Mexico Medium Density Fiberboard Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2026-2034

Mexico Medium Density Fiberboard Market Summary:

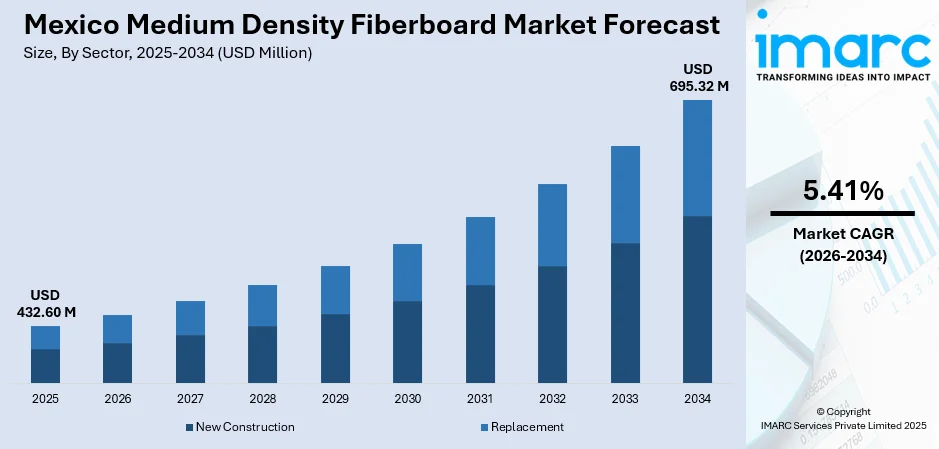

The Mexico medium density fiberboard market size was valued at USD 432.60 Million in 2025 and is projected to reach USD 695.32 Million by 2034, growing at a compound annual growth rate of 5.41% from 2026-2034.

The market is fueled by Mexico's expanding residential and commercial construction sectors, which generate substantial demand for cost-effective interior building materials. Urbanization trends across major metropolitan areas, combined with rising disposable incomes and consumer preference for modern interior design, continue to strengthen demand for MDF products in furniture manufacturing and home renovation projects. The growing emphasis on sustainable building materials and eco-friendly manufacturing processes is also bolstering the Mexico medium density fiberboard market share.

Key Takeaways and Insights:

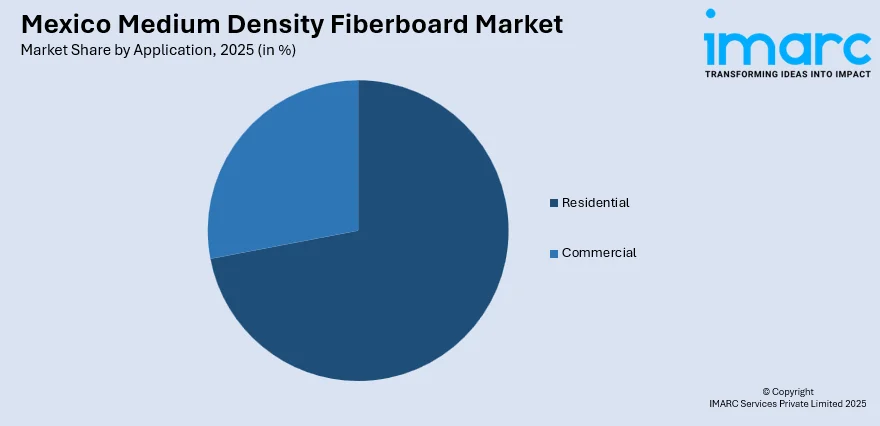

- By Application: Residential dominates the market with a share of 72% in 2025, fueled by the widespread use of MDF in furniture, cabinetry, and interior applications across residential housing projects.

- By Sector: Replacement leads the market with a share of 60% in 2025, owing to strong renovation and remodeling activities in existing residential properties.

- Key Players: The Mexico medium density fiberboard market exhibits moderate competitive intensity, with multinational composite panel manufacturers competing alongside regional producers. Market participants focus on product diversification, sustainable manufacturing practices, and strategic distribution partnerships to maintain competitive positioning.

To get more information on this market Request Sample

Mexico's MDF market benefits from strategic trade connections under the USMCA agreement, facilitating cross-border material flows and manufacturing collaborations with North American partners. The Mexico furniture market size reached USD 10.2 Billion in 2024. Looking forward, the market is expected to reach USD 15.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033, representing a major consumption base for MDF products used in cabinetry, shelving, and interior components. Government housing initiatives through INFONAVIT, which has disbursed over 10 million housing loans to Mexican citizens, continue to support residential construction activity and associated demand for interior finishing materials. The market is further strengthened by nearshoring trends driving industrial expansion in northern states like Nuevo León and Chihuahua, where manufacturing hub development generates demand for commercial interiors and office furnishings utilizing MDF panels.

Mexico Medium Density Fiberboard Market Trends:

Rising Demand for Eco-Friendly and Low-Emission MDF Products

In Mexico, both consumers and manufacturers are increasingly prioritizing eco-friendly building materials with reduced formaldehyde emissions. To meet this demand, producers are adopting low-emission resin systems and incorporating recycled wood content into their products. These practices are accelerating the use of sustainable MDF formulations across the industry, reflecting a stronger commitment to environmentally responsible production and resource-efficient manufacturing. The trend highlights a broader shift toward greener materials and sustainable practices within Mexico’s construction and furniture sectors.

Technological Advancements in Manufacturing Processes

MDF manufacturers are investing in production line automation and advanced pressing technologies to improve product consistency, quality, and operational efficiency. Digital integration enables better inventory management and customized panel specifications for diverse end-user requirements. In September 2024, Lectra announced the expansion of its Furniture On Demand solution to Mexico, leveraging Industry 4.0 technologies including automated fabric handling and digital order integration to streamline furniture production processes and reduce inventory waste.

Growing Preference for Space-Efficient and Modular Furniture

Urbanization in Mexico's major metropolitan areas is driving demand for multi-functional, space-optimizing furniture that relies heavily on MDF as a core material. Modular furniture systems designed for compact living spaces are gaining popularity among urban consumers and first-time homeowners. In November 2024, IKEA unveiled its largest store in Mexico with the inauguration of IKEA Guadalajara Expo, a 37,000-square-meter facility showcasing 8,400 items including MDF-based furniture solutions designed for urban living requirements.

Market Outlook 2026-2034:

The Mexico medium density fiberboard market is positioned for steady expansion supported by continued urbanization, housing development initiatives, and furniture industry growth. Nearshoring trends driving manufacturing investment in northern border states are expected to generate additional demand for commercial and industrial interior applications. The market generated a revenue of USD 432.60 Million in 2025 and is projected to reach a revenue of USD 695.32 Million by 2034, growing at a compound annual growth rate of 5.41% from 2026-2034.

Mexico Medium Density Fiberboard Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Residential | 72% |

| Sector | Replacement | 60% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential segment dominates with a market share of 72% of the total Mexico medium density fiberboard market in 2025.

The residential application segment maintains dominant market position due to extensive MDF utilization in furniture manufacturing, kitchen cabinetry, flooring substrates, and wall paneling for housing projects. Mexico’s residential real estate market continues to drive strong demand for interior finishing materials, fueled by ongoing construction and urban development. The sector’s growth supports consistent requirements for high-quality finishes, including flooring, wall panels, and decorative surfaces, reflecting sustained activity in both new housing projects and renovation initiatives across the country. Government-supported housing initiatives led by INFONAVIT and CONAVI are driving strong demand for cost-effective MDF products in the State of Mexico’s eastern municipalities. In 2025, these programs aim to fund 120,000 new homes, implement 100 housing upgrades, and deliver over 120,000 property deeds, reinforcing the need for affordable interior solutions in Mexico’s expanding residential construction sector.

Rising disposable incomes and changing consumer lifestyle preferences are fueling investment in home renovation and interior design improvements, further strengthening residential MDF demand. The Mexico home furniture market size reached USD 7.3 Billion in 2024. Looking forward, the market is expected to reach USD 13.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.64% during 2025-2033, and relies substantially on MDF as a primary material for manufacturing affordable yet durable furniture pieces. Urbanization trends driving high-density residential development in Mexico City, Guadalajara, and Monterrey create ongoing requirements for space-efficient, MDF-based furniture and built-in storage solutions.

Sector Insights:

- New Construction

- Replacement

The replacement sector leads the market with a share of 60% of the total Mexico medium density fiberboard market in 2025.

The replacement sector dominates the market, fueled by strong renovation and remodeling activity across Mexico’s existing housing stock. Many homeowners, particularly in densely populated areas, are choosing to upgrade and renovate their current properties instead of moving, driving steady demand for MDF replacement materials. The growing DIY home improvement trend further supports consistent use of MDF panels for applications such as cabinet refacing, flooring updates, and interior finish enhancements, sustaining market growth across residential projects.

Aging residential infrastructure and evolving aesthetic preferences motivate homeowners to upgrade interior finishes, driving replacement purchases of MDF cabinetry, moldings, and decorative panels. The residential remodeling sector benefits from growing homeowner equity and increased focus on enhancing living space functionality, particularly in urban areas where housing turnover costs discourage relocation. Property owners seeking to improve resale values frequently invest in kitchen and bathroom renovations utilizing MDF-based cabinetry and finishing materials.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant consumption region driven by manufacturing hub expansion and nearshoring-related industrial investment in states like Nuevo León, Chihuahua, and Baja California. The region benefits from proximity to U.S. markets and trade facilitation under the USMCA, supporting both furniture export manufacturing and domestic construction material demand.

Central Mexico, anchored by Mexico City and surrounding metropolitan areas, constitutes the largest consumption base due to high population density, concentrated real estate development activity, and substantial furniture manufacturing capacity. Guadalajara and other central region cities contribute significantly through residential construction and home furnishing requirements.

Southern Mexico experiences growing MDF demand from tourism-related hospitality construction in Yucatan Peninsula resort areas and expanding urban development in secondary cities. Regions like Cancun, Riviera Maya, and Merida drive demand for hotel interiors and vacation property furnishings utilizing MDF panels.

Market Dynamics:

Growth Drivers:

Why is the Mexico Medium Density Fiberboard Market Growing?

Expanding Residential Construction and Housing Development Programs

Mexico’s residential construction sector continues to grow, driven by government housing programs and private investment in affordable and mid-range developments. Policies promoting efficient land use and accessible housing sustain steady demand for cost-effective interior materials like MDF. These programs encourage the use of MDF in cabinetry, interior doors, moldings, and furniture within both new constructions and home renovations, making it an essential material in the ongoing expansion and modernization of the country’s residential properties. For instance, in October 2025, Mexico City’s Roma Norte neighborhood welcomed ONTO Álvaro Obregón, a 3,770-square-metre timber apartment building designed by local studio CRB Arquitectos. Completed in 2025, the development features planted atriums and sculptural staircases, blending architectural innovation with urban greenery. The building features a combination of units available for purchase and rent, managed via a hotel-style system designed to support both short- and medium-term stays, catering to the vibrant, fast-paced lifestyle of the neighborhood.

Growing Furniture Manufacturing Industry and Export Activity

The Mexican furniture industry is a major consumer of MDF, leveraging its versatility, machinability, and affordability across a wide range of products. Manufacturers supply both domestic and international markets, producing furniture for homes, offices, and commercial spaces. Nearshoring trends have further expanded production, enabling easier access to North American markets while reducing supply chain complexities. Financial support mechanisms for furniture manufacturers strengthen production capacity, boosting MDF consumption across manufacturing operations and export-focused product lines. For instance, in October 2025, the Viking 2.0 Project in Zitácuaro, Michoacán, marks a major technological milestone for the wood products industry with a US$290 million investment. The facility will produce 300,000 m³ of medium-density fiberboard (MDF) and 150,000 m³ of melamine, while also integrating paper impregnation processes within the same complex, enhancing production efficiency and product versatility.

Nearshoring-Driven Industrial Expansion and Commercial Construction

Industrial nearshoring is driving growth in commercial and industrial construction across northern Mexico, increasing demand for MDF in office interiors, commercial furnishings, and hospitality projects. The expansion of manufacturing facilities encourages associated residential development, as workers seek housing near industrial hubs. This cycle of industrial, commercial, and residential growth generates continuous demand for MDF products, supporting their use in new construction, renovations, and furniture manufacturing in regions experiencing nearshoring-driven economic activity.

Market Restraints:

What Challenges the Mexico Medium Density Fiberboard Market is Facing?

Competition from Alternative Materials and Substitutes

MDF faces competition from substitute materials including particleboard, plywood, solid wood, and increasingly wood-plastic composites in various applications. These alternatives may offer specific performance advantages or cost benefits depending on end-use requirements, potentially limiting MDF market expansion in certain product categories.

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in wood fiber and resin prices impact MDF manufacturing costs and product pricing stability. Supply chain disruptions affecting raw material availability and transportation costs create operational challenges for producers, potentially constraining production capacity and market growth during periods of material scarcity.

Stringent Formaldehyde Emission Regulations and Compliance Requirements

Increasingly stringent formaldehyde emission standards for composite wood products require manufacturers to invest in low-emission resin technologies and third-party certification programs. Compliance with TSCA Title VI and evolving Mexican environmental regulations adds production costs and complexity, particularly for smaller manufacturers lacking resources for technological upgrades.

Competitive Landscape:

The Mexico medium density fiberboard market features a moderately fragmented competitive structure with participation from multinational composite panel corporations, regional manufacturers, and specialized producers serving niche applications. Market participants compete on product quality, pricing, distribution capabilities, and value-added services including custom panel specifications and technical support. Leading players invest in manufacturing technology upgrades, sustainable production processes, and supply chain optimization to maintain competitive positioning. Strategic partnerships with furniture manufacturers, construction companies, and distribution networks enable market access and customer retention across residential and commercial segments.

Recent Developments:

- April 2025: Vinte revealed plans to invest MXN 2.7 billion (USD 131.7 million) in Hidalgo for the Real Bilbao residential development project, expected to generate over 18,000 jobs while providing affordable housing options that will drive demand for interior building materials including MDF products.

Mexico Medium Density Fiberboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico medium density fiberboard market size was valued at USD 432.60 Million in 2025.

The Mexico medium density fiberboard market is expected to grow at a compound annual growth rate of 5.41% from 2026-2034 to reach USD 695.32 Million by 2034.

The residential application segment dominated the market with a 72% share in 2025, driven by extensive utilization in furniture manufacturing, kitchen cabinetry, and interior finishing applications for housing projects.

Key factors driving the Mexico medium density fiberboard market include expanding residential construction activity, growing furniture manufacturing output, nearshoring-driven industrial investment, rising renovation and remodeling demand, and increasing adoption of eco-friendly building materials.

Major challenges include competition from alternative materials such as particleboard and plywood, raw material price volatility, supply chain disruptions, stringent formaldehyde emission regulations, and compliance costs associated with environmental certification requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)