Mexico Metal Coatings Market Size, Share, Trends and Forecast by Resin Type, Process, Technology, End Use Industry, and Region, 2025-2033

Mexico Metal Coatings Market Overview:

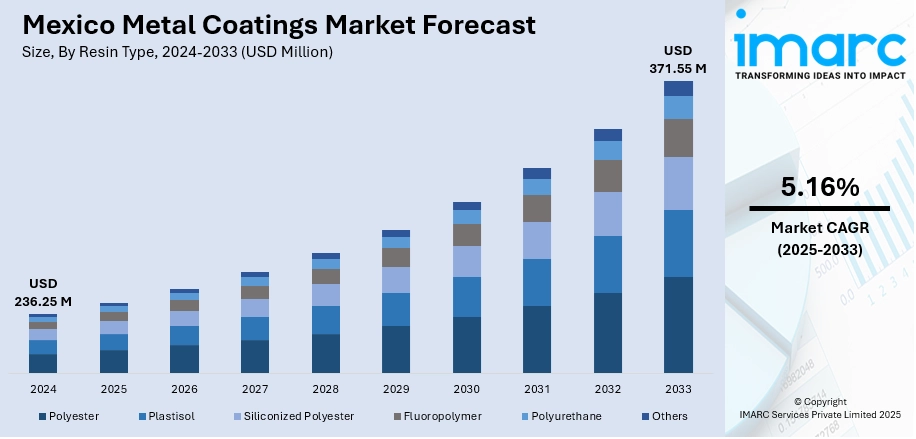

The Mexico metal coatings market size reached USD 236.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 371.55 Million by 2033, exhibiting a growth rate (CAGR) of 5.16% during 2025-2033. The market is fueled by fast-growing automotive, which requires tough, corrosion-resistant coatings for protecting and beautifying vehicles. Also, growing infrastructure and urbanization raise the demand for protective coatings in construction and public sector projects. Finally, growth in emphasis on sustainability drives the adoption of green, low- volatile organic compound (VOC), water-based coatings that meet environmental standards and consumers' demands. All these factors drive Mexico metal coatings market share and development together.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 236.25 Million |

| Market Forecast in 2033 | USD 371.55 Million |

| Market Growth Rate 2025-2033 | 5.16% |

Mexico Metal Coatings Market Trends:

Infrastructure Development and Urbanization

Rapid urbanization and infrastructure growth in Mexico are key drivers of the metal coatings market. As cities expand and new construction projects arise, metal parts in buildings, bridges, and transportation systems need protective coatings to guard against rust and environmental damage. These coatings extend the lifespan of structures, reducing maintenance costs and enhancing safety. Growing investments in public facilities and commercial developments are boosting demand for both protective and architectural coatings. Besides durability, there is a rising need for coatings that improve aesthetic appeal, aligning with modern design trends in urban areas. This blend of functional protection and visual enhancement makes metal coatings essential in supporting Mexico’s expanding urban infrastructure and helps meet the evolving needs of the construction sector.

To get more information on this market, Request Sample

Expansion of the Automotive Industry

Mexico’s automotive industry is a vital part of its economy, contributing 3.6% to the nation’s GDP and 18% to manufacturing GDP, while employing over one million people. This sector’s rapid growth, driven by more automakers establishing and expanding production facilities, is a key factor boosting demand for metal coatings. These coatings are essential for protecting vehicles from corrosion and wear, enhancing durability and aesthetic appeal. The rise of electric vehicles further drives the adoption of advanced coatings capable of withstanding diverse environmental conditions. The industry’s focus on quality and longevity fuels continuous innovation in coating technologies. As Mexico positions itself among the world’s top vehicle producers, the expanding automotive sector creates strong demand for specialized metal coatings that help maintain vehicle performance and appearance, supporting sustained Mexico metal coatings market growth.

Shift Towards Sustainable and Eco-Friendly Coatings

Mexico's metal coatings industry is increasingly adopting sustainable and environment-friendly products as a result of growing environmental consciousness and stricter environmental controls. Sectors are moving to low VOC content coatings as well as water-based coatings, which reduce pollution and health hazards while retaining durability and protection. Major sectors such as automotive, construction, and manufacturing are using these environment-friendly materials, as trends follow globally towards sustainability. The increasing focus on green building certifications also fuels the need for environmentally friendly coatings in infrastructure development. Not only does this shift ease compliance with environmental regulations, but it also flows with consumer demand for more sustainable products. Mexico metal coatings market trends reflect this transition, as the market is witnessing innovation and expansion geared towards sustainable metal coatings, encouraging both green responsibility and industry growth.

Mexico Metal Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on resin type, process, technology, and end use industry.

Resin Type Insights:

- Polyester

- Plastisol

- Siliconized Polyester

- Fluoropolymer

- Polyurethane

- Others

The report has provided a detailed breakup and analysis of the market based on the resign type. This includes polyester, plastisol, siliconized polyester, fluoropolymer, polyurethane, and others.

Process Insights:

- Coil Coating

- Extrusion Coating

- Hot-Dip Galvanizing

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes coil coating, extrusion coating, and hot-dip galvanizing.

Technology Insights:

- Liquid Coating

- Powder Coating

The report has provided a detailed breakup and analysis of the market based on the technology. This includes liquid coating and powder coating.

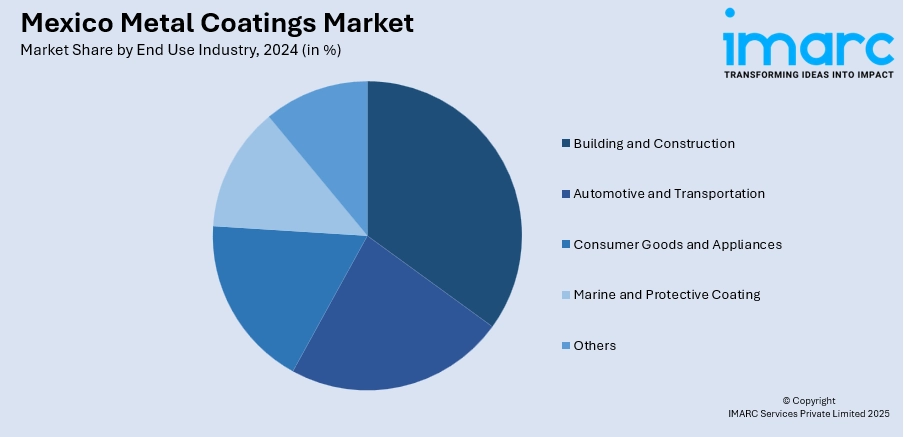

End Use Industry Insights:

- Building and Construction

- Automotive and Transportation

- Consumer Goods and Appliances

- Marine and Protective Coatings

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive and transportation, consumer goods and appliances, marine and protective coatings, and others

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Coatings Market News:

- In April 2025, Komaspec opened a new 20,000 sq. ft. facility in Juarez, Mexico, to meet growing demand for custom metal parts. The factory features advanced technology for laser cutting, bending, threading, and surface finishing. Located in a free trade zone, it offers faster production and reduced shipping times for North American customers. Parts are available exclusively through Komacut.com, providing instant quotes and streamlined ordering with flexible manufacturing options in Mexico or China.

- In March 2024, Brazilian company WEG is investing R$100 million to build a new industrial coatings factory in Mexico. The 5,300m² facility will boost production capacity and serve North and Central America. Scheduled to begin operations in early 2026, the expansion supports WEG’s goal to grow its international coatings business. According to Rafael Torezan, the move aims to meet rising demand for efficient and sustainable coating solutions in the region.

Mexico Metal Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Plastisol, Siliconized Polyester, Fluoropolymer, Polyurethane, Others |

| Processes Covered | Coil Coating, Extrusion Coating, Hot-Dip Galvanizing |

| Technologies Covered | Liquid Coating, Powder Coating |

| End Use Industries Covered | Building and Construction, Automotive and Transportation, Consumer Goods and Appliances, Marine and Protective Coating, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal coatings market on the basis of resin type?

- What is the breakup of the Mexico metal coatings market on the basis of process?

- What is the breakup of the Mexico metal coatings market on the basis of technology?

- What is the breakup of the Mexico metal coatings market on the basis of end use industry?

- What is the breakup of the Mexico metal coatings market on the basis of region?

- What are the various stages in the value chain of the Mexico metal coatings market?

- What are the key driving factors and challenges in the Mexico metal coatings market?

- What is the structure of the Mexico metal coatings market and who are the key players?

- What is the degree of competition in the Mexico metal coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)