Mexico Mobility as a Service Market Size, Share, Trends and Forecast by Service Type, Transportation Type, Application Platform, Propulsion Type, and Region, 2025-2033

Mexico Mobility as a Service Market Overview:

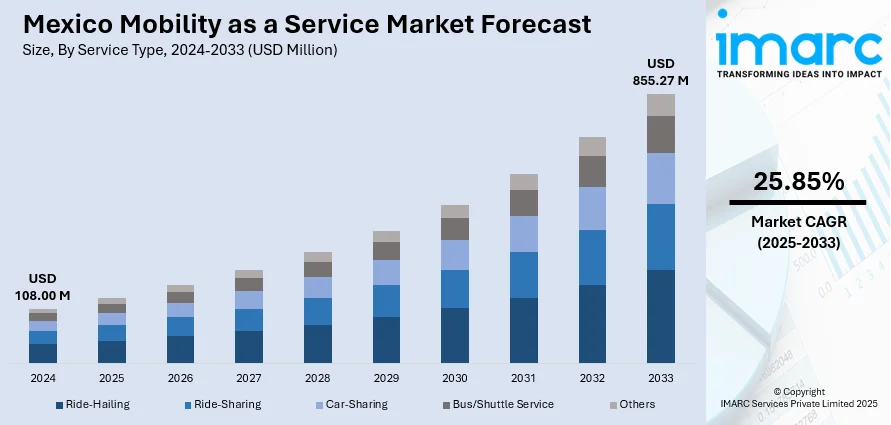

The Mexico mobility as a service market size reached USD 108.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 855.27 Million by 2033, exhibiting a growth rate (CAGR) of 25.85% during 2025-2033. The increasing urbanization, growing demand for integrated transport solutions, government initiatives to reduce traffic congestion, environmental concerns promoting sustainable mobility, and the expansion of ride-hailing and public transport networks, and the shift toward convenient and cost-effective urban transportation options are some of the major factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.00 Million |

| Market Forecast in 2033 | USD 855.27 Million |

| Market Growth Rate 2025-2033 | 25.85% |

Mexico Mobility as a Service Market Trends:

Increasing Smartphone Penetration and Digital Transformation

The rapid growth of smartphone penetration in Mexico is a crucial factor supporting Mexico mobility as a service market growth. With the increasing accessibility of affordable smartphones and improved internet connectivity, more consumers are gaining access to digital transport solutions. Smartphones are becoming central hubs for mobility management, offering a platform for users to access a wide range of mobility services, from ride-hailing to public transport information and bike-sharing. Mexico's smartphone and internet penetration has seen substantial growth in recent years. Notably, in early 2024, there were 107.3 million internet users nationwide, with 83.2% of internet penetration rate. Furthermore, at that time, Mexico had 125.4 million active cellular mobile connections. The increasing digital infrastructure and smartphone penetration provide a perfect setup for the growth of MaaS platforms, providing integrated, on-demand transport services. Real-time route optimization, payment, and tracking features improve convenience and efficiency and make consumers adopt these platforms for regular commutes. Additionally, the linking of smartphones within the MaaS framework allows users to provide quality data that could be used in providing customized products, optimizing itineraries, and enhancing aggregate efficiency. Increased smartphone penetration improves the prospects of MaaS leading the transformation in mobility in the cities of Mexico exponentially.

Expansion of Electrified and Sustainable Mobility Options

Environmental concerns and government policies are driving the expansion of electrified and sustainable mobility options across the MaaS landscape in Mexico, which is positively impacting Mexico mobility as a service market outlook. With Mexico facing air pollution challenges, especially in densely populated urban areas, there is increasing pressure on mobility providers to adopt low-emission alternatives. As a result, many MaaS platforms are incorporating electric vehicles (EVs), hybrid taxis, e-scooters, and electric buses into their service offerings. Notably, electric and plug-in hybrid cars (EVs and PHEVs) showed a sharp increase in the Mexican automobile market in 2024, with sales amounting to 69,713 units. The government of Mexico is introducing incentives such as tax relief, EV purchase subsidies, and the rollout of EV charging infrastructure in city centers. The international climate policy and sustainable urban mobility plans (SUMPs) are also leading cities to favor green transport efforts. Some of the ride-hailing services and fleet operators are also committing themselves to going electric within the next decade. Besides this, the existence of clean sources of energy and technological innovation in batteries also bolsters this trend, making electrified transport more affordable and viable. This transformation is aligned with the needs of users who favor green modes of travel and is redefining the composition of the country's mobility offerings in the future. These factors are augmenting Mexico mobility as a service market share.

Mexico Mobility as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, transportation type, application platform, and propulsion type.

Service Type Insights:

- Ride-Hailing

- Ride-Sharing

- Car-Sharing

- Bus/Shuttle Service

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes ride-hailing, ride-sharing, car-sharing, bus/shuttle service, and others.

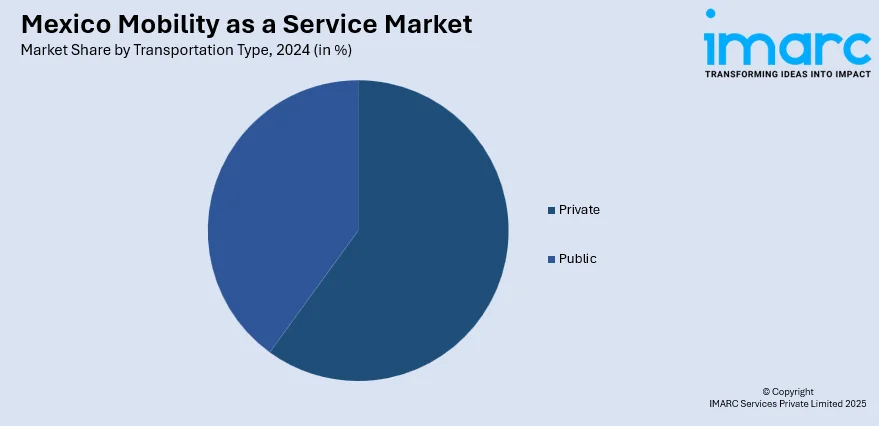

Transportation Type Insights:

- Private

- Public

A detailed breakup and analysis of the market based on the transportation type have also been provided in the report. This includes private and public.

Application Platform Insights:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the application platform. This includes android, iOS, and others.

Propulsion Type Insights:

- Electric Vehicle

- Internal Combustion Engine

- Others

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes electric vehicle, internal combustion engine, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mobility as a Service Market News:

- On February 20, 2025, the state of Sonora, Mexico, initiated a sustainable public transportation project by deploying five electric buses on Line 18 in Hermosillo. This initiative, part of the Sonora Sustainable Energy Plan, aims to reduce the environmental impact of public transit and enhance service quality. Governor Alfonso Durazo emphasized the project's role in transforming the transportation system to be more dignified, safe, and inclusive, thereby improving the quality of life for Sonora's residents.

Mexico Mobility as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Ride-Hailing, Ride-Sharing, Car-Sharing, Bus/Shuttle Service, Others |

| Transportation Types Covered | Public, Private |

| Application Platforms Covered | Android, iOS, Others |

| Propulsion Types Covered | Electric Vehicle, Internal Combustion Engine, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mobility as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mobility as a service market on the basis of service type?

- What is the breakup of the Mexico mobility as a service market on the basis of transportation type?

- What is the breakup of the Mexico mobility as a service market on the basis of application platform?

- What is the breakup of the Mexico mobility as a service market on the basis of propulsion type?

- What is the breakup of the Mexico mobility as a service market on the basis of region?

- What are the various stages in the value chain of the Mexico mobility as a service market?

- What are the key driving factors and challenges in the Mexico mobility as a service market?

- What is the structure of the Mexico mobility as a service market and who are the key players?

- What is the degree of competition in the Mexico mobility as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mobility as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mobility as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mobility as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)