Mexico Non-Ferrous Metals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Non-Ferrous Metals Market Overview:

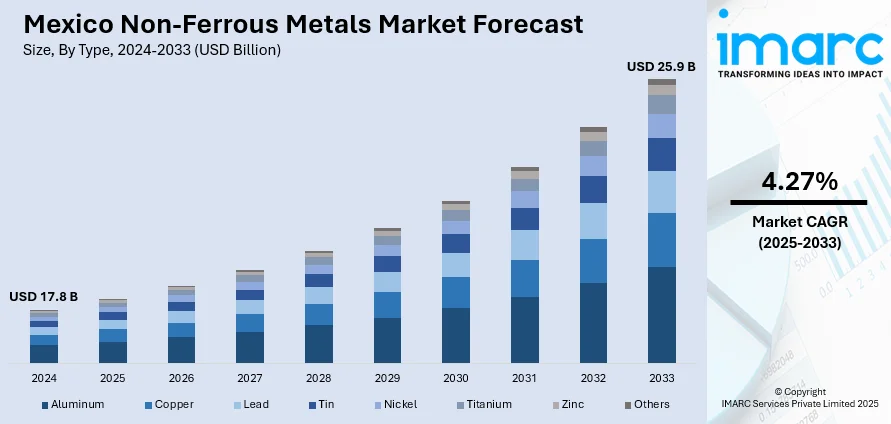

The Mexico non-ferrous metals market size reached USD 17.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.27% during 2025-2033. The expansion of automotive manufacturing, boost in aerospace production, and burgeoning investments in renewable energy projects are propelling the market growth. Rising demand for electric vehicles (EVs) and a growing output from the electronics manufacturing sector are fueling the market growth. Government support for mining operations and trade benefits under the United States-Mexico-Canada Agreement (USMCA), surging foreign direct investment (FDI), and a shift toward circular economy practices are favoring the market growth. Apart from this, global fluctuations in metal prices are encouraging local sourcing and increased exploration of rare non-ferrous metals are further boosting the Mexico non-ferrous metals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.8 Billion |

| Market Forecast in 2033 | USD 25.9 Billion |

| Market Growth Rate 2025-2033 | 4.27% |

Mexico Non-Ferrous Metals Market Trends:

Rising Demand from Vehicle and Aircraft Production

Mexico’s non-ferrous metals market is witnessing strong growth due to the rising output of cars and aircraft in the country. Automakers and aerospace manufacturers are using more lightweight metals like aluminum and copper because they help improve fuel efficiency and performance. As per the reports, in March 2023, EUROGUSS MEXICO 2023 welcomed close to 1,100 trade visitors and 94 exhibitors, pointing to booming demand for light metal die-casting in Mexico due to capacity shortages and growth in the automotive sector. Moreover, aluminum is used in body frames and parts to reduce vehicle weight, while copper is important for wiring and electrical systems. Moreover, the shift toward EV’s has made copper even more valuable, especially for batteries and motors, which is accelerating the Mexico non-ferrous metals market growth. In the aerospace sector, the country has become a key location for building aircraft parts, with many global companies investing in local production. As both industries are expanding, suppliers are witnessing steady demand for materials that meet global standards, which is further favoring the market growth.

To get more information of this market, Request Sample

New Construction Projects Supporting Market Growth

Rising infrastructure investment is another key factor supporting the Mexico non-ferrous metals market growth. Government-backed initiatives for highways, airports, and industrial parks have boosted demand for copper wiring, aluminum framing, and non-corrosive metals used in building systems. Moreover, urbanization trends in cities, such as Monterrey, Guadalajara, and Mexico City are also playing a role, as new home and commercial building construction demands energy efficiency and durable construction inputs. Non-ferrous metals are preferred in most cases as they are lighter, conduct heat better, and possess a longer life cycle compared to traditional steel. Additionally, public-private partnerships in energy and logistic infrastructure have created new fields of application for metal in cables, cladding, piping, and electrical installations. According to the reports, in September 2024, Apollo Silver optioned the Cinco de Mayo Project in Chihuahua, underpinning Mexico's non-ferrous metals market with prospective zinc, lead, silver, molybdenum, and gold resource development. Furthermore, as construction activity continues to be strong in the face of inflationary pressures, this industry is anticipated to continue being a steady source of demand for major non-ferrous commodities across the nation.

Increasing Copper Use with Clean Energy Expansion

Mexico’s focus on renewable energy is creating new opportunities for copper suppliers. Copper plays a major role in clean energy systems, especially solar panels and wind turbines, as because it is one of the best conductors of electricity. As more solar farms are built in areas like Sonora, and wind projects are expanded in southern states, there’s a growing need for copper in power cables, grounding systems, and transformers. These installations require large amounts of metal to connect energy sources to the grid. Additionally, government efforts to increase green energy output are encouraging long-term investment in related infrastructure, which is further accelerating the market growth. Amplified demand from foreign investors and producers of Mexico's clean energy sector is also likely to spur copper imports and local output, generating wider economic gains and cementing the importance of copper in countries transition to a new energy era.

Mexico Non-Ferrous Metals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorize\d the market based on type and application.

Type Insights:

- Aluminum

- Copper

- Lead

- Tin

- Nickel

- Titanium

- Zinc

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes aluminum, copper, lead, tin, nickel, titanium, zinc, and others.

Application Insights:

- Automobile Industry

- Electronic Power Industry

- Construction Industry

- Others

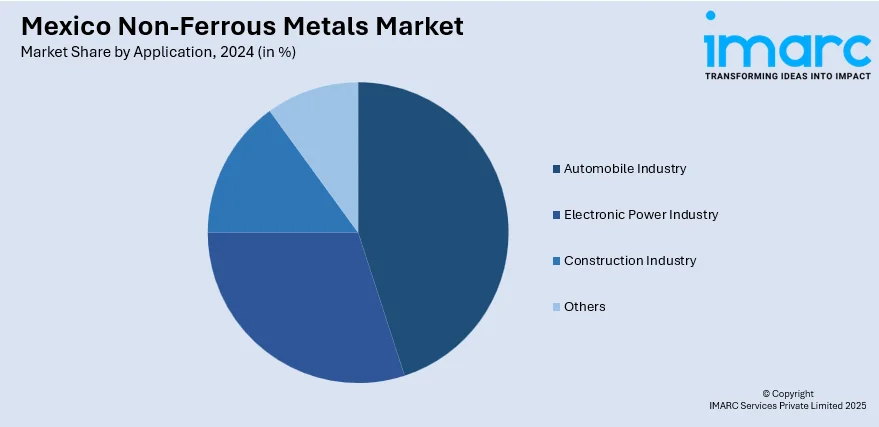

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes the automobile industry, electronic power industry, construction industry, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Non-Ferrous Metals Market News:

- In January 2024, Grupo México reported major developments in three copper ventures: El Pilar, Buenavista Zinc, and El Arco. As demand for copper rises due to sustainable operations, the company will increase production levels, with El Pilar projecting 36,000 tonnes of copper every year and Buenavista Zinc on the verge of completion.

Mexico Non-Ferrous Metals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, Others |

| Applications Covered | Automobile Industry, Electronic Power Industry, Construction Industry, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico non-ferrous metals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico non-ferrous metals market on the basis of type?

- What is the breakup of the Mexico non-ferrous metals market on the basis of application?

- What is the breakup of the Mexico non-ferrous metals market on the basis of region?

- What are the various stages in the value chain of the Mexico non-ferrous metals market?

- What are the key driving factors and challenges in the Mexico non-ferrous metals market?

- What is the structure of the Mexico non-ferrous metals market and who are the key players?

- What is the degree of competition in the Mexico non-ferrous metals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico non-ferrous metals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico non-ferrous metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico non-ferrous metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)