Mexico Mining Truck Market Size, Share, Trends and Forecast by Type, Payload Capacity, Application, Drive, and Region, 2025-2033

Mexico Mining Truck Market Overview:

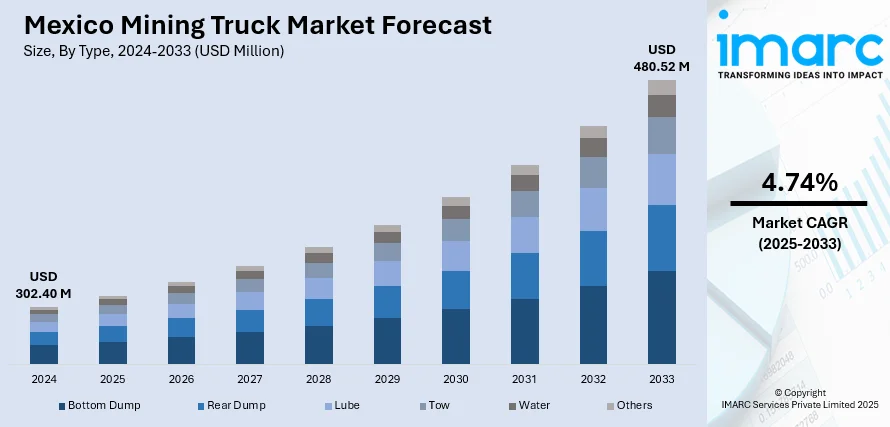

The Mexico mining truck market size reached USD 302.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 480.52 Million by 2033, exhibiting a growth rate (CAGR) of 4.74% during 2025-2033. The Mexico mining truck market is being driven by rising mineral extraction activities, increased foreign investment in mining infrastructures, adoption of autonomous and electric haul trucks, supportive government policies, and rising demand for efficient and durable transport solutions in rugged terrains to meet the needs of expanding mining operations across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 302.40 Million |

| Market Forecast in 2033 | USD 480.52 Million |

| Market Growth Rate 2025-2033 | 4.74% |

Mexico Mining Truck Market Trends:

Expanding Mineral Exploration and Extraction Activities

One of the key drivers of the Mexico mining truck market is the increasing extent of mineral exploration and extraction, on account of the rich geological resources of the country. Mexico is one of the leading producers of precious metals like gold, silver, and copper globally. The escalating demand for metals in electronics, renewable energy, and electric vehicles (EVs), is encouraging global and local mining companies to invest and focus more on Mexican mining activities. While mining areas are becoming more extended and complicated, there is higher demand for large, high-volume, and advanced technological mining trucks. There is a growing demand for mining trucks with greater payload, better maneuverability, and higher durability by companies operating even as new operations reach more remote and deeper regions. The huge mineral deposits in states such as Sonora, Chihuahua, and Zacatecas are extensively being exploited, and this further highlights the necessity of dependable ore transportation.

Technological Modernization and Automation in Mining Fleets

Another key market driver is the rising shift towards fleet automation and technology modernization in the mining business. Mining organizations face mounting pressure to lower costs of operations, boost safety, and enhance productivity, all of which have led to an enormous change in the direction of digital transformation of mining logistics. Sophisticated technologies like autonomous haulage systems (AHS), telematics, and real-time fleet management software are widely being used in mining trucks. In Mexico, businesses are gradually using semi-autonomous and fully autonomous mining trucks to maximize the use of fuel, reduce costs of labor, and reduce accidents in risky conditions. New-generation trucks include sensors, GPS, and artificial intelligence-based systems that enable the monitoring of real-time performance, predictive maintenance, and data-led decision-making. This is particularly true in giant operations by multinationals that are focusing on zero-emissions objectives and sustainability targets through automation and electrification.

Mexico Mining Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, payload capacity, application, and drive.

Type Insights:

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottom dump, rear dump, lube, tow, water, and others.

Payload Capacity Insights:

- <90 Metric Tons

- 90≤149 Metric Tons

- 150≤290 Metric Tons

- >290 Metric Tons

A detailed breakup and analysis of the market based on the payload capacity have also been provided in the report. This includes <90 metric tons, 90≤149 metric tons, 150≤290 metric tons, and >290 metric tons.

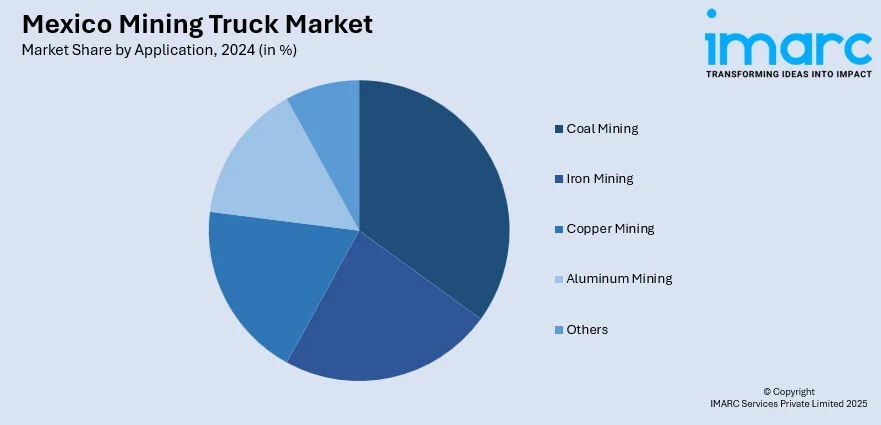

Application Insights:

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes coal mining, iron mining, copper mining, aluminum mining, and others.

Drive Insights:

- Mechanical Drive

- Electrical Drive

A detailed breakup and analysis of the market based on the drive have also been provided in the report. This includes mechanical drive and electrical drive.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mining Truck Market News:

- March 2024: Epiroc secured a contract from Dumas Contracting Ltd. to supply mining equipment, including advanced mining trucks such as the Minetruck MT2200 and MT436B, for a silver mining project in northern Mexico. The deal also included drilling rigs, loaders, spare parts, technical services, and digital solutions.

- March 2023: Sandvik secured an approximately USD 63 million contract from Canadian miner Torex Gold Resources to supply a 35-unit equipment fleet for the Media Luna project in Mexico. The order included 15 battery-electric vehicles (BEVs) and 20 conventional diesel-powered units, in addition to loaders, trucks, bolters, production drills, and a raise borer.

Mexico Mining Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bottom Dump, Rear Dump, Lube, Tow, Water, Others |

| Payload Capacities Covered | <90 Metric Tons, 90≤149 Metric Tons, 150≤290 Metric Tons, >290 Metric Tons |

| Applications Covered | Coal Mining, Iron Mining, Copper Mining, Aluminum Mining, Others |

| Drives Covered | Mechanical Drive, Electrical Drive |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mining truck market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mining truck market on the basis of type?

- What is the breakup of the Mexico mining truck market on the basis of payload capacity?

- What is the breakup of the Mexico mining truck market on the basis of application?

- What is the breakup of the Mexico mining truck market on the basis of drive?

- What are the various stages in the value chain of the Mexico mining truck market?

- What are the key driving factors and challenges in the Mexico mining truck?

- What is the structure of the Mexico mining truck market and who are the key players?

- What is the degree of competition in the Mexico mining truck market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mining truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mining truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mining truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)