Mexico Mobility Aid Medical Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Mexico Mobility Aid Medical Devices Market Overview:

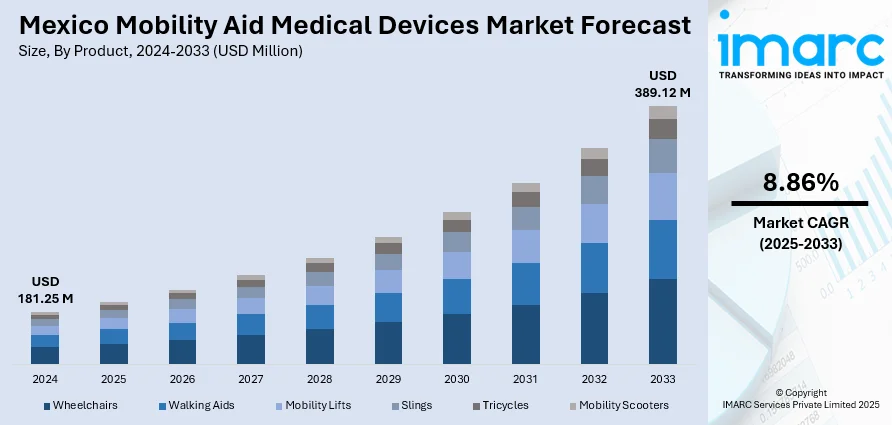

The Mexico mobility aid medical devices market size reached USD 181.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 389.12 Million by 2033, exhibiting a growth rate (CAGR) of 8.86% during 2025-2033. The market is expanding due to rising demand for smart therapeutic devices and robotic-assisted solutions. Besides, growing focus on chronic care management and surgical precision continues to support Mexico mobility aid medical devices market share across hospitals and specialized healthcare facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 181.25 Million |

| Market Forecast in 2033 | USD 389.12 Million |

| Market Growth Rate 2025-2033 | 8.86% |

Mexico Mobility Aid Medical Devices Market Trends:

Rise of Precision Robotics in Orthopedic Care

The growing emphasis on surgical precision and post-operative recovery success is driving a significant shift in the expansion of the Mexico mobility aid medical devices market growth. As healthcare professionals strive to minimize surgical side effects and reduce rehabilitation periods, robot-assisted systems are becoming increasingly indispensable in orthopedic procedures. These systems deliver better precision, less invasiveness, and higher consistency in complex procedures, especially in joint replacement and spinal surgeries. In May of 2024, THINK Surgical launched the TMINI Miniature Robotic System in Mexico, a breakthrough in orthopedic robotics. The first wireless and handheld system, it bridges the gaps between robotic dexterity and surgeon's touch. With its compact size, it enables better mobility in the surgical room and preserves accuracy for successful orthopedic results. The TMINI system has made a significant impact in knee procedures, where proper alignment and positioning are crucial for both short- and long-term mobility. This innovation has sped the deployment of robotic systems in hospitals and surgery centers in Mexico.

To get more information on this market, Request Sample

Smart Therapeutics for Chronic Mobility Management

The growing prevalence of chronic conditions such as diabetes and neurological disorders is reshaping the landscape of mobility aid medical devices in Mexico. Patients with these conditions often face mobility challenges that require continuous monitoring and adaptive therapeutic support. As a result, there is a growing demand for intelligent, wearable devices that not only assist with mobility but also manage underlying health issues in real-time. In July 2024, Medtronic launched two groundbreaking devices in Mexico: the MiniMed 780G insulin delivery system and the Percept RC Neurostimulator. The MiniMed 780G offers automated insulin delivery with Meal Detection technology, helping patients maintain stable glucose levels and avoid mobility-limiting complications. Meanwhile, the Percept RC Neurostimulator utilizes BrainSense technology to personalize treatment for movement disorders, such as Parkinson’s disease, thereby improving motor function and quality of life. These innovations represent a shift toward integrated care, where mobility aids are no longer standalone tools but part of a broader health management ecosystem. This shift reflects evolving market dynamics, particularly in urban healthcare settings focused on long-term patient care.

Mexico Mobility Aid Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Wheelchairs

- Walking Aids

- Mobility Lifts

- Slings

- Tricycles

- Mobility Scooters

The report has provided a detailed breakup and analysis of the market based on the product. This includes wheelchairs, walking aids, mobility lifts, slings, tricycles, and mobility scooters.

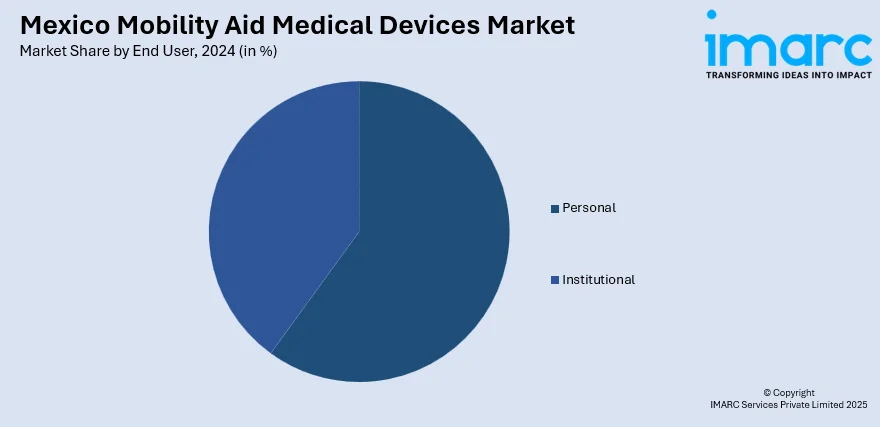

End User Insights:

- Personal

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal and institutional.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobility Aid Medical Devices Market News:

- February 2025: Rx Bandz and Zeyco signed an MOU to distribute the MiniJect epinephrine auto-injector across Mexico. This compact, patient-friendly device addressed critical gaps in allergy care, enhancing emergency response and expanding access to life-saving mobility aid medical devices nationwide.

- July 2024: Medtronic introduced advanced mobility-focused technologies, including the MiniMed 780G insulin delivery system and Percept RC Neurostimulator. These innovations enhanced chronic care and mobility support, positively impacting the Mexico Mobility Aid Medical Devices market by driving adoption of intelligent, patient-centric solutions.

Mexico Mobility Aid Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs, Walking Aids, Mobility Lifts, Slings, Tricycles, Mobility Scooters |

| End Users Covered | Personal, Institutional |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobility aid medical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobility aid medical devices market on the basis of product?

- What is the breakup of the Mexico mobility aid medical devices market on the basis of end user?

- What is the breakup of the Mexico mobility aid medical devices market on the basis of region?

- What are the various stages in the value chain of the Mexico mobility aid medical devices market?

- What are the key driving factors and challenges in the Mexico mobility aid medical devices market?

- What is the structure of the Mexico mobility aid medical devices market and who are the key players?

- What is the degree of competition in the Mexico mobility aid medical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobility aid medical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobility aid medical devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobility aid medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)