Mexico Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034

Mexico Menswear Market Summary:

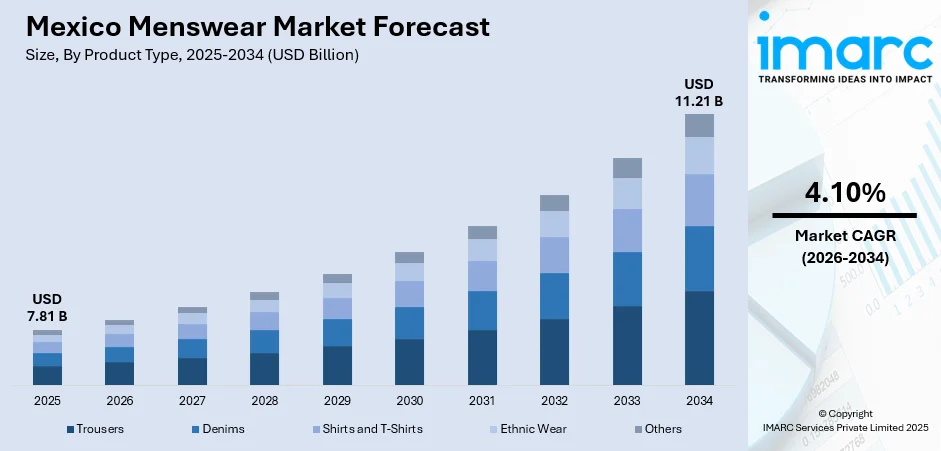

The Mexico menswear market size was valued at USD 7.81 Billion in 2025 and is projected to reach USD 11.21 Billion by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

The market is driven by rising consumer preference for sustainable and ethically sourced clothing, growing popularity of athleisure and functional wear that blends style with comfort, and increasing cultural pride reflected through heritage-inspired fashion designs. Urbanization, evolving lifestyle patterns, and the expansion of organized retail channels further contribute to market expansion. Additionally, digital commerce penetration and shifting fashion sensibilities among younger demographics continue to bolster demand, supporting steady Mexico menswear market share growth.

Key Takeaways and Insights:

- By Product Type: Shirts and t-shirts dominate the market with a share of 38.52% in 2025, driven by versatile styling options and growing preference for comfortable casual wear suitable for Mexico's warm climate.

- By Season: Summer wear leads the market with a share of 40.38% in 2025, owing to Mexico's predominantly warm tropical climate requiring lightweight, breathable apparel throughout most regions.

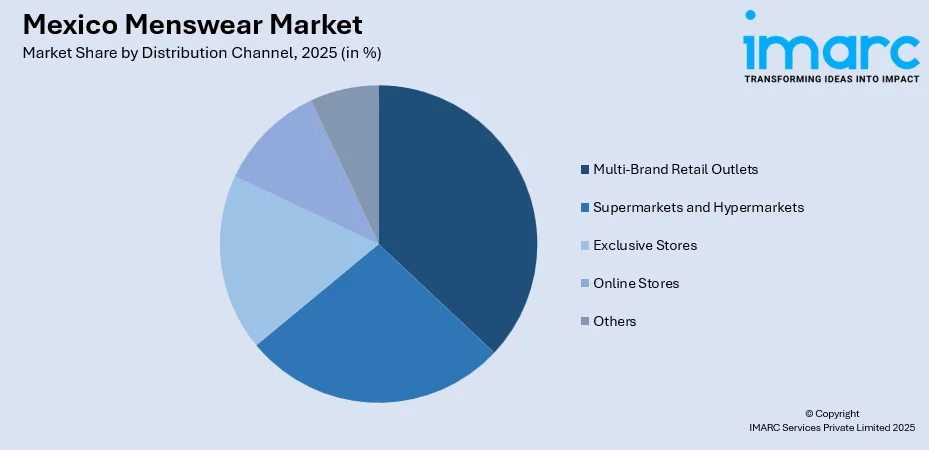

- By Distribution Channel: Multi-brand retail outlets represent the largest segment with a market share of 28.69% in 2025, driven by consumers diverse brands selections and competitive pricing through established retail networks.

- Key Players: The Mexico menswear market features a competitive landscape comprising international fast-fashion brands, luxury fashion houses, domestic manufacturers, and emerging sustainable fashion labels competing through product innovation, pricing strategies, and omnichannel distribution approaches.

To get more information on this market Request Sample

The Mexico menswear market is experiencing robust expansion fueled by several interconnected demand catalysts. Increasing urbanization and rising disposable incomes among the working-age male population have elevated spending capacity on apparel and fashion accessories. The growing influence of global fashion trends, disseminated through social media platforms and digital influencers, has heightened style consciousness among Mexican men across age groups. In August 2025, H&M collaborated with Mexican designer Lorena Saravia for its latest designer collection, highlighting Mexico’s emerging fashion talent and reinforcing the brand’s global influence. Additionally, the proliferation of organized retail formats, including department stores and specialty fashion outlets, has improved product accessibility and shopping convenience. The expanding e-commerce infrastructure enables consumers in both metropolitan and semi-urban areas to explore diverse menswear collections. Furthermore, workplace formalization and evolving dress code expectations across corporate environments continue driving demand for professional attire and contemporary casual wear.

Mexico Menswear Market Trends:

Growing Preference for Sustainable and Eco-Conscious Fashion

The Mexican menswear landscape is witnessing a significant transformation toward environmentally responsible clothing choices. Consumers are increasingly prioritizing garments manufactured using organic fibers, recycled materials, and low-impact production processes. In February 2025, Mexico City-based brand 101% launched eco-conscious performance apparel using GRS-certified recycled nylon from pre- and post-consumer waste, promoting sustainable practices. Moreover, this consciousness extends beyond fabric selection to encompass sustainable packaging solutions and transparent supply chain practices. Brands embracing circular fashion principles, including garment recycling programs and repair services, are gaining favorable consumer attention. The movement reflects broader societal awareness regarding environmental conservation and responsible consumption patterns. Younger demographics particularly demonstrate heightened sensitivity toward ecological footprints associated with fashion purchases, compelling manufacturers to integrate sustainability into core product development strategies and marketing communications across diverse menswear categories.

Expansion of Athleisure and Performance-Oriented Apparel

Contemporary Mexican consumers are gravitating toward versatile clothing that seamlessly transitions between fitness activities, casual outings, and relaxed professional environments. In August 2025, Fabletics opened its first physical store in Metepec, Mexico, introducing high-performance, stylish athleisure apparel and expanding nationwide access to versatile activewear. This convergence of athletic functionality with everyday fashion aesthetics has propelled athleisure into mainstream wardrobes. Performance fabrics featuring moisture-wicking properties, enhanced stretch capabilities, and temperature regulation technologies are increasingly incorporated into everyday menswear designs. The trend reflects evolving lifestyle priorities where health consciousness and physical activity coexist with professional commitments and social engagements. Joggers, technical polo shirts, and hybrid footwear exemplify this category's appeal. As flexible working arrangements and wellness-focused lifestyles continue gaining prominence, demand for multifunctional apparel combining comfort with contemporary styling remains on an upward trajectory.

Revival of Cultural Heritage and Artisanal Craftsmanship

Mexican menswear is experiencing a renaissance of traditional design elements integrated into contemporary fashion collections. Indigenous textile patterns, handwoven fabrics, and regionally distinctive embroidery techniques are being reimagined for modern masculine aesthetics. As per sources, in November 2025, the “Crafted in Mexico” project, in collaboration with the Ministry of Culture and Google Arts & Culture, showcased 32 new artisan stories from eight communities, promoting Mexican textile heritage. Moreover, this cultural reawakening celebrates artisanal craftsmanship while supporting local weaving communities and preserving ancestral textile traditions. Designers are blending heritage motifs with contemporary silhouettes, creating distinctive pieces that resonate with consumers seeking authentic, meaningful fashion statements. The trend extends across casual and formal categories, with traditional influences appearing in everything from statement outerwear to accessories. This movement satisfies growing consumer appetite for unique, story-driven fashion while reinforcing national cultural identity within the evolving menswear marketplace.

Market Outlook 2026-2034:

The Mexico menswear market revenue is projected to demonstrate consistent expansion throughout the forecast period, supported by favorable demographic trends and increasing fashion awareness. Continued urbanization, rising middle-class prosperity, and evolving consumer preferences toward branded apparel are expected to sustain market momentum. Digital retail channel proliferation will enhance product accessibility across geographic regions. Innovation in fabric technologies, sustainable manufacturing practices, and omnichannel retail strategies will further strengthen revenue generation, positioning the market for sustained growth through the assessment period. The market generated a revenue of USD 7.81 Billion in 2025 and is projected to reach a revenue of USD 11.21 Billion by 2034, growing at a compound annual growth rate of 4.10% from 2026-2034.

Mexico Menswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Shirts and T-Shirts | 38.52% |

| Season | Summer Wear | 40.38% |

| Distribution Channel | Multi-Brand Retail Outlets | 28.69% |

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

Shirts and t-shirts dominate with a market share of 38.52% of the total Mexico menswear market in 2025.

Shirts and t-shirts represent the cornerstone category within Mexico's menswear landscape, commanding substantial consumer preference across demographic segments. This dominance stems from their universal applicability spanning workplace environments, social gatherings, and casual everyday wear. Cotton-based shirts and T-shirts particularly resonate with Mexican consumers given the prevailing warm climatic conditions across most regions. According to records, in 2024, Mexico’s total trade of knitted T-shirts amounted to US$2,166 M, comprising US$1,149M in exports and US$1,017M in imports, with Baja California, State of Mexico, and Yucatán leading export volumes. Furthermore, this segment benefits from continuous design innovation, with manufacturers introducing diverse collar styles, fit variations, and fabric blends catering to evolving fashion sensibilities.

The category's accessibility across price points ensures broad market penetration, from value-oriented mass-market offerings to premium designer collections. T-shirts serve as essential wardrobe foundations while also functioning as fashion statement pieces featuring graphic prints and brand logos. Formal and semi-formal shirts maintain steady demand from professional workforce segments requiring presentable office attire. The segment's versatility, affordability, and styling flexibility collectively reinforce its leading position within the Mexico menswear market structure.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

Summer wear leads with a share of 40.38% of the total Mexico menswear market in 2025.

Summer wear maintains commanding presence within Mexico's menswear market, reflecting geographic and climatic realities across the nation's diverse regions. The predominance of warm weather conditions throughout significant portions of the year drives sustained demand for lightweight, breathable apparel designed for comfort during elevated temperatures. Fabrics featuring moisture management properties and relaxed fits dominate this category, addressing practical consumer requirements for heat-appropriate clothing solutions.

Consumer preferences within this segment emphasize natural fibers, particularly cotton and linen blends, valued for their comfort and breathability characteristics. As per sources, in March 2025, Men's Fashion launched its Havana Spring-Summer 2025 collection in Mexico, featuring linen suits, bamboo fiber garments, guayaberas, and sustainable Tlaolli pieces, emphasizing comfort, elegance, and modern style. Moreover, short-sleeved shirts, casual shorts, and lightweight trousers constitute primary purchase categories. The tourism industry further amplifies demand, with visitors seeking climate-appropriate vacation wardrobes. Retailers strategically prioritize summer collections given extended selling seasons across Mexican territories. The segment's dominance reflects fundamental alignment between product characteristics and environmental conditions governing daily consumer clothing choices throughout most calendar months.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

Multi-brand retail outlets exhibit a clear dominance with a 28.69% share of the total Mexico menswear market in 2025.

Multi-brand retail outlets have established themselves as the preferred shopping destination for Mexican menswear consumers, offering distinctive advantages in product selection and comparative shopping convenience. These establishments aggregate diverse brand portfolios under unified retail environments, enabling consumers to evaluate multiple options across price points and styling preferences within single shopping excursions. As per sources, in April 2025, Farm Rio launched its first Mexico store at Shopping Artz Pedregal, showcasing over 180 Summer 2025 collection pieces, with dedicated spaces planned within Palacio de Hierro outlets. Further, the format appeals particularly to value-conscious shoppers seeking competitive pricing and promotional offers.

Strategic positioning within high-traffic commercial complexes and shopping centers ensures consistent footfall and consumer accessibility. These outlets benefit from established trust relationships with consumers familiar with their product quality assurances and return policies. The format accommodates varied consumer preferences, stocking everything from affordable everyday basics to aspirational mid-range fashion brands. Professional sales assistance and curated merchandise displays enhance shopping experiences, differentiating physical retail from online alternatives. This channel's dominance reflects Mexican consumer preferences for tangible product evaluation before purchase decisions.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant menswear consumption region, characterized by proximity to United States fashion influences and higher average income levels in industrial cities. The region's workforce employed in manufacturing and cross-border commerce demonstrates preference for both professional attire and casual American-influenced styles, supporting diverse product category demand.

Central Mexico dominates the national menswear market, anchored by Mexico City's massive consumer base and commercial infrastructure. This region concentrates premium retail outlets, fashion-forward consumers, and corporate employment generating professional attire demand. Dense urbanization and established shopping destinations make Central Mexico the primary battleground for menswear brand competition.

Southern Mexico presents distinct market characteristics shaped by warmer tropical climates and diverse cultural influences. Consumer preferences emphasize lightweight, breathable fabrics suitable for humid conditions. Traditional textile heritage influences regional fashion aesthetics, with locally produced garments and artisanal elements maintaining cultural relevance alongside contemporary menswear offerings in urban commercial centers.

Others encompass coastal resort destinations and emerging urban centers experiencing economic development. Tourism-driven economies in beach destinations generate seasonal demand for vacation-appropriate menswear. Growing secondary cities present expansion opportunities as retail infrastructure develops and consumer spending capacity increases alongside regional economic advancement.

Market Dynamics:

Growth Drivers:

Why is the Mexico Menswear Market Growing?

Rising Urbanization and Expanding Middle-Class Population

Mexico's ongoing urbanization trajectory continues reshaping consumer spending patterns within the apparel sector. Metropolitan expansion concentrates working-age populations in urban centers characterized by increased employment opportunities, higher income levels, and enhanced retail infrastructure. This demographic migration elevates exposure to contemporary fashion influences while simultaneously increasing disposable income available for discretionary clothing purchases. Urban dwellers demonstrate heightened brand awareness and fashion consciousness compared to rural counterparts, driving demand for quality menswear across categories. The expanding middle-class segment exhibits growing aspirations for lifestyle upgrades, including wardrobe enhancement with branded and fashionable apparel. Shopping mall proliferation in secondary cities further democratizes access to organized retail channels, extending market reach beyond traditional metropolitan strongholds and broadening the consumer base for menswear products. As per sources, in 2024, Mexico’s retail sector announced 15 new shopping malls scheduled to open by the end of 2025, expanding urban retail infrastructure and enhancing consumer access.

Digital Transformation and E-Commerce Channel Expansion

The accelerating digitalization of retail commerce has significantly expanded market accessibility for Mexican menswear consumers. Online shopping platforms enable consumers across geographic locations to browse extensive product catalogs, compare pricing, and access brands previously unavailable in local markets. Enhanced logistics infrastructure facilitates reliable delivery services even to semi-urban and rural destinations. Digital payment adoption removes traditional barriers to online transactions, encouraging broader consumer participation in e-commerce. Social media platforms serve dual functions as fashion inspiration sources and direct purchasing channels, particularly resonating with younger demographics. As per sources, in 2025, 45% of Mexican online shoppers purchased clothing or accessories via TikTok Shop and Instagram Shopping, with 52 % of Gen Z using social commerce for fashion discovery and purchases. Furthermore, brands leverage digital marketing capabilities to engage target audiences through personalized content and influencer collaborations. The omnichannel retail evolution, integrating online browsing with physical store experiences, provides consumers flexibility in shopping journey preferences while expanding overall market participation and purchase frequency.

Evolving Workplace Culture and Professional Dress Requirements

Transformations in Mexican corporate culture and employment landscapes are generating sustained demand for professional menswear categories. According to reports, Mexico’s international sales of Mens or Boys Suits, Ensembles, Jackets, Blazers, and Trousers reached US$86.6M, while international purchases totaled US$33.5M. Furthermore, economic formalization has expanded white-collar employment opportunities requiring appropriate business attire. While traditional formal dress codes persist in certain industries, the broader adoption of business casual policies has created demand for versatile clothing bridging professional and casual contexts. This evolution favors chinos, smart casual shirts, and blazers suitable for modern workplace environments. Additionally, the growth of service sector employment, including hospitality and retail, necessitates presentable uniforms and staff attire. Young professionals entering the workforce represent significant first-time buyers of professional wardrobes. The hybrid work phenomenon has further influenced preferences toward comfortable yet presentable clothing suitable for video conferencing and occasional office attendance, sustaining diverse demand across menswear categories.

Market Restraints:

What Challenges the Mexico Menswear Market is Facing?

Intense Price Competition and Margin Pressures

The Mexico menswear market faces persistent challenges from aggressive pricing competition across retail channels. Mass-market retailers and fast fashion operators continuously pressure pricing structures, compelling competitors to sacrifice margins or risk market share erosion. This environment challenges premium and mid-tier brands seeking to maintain quality standards while remaining price competitive. Consumers demonstrate high price sensitivity, frequently prioritizing affordability over brand loyalty.

Counterfeit Products and Informal Market Competition

The prevalence of counterfeit apparel and informal market channels presents ongoing challenges for legitimate menswear market participants. Unregulated street vendors and informal markets offer low-priced alternatives that attract budget-conscious consumers, diverting potential sales from organized retail channels. Counterfeit products bearing imitation branding undermine authentic brand value propositions while potentially compromising consumer safety through substandard manufacturing. Enforcement challenges complicate efforts to curtail informal market activities.

Seasonal Demand Fluctuations and Inventory Management Challenges

Mexican menswear retailers contend with demand variability across calendar periods, complicating inventory planning and working capital management. While Mexico's warm climate moderates’ extreme seasonal swings compared to temperate markets, promotional calendar concentrations around holidays and back-to-school periods create demand peaks followed by slower intervals. Managing inventory across these cycles requires sophisticated forecasting capabilities that challenge smaller operators. Excess inventory from overestimated demand necessitates margin-eroding markdowns, while stockouts during peak periods sacrifice sales opportunities.

Competitive Landscape:

The Mexico menswear market operates within a dynamic competitive environment characterized by diverse participant categories spanning international fashion corporations, regional apparel conglomerates, and emerging domestic brands. Competition intensifies across multiple dimensions, including product innovation, pricing strategies, retail network expansion, and digital marketing effectiveness. Established players leverage brand recognition, supply chain efficiencies, and extensive distribution networks to maintain market positions. Meanwhile, agile newcomers differentiate through niche positioning, sustainable practices, or direct-to-consumer models. The retail landscape encompasses traditional department stores, specialty fashion retailers, multi-brand outlets, and rapidly expanding e-commerce platforms. Successful market participants demonstrate capabilities in trend anticipation, inventory optimization, and omnichannel customer engagement while continuously adapting to evolving consumer preferences and competitive pressures.

Recent Developments:

-

In November 2025, GapStudio debuted its first menswear collection in Mexico for Winter 2025, featuring tailored blazers, wide-leg trousers, tuxedo vests, and gender-inclusive styles. Inspired by nineties aesthetics and iconic muses, the collection emphasizes rich textures, fluid proportions, and modern versatility, highlighted in campaign images with Gwyneth Paltrow and Apple Martin.

Mexico Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico menswear market size was valued at USD 7.81 Billion in 2025.

The Mexico menswear market is expected to grow at a compound annual growth rate of 4.10% from 2026-2034 to reach USD 11.21 Billion by 2034.

Shirts and t-shirts held the largest market share owing to their universal styling versatility, climate appropriateness for warm Mexican weather, affordability across price points, and essential wardrobe status among male consumers across all demographic groups.

Key factors driving the Mexico menswear market include rising urbanization, expanding middle-class population, growing fashion consciousness, digital retail channel expansion, evolving workplace dress requirements, and increasing preference for sustainable fashion choices.

Major challenges include intense price competition compressing profit margins, proliferation of counterfeit products through informal market channels, seasonal demand fluctuations affecting inventory management, and consumer price sensitivity limiting premium segment expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)