Mexico Mineral Exploration Equipment Market Size, Share, Trends and Forecast by Equipment Type, Mineral Type, End User, and Region, 2025-2033

Mexico Mineral Exploration Equipment Market Overview:

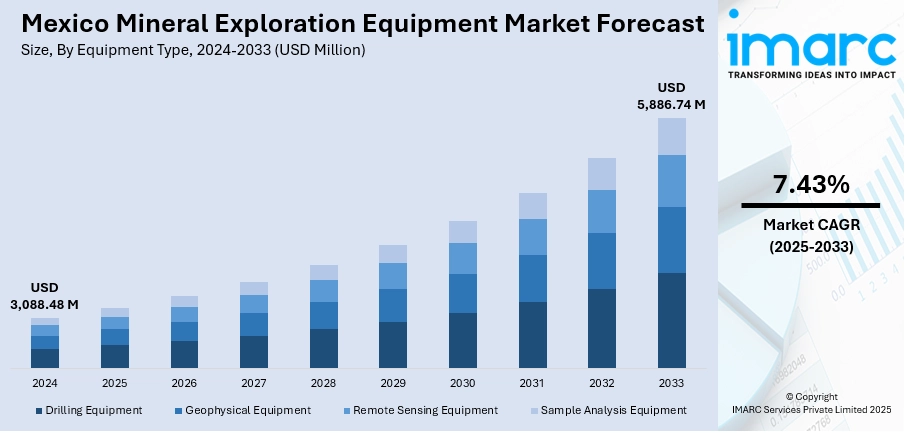

The Mexico mineral exploration equipment market size reached USD 3,088.48 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,886.74 Million by 2033, exhibiting a growth rate (CAGR) of 7.43% during 2025-2033. The market is driven by rising demand for critical minerals essential to clean energy and technology sectors, prompting intensified exploration activities. Technological advancements are transforming traditional methods, with companies adopting artificial intelligence (AI), remote sensing, and automated drilling to improve efficiency and reduce costs. Additionally, stricter environmental regulations and sustainability goals are pushing for low-impact, eco-friendly equipment. Moreover, the encouraging investment in modern, high-performance tools that meet operational, environmental, and regulatory demands further strengthening the Mexico mineral exploration equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,088.48 Million |

| Market Forecast in 2033 | USD 5,886.74 Million |

| Market Growth Rate 2025-2033 | 7.43% |

Mexico Mineral Exploration Equipment Market Trends:

Technological Modernization in Exploration Tools

Mexico's mining industry is going through a process of technological innovation, having a significant impact on the market for mineral exploration equipment. Conventional methods of exploration are being substituted or complemented by digital technologies like satellite imagery, artificial intelligence-driven data analysis, and mechanized drilling systems. These technologies not only enhance precision in detecting mineral deposits but also decrease the cost of exploration as well as environmental disturbance. Firms are currently incorporating GPS systems and smart sensors into exploration gear to map terrain more effectively and retrieve information in real-time. This updating enables quicker decision-making and improved resource usage. Equipment providers are highlighting user-friendly, multifunctional, and power-saving tools to attract increasingly technology-oriented mining companies. With more youth, environmentally aware operators coming into the market, there is an increasing demand for cleaner, safer, and more networked exploration solutions, which translates to tech-led innovation being a driving Mexico mineral exploration equipment market trend.

To get more information on this market, Request Sample

Increased Demand for Critical Minerals

Mexico’s mineral exploration equipment market is gaining momentum, driven by the global demand for critical minerals like lithium, copper, and rare earth elements essential for electric vehicles and renewable energy technologies. The Mexican Ministry of Economy (SE) reported a 15% rise in mining exploration permits in 2024 compared to 2023, particularly for lithium and copper projects. This increase reflects growing exploration activities supported by government policies that encourage the adoption of advanced technologies. As a result, there is rising demand for sophisticated exploration tools featuring geophysical imaging, remote sensing, and automated core drilling capabilities. The trend towards exploring underexplored regions is boosting the need for rugged, mobile, and efficient equipment. This strategic shift highlights Mexico’s commitment to securing critical resources with innovative, high-performance solutions in mineral exploration.

Regulatory and Environmental Pressures

Environmental regulations and sustainability concerns are reshaping the dynamics of mineral exploration in Mexico. As both national policies and international investment standards grow stricter, companies are under pressure to adopt eco-friendly and low-impact exploration practices. This shift is propelling Mexico mineral exploration equipment market growth that supports sustainable exploration, such as low-emission drilling machines, noise-reduced operations, and minimal land disturbance technologies. The regulatory environment is encouraging firms to seek equipment that complies with evolving environmental impact assessments and reclamation requirements. Moreover, community engagement and land-use concerns necessitate tools that enable faster exploration cycles with minimal footprint. Equipment that helps miners adhere to legal frameworks while still maintaining competitive output is increasingly valued. As a result, suppliers who emphasize environmental compliance and offer equipment aligned with sustainable exploration models are becoming more prominent players in Mexico’s evolving exploration landscape.

Mexico Mineral Exploration Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, mineral type, end user.

Equipment Type Insights:

- Drilling Equipment

- Geophysical Equipment

- Remote Sensing Equipment

- Sample Analysis Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes drilling equipment, geophysical equipment, remote sensing equipment, and sample analysis equipment.

Mineral Type Insights:

- Metallic Minerals

- Non-Metallic Minerals

- Coal Exploration

A detailed breakup and analysis of the market based on the mineral type have also been provided in the report. This includes metallic minerals, non-metallic minerals, and coal exploration.

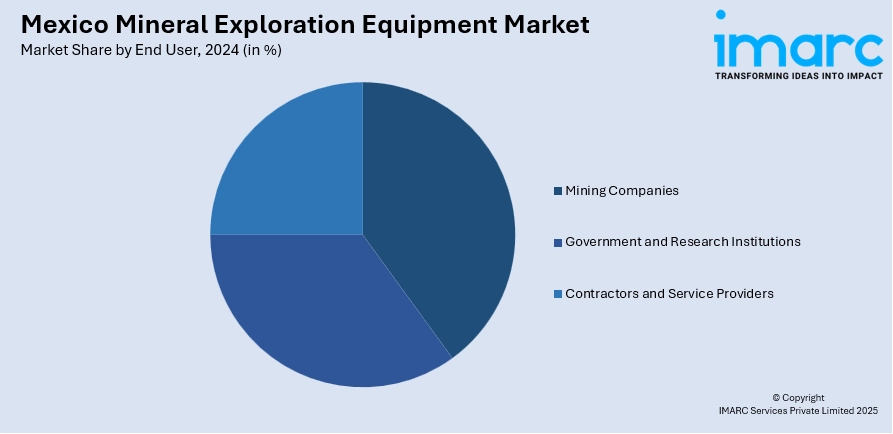

End User Insights:

- Mining Companies

- Government and Research Institutions

- Contractors and Service Providers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes mining companies, government and research institutions, and contractors and service providers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mineral Exploration Equipment Market News:

- In May 2025, Pan American Silver will acquire MAG Silver in a $2.1 billion deal, gaining a 44% interest in the high-grade Juanicipio silver mine in Mexico, operated by Fresnillo. The transaction strengthens Pan American’s silver portfolio with a low-cost, tier-one asset and includes additional exploration upside from MAG’s other projects. MAG shareholders will receive a mix of cash and shares, owning approximately 14% of Pan American post-transaction, aligning both companies for future growth in the Americas.

Mexico Mineral Exploration Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Drilling Equipment, Geophysical Equipment, Remote Sensing Equipment, Sample Analysis Equipment |

| Mineral Types Covered | Metallic Minerals, Non-Metallic Minerals, Coal Exploration |

| End Users Covered | Mining Companies, Government and Research Institutions, Contractors and Service Providers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mineral exploration equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mineral exploration equipment market on the basis of equipment type?

- What is the breakup of the Mexico mineral exploration equipment market on the basis of mineral type?

- What is the breakup of the Mexico mineral exploration equipment market on the basis of end user?

- What is the breakup of the Mexico mineral exploration equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico mineral exploration equipment market?

- What are the key driving factors and challenges in the Mexico mineral exploration equipment market?

- What is the structure of the Mexico mineral exploration equipment market and who are the key players?

- What is the degree of competition in the Mexico mineral exploration equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mineral exploration equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mineral exploration equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mineral exploration equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)