Mexico Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

Mexico Mobile Phone Insurance Market Overview:

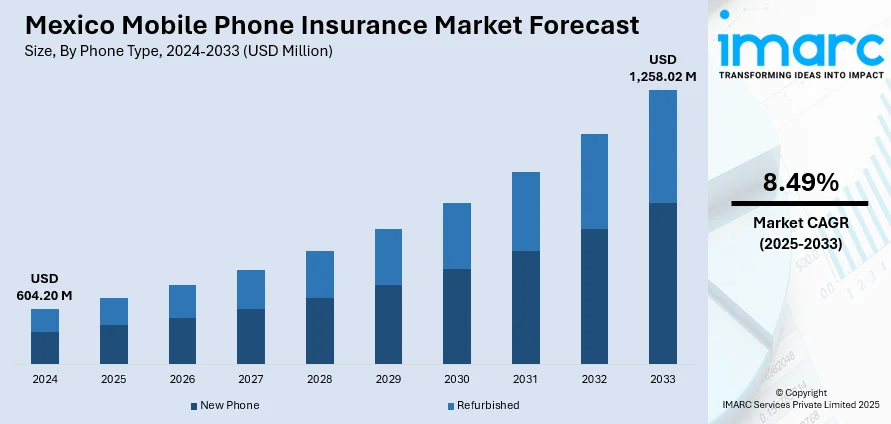

The Mexico mobile phone insurance market size reached USD 604.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,258.02 Million by 2033, exhibiting a growth rate (CAGR) of 8.49% during 2025-2033. Rising smartphone penetration, increasing incidents of device theft and damage, growing awareness about financial protection, digital transformation in insurance services, and strategic collaborations between telecom providers and insurers are among the key factors driving the Mexico mobile phone insurance market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 604.20 Million |

| Market Forecast in 2033 | USD 1,258.02 Million |

| Market Growth Rate 2025-2033 | 8.49% |

Mexico Mobile Phone Insurance Market Trends:

Increasing Dependence on Mobile Devices

Since mobile phones have become integral tools for communication, work, entertainment, and everyday use, their significance in individuals' lives is indispensable. With the growing dependency on smartphones for a variety of purposes, including financial management, work-related tasks, and entertainment, these devices have become an intrinsic part of consumers' daily lives. This high reliance on mobile phones enhances the fear of damage or loss. Therefore, consumers are more likely to secure their precious devices through mobile phone insurance, particularly when the cost of repairing or replacing a top-of-the-line smartphone is substantial. As such, the swift uptake of smartphones in Mexico, fueled by technological innovation and affordability, has resulted in a boom in mobile phone ownership, driving the need for insurance policies that cover these phones against accidents, theft, and technical faults.

Growing Consumer Awareness of Insurance Products

Change in consumer behavior towards gaining an understanding and pursuing insurance coverage is another major driver of the Mexico mobile phone insurance market. In recent years, there has been a significant rise in awareness regarding the need to insure personal assets, especially high-value ones like mobile phones. Consumers are better informed about the various insurance products available, the value of comprehensive coverage, and the peace of mind it offers in the event of device loss or damage. This has been fueled by advertising campaigns, media reports, and the presence of insurance products through mobile carriers and retailers. In line with this, as Mexican consumers grow more financially literate, they are looking at mobile phone insurance as a smart investment, rather than an optional add-on. This increased awareness is also bolstered by the rising number of mobile phone plans that offer insurance coverage as part of the deal, making it more convenient and attractive to a broader market.

Mexico Mobile Phone Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Phone Type Insights:

- New Phone

- Refurbished

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished.

Coverage Insights:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection.

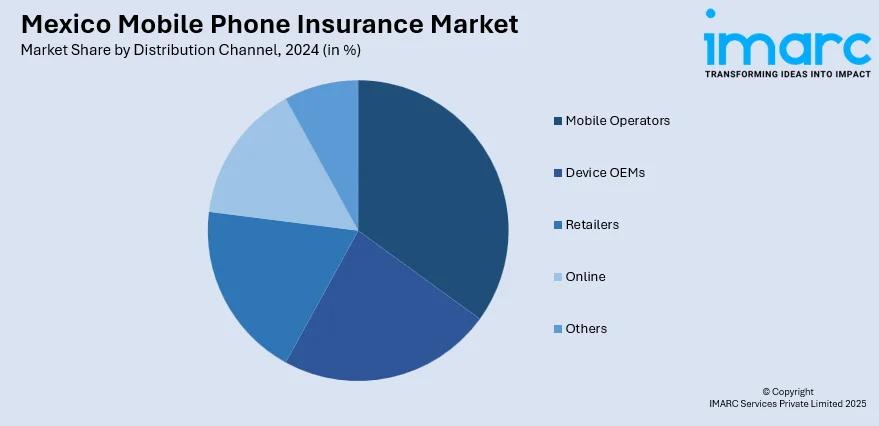

Distribution Channel Insights:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mobile operators, device OEMs, retailers, online, and others.

End User Insights:

- Corporate

- Personal

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate and personal.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile Phone Insurance Market News:

- July 2024: Chubb Ltd. reorganized its Latin American operations, including in Mexico, into three sub-regions to enhance focus and efficiency. This strategic move aims to better serve the region's diverse markets. Notably, Chubb has expanded its digital offerings, including mobile phone insurance, through partnerships with local SuperApps.

- November 2023: Mexico’s President announced that mobile phone coverage in the country had reached 94.5%, benefiting over 119 million people. This expansion, driven by the government's "Internet for All" initiative, includes installing thousands of cellular towers and extending fiber optic networks, especially in rural areas. With broader connectivity, more citizens can access digital services, including mobile phone insurance, which becomes increasingly vital as mobile devices play a central role in daily life.

- October 2023: Inter.mx launched the "Te Regalamos Un Seguro" program, offering free mobile phone insurance to Mexican users, aiming to increase insurance adoption in the country. By partnering with Stripe, Inter.mx streamlines subscription management and payment processing, facilitating the rollout of this innovative insurance offering.

Mexico Mobile Phone Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile phone insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile phone insurance market on the basis of phone type?

- What is the breakup of the Mexico mobile phone insurance market on the basis of coverage?

- What is the breakup of the Mexico mobile phone insurance market on the basis of distribution channel?

- What is the breakup of the Mexico mobile phone insurance market on the basis of end user?

- What is the breakup of the Mexico mobile phone insurance market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile phone insurance market?

- What are the key driving factors and challenges in the Mexico mobile phone insurance market?

- What is the structure of the Mexico mobile phone insurance market and who are the key players?

- What is the degree of competition in the Mexico mobile phone insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile phone insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)