Mexico Network as a Service Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Mexico Network as a Service Market Overview:

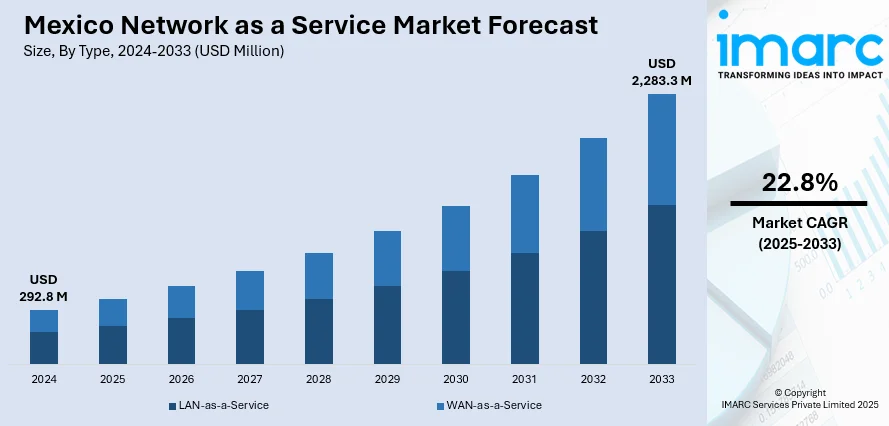

The Mexico network as a service market size reached USD 292.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,283.3 Million by 2033, exhibiting a growth rate (CAGR) of 22.8% during 2025-2033. Growing demand for cost-effective, flexible connectivity in underserved regions is driving innovation, supported by public-private partnerships and next-generation infrastructure rollouts across the country. These developments are significantly influencing the Mexico network as a service market share, positioning it for sustained growth in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.8 Million |

| Market Forecast in 2033 | USD 2,283.3 Million |

| Market Growth Rate 2025-2033 | 22.8% |

Mexico Network as a Service Market Trends:

Decentralized Models Reshaping Connectivity

Mexico’s Network as a Service (NaaS) market is undergoing a fundamental transformation as operators adopt decentralized infrastructure models to increase coverage while reducing operational costs. This shift is enabling more agile, scalable, and resilient network expansion without the need for large-scale capital investments in conventional cell towers. A clear example of this emerged in February 2025 when Movistar partnered with Helium to deploy decentralized wireless services for over 2.3 Million users across Mexico. The project involved the installation of Helium Mobile Hotspots at 300 sites, functioning as mini-cell towers powered by individuals instead of centralized infrastructure. This innovation allowed Movistar to offload data traffic seamlessly onto the Helium Network, improving service coverage and reducing strain on its core network. Moreover, it opened the door for reselling Helium Network access to other MVNOs, creating new revenue streams and partnerships. The model not only enhances service delivery but also supports community involvement and accelerates infrastructure sharing. As more telecom players explore this user-powered approach, decentralized wireless is emerging as a strategic trend in Mexico’s NaaS landscape. It is proving especially useful in semi-urban and edge areas, where deploying traditional infrastructure may not be economically viable but where connectivity needs continue to grow.

To get more information of this market, Request Sample

Hybrid Satellite-LTE Driving Rural Inclusion

Another defining trend shaping Mexico’s Network as a Service (NaaS) market is the growing use of hybrid connectivity models, especially in rural and underserved regions. This approach involves combining satellite and LTE technologies to overcome the challenges of difficult terrain, poor infrastructure, and unreliable power supply. In November 2024, Viasat and Altán jointly launched an LTE broadband service over satellite, spanning 13 states across Mexico. By integrating Viasat’s satellite capacity with Altán’s mobile network, the service delivered affordable internet access to remote communities with limited or no cellular coverage. The deployment featured ultra-low-cost LTE towers, many of which were solar-powered, ensuring continuous service even in off-grid locations. This development significantly improved rural digital inclusion and demonstrated how hybrid network setups can offer stable, scalable, and quick-to-deploy solutions in hard-to-reach areas. It also enabled essential services such as telemedicine, remote education, and digital commerce, directly impacting local quality of life. With nearly 30% of Mexico’s population living without reliable broadband, the hybrid satellite-LTE model is now a key driver in expanding the reach of NaaS offerings. The success of this initiative sets a strong precedent for similar rollouts aimed at closing Mexico’s persistent connectivity gaps.

Mexico Network as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- LAN-as-a-Service

- WAN-as-a-Service

The report has provided a detailed breakup and analysis of the market based on the type. This includes LAN-as-a-service and WAN-as-a-service.

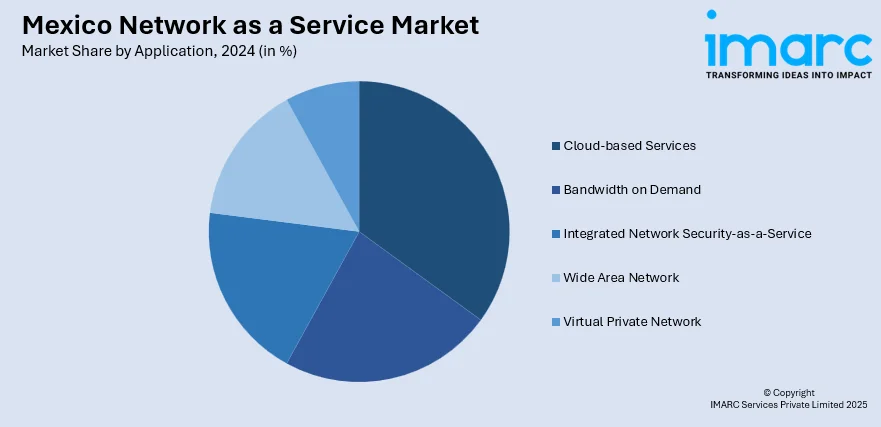

Application Insights:

- Cloud-based Services

- Bandwidth on Demand

- Integrated Network Security-as-a-Service

- Wide Area Network

- Virtual Private Network

As per the Mexico network as a service market outlook, a detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based services, bandwidth on demand, integrated network security-as-a-service, wide area network, and virtual private network.

End Use Industry Insights:

- Healthcare

- BFSI

- Retail and E-Commerce

- IT and Telecom

- Manufacturing

- Transportation and Logistics

- Public Sector

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes healthcare, BFSI, retail and e-commerce, IT and telecom, manufacturing, transportation and logistics, and public sector.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Network as a Service Market News:

- April 2025: Sparkle launched a new PoP in Querétaro, Mexico, expanding its Tier-1 IP backbone Seabone. The move enhanced low-latency IP transit and DDoS protection services, boosting Mexico’s network as a service market with greater infrastructure redundancy and advanced virtual connectivity solutions.

- February 2025: Alibaba Cloud launched its first cloud region in Mexico, offering elastic computing, storage, and networking services. This enhanced Mexico network as a service market growth by supporting low-latency, secure infrastructure for startups and enterprises, accelerating digital transformation and local tech ecosystem growth.

Mexico Network as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LAN-as-a-Service, WAN-as-a-Service |

| Applications Covered | Cloud-based Services, Bandwidth on Demand, Integrated Network Security-as-a-Service, Wide Area Network, Virtual Private Network |

| End Use Industries Covered | Healthcare, BFSI, Retail and E-Commerce, IT and Telecom, Manufacturing, Transportation and Logistics, Public Sector |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico network as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico network as a service market on the basis of type?

- What is the breakup of the Mexico network as a service market on the basis of application?

- What is the breakup of the Mexico network as a service market on the basis of end use industry?

- What is the breakup of the Mexico network as a service market on the basis of region?

- What are the various stages in the value chain of the Mexico network as a service market?

- What are the key driving factors and challenges in the Mexico network as a service?

- What is the structure of the Mexico network as a service market and who are the key players?

- What is the degree of competition in the Mexico network as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico network as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico network as a service market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico network as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)