Mexico Mixed Xylene Market Size, Share, Trends and Forecast by Grade, End Use, and Region, 2026-2034

Mexico Mixed Xylene Market Summary:

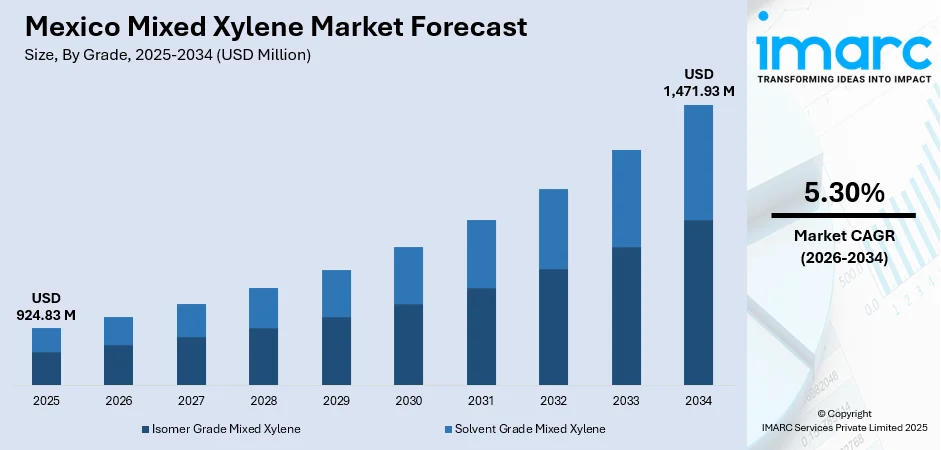

The Mexico mixed xylene market size was valued at USD 924.83 Million in 2025 and is projected to reach USD 1,471.93 Million by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034.

The Mexico mixed xylene market is experiencing steady growth, driven by robust demand from the petrochemical, paints and coatings, and automotive manufacturing sectors. The country's strategic position as a prominent automotive producer in North America fuels consumption for high-performance solvents and fuel additives. Expanding construction activities and infrastructure development projects further enhance demand for mixed xylene in protective coatings applications. The increasing production of polyethylene terephthalate plastics for packaging and consumer goods strengthens the market foundation, positioning mixed xylene as an essential feedstock in Mexico's growing industrial landscape.

Key Takeaways and Insights:

-

By Grade: Isomer grade mixed xylene dominates the market with a share of 58% in 2025, attributed to its critical role in para-xylene production for polyethylene terephthalate manufacturing. Rising demand from the packaging and textile sectors strengthens its market position, while continuous investments in petrochemical infrastructure support production expansion.

-

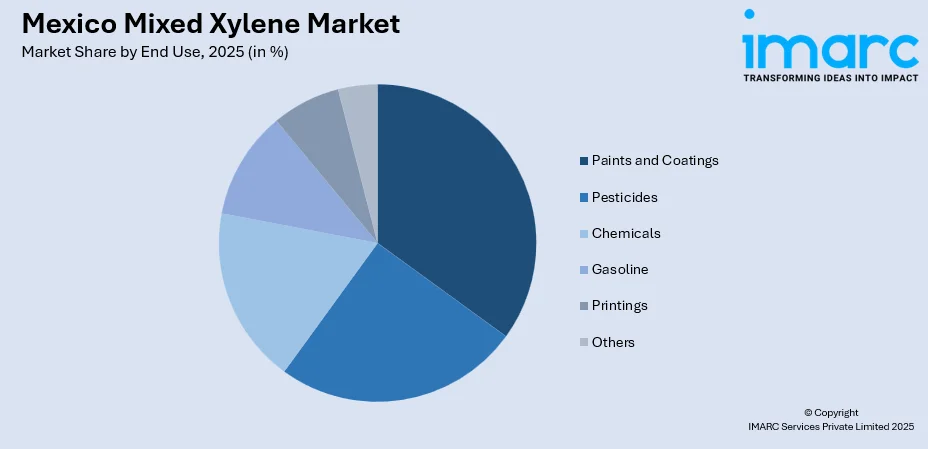

By End Use: Paints and coatings lead the market with a share of 25% in 2025, driven by expanding automotive manufacturing operations and construction activities across Mexico. Growing preference for high-performance industrial coatings and sustainable formulations enhances demand, while strategic investments by multinational coating manufacturers bolster market expansion.

-

Key Players: Key players drive the Mexico mixed xylene market by expanding production capacities, investing in advanced refining technologies, and strengthening distribution networks. Their focus on sustainable manufacturing processes, strategic partnerships with downstream industries, and compliance with environmental regulations accelerates market growth and ensures consistent supply across diverse industrial applications.

To get more information on this market Request Sample

The Mexico mixed xylene market demonstrates robust growth potential, supported by expanding petrochemical operations and downstream industrial demand. The government's strategic initiatives to revitalize domestic petrochemical production create favorable conditions for market expansion. In February 2025, Pemex announced a USD 975 Million investment to strengthen Mexico's petrochemical industry, targeting annual aromatics production of 330,000 Metric Tons by 2030. Mixed xylene, a key feedstock for producing terephthalic acid, phthalic anhydride, and other aromatic derivatives, is witnessing rising consumption in the manufacturing of plastics, synthetic fibers, and coatings. Expanding automotive, packaging, and construction industries in Mexico are further supporting consistent demand for mixed xylene-based products. Additionally, growing urbanization and industrialization are encouraging the establishment of new chemical processing facilities, enhancing local supply capabilities. Investments in refining infrastructure and improved logistics are also enabling efficient distribution, ensuring steady market availability. As manufacturers seek cost-effective and high-purity solvents for industrial applications, mixed xylene continues to gain prominence.

Mexico Mixed Xylene Market Trends:

Growing Adoption of Sustainable Coating Technologies

Environmental sustainability is reshaping mixed xylene consumption patterns in Mexico's coatings industry. Manufacturers increasingly adopt low volatile organic compounds (VOC) and water-borne formulations to comply with stringent Secretariat of Environment and Natural Resources (SEMARNAT) regulations while meeting evolving consumer preferences. In January 2025, Volkswagen inaugurated the world's first fully electric paint shop at its Puebla facility with a USD 763.5 Million investment, eliminating natural gas usage while painting 90 car bodies per hour. The shift towards sustainable coating solutions fosters innovations in solvent mixtures, prompting manufacturers to create improved mixed xylene applications that align performance needs with environmental regulations across the automotive and industrial sectors.

Expansion of polyethylene terephthalate (PET) and Polyester Manufacturing Capacity

The growing demand for PET plastics in Mexico is accelerating mixed xylene consumption for terephthalic acid production. Rising consumer preference for sustainable packaging solutions and the expanding beverage packaging industry drive PET resin demand across the country. As per IMARC Group, the Mexico beverage packaging market size reached USD 2,629.50 Million in 2024. Mexico's bottled water market remains one of the largest globally, with consumption patterns supporting continuous packaging material requirements. Manufacturers are investing in recycling infrastructure and circular economy initiatives to meet sustainability targets. The polyester textile sector's growth further strengthens the downstream value chain, creating sustained demand for high-purity isomer grade mixed xylene as essential feedstock for polymer production.

Increasing construction activities

Rising construction activities in Mexico are driving the mixed xylene market by increasing demand for paints, coatings, adhesives, and sealants where mixed xylene is widely used as a solvent. The federal government of Mexico revealed plans to construct 1.1 Million new residences over the six-year government term (2024-2030), raising its aim by 100,000 units. Expanding residential, commercial, and infrastructure projects require durable coatings and protective materials. This boosts consistent consumption of mixed xylene, supporting steady market growth.

Market Outlook 2026-2034:

The Mexico mixed xylene market is poised for sustained growth throughout the forecast period, supported by expanding industrial manufacturing activities and strategic petrochemical investments. The market generated a revenue of USD 924.83 Million in 2025 and is projected to reach a revenue of USD 1,471.93 Million by 2034, growing at a compound annual growth rate of 5.30% from 2026-2034. Nearshoring trends driving automotive and manufacturing sector expansion create favorable demand conditions, while infrastructure development projects generate sustained consumption for protective coatings and industrial solvents.

Mexico Mixed Xylene Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Grade | Isomer Grade Mixed Xylene | 58% |

| End Use | Paints and Coatings | 25% |

Grade Insights:

- Isomer Grade Mixed Xylene

- Solvent Grade Mixed Xylene

Isomer grade mixed xylene dominates with a market share of 58% of the total Mexico mixed xylene market in 2025.

Isomer grade mixed xylene maintains its dominant position in the Mexico market due to its essential role as feedstock for para-xylene production, which serves as the primary raw material for terephthalic acid and polyethylene terephthalate manufacturing. The grade's high purity specifications enable efficient isomer separation processes, meeting stringent quality requirements for downstream polymer production. Growing demand from the packaging industry drives consumption patterns as manufacturers expand PET bottle and container production capacities across Mexico.

The expanding polyester textile sector further reinforces isomer grade demand, with Mexico's proximity to major consumer markets creating strategic advantages for domestic production. Recycling initiatives are gaining momentum, as manufacturers are partnering with sustainability-focused organizations to develop circular economy solutions for post-consumer PET materials. Continuous investments in petrochemical infrastructure enhance production capabilities, ensuring reliable supply for the growing polymer and textile industries while supporting Mexico's industrial development objectives and export competitiveness in regional markets.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Paints and Coatings

- Pesticides

- Chemicals

- Gasoline

- Printings

- Others

Paints and coatings lead with a share of 25% of the total Mexico mixed xylene market in 2025.

The paints and coatings segment dominates end use applications due to mixed xylene's superior solvent properties that ensure smooth application, proper viscosity control, and excellent finish quality in industrial formulations. Mexico's booming automotive manufacturing sector generates substantial demand for high-performance coating solutions, while construction activities drive consumption for architectural and protective coatings. In March 2025, Neuce announced a USD 600 Million investment to build a new paint plant in Tlaxcala, expanding production capacity to meet rising demands across automotive, aluminum extrusion, and steel sectors.

Paints and coatings hold prominence in the market due to their extensive and recurring consumption across multiple end use activities. Mixed xylene is widely used in coating formulations applied for surface protection, refurbishment, and aesthetic enhancement in residential, commercial, and industrial settings. Regular repainting cycles, equipment maintenance, and corrosion prevention needs create steady demand. Its compatibility with large-scale production and application processes makes paints and coatings the most consistent and high-volume consumers of mixed xylene in Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a major share of the mixed xylene market due to its strong industrial base and proximity to international manufacturing corridors. The region hosts extensive automotive, chemical, and electronics manufacturing activities that require solvents for coatings, processing, and maintenance. Export-oriented industrial clusters and industrial parks drive consistent demand. Well-developed logistics infrastructure supports smooth supply and distribution of aromatic hydrocarbons, making Northern Mexico a key consumption hub for mixed xylene.

Central Mexico is an important mixed xylene market driven by dense urbanization and diversified industrial activity. The region supports significant demand from the paints, coatings, adhesives, and chemical manufacturing sectors, serving construction, consumer goods, and industrial maintenance. High population density and commercial development increase usage in decorative and protective applications. Central Mexico also benefits from strong transportation connectivity, enabling efficient movement of raw materials and finished chemical products.

Southern Mexico shows steady growth in the mixed xylene market, supported by infrastructure development and emerging industrial activities. Rising construction projects, public infrastructure upgrades, and regional manufacturing expansion increase demand for paints, coatings, and solvents. The region also supports consumption from smaller chemical processors and maintenance-related applications. As industrialization and urban development progress, mixed xylene usage continues to rise, contributing to balanced regional market growth.

Market Dynamics:

Growth Drivers:

Why is the Mexico Mixed Xylene Market Growing?

Expanding Automotive Manufacturing Sector

The expanding automotive manufacturing sector is fueling the market expansion in Mexico. The automotive sector remains a primary consumption driver, with Mexico producing 4.2 Million vehicles in 2024 and ranking fifth globally in automotive manufacturing. Mixed xylene is extensively used in automotive paints, coatings, thinners, and surface preparation materials applied during body painting and component finishing. As vehicle production volumes increase, demand rises for high-performance coatings that protect against corrosion, abrasion, and environmental exposure. Mixed xylene also supports cleaning and degreasing operations used in parts manufacturing and assembly lines. Growth in automotive component manufacturing, including metal, plastic, and rubber parts, further boosts solvent consumption. In addition, vehicle repair, refinishing, and aftermarket services require xylene-based products, creating recurring demand beyond original manufacturing. Mexico’s role as a major vehicle production and export hub ensures consistent solvent requirements across original equipment manufacturers (OEMs) and suppliers. This strong linkage between automotive output and coating-intensive processes directly supports sustained growth of the mixed xylene market.

Rising Demand from the Chemical Manufacturing Industry

The expanding chemical manufacturing sector in Mexico significantly supports mixed xylene market growth. Mixed xylene serves as an important intermediate and solvent in the production of agrochemicals, pharmaceuticals, dyes, resins, and specialty chemicals. Growth in domestic chemical production reduces import dependency and boosts local consumption of aromatic hydrocarbons. Increasing investments in chemical processing facilities and capacity expansions strengthen downstream demand. Mixed xylene’s effectiveness as a reaction medium and cleaning solvent makes it valuable across diverse formulations. Additionally, rising demand for specialty and performance chemicals in industrial and consumer applications supports consistent usage. According to IMARC Group, the Mexico specialty chemicals market size reached USD 11,704.50 Million in 2024. As Mexico focuses on strengthening its chemical value chain to serve both domestic and export markets, mixed xylene remains a cost-efficient and versatile input, driving sustained market development.

Increasing Construction and Infrastructure Activities

The ongoing construction and infrastructure development across Mexico is propelling the market expansion. Mixed xylene is widely used as a solvent in paints, coatings, adhesives, and sealants applied in residential, commercial, and industrial construction. Ongoing urban housing projects, transportation networks, industrial parks, and public infrastructure upgrades drive consistent demand for architectural and protective coatings. In July 2025, Mexican officials unveiled the plan to upgrade the national port system, focusing on six major ports: Ensenada, Manzanillo-Cuyutlan, Lazaro Cardenas, Acapulco, Veracruz, and Progreso. The initiative sought to enhance maritime competitiveness, upgrade logistics infrastructure, and draw unprecedented amounts of public and private investment. It merged MXD 55.2 Billion (USD 2.96 Billion) in public financing with MXD 241 Billion (USD 12.94 Billion) in private investment to establish Mexico as a leader in global logistics. As buildings require durable finishes that offer weather resistance, corrosion protection, and aesthetic appeal, the use of solvent-based coatings remains significant. Mixed xylene improves coating performance by enhancing flow, drying time, and finish quality.

Market Restraints:

What Challenges the Mexico Mixed Xylene Market is Facing?

Stringent Environmental Regulations

Increasingly stringent environmental regulations regarding volatile organic compound emissions pose significant challenges for the mixed xylene market. SEMARNAT continues to implement stringent air quality standards requiring manufacturers to adopt low-VOC formulations. Compliance costs associated with emission control systems and formulation modifications impact operational expenses across the coatings and chemical industries.

Feedstock Supply Constraints and Price Volatility

Domestic feedstock supply limitations and crude oil price volatility create market uncertainties affecting mixed xylene production economics. Pemex refineries operating below optimal capacity levels necessitate import dependency for meeting domestic demand. Fluctuating naphtha prices impact production costs, creating margin pressures for manufacturers and downstream processors throughout the supply chain.

Competition from Alternative Solvents

Growing adoption of alternative solvent technologies poses competitive challenges for traditional mixed xylene applications. Bio-based solvents, water-borne coating systems, and powder coating technologies gain market share as manufacturers seek environmentally sustainable solutions. The shift towards greener formulations requires traditional mixed xylene suppliers to adapt product offerings and explore specialized applications.

Competitive Landscape:

The Mexico mixed xylene market features a competitive landscape, characterized by the presence of state-owned petrochemical operations alongside multinational chemical corporations and regional distributors. International suppliers contribute through imports and downstream operations. Key market participants focus on expanding distribution networks, ensuring product quality consistency, and developing specialized formulations for diverse industrial applications. Strategic partnerships between petrochemical producers and end user industries strengthen supply chain relationships, while investments in production capacity modernization enhance competitive positioning across the automotive, coatings, and chemical manufacturing sectors.

Mexico Mixed Xylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Isomer Grade Mixed Xylene, Solvent Grade Mixed Xylene |

| End Uses Covered | Paints and Coatings, Pesticides, Chemicals, Gasoline, Printings, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico mixed xylene market size was valued at USD 924.83 Million in 2025.

The Mexico mixed xylene market is expected to grow at a compound annual growth rate of 5.30% from 2026-2034 to reach USD 1,471.93 Million by 2034.

Isomer grade mixed xylene dominated the market with a share of 58%, driven by its critical role in para-xylene production for PET manufacturing and growing demand from packaging and textile sectors.

Key factors driving the Mexico mixed xylene market include expanding automotive manufacturing sector, robust construction and infrastructure development activities, growing PET packaging demand, strategic petrochemical investments by private firms, and nearshoring trends attracting industrial operations.

Major challenges include stringent environmental regulations on VOC emissions, feedstock supply constraints and crude oil price volatility, competition from alternative solvents and bio-based formulations, import dependency for meeting domestic demand, and compliance costs for emission control requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)