Mexico Modified Starch Market Size, Share, Trends and Forecast by Raw Material, Type, Function, Application, and Region, 2025-2033

Mexico Modified Starch Market Overview:

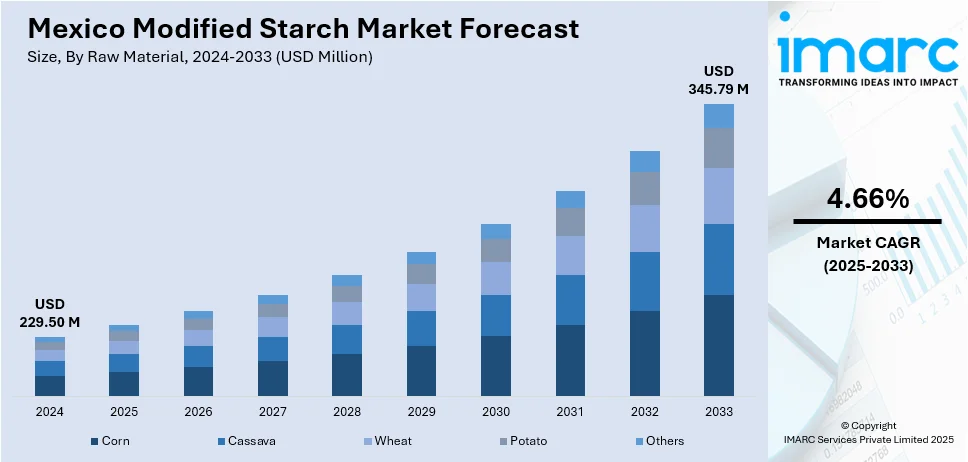

The Mexico modified starch market size reached USD 229.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 345.79 Million by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. Rising consumption of convenience and traditional foods, customized starch solutions for regional culinary uses, expansion of clean-label formulations, growing allergen-free product lines, governmental backing for bio-based industries, investment in green chemistry, academic-industrial R&D collaboration, and adoption of starch for process optimization and sustainability targets are some of the factors positively impacting the Mexico modified starch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 229.50 Million |

| Market Forecast in 2033 | USD 345.79 Million |

| Market Growth Rate 2025-2033 | 4.66% |

Mexico Modified Starch Market Trends:

Increased Modified Starch Integration in Convenience and Traditional Foods

One of the primary factors shaping the market is the growing integration of modified starch in both convenience foods and traditional culinary products. With rising urbanization and shifting consumer preferences, demand for processed and ready-to-eat foods has expanded, especially among the working population. Alongside this, domestic producers are actively working to expand their Mexico modified starch market share by customizing starch derivatives to align with Mexican culinary textures and cooking methods. Tailored formulations that tolerate heat and acidic environments—common in salsas and condiments—are now a core offering. Additionally, increased collaboration between starch suppliers and food manufacturers has improved knowledge transfer regarding starch performance under regional conditions. A study developed dual-modified starch from Mexican Ataulfo mango kernels (a byproduct of Mexico's 2.1M-ton annual mango production) through acetylation-crosslinking, achieving 89% higher freeze-thaw stability and 2.3x increased oil absorption versus native starch – ideal for snack and sauce industries. The modified starch's low retrogradation (12% vs 38% in corn starch) and high thermal resistance (peak viscosity 2,890 cP at 95°C) address key challenges in Mexican industrial food processing while valorizing agricultural waste. With Mexico being a key export hub for Latin American food products, demand for reliable, scalable starch solutions is reinforcing the position of local producers in regional trade dynamics and distribution networks. Parallel to these developments, consumer focus on label transparency and allergen-free options is accelerating Mexico modified starch market growth across the food sector. The growth of specialty food segments catering to diabetic, gluten-sensitive, and wellness-conscious consumers has led to increased formulation complexity, where modified starch is essential for achieving product stability without artificial binders.

Government and Industrial Push for Bio-Based Alternatives

An equally impactful driver is the Mexican government’s support for bio-based industrial materials, which is influencing demand for modified starch in sectors beyond food. A study analyzed native and modified starches from underutilized Mexican seeds like avocado (Persea americana), ramón nut (Brosimum alicastrum), and mango (Mangifera indica), revealing 65-80% starch content with superior functional properties—ramón starch showed 40% higher water absorption than corn starch, while modified avocado seed starch achieved 85% freeze-thaw stability. The environmental regulatory framework has evolved to promote sustainable manufacturing practices in paper, adhesives, and bioplastics. In this broader industrial context, the Mexico modified starch market outlook for modified starch is further shaped by the country’s strategic push for industrial modernization. Several national initiatives are facilitating private investment into green chemistry, with incentives provided for the adoption of non-petroleum-based inputs. Modified starch fits squarely within this agenda, appealing to multinational manufacturers based in Mexico seeking to meet internal sustainability targets. In addition, local academic institutions are collaborating with manufacturers to develop next-gen starch derivatives tailored to the needs of high-tech applications such as electronics insulation, food, and biodegradable films. Industrial users are also adopting modified starch to achieve production optimization, enhancing Mexico modified starch market demand through improved throughput, process flexibility, and resource efficiency. Modified starch helps reduce energy input and raw material waste in operations involving adhesives, textile finishing, and paper treatment. As manufacturers upgrade their production lines to meet international standards, there is increased emphasis on versatile inputs that support high-speed, automated operations.

Mexico Modified Starch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material, type, function, and application.

Raw Material Insights:

- Corn

- Cassava

- Wheat

- Potato

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, cassava, wheat, potato, and others.

Type Insights:

- Starch Esters and Ethers

- Resistant

- Cationic

- Pre-gelatinized

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes starch esters and ethers, resistant, cationic, pre-gelatinized, and others.

Function Insights:

- Thickeners

- Stabilizers

- Binders

- Emulsifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes thickeners, stabilizers, binders, emulsifiers, and others.

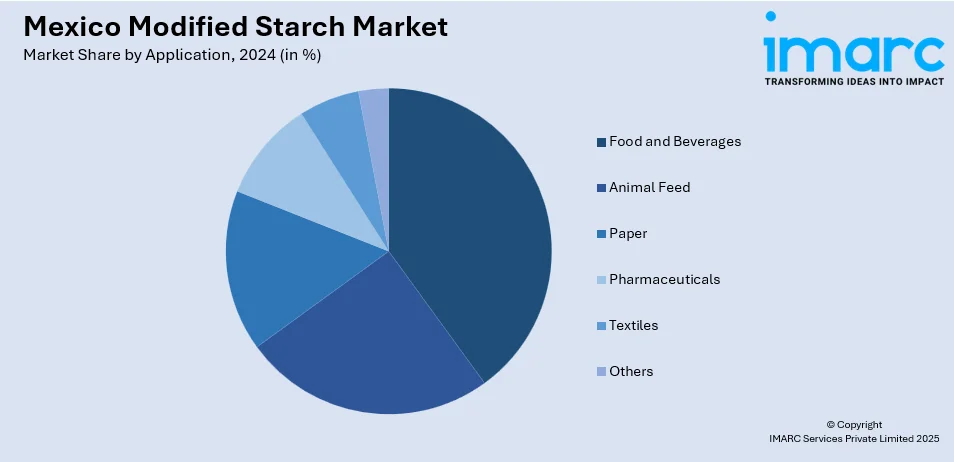

Application Insights:

- Food and Beverages

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, animal feed, paper, pharmaceuticals, textiles, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Modified Starch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Cassava, Wheat, Potato, Others |

| Types Covered | Starch Esters and Ethers, Resistant, Cationic, Pre-gelatinized, Others |

| Functions Covered | Thickeners, Stabilizers, Binders, Emulsifiers, Others |

| Applications Covered | Food and Beverages, Animal Feed, Paper, Pharmaceuticals, Textiles, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico modified starch market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico modified starch market on the basis of raw material?

- What is the breakup of the Mexico modified starch market on the basis of type?

- What is the breakup of the Mexico modified starch market on the basis of function?

- What is the breakup of the Mexico modified starch market on the basis of application?

- What is the breakup of the Mexico modified starch market on the basis of region?

- What are the various stages in the value chain of the Mexico modified starch market?

- What are the key driving factors and challenges in the Mexico modified starch market?

- What is the structure of the Mexico modified starch market and who are the key players?

- What is the degree of competition in the Mexico modified starch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico modified starch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico modified starch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico modified starch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)