Mexico Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2026-2034

Mexico Mushroom Market Overview:

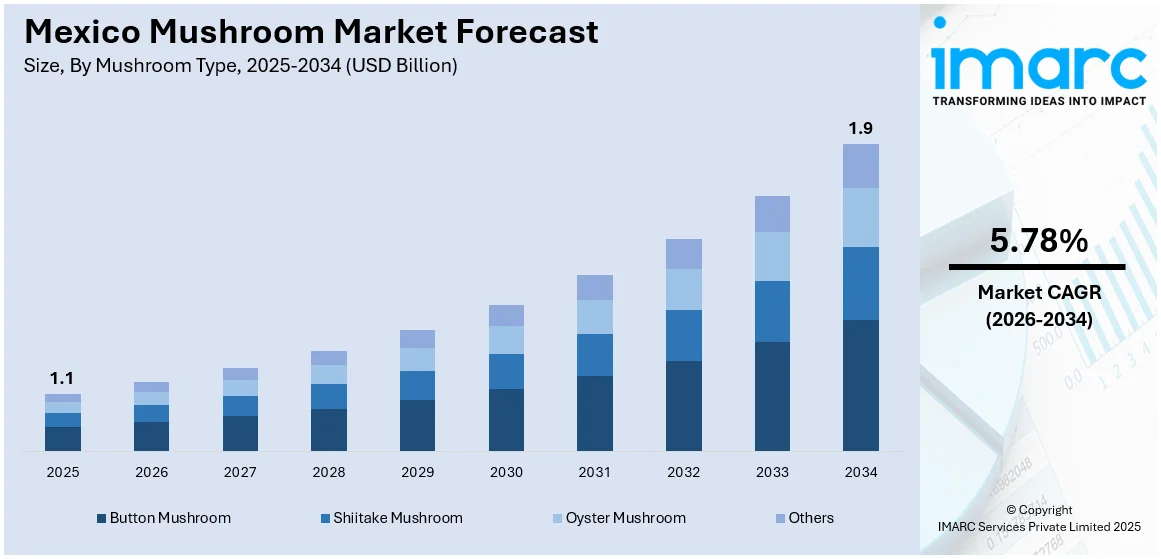

The Mexico mushroom market size reached USD 1.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2034, exhibiting a growth rate (CAGR) of 5.78% during 2026-2034. The increasing consumer awareness of medicinal mushrooms' health benefits, a growing preference for organic and sustainable farming practices, and the rising demand for mushroom-based food products due to the shift toward plant-based diets and alternative proteins, enhancing the Mexico mushroom market growth and diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.1 Billion |

| Market Forecast in 2034 | USD 1.9 Billion |

| Market Growth Rate 2026-2034 | 5.78% |

Mexico Mushroom Market Trends:

Growing Demand for Medicinal Mushrooms:

In Mexico, the market for medicinal mushrooms such as Reishi, Shiitake, and Cordyceps is expanding very fast as the population becomes more aware of their health benefits. The mushrooms are highly prized due to their immune-stimulating, anti-inflammatory, and antioxidant activities, which appeal to the health-conscious community. As the focus on wellness continues to grow, individuals are increasingly opting for functional foods that provide benefits beyond basic nutrition, leading to a shift in dietary habits. This increasing demand for health-promoting ingredients has propelled the increase in medicinal mushroom production. Local producers and foreign companies alike are scaling up their production to cater to the increasing demand for these mushrooms, presenting substantial opportunities in the Mexican mushroom industry. With ongoing consumer demand for natural health remedies, the market will continue to grow in the next few years impacting a positive Mexico mushroom market outlook.

To get more information on this market Request Sample

Shift Toward Organic and Sustainable Farming Practices:

In regions like Atlacomulco, Valle de Bravo, and Zitácuaro in the State of Mexico, the cultivation of 5,000 tons of mushrooms annually is powered by sustainable farming practices. By using agricultural by-products like barley straw and coffee pulp, approximately 407,871 kg of these materials are converted into 34,626 kg of edible mushrooms. This eco-friendly process generates 228,888 kg of spent substrate, which is transformed into organic fertilizer, enriching the soil for future crops. Mexican shoppers, more mindful of environmental consequence and health issues, are also giving preference to organic and pesticide-free foods. Consequently, organically grown mushrooms, which have no synthetic chemicals, are also gaining popularity. Mushroom farmers in response are moving towards sustainable production practices, such as biodegradable packaging materials, organic culture, and efficient energy use practices, so the demand for organically grown and clean-label mushroom products is kept up while maintaining the environmental sustainability of mushroom culture.

Expansion of Mushroom-Based Food Products:

The development of mushroom-based food items is a main trend in the Mexican mushroom industry, fueled by increased demand for plant-based eating and alternative proteins. Mushrooms are being used more and more as diverse ingredients across an array of food products, such as meat substitutes, snacks, soups, and sauces. Their capacity to increase the nutritional content and palatability of foods makes them a desirable option for consumers in search of healthier, plant-based options. As consumers demand such products increase, processed mushroom foods such as mushroom powders, extracts, and capsules become increasingly available, widening the Mexico mushroom market share. The products appeal to consumers with various tastes, including those in the wellness industry, who are in search of functional, nutrient-rich foods. This change toward mushroom-based alternatives is revolutionizing the food environment, an outgrowth of more general movements toward sustainability and healthy eating.

Mexico Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on mushroom type, form, distribution channel and end use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

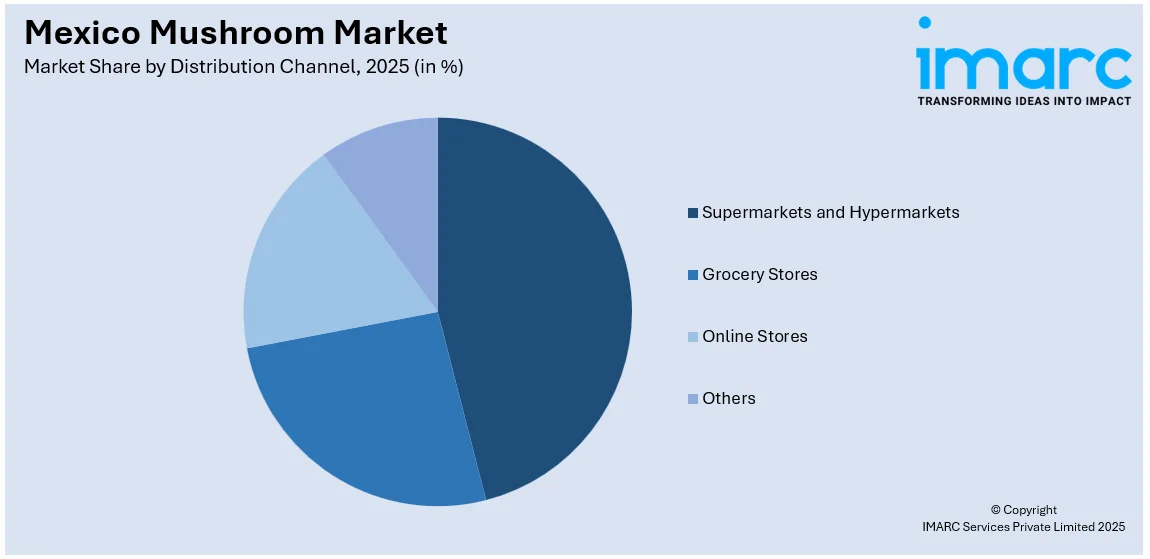

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Mushroom Market News:

- In March 2025, Nourishing Nutrients LLC launched a premium 100% organic mushroom powder made exclusively from fruiting body extracts, featuring no grain or mycelium fillers. The blend includes 10 functional mushrooms, such as Lion's Mane, Reishi, and Chaga, offering a high-quality supplement. This USDA Organic-certified powder is sustainably sourced, manufactured in a GMP-certified facility, and third-party tested for purity and quality, ensuring it delivers the full benefits of natural bioactive compounds.

- In February 2025, The Sisters of the Valley launched Sisters of the Valley Mexico, an online store dedicated to mushroom coffee and merchandise. This move follows the abrupt shutdown of their previous sales platform by PayPal, citing false narcotics violations. The new store focuses on plant-based wellness, featuring mushroom coffee blends and various merchandise. Despite challenges, the Sisters continue to support non-psychoactive plant medicine, prioritizing community and collaboration in their business.

Mexico Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | includes Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico mushroom market on the basis of mushroom type?

- What is the breakup of the Mexico mushroom market on the basis of form?

- What is the breakup of the Mexico mushroom market on the basis of distribution channel?

- What is the breakup of the Mexico mushroom market on the basis of end use?

- What is the breakup of the Mexico mushroom market on the basis of region?

- What are the various stages in the value chain of the Mexico mushroom market?

- What are the key driving factors and challenges in the Mexico mushroom market?

- What is the structure of the Mexico mushroom market and who are the key players?

- What is the degree of competition in the Mexico mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico mushroom market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)