Mexico Molecular Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2025-2033

Mexico Molecular Diagnostics Market Overview:

The Mexico molecular diagnostics market size reached USD 250.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 466.38 Million by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. Chronic and infectious disease prevalence, integration of molecular assays into national health protocols, improved diagnostic accuracy, and insurance policy adaptation, alongside urban lab expansion, adoption of automated platforms, academic-industry collaboration, increased access to reagents, workforce training, modular technologies, and decentralized testing models are some of the factors positively impacting the Mexico molecular diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.80 Million |

| Market Forecast in 2033 | USD 466.38 Million |

| Market Growth Rate 2025-2033 | 6.40% |

Mexico Molecular Diagnostics Market Trends:

Rising Prevalence of Chronic and Infectious Diseases

One of the foremost elements shaping this sector’s trajectory is the increasing burden of both communicable and non-communicable diseases across the Mexican population. A growing incidence of conditions such as cancer, HIV, tuberculosis, and diabetes has necessitated the adoption of early and precise diagnostic methods. Molecular diagnostics offers rapid, accurate identification of pathogens and genetic markers, which is critical for timely intervention and treatment planning. Public health authorities have responded by incorporating molecular assays into national disease surveillance and management protocols, particularly for respiratory and sexually transmitted infections. Additionally, healthcare providers are integrating these diagnostic platforms to reduce diagnostic errors and improve patient outcomes. On July 12, 2023, BPGbio, Inc. announced a partnership with Grupo Terralpe to commercialize its novel AI-discovered prostate cancer diagnostic test, pstateDx™, in Mexico. The pstateDx™ test, the first diagnostic product from BPGbio’s Interrogative Biology® platform, is a non-PSA-based blood test that measures filamin A to distinguish aggressive prostate cancer from benign prostatic hyperplasia (BPH), potentially reducing the need for invasive biopsies. Urban hospitals and private clinics are increasingly investing in real-time PCR systems and automated testing platforms to streamline diagnostic workflows. These systems allow for high-throughput testing, especially important during public health emergencies, as seen with COVID-19. Health insurance policies are gradually being updated to cover advanced diagnostic procedures, further increasing access. Approximately mid-cycle in this trajectory, Mexico molecular diagnostics market growth has emerged as a critical response to rising clinical and epidemiological complexity, reinforcing its relevance across healthcare sectors.

.webp)

Expansion of Laboratory Infrastructure and Diagnostic Technology Access

The significant development of laboratory capabilities in urban and semi-urban areas is another major factor reshaping the market landscape. Clinical laboratories are scaling up capacity to include molecular platforms, while diagnostic service providers are standardizing quality assurance frameworks to meet international accreditation standards. Investment in automated systems, such as digital PCR and next-generation sequencing-based diagnostics, has made testing more efficient and reproducible. Simultaneously, academic and private sector collaboration has helped develop training modules for lab professionals, thereby reducing skill shortages and improving procedural accuracy. International diagnostic firms are entering the market through local partnerships, increasing access to advanced kits and reagents. Lower equipment costs and modular platform designs have allowed mid-sized healthcare facilities to adopt molecular diagnostics without significant capital expenditure. Mobile diagnostic units and decentralized testing models are also being piloted in underserved regions, bridging the gap between rural healthcare demand and laboratory reach. On April 2, 2025, Mexico confirmed its first human case of avian influenza A(H5N1), with 91 contacts traced and 49 tested negative through RT-PCR molecular diagnostics. This marked the country’s second human infection with an H5 subtype and occurred amid 75 documented poultry outbreaks across 15 states, highlighting the ongoing zoonotic risk. The event demonstrates the critical role of molecular testing in confirming infections, tracing transmission, and supporting nationwide disease surveillance in both human and animal populations. These advancements have collectively reinforced the clinical value and operational viability of molecular diagnostics in Mexico. As laboratory readiness and technological penetration deepen, the structural ecosystem continues to strengthen in alignment with broader market dynamics.

Mexico Molecular Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, application, and end user.

Product Insights:

- Reagents and Kits

- Instruments

- Software and Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes reagents and kits, instruments, and software and services.

Technology Insights:

- Polymerase Chain Reactions (PCR)

- Hybridization

- DNA Sequencing

- Microarray

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes polymerase chain reactions (PCR), hybridization, DNA sequencing, microarray, isothermal nucleic acid amplification technology (INAAT), and others.

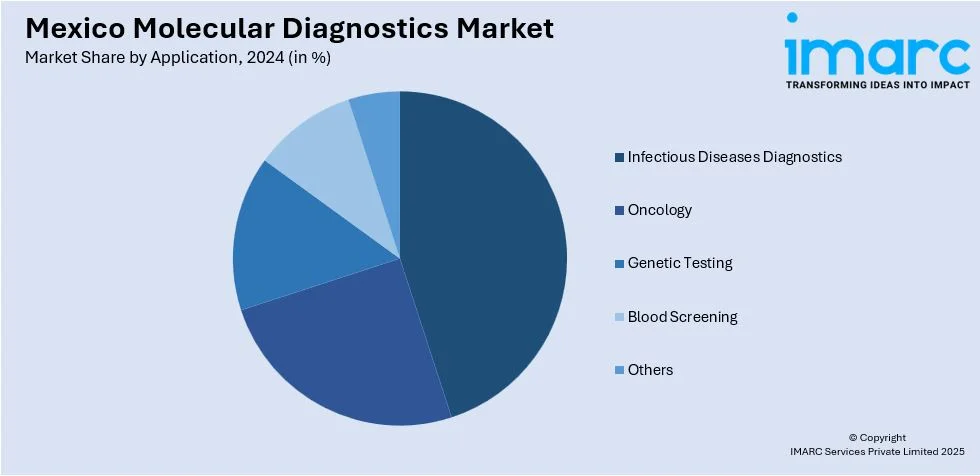

Application Insights:

- Infectious Diseases Diagnostics

- Oncology

- Genetic Testing

- Blood Screening

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infectious diseases diagnostics, oncology, genetic testing, blood screening, and others.

End User Insights:

- Hospitals

- Laboratories

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, laboratories, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has provided a comprehensive analysis of all major regional markets. This includes Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Molecular Diagnostics Market News:

- On July 15, 2024, United Imaging installed its uMI 550 PET/CT system at the Instituto Nacional de Pediatría (INP) in Mexico City, marking the first installation of this advanced digital PET/CT technology in Mexico. The uMI 550 system, designed for pediatric precision imaging, features an industry-leading 2.76 mm LYSO crystal and advanced motion correction algorithms, enabling ultra-high spatial resolution, reduced scan times, and minimal radiation exposure.

Mexico Molecular Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reagents and Kits, Instruments, Software and Services |

| Technologies Covered | Polymerase Chain Reactions (PCR), Hybridization, DNA Sequencing, Microarray, Isothermal Nucleic Acid Amplification Technology (INAAT), Others |

| Applications Covered | Infectious Diseases Diagnostics, Oncology, Genetic Testing, Blood Screening, Others |

| End Users Covered | Hospitals, Laboratories, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico molecular diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico molecular diagnostics market on the basis of product?

- What is the breakup of the Mexico molecular diagnostics market on the basis of technology?

- What is the breakup of the Mexico molecular diagnostics market on the basis of application?

- What is the breakup of the Mexico molecular diagnostics market on the basis of end user?

- What is the breakup of the Mexico molecular diagnostics market on the basis of region?

- What are the various stages in the value chain of the Mexico molecular diagnostics market?

- What are the key driving factors and challenges in the Mexico molecular diagnostics market?

- What is the structure of the Mexico molecular diagnostics market and who are the key players?

- What is the degree of competition in the Mexico molecular diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico molecular diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico molecular diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico molecular diagnostics market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)