Mexico Metal Fabrication Market Size, Share, Trends and Forecast by Material Type, Service Type, End-Use Industry, and Region, 2025-2033

Mexico Metal Fabrication Market Overview:

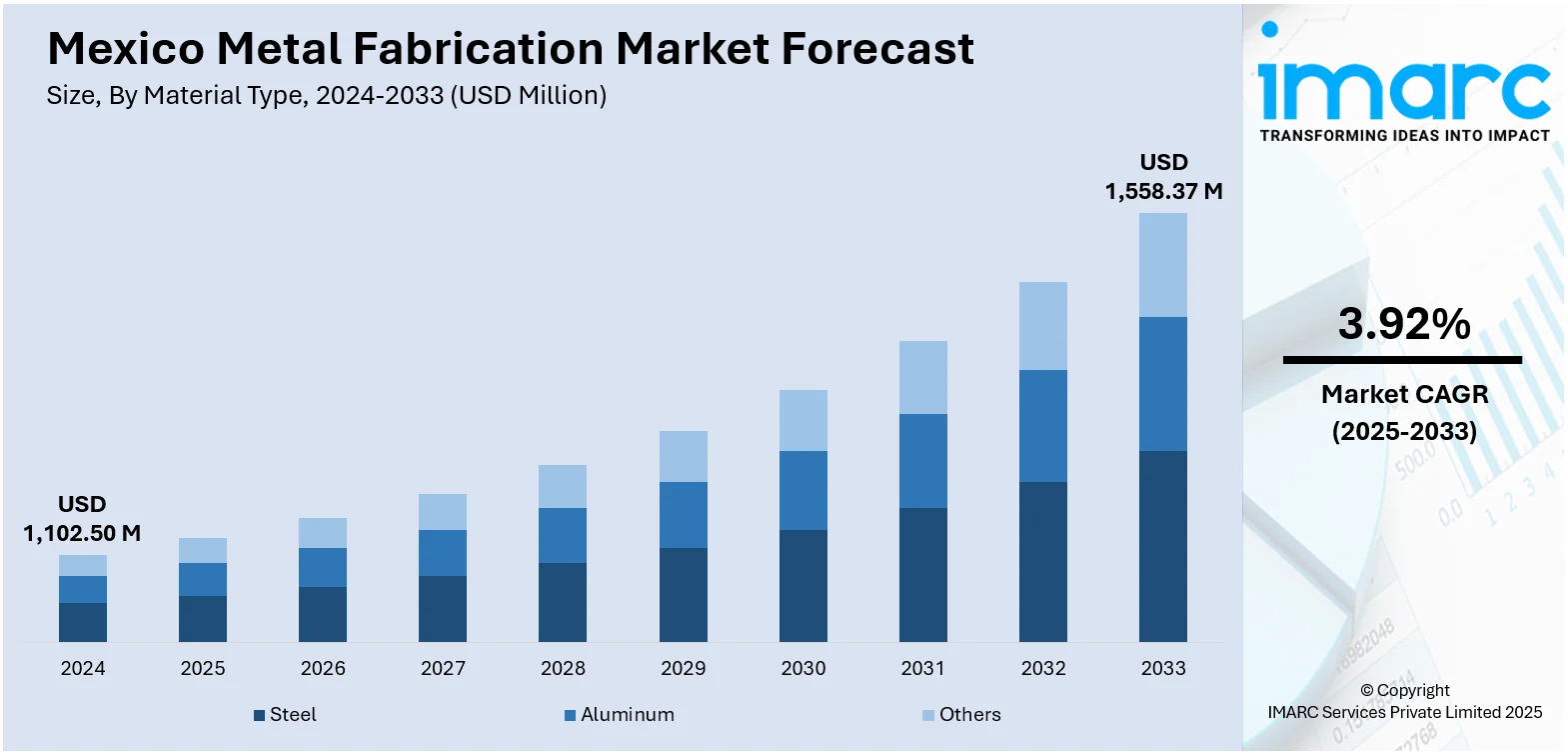

The Mexico metal fabrication market size reached USD 1,102.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,558.37 Million by 2033, exhibiting a growth rate (CAGR) of 3.92% during 2025-2033. The market is driven by rising industrialization, infrastructure development, and demand from automotive and aerospace sectors. Technological advancements, favorable trade agreements, and government incentives further support the expansion of the Mexico metal fabrication market share across various high-growth manufacturing domains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,102.50 Million |

| Market Forecast in 2033 | USD 1,558.37 Million |

| Market Growth Rate 2025-2033 | 3.92% |

Mexico Metal Fabrication Market Trends:

Integration of Advanced Manufacturing Technologies

Metal fabrication processes in Mexico are rapidly evolving with the integration of advanced manufacturing technologies. Solutions such as robotic welding, laser cutting, and CNC machining are becoming standard practices, leading to enhanced accuracy and streamlined production cycles. These technologies are improving workflow efficiency and reducing operational bottlenecks. Furthermore, the use of smart systems, powered by Artificial Intelligence (AI) and the Internet of Things (IoT), is enabling manufacturers to monitor production in real time, manage resources intelligently, and maintain consistent product quality. This shift toward digitized and intelligent operations is positioning Mexico's metal fabrication sector as a competitive player globally and is a vital contributor to Mexico metal fabrication market growth. For instance, in May 2025, Meltio, Sitres Latam, Alar, and Tecnológico de Monterrey partnered to advance wire-laser metal Additive Manufacturing (AM) in Mexico using Meltio’s Directed Energy Deposition (DED) technology. Alar was the first to adopt the Meltio M600, while the university supports training and industrial collaboration with the M450. The initiative promotes innovation, manufacturing agility, and industry-academic cooperation to boost local AM capabilities.

To get more information on this market, Request Sample

Regulatory Support and Local Industry Promotion

Government policies in Mexico are actively supporting the growth of domestic manufacturing, including the metal fabrication industry. Strategies like enhancing the national content of procurement contracts and reducing reliance on imported components are driving demand for locally fabricated products. Additionally, regulatory actions to tighten steel import practices and enforce fair pricing are safeguarding domestic manufacturers from international market pressures. For instance, as per industry reports, Mexico's steel industry will invest USD 8.7 Billion from 2025 to 2028 to replace steel imports and meet domestic demand. With new capacity reaching 34 million tons, the goal is to eliminate reliance on 16 million tons of annual imports and boost self-sufficiency amid possible U.S. tariffs. These measures are reinforcing the country’s industrial self-sufficiency and creating a more favorable business environment for metal fabricators. As a result, regulatory backing continues to be a key enabler of Mexico metal fabrication market growth.

Mexico Metal Fabrication Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on material type, service type, and end-use industry.

Material Type Insights:

- Steel

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel, aluminum, and others.

Service Type Insights:

- Casting

- Forging

- Machining

- Welding and Tubing

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes casting, forging, machining, welding and tubing, and others.

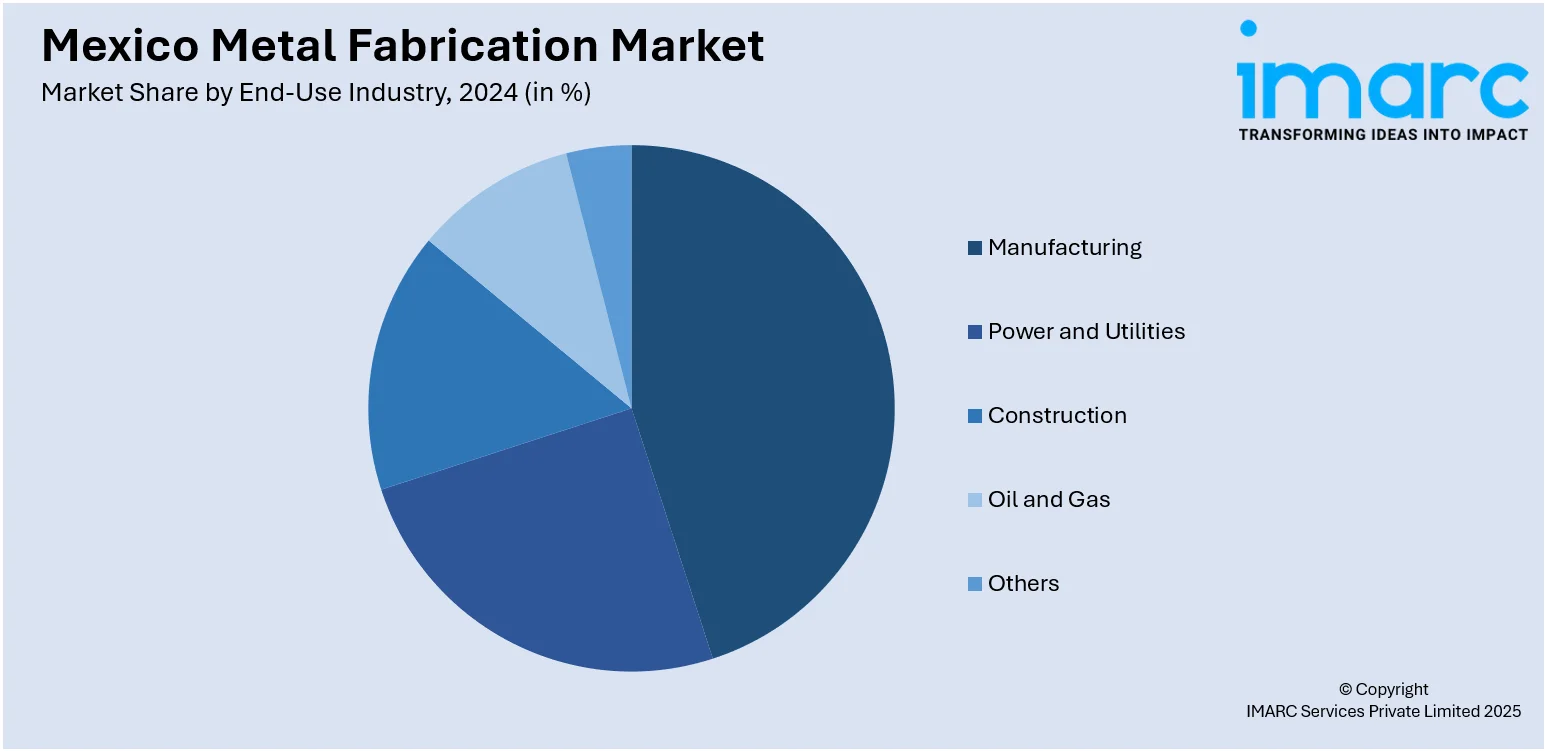

End-Use Industry Insights:

- Manufacturing

- Power and Utilities

- Construction

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes manufacturing, power and utilities, construction, oil and gas, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Metal Fabrication Market News:

- In April 2025, Komaspec, a Canadian contract manufacturer, opened a new 20,000 sq. ft. facility in Juárez, Mexico to meet rising demand for custom metal parts. This plant offers advanced sheet metal fabrication and faster delivery for North American clients.

- In May 2024, Venture Steel Inc., a leading flat-rolled metal processor and distributor, is expanding its facility in Ramos Arizpe, Mexico, to meet growing demand in the local manufacturing market. The Toronto-based company will install new processing equipment to enhance capacity and service. This expansion supports Venture Steel’s strategy for sustainable growth and improved customer service.

Mexico Metal Fabrication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Steel, Aluminum, Others |

| Service Types Covered | Casting, Forging, Machining, Welding and Tubing, Others |

| End-User Industries Covered | Manufacturing, Power and Utilities, Construction, Oil and Gas, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico metal fabrication market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico metal fabrication market on the basis of material type?

- What is the breakup of the Mexico metal fabrication market on the basis of service type?

- What is the breakup of the Mexico metal fabrication market on the basis of end-use industry?

- What is the breakup of the Mexico metal fabrication market on the basis of region?

- What are the various stages in the value chain of the Mexico metal fabrication market?

- What are the key driving factors and challenges in the Mexico metal fabrication market?

- What is the structure of the Mexico metal fabrication market and who are the key players?

- What is the degree of competition in the Mexico metal fabrication market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico metal fabrication market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico metal fabrication market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico metal fabrication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)