Mexico Metal Additive Manufacturing Market Size, Share, Trends and Forecast by Type, Component, End Use Industry, and Region, 2025-2033

Mexico Metal Additive Manufacturing Market Overview:

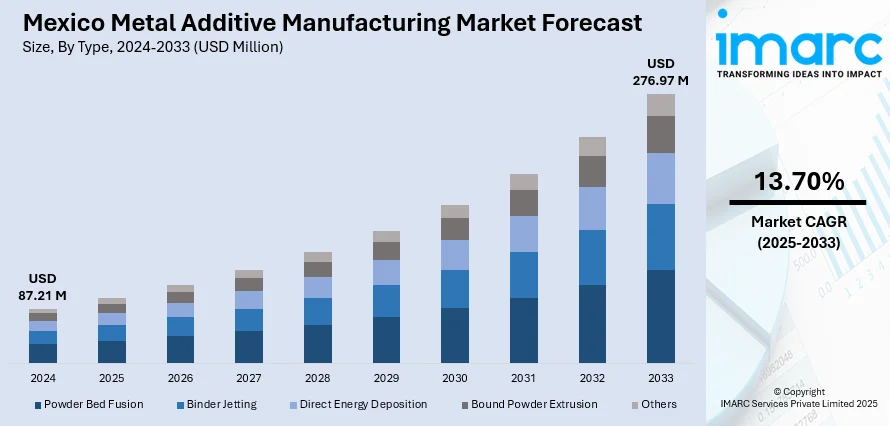

The Mexico metal additive manufacturing market size reached USD 87.21 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 276.97 Million by 2033, exhibiting a growth rate (CAGR) of 13.70% during 2025-2033. Government support through funding, incentives, and policies is supporting the growth of the market, fostering industrialization and advancing high-tech industries. This backing encourages companies to adopt metal additive manufacturing technologies to remain competitive. Additionally, the integration of Industry 4.0 technologies, including data analytics, automation, and the Internet of Things (IoT), is enhancing manufacturing processes, increasing precision, and improving efficiency. The growing focus on digital transformation in manufacturing is further contributing to the expansion of Mexico metal additive manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 87.21 Million |

| Market Forecast in 2033 | USD 276.97 Million |

| Market Growth Rate 2025-2033 | 13.70% |

Mexico Metal Additive Manufacturing Market Trends:

Government Support and Investment in Manufacturing

The governing body is playing a crucial role in promoting the metal additive manufacturing sector by offering significant funding, incentives, and policies that foster industrial innovation. In 2024, the government presented the objectives of "Plan México," an extensive initiative designed to enhance economic growth via targeted investments in vital sectors like energy, infrastructure, mining, and automotive industries. An essential aspect of this strategy is the encouragement of industrialization, specifically highlighting high-tech sectors and the advancement of sophisticated technologies. This encompasses significant assistance for the automotive industry, which is progressively integrating technologies, such as additive manufacturing to improve production efficiency. By promoting investments in sectors like renewable energy and electromobility, the government is fostering a supportive atmosphere for the development of metal additive manufacturing, a technology that corresponds with the nation's wider industrial goals. In addition, government-driven programs are leading to increased investments in research operations for additive manufacturing, which in turn is encouraging companies to adopt these technologies to remain competitive both locally and on the global stage. Through such initiatives, the governing body is laying the foundation for a robust metal additive manufacturing ecosystem, fostering innovation and positioning Mexico as a key player in the international manufacturing landscape.

Integration with Industry 4.0 and Smart Manufacturing

The incorporation of metal additive manufacturing and Industry 4.0 technologies is propelling the market growth in Mexico. As producers adopt automation, data analysis, and the IoT metal additive manufacturing is becoming more integrated into intelligent manufacturing systems to enhance processes and boost product quality. This collaboration allows for real-time tracking, predictive upkeep, and improved production management, offering manufacturers higher accuracy, efficiency, and adaptability. In accordance with this trend, Mexico's IoT market is experiencing substantial expansion, attaining a value of USD 15,339.0 million by 2024. Forecasts suggest that this market will grow to USD 46,079.0 million by 2033, demonstrating a strong growth rate of 13% CAGR from 2025 to 2033. The growing need for IoT solutions is driving the incorporation of these technologies into manufacturing, which in turn hastens the adoption of metal additive manufacturing. Through the use of IoT devices, manufacturers in Mexico can collect data from production lines to enhance resource utilization, refine decision-making, and simplify operations. The drive for digital transformation in the manufacturing industry is thus encouraging firms to embrace metal additive manufacturing technologies to minimize downtime, improve product lifecycle management, and attain increased operational flexibility.

Mexico Metal Additive Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, and end use industry.

Type Insights:

- Powder Bed Fusion

- Binder Jetting

- Direct Energy Deposition

- Bound Powder Extrusion

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes powder bed fusion, binder jetting, direct energy deposition, bound powder extrusion, and others.

Component Insights:

- Systems

- Materials

- Service and Parts

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes systems, materials, and service and parts.

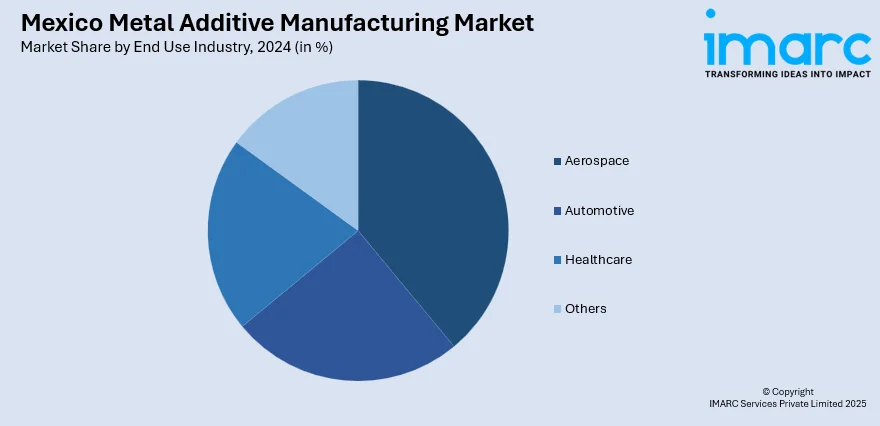

End Use Industry Insights:

- Aerospace

- Automotive

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes aerospace, automotive, healthcare, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Additive Manufacturing Market News:

- In March 2025, New Mexico State University held a groundbreaking ceremony for the expansion of the Aggie Innovation Space and the creation of the New Mexico Mutual Metal Additive Manufacturing Center. Funded through a partnership with New Mexico Mutual, the center will enhance metal 3D printing and prototyping capabilities. The facility aims to support innovation, hands-on learning, and workforce development in advanced manufacturing.

Mexico Metal Additive Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powder Bed Fusion, Binder Jetting, Direct Energy Deposition, Bound Powder Extrusion, Others |

| Components Covered | Systems, Materials, Service and Parts |

| End Use Industries Covered | Aerospace, Automotive, Healthcare, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal additive manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal additive manufacturing market on the basis of type?

- What is the breakup of the Mexico metal additive manufacturing market on the basis of component?

- What is the breakup of the Mexico metal additive manufacturing market on the basis of end use industry?

- What is the breakup of the Mexico metal additive manufacturing market on the basis of region?

- What are the various stages in the value chain of the Mexico metal additive manufacturing market?

- What are the key driving factors and challenges in the Mexico metal additive manufacturing market?

- What is the structure of the Mexico metal additive manufacturing market and who are the key players?

- What is the degree of competition in the Mexico metal additive manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal additive manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal additive manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal additive manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)