Mexico Mobile and Wireless Backhaul Market Size, Share, Trends and Forecast by Equipment Type, Network Topology, Service, and Region, 2025-2033

Mexico Mobile and Wireless Backhaul Market Overview:

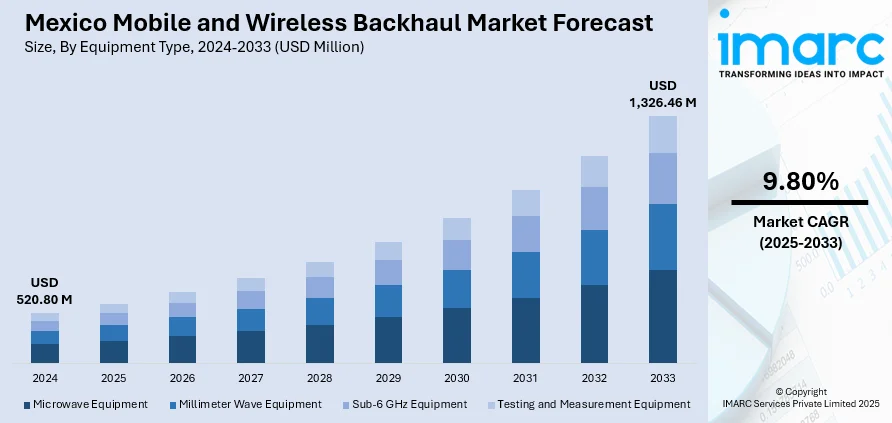

The Mexico mobile and wireless backhaul market size reached USD 520.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,326.46 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is expanding rapidly due to rising mobile data usage, increased Internet of Things (IoT) adoption, and the push for rural connectivity. Telecom providers are prioritizing high-capacity, low-latency wireless solutions where fiber is impractical, particularly as 4G and 5G rollouts accelerate. Smart city initiatives and the proliferation of connected devices demand scalable infrastructure, while rural expansion efforts rely on affordable, flexible backhaul to bridge service gaps. Together, these trends are contributing to the Mexico mobile and wireless backhaul market share and improving digital infrastructure landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 520.80 Million |

| Market Forecast in 2033 | USD 1,326.46 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Mexico Mobile and Wireless Backhaul Market Trends:

Increase in Mobile Data Usage

A rapid rise in mobile data usage is driving the need for wireless backhaul in Mexico, as users rely more on mobile broadband for streaming, cloud services, and remote work. To stay competitive, telecom providers are enhancing their networks to guarantee quicker and more reliable connectivity, especially in regions where installing fiber is expensive or unfeasible. Wireless technologies, such as microwave and millimeter-wave systems, provide the adaptability and expandability required to accommodate this increase. Furthermore, the transition to 4G and the preparations for 5G create additional urgency, as these technologies demand backhaul with high capacity and low latency. In 2024, América Móvil highlighted this change by declaring a $7 billion capital investment strategy for 2025 aimed at speeding up 5G rollout throughout Latin America, with Mexico being the primary market. The firm’s approach involved possible satellite collaborations with SpaceX, highlighting the increasing significance of hybrid wireless backhaul systems to satisfy escalating data needs and coverage requirements.

Growing IoT and Smart City Developments

The rapid growth of IoT devices and the push for smart city initiatives are key factors driving the need for mobile and wireless backhaul in Mexico. As cities implement technologies for intelligent lighting, surveillance, traffic management, and environmental observation, the amount of real-time data transmitted through networks increases significantly. These systems demand connectivity with low latency and high reliability, and wireless backhaul can provide this more effectively than conventional wired infrastructure, particularly in extensive, spread-out urban areas. Local governments and service providers are establishing scalable backhaul networks that can accommodate thousands of connected devices. Wireless technologies provide the adaptability and affordability required to connect sensors, control hubs, and gateways throughout intelligent infrastructure. In 2025, Foxconn entered into an MOU with the Sonora state to develop a smart city following its Build-Operate-Localize model, emphasizing transportation, public safety, and port management. Such projects significantly rely on strong wireless backhaul to facilitate real-time IoT functions.

Expanding Rural Connectivity Initiatives

Efforts to bridge Mexico’s digital gap are increasing the adoption of wireless backhaul solutions, especially in rural and semi-urban regions where conventional infrastructure is scarce. The installation of fiber in these areas continues to be costly and logistically difficult, leading both private and public organizations to seek mobile and wireless solutions. Point-to-point and point-to-multipoint systems offer an affordable way to expand network coverage without extensive construction. These technologies play a crucial role in facilitating essential services, such as remote learning, telemedicine, and mobile banking access, in underserved regions. Regulatory incentives and universal service initiatives are also encouraging telecom providers to enhance rural connectivity. In 2024, Governor Michelle Lujan Grisham declared New Mexico’s intention to pursue $675 million in federal BEAD Program funds to enhance broadband access for rural and tribal areas. Such funding strategies and objectives are influencing connectivity initiatives in Mexico, where wireless backhaul is crucial for accessing remote users.

Mexico Mobile and Wireless Backhaul Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, network topology, and service.

Equipment Type Insights:

- Microwave Equipment

- Millimeter Wave Equipment

- Sub-6 GHz Equipment

- Testing and Measurement Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes microwave equipment, millimeter wave equipment, sub-6 GHz equipment, and testing and measurement equipment.

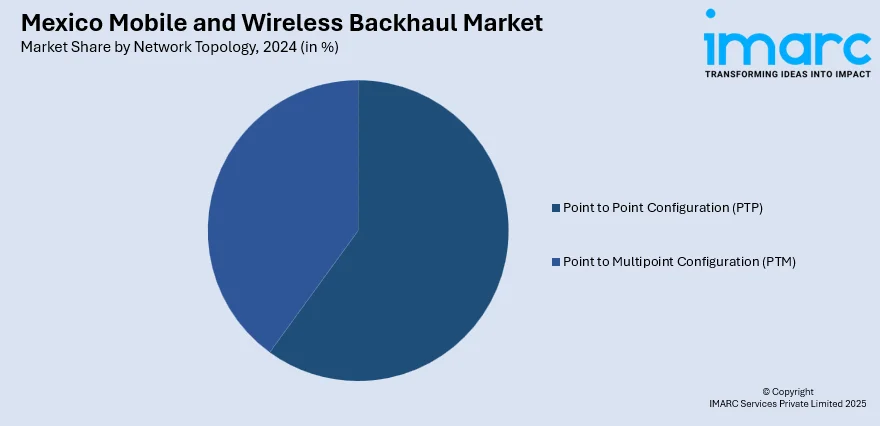

Network Topology Insights:

- Point to Point Configuration (PTP)

- Point to Multipoint Configuration (PTM)

A detailed breakup and analysis of the market based on the network topology have also been provided in the report. This includes point to point configuration (PTP) and point to multipoint configuration (PTM).

Service Insights:

- Network Services

- System Integration Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the service. This includes network services, system integration services, and professional services.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobile and Wireless Backhaul Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Microwave Equipment, Millimeter Wave Equipment, Sub-6 GHz Equipment, Testing and Measurement Equipment |

| Network Topologies Covered | Point to Point Configuration (PTP), Point to Multipoint Configuration (PTM) |

| Services Covered | Network Services, System Integration Services, Professional Services |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobile and wireless backhaul market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobile and wireless backhaul market on the basis of equipment type?

- What is the breakup of the Mexico mobile and wireless backhaul market on the basis of network topology?

- What is the breakup of the Mexico mobile and wireless backhaul market on the basis of service?

- What is the breakup of the Mexico mobile and wireless backhaul market on the basis of region?

- What are the various stages in the value chain of the Mexico mobile and wireless backhaul market?

- What are the key driving factors and challenges in the Mexico mobile and wireless backhaul market?

- What is the structure of the Mexico mobile and wireless backhaul market and who are the key players?

- What is the degree of competition in the Mexico mobile and wireless backhaul market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobile and wireless backhaul market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobile and wireless backhaul market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobile and wireless backhaul industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)