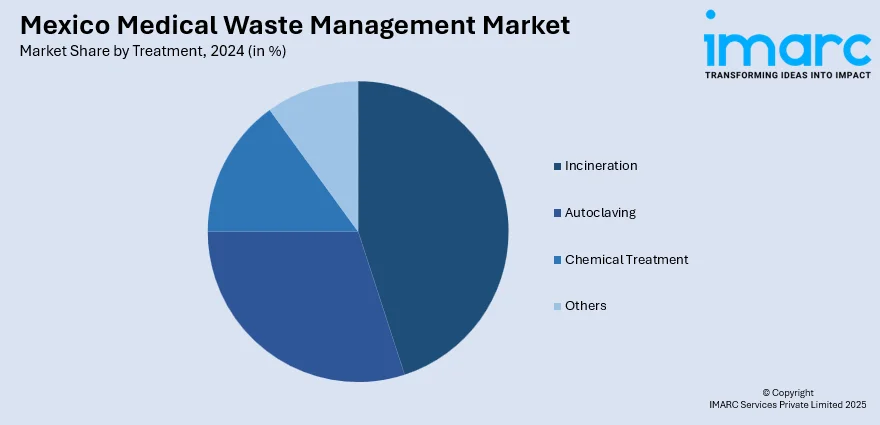

Incineration involves burning medical waste at high temperatures to reduce volume and destroy pathogens. It is particularly effective for infectious and hazardous waste but requires proper emission controls to minimize environmental impact. This method ensures safe disposal, significantly lowering the risk of contamination or disease transmission.

Besides this, the autoclaving uses high-pressure steam to sterilize medical waste, effectively eliminating bacteria, viruses, and other pathogens. It is suitable for infectious waste and sharps, offering an environmentally safer alternative to incineration. Autoclaved waste can often be safely shredded or recycled, supporting sustainable waste management practices within healthcare facilities.

Furthermore, chemical treatment neutralizes hazardous medical waste using disinfectants or other chemical agents. It is commonly applied to liquid waste, pharmaceuticals, and certain contaminated materials. This method ensures pathogen inactivation while minimizing environmental impact and provides a controlled, safe approach for disposing of materials unsuitable for incineration or autoclaving.

Also, the other treatment methods include microwave treatment, plasma pyrolysis, and encapsulation, among emerging technologies. These approaches target specific waste types, aiming to reduce volume, eliminate pathogens, or enable safe disposal. Innovative methods are increasingly adopted to meet regulatory standards, improve efficiency, and minimize environmental and public health risks.

Regional Analysis:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico has a concentration of urban healthcare facilities and industrial hubs, generating significant medical waste volumes. The region emphasizes modern treatment technologies, strict regulatory compliance, and efficient logistics. Offsite treatment facilities and recycling initiatives are increasingly used to manage waste sustainably and meet growing public health demands.

Moreover, the Central Mexico, home to the capital and major hospitals, experiences high medical waste generation from dense populations and extensive healthcare services. Facilities focus on a mix of onsite and offsite treatment, incorporating autoclaving, incineration, and chemical methods. Regulatory enforcement and public awareness drive adoption of safer, environmentally responsible waste management practices.

Also, the Southern Mexico has a mix of urban and rural healthcare centers, leading to varied medical waste volumes. Limited infrastructure in some areas encourages reliance on offsite treatment and collection services. Efforts focus on expanding access to proper disposal technologies, improving training, and raising awareness about health and environmental risks.

Apart from this, the other regions, including remote and less-developed areas, face challenges in medical waste management due to limited facilities and logistical constraints. These areas increasingly depend on centralized treatment centers and mobile collection services. Initiatives aim to strengthen compliance, enhance capacity, and implement sustainable, safe disposal practices across dispersed healthcare sites.

Competitive Landscape:

The market is moderately fragmented: many local operators handle basic collection and transport, while a smaller set of more capable firms compete for contracts involving advanced treatment, disposal, and regulatory compliance. Differentiation largely depends on service quality (including traceability and safety), technological capability (e.g. non-burn treatment, autoclaving, sterilization), permitted infrastructure, and ability to navigate a complex regulatory environment. Margins are squeezed by rising compliance costs, capital investment needs, and public scrutiny. Larger competitors gain advantage via scale, specialized treatment capacity, and integrated logistics. Smaller players compete in niche or rural markets in the Mexico medical waste management market analysis. Partnerships with healthcare providers and licensing status are key competitive levers. Innovation (including environmentally friendly practices) and reliability in meeting standards are emerging decisive factors.

The report provides a comprehensive analysis of the competitive landscape in the Mexico medical waste management market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: The Secretariat of Environment and Natural Resources (SEMARNAT) of Mexico announced a partnership with the Global Environment Facility (GEF), the United Nations Industrial Development Organization (UNIDO), the United Nations Environment Programme (UNEP), and other partners. The partnership aims to end the usage of mercury in the chloralkali industry in order to safeguard the environment and public health while encouraging environmentally friendly industrial processes. The medical sector makes substantial use of chloralkali, with around 88% of contemporary medications being produced using it, either as an ingredient or as a processing aid.

Mexico Medical Waste Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatment Sites Covered |

|

| Treatments Covered | Incineration, Autoclaving, Chemical Treatment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico medical waste management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico medical waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico medical waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical waste management market in Mexico was valued at USD 628.71 Million in 2024.

The Mexico medical waste management market is projected to exhibit a CAGR of 10.04% during 2025-2033, reaching a value of USD 1,487.32 Million by 2033.

Mexico’s medical waste management market is driven by stricter regulations, growing healthcare infrastructure, and rising awareness of environmental and health risks. As hospitals and clinics expand, so does the need for safe disposal solutions. Demand is increasing for reliable, sustainable, and compliant services that ensure proper treatment and minimize contamination risks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)