Mexico Mobile Cloud Market Size, Share, Trends and Forecast by Service, Deployment, User, Application, and Region, 2025-2033

Mexico Mobile Cloud Market Overview:

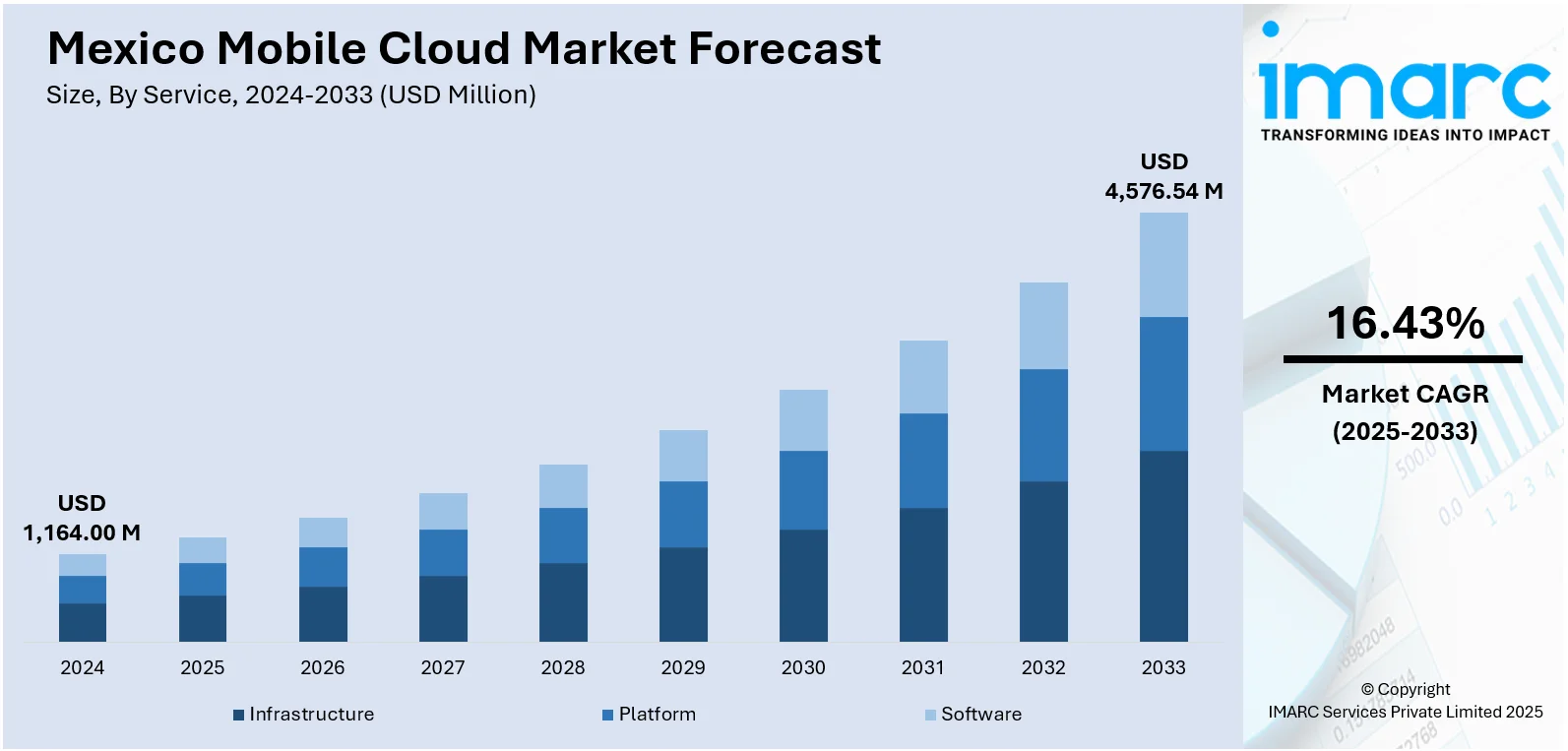

The Mexico mobile cloud market size reached USD 1,164.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,576.54 Million by 2033, exhibiting a growth rate (CAGR) of 16.43% during 2025-2033. The market is experiencing significant growth due to increased smartphone penetration, the expansion of 5G networks, and the adoption of digital transformation strategies by businesses and government entities. Additionally, investments from major cloud service providers are enhancing infrastructure and service availability. The combined effect of these elements is contributing to the expansion of the Mexico mobile cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,164.00 Million |

| Market Forecast in 2033 | USD 4,576.54 Million |

| Market Growth Rate 2025-2033 | 16.43% |

Mexico Mobile Cloud Market Trends:

Expansion of 5G Networks

The deployment of 5G technology in Mexico is a pivotal factor driving the mobile cloud market. With the launch of 5G services, mobile users experience significantly higher data speeds and lower latency, facilitating the seamless operation of cloud-based applications on mobile devices. This advancement supports real-time data processing and enhances user experiences in sectors such as gaming, healthcare, and education. Telecommunications companies are investing heavily in 5G infrastructure, expanding coverage to urban and rural areas alike. The increased accessibility and improved performance of mobile networks are expected to further accelerate the adoption of mobile cloud services across the country, contributing to the Mexico mobile cloud market growth. For instance, in April 2024, América Móvil expanded its 5G network in Mexico to 125 cities and now serves over 10 million 5G subscribers. Operating under the Telcel brand, it leads Mexico’s mobile market with 83.4 million users (68.6 million prepaid). Nationwide 5G users are expected to rise from 16.9M in 2025 to 87M by 2030, with 62% market penetration and 86% population coverage.

To get more information on this market, Request Sample

Strategic Investments by Cloud Service Providers

Major global cloud service providers are making substantial investments in Mexico to expand their infrastructure and services. For instance, in March 2025, at MWC25, AWS announced its support for the launch of Wim, a fully cloud-native mobile network operator (MNO) in Mexico. Built entirely on AWS, Wim integrates streaming services and lifestyle perks into its mobile offering, creating a digital lifestyle platform. Deployed in just four months, Wim uses AI for personalization, fraud detection, and network optimization. Future plans include expanding generative AI applications. This launch showcases AWS’s deepening role in Mexico’s telecom innovation and cloud-driven service transformation. These investments are not only improving service availability and reliability but also fostering innovation in cloud-based solutions tailored to the needs of Mexican businesses and consumers. As a result, the Mexico mobile cloud market growth is being significantly bolstered by these strategic initiatives.

Mexico Mobile Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on service, deployment, user, and application.

Service Insights:

- Infrastructure

- Platform

- Software

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure, platform, and software.

Deployment Insights:

- Public

- Private

- Hybrid

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes public, private, and hybrid.

User Insights:

- Enterprise

- Consumer

The report has provided a detailed breakup and analysis of the market based on the user. This includes enterprise and consumer.

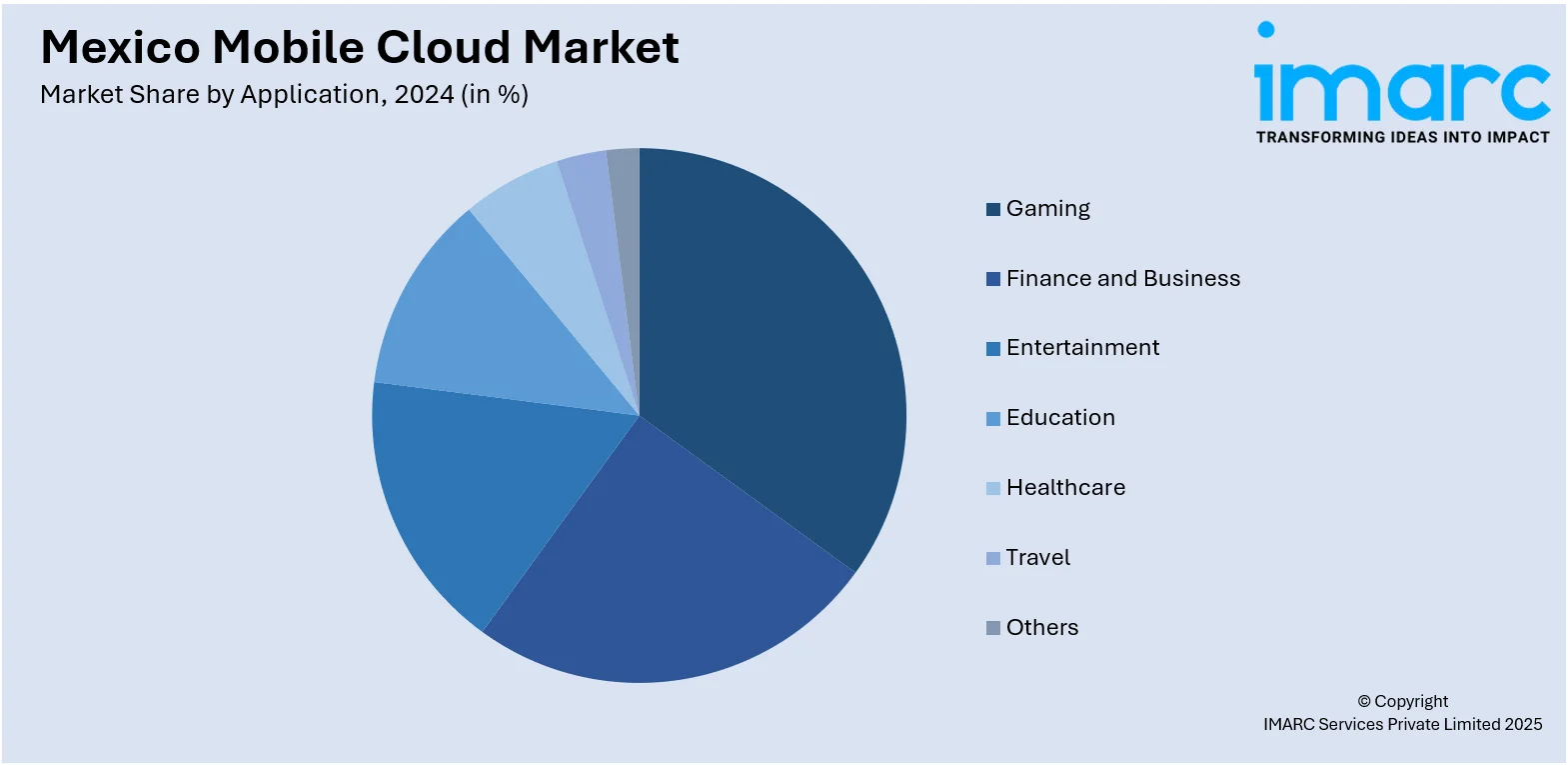

Application Insights:

- Gaming

- Finance and Business

- Entertainment

- Education

- Healthcare

- Travel

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gaming, finance and business, entertainment, education, healthcare, travel, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Cloud Market News:

- In June 2025, Microsoft and its partners are driving rapid cloud and AI adoption in Mexico, with enterprise cloud usage growing over 25% annually. Traditional sectors like finance and healthcare are increasingly migrating to the cloud for productivity, security, and innovation. Microsoft’s tools, including Azure, Microsoft 365, and Power Platform, are in high demand, especially among SMEs. Investments in data centers and AI solutions like Copilot and ChatGPT are accelerating modernization. The Microsoft ecosystem significantly contributes to Mexico mobile cloud market growth.

- In June 2025, Veea Inc. and StarGroup partnered to expand digital access in rural Mexico through smart connectivity and entertainment solutions. Leveraging Veea’s edge computing and cloud-managed platform, the initiative delivers internet, IoT integration, and cloud-based apps to underserved areas. The effort aims to boost digital inclusion, education, and local innovation.

- In May 2025, at GSMA M360 LATAM, Mexico’s major mobile operators, namely Altán Redes, América Móvil, AT&T Mexico, and Telefónica, launched the GSMA Open Gateway initiative. This global project allows developers access to network APIs, accelerating secure app development across devices and operators. Mexico’s initial APIs focus on digital security, including SIM swap detection, device location, and number verification. These tools help reduce fraud in mobile transactions. The initiative supports Mexico mobile cloud market growth by enabling seamless, secure, and cross-industry digital innovation.

- In February 2025, Alibaba Cloud launched its first cloud region in Mexico to support digital transformation and innovation across Latin America. This new infrastructure offers secure, scalable, and cost-effective cloud services for sectors like e-commerce, fintech, and telecom, with low latency and local compliance. It includes programs for talent development, SME support, and community engagement.

Mexico Mobile Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure, Platform, Software |

| Deployments Covered | Public, Private, Hybrid |

| Users Covered | Enterprise, Consumer |

| Applications Covered | Gaming, Finance and Business, Entertainment, Education, Healthcare, Travel, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile cloud market on the basis of service?

- What is the breakup of the Mexico mobile cloud market on the basis of deployment?

- What is the breakup of the Mexico mobile cloud market on the basis of user?

- What is the breakup of the Mexico mobile cloud market on the basis of application?

- What is the breakup of the Mexico mobile cloud market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile cloud market?

- What are the key driving factors and challenges in the Mexico mobile cloud market?

- What is the structure of the Mexico mobile cloud market and who are the key players?

- What is the degree of competition in the Mexico mobile cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)