Mexico Nano Coatings Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2026-2034

Mexico Nano Coatings Market Summary:

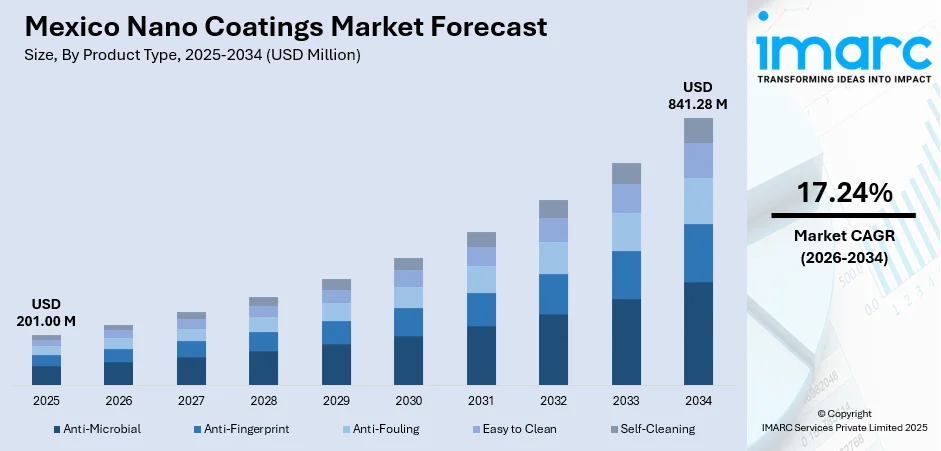

The Mexico nano coatings market size was valued at USD 201.00 Million in 2025 and is projected to reach USD 841.28 Million by 2034, growing at a compound annual growth rate of 17.24% from 2026-2034.

The Mexico nano coatings market is experiencing robust growth driven by increasing demand from the construction and healthcare sectors for advanced protective solutions. The country's expanding manufacturing base, accelerated by significant foreign direct investment, is creating substantial opportunities for nano coating applications. Rising awareness of anti-microbial surface treatments, coupled with the growing adoption of sustainable building practices, continues to strengthen the Mexico nano coatings market share.

Key Takeaways and Insights:

-

By Product Type: Anti-microbial segment dominates the market with a share of 32% in 2025, driven by heightened demand for infection control solutions across healthcare facilities, food processing plants, and public infrastructure following increased hygiene awareness.

-

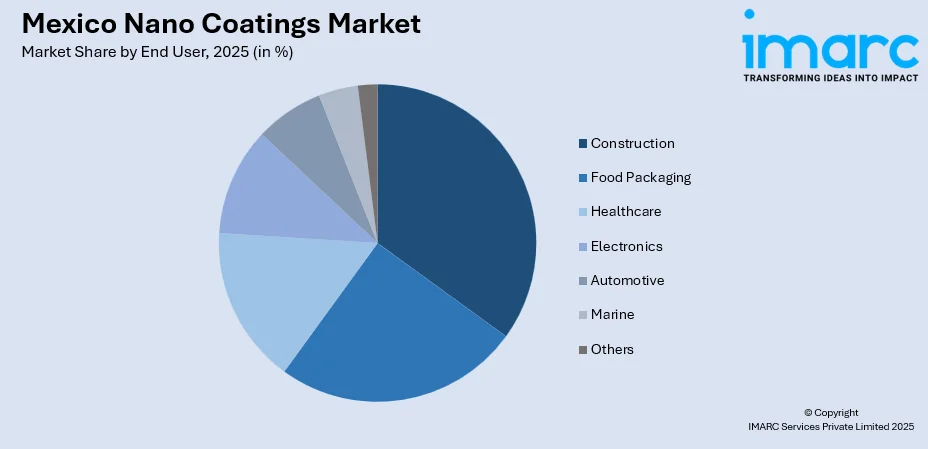

By End User: Construction sector leads the market with a share of 25% in 2025, supported by Mexico's construction industry expansion that recorded 4.1% growth in 2024, with significant investment in residential and infrastructure projects.

-

Key Players: The Mexico nano coatings market exhibits a moderately fragmented competitive landscape, with established multinational corporations competing alongside regional manufacturers. Market participants are focusing on capacity expansion, product innovation, and strategic partnerships to strengthen their regional presence and capture emerging opportunities in construction, healthcare, and electronics sectors.

To get more information on this market Request Sample

The Mexico nano coatings market is positioned at the intersection of technological advancement and industrial growth, benefiting from the country's strategic location and favorable trade agreements under the USMCA framework. The market is witnessing increased adoption across diverse applications, from building exteriors and medical devices to automotive components and food packaging, driven by growing awareness about advanced protective solutions. Mexico's role as a premier nearshoring destination has attracted significant manufacturing investment, with international companies establishing production facilities. The convergence of robust construction activity, expanding healthcare infrastructure, and thriving electronics manufacturing sector continues to create substantial opportunities for nano coating applications. Furthermore, increasing emphasis on product durability, hygiene standards, and sustainable practices across industries is reinforcing demand for innovative coating technologies throughout the region.

Mexico Nano Coatings Market Trends:

Rising Adoption of Self-Cleaning Coatings in Green Building Construction

The increasing emphasis on sustainable construction practices is driving demand for self-cleaning nano coatings in Mexico's building sector. These coatings utilize hydrophobic and photocatalytic properties to maintain clean building facades with minimal maintenance, reducing water consumption and cleaning chemical usage. The integration of self-cleaning nano coatings aligns with green building certification requirements, supports environmental sustainability goals, and reduces long-term operational costs for commercial and residential property owners.

Expansion of Anti-microbial Solutions Across Healthcare Infrastructure

Healthcare facilities throughout Mexico are increasingly adopting anti-microbial nano coatings to combat hospital-acquired infections and maintain sterile environments. The heightened focus on hygiene standards has accelerated deployment on medical devices, surgical instruments, and high-touch surfaces within clinical settings. Government regulations mandating safety and hygiene standards in hospitals and intensive care facilities are further propelling market adoption, while expanding healthcare infrastructure creates additional opportunities for anti-microbial coating applications.

Integration of Smart Coating Technologies in Electronics Manufacturing

Mexico's growing electronics manufacturing sector, bolstered by nearshoring investments, is increasingly incorporating advanced nano coatings with smart functionalities. These coatings provide enhanced protection against moisture, corrosion, and environmental stressors while enabling miniaturization of electronic components. The integration of self-healing and adaptive properties in nano coatings is transforming product durability standards within the Mexican electronics industry, supporting the country's position as a key manufacturing hub for North American technology markets.

Market Outlook 2026-2034:

The Mexico nano coatings market is poised for sustained expansion throughout the forecast period, driven by continued investment in construction, healthcare infrastructure, and advanced manufacturing sectors. Government infrastructure initiatives, including transportation projects and energy pipeline developments, will generate additional opportunities for nano coating adoption. The growing emphasis on sustainable building practices and green certifications is further propelling demand for self-cleaning, anti-microbial, and energy-efficient coatings. Additionally, expanding healthcare facilities and heightened hygiene standards across medical institutions continue to support market momentum throughout the region. The market generated a revenue of USD 201.00 Million in 2025 and is projected to reach a revenue of USD 841.28 Million by 2034, growing at a compound annual growth rate of 17.24% from 2026-2034.

Mexico Nano Coatings Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Anti-Microbial |

32% |

|

End User |

Construction |

25% |

Product Type Insights:

- Anti-Microbial

- Anti-Fingerprint

- Anti-Fouling

- Easy to Clean

- Self-Cleaning

The anti-microbial segment dominates the Mexico nano coatings market with a 32% share in 2025.

The anti-microbial nano coatings segment has emerged as the leading product category in Mexico, driven by the critical need to prevent healthcare-associated infections and maintain sterile environments across medical facilities. These coatings incorporate silver, copper, or zinc oxide nanoparticles that provide continuous protection against bacterial growth on medical devices, surgical instruments, and hospital surfaces. The heightened awareness of hygiene following global health concerns has significantly accelerated adoption across healthcare, food processing, and public infrastructure sectors throughout Mexico.

The demand for anti-microbial nano coatings extends beyond healthcare into food packaging, where these solutions help prevent microbial contamination and extend product shelf life. According to IMARC Group, the Mexico anti-microbial coatings market is expected to reach USD 162.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033, with the medical and healthcare industry segment anticipated to hold dominant share due to the critical need for infection prevention. In Mexico, government regulations requiring safety and hygiene standards in hospitals and intensive care facilities are driving adoption, with manufacturers increasingly incorporating these coatings into their product offerings to meet evolving market requirements.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Food Packaging

- Healthcare

- Electronics

- Automotive

- Marine

- Others

The construction sector leads the Mexico nano coatings market with a 25% share in 2025.

The construction sector has emerged as the leading end-user segment in Mexico's nano coatings market, supported by the country's expanding building and infrastructure activities. Robust growth in residential construction, commercial developments, and civil engineering works is driving demand for nano coatings that provide enhanced durability, weather resistance, and self-cleaning properties for building exteriors. Government infrastructure initiatives and increased foreign investment in industrial facilities continue to strengthen sectoral demand.

The Mexico construction market is creating substantial opportunities for nano coating applications. Key developments including the Sierra Madre gas pipeline, infrastructure projects for the 2026 FIFA World Cup, and numerous industrial facility constructions in northern states are expected to fuel demand. The adoption of Building Information Modeling (BIM) and sustainable building practices is further accelerating the integration of advanced nano coatings that offer anti-microbial, anti-corrosion, and energy-efficient properties to meet evolving construction standards.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico dominates the nano coatings market, driven by its concentration of manufacturing facilities and industrial parks serving the nearshoring boom. States like Nuevo León, Chihuahua, and Baja California benefit from proximity to the United States border, attracting significant foreign direct investment in electronics, automotive, and industrial sectors that extensively utilize nano coating technologies.

Central Mexico represents a significant market share supported by Mexico City's metropolitan construction activities, healthcare infrastructure expansion, and growing industrial base. The Bajío corridor, including Querétaro and Guanajuato, has emerged as a key manufacturing hub with increasing demand for advanced protective coatings across automotive and aerospace industries.

While representing a smaller market share, Southern Mexico is witnessing gradual growth through infrastructure development projects and tourism-related construction activities. Government initiatives aimed at integrating southern states into national value chains are expected to create future opportunities for nano coating applications in emerging industrial sectors.

Market Dynamics:

Growth Drivers:

Why is the Mexico Nano Coatings Market Growing?

Accelerating Nearshoring Investments and Manufacturing Expansion

Mexico's emergence as a premier nearshoring destination is significantly driving the nano coatings market, as international manufacturers establish production facilities to serve North American markets. The country's strategic location, competitive labor costs, and favorable trade agreements under the USMCA have attracted substantial foreign direct investment in various sectors. This industrial expansion is creating robust demand for protective nano coatings that enhance product durability and performance, positioning Mexico as a key growth market for advanced coating solutions.

Robust Construction and Infrastructure Development Activities

Mexico's construction industry expansion is generating substantial demand for nano coatings across residential, commercial, and infrastructure projects. The sector's growth reflects increased investment in building activities, with significant developments including new industrial facilities, healthcare centers, and transportation infrastructure. The adoption of sustainable building practices and green building certifications is further accelerating the integration of self-cleaning and anti-microbial nano coatings that reduce maintenance costs while enhancing building longevity and environmental performance.

Heightened Focus on Healthcare Hygiene and Infection Control

The increasing emphasis on infection prevention and hygiene standards across Mexico's healthcare sector is driving significant adoption of anti-microbial nano coatings. Healthcare-associated infections remain a critical concern, with government regulations mandating enhanced safety standards in hospitals and intensive care facilities. The expansion of healthcare infrastructure, including the construction of new medical facilities and modernization of existing hospitals, is creating opportunities for anti-microbial coating applications on medical devices, surgical instruments, and high-touch surfaces.

Market Restraints:

What Challenges the Mexico Nano Coatings Market is Facing?

High Production and Application Costs

The elevated costs associated with nano coating production and application present barriers to widespread market adoption, particularly among small and medium enterprises. Advanced nanotechnology processes require specialized equipment, skilled labor, and quality raw materials, contributing to higher product prices compared to conventional coating solutions.

Infrastructure and Energy Supply Constraints

Energy supply limitations and infrastructure disparities between northern industrial regions and other parts of Mexico pose challenges for nano coating manufacturers. Electricity costs and grid limitations can impact production efficiency, while water scarcity in certain industrial states creates additional operational constraints.

Regulatory Complexity and Long-Term Safety Concerns

Evolving regulatory frameworks governing nanomaterial safety and environmental impact create compliance challenges for market participants. Concerns regarding the long-term effects of nanoparticle exposure and potential toxicity of certain coating formulations require ongoing research and development efforts to address, potentially limiting adoption in sensitive applications.

Competitive Landscape:

The Mexico nano coatings market exhibits a moderately fragmented competitive landscape characterized by the presence of established multinational corporations and regional manufacturers serving diverse application segments. Market participants are actively pursuing capacity expansion strategies, with companies establishing production facilities within Mexico. Competition is intensifying as players focus on product innovation, developing coatings with enhanced functionalities such as self-healing, anti-microbial, and multi-functional properties to differentiate their offerings. Strategic partnerships between technology providers and end-user industries are becoming increasingly common, enabling customized solution development and market penetration. The market is witnessing consolidation activities as larger players seek to strengthen their portfolios and regional presence through acquisitions.

Recent Developments:

-

August 2024: HZO, a global leader in protective nanocoatings for electronics, opened a new 15,000-square-foot production facility in Chihuahua, Mexico. The facility aims to employ approximately 100 professionals and enhance the company's ability to serve customers in the mobility and industrial sectors, taking advantage of Mexico's IMMEX program for manufacturing operations.

-

June 2023: TriNANO Technologies launched a nanocoating for solar modules that increases energy output by up to 4% due to light trapping, anti-reflection, and self-cleaning properties. This innovation supports the growing integration of nano coatings in renewable energy applications and sustainable building solutions.

Mexico Nano Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Anti-Microbial, Anti-Fingerprint, Anti-Fouling, Easy to Clean, Self-Cleaning |

| End Users Covered | Construction, Food Packaging, Healthcare, Electronics, Automotive, Marine, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico nano coatings market size was valued at USD 201.00 Million in 2025.

The Mexico nano coatings market is expected to grow at a compound annual growth rate of 17.24% from 2026-2034 to reach USD 841.28 Million by 2034.

The anti-microbial segment dominated the market with a 32% share in 2025, driven by heightened demand for infection control solutions across healthcare facilities, food processing plants, and public infrastructure following increased hygiene awareness.

Key factors driving the Mexico nano coatings market include accelerating nearshoring investments attracting manufacturing facilities, robust construction and infrastructure development activities, heightened focus on healthcare hygiene and infection control, and increasing adoption of sustainable building practices requiring advanced protective coating solutions.

Major challenges include high production and application costs limiting adoption among small enterprises, infrastructure and energy supply constraints in certain regions, regulatory complexity regarding nanomaterial safety, and the need for skilled labor and specialized equipment for advanced coating applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)