Mexico Nuclear Power Equipment Market Size, Share, Trends and Forecast by Reactor Type, Equipment Type, and Region, 2025-2033

Mexico Nuclear Power Equipment Market Overview:

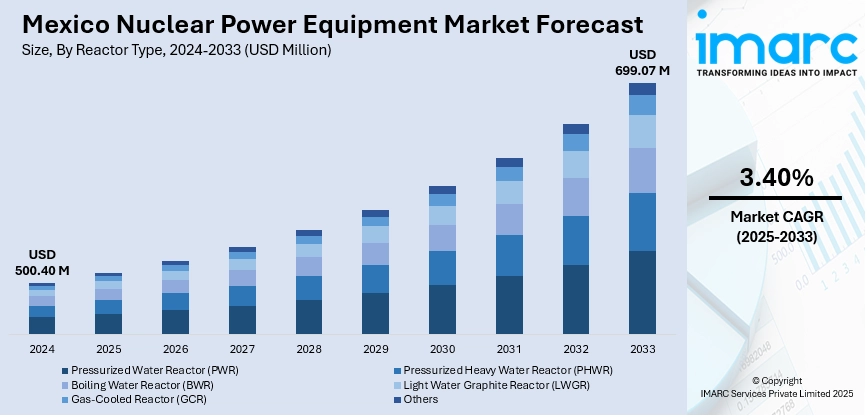

The Mexico nuclear power equipment market size reached USD 500.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 699.07 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is expanding due to government investments in nuclear infrastructure and clean energy initiatives. Moreover, focused on enhancing energy security and reducing reliance on fossil fuels, these efforts are expected to significantly increase the Mexico nuclear power equipment market share, driving growth in the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 500.40 Million |

| Market Forecast in 2033 | USD 699.07 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Mexico Nuclear Power Equipment Market Trends:

Strategic Investments in Energy Expansion

Mexico is turning its attention to the development of its energy infrastructure with the inclusion of high-technology solutions, where nuclear energy is a key element in the country's future energy plan. The ambitious target of increasing new electricity generation capacity by 29 GW by 2030 will include a wide range of projects. In line with this, Mexico has drafted plans for massive investments in renewable energy and nuclear power. Although the initial focus was on solar and wind projects, the scope for Mexico nuclear power equipment market growth is huge. These investments are expected to result in the demand for nuclear power equipment and technology and thereby foster long-term market growth. In addition, the contribution of nuclear energy in cutting carbon emissions and offering a reliable supply of power will continue to attract interest and investment. Increased development of nuclear facilities, especially the construction of new reactors or refitting existing ones, will see the demand for added advancements in nuclear gear, leading to a consistent demand for nuclear power equipment manufacturers and services. This approach not only bolsters Mexico's energy security but also places it at an advantage to achieve international sustainability goals while pushing the nuclear power industry ahead.

To get more information on this market, Request Sample

Regulatory Support and Market Modernization

Mexico's changing energy policies are fueling the development of the nuclear power equipment market, with the changes in regulations offering a more conducive environment for nuclear power development. The government is not only investing in renewable energy but also getting ready to upgrade its current nuclear facilities, thus becoming a more competitive competitor in the international market. With the 2025 expansion announcement, the nation is set to increase its capacity, mitigating increasing electricity needs and reliance on fossil fuels. These moves are anticipated to enhance a more secure and diversified energy market. Under the government's overall plan to diversify its energy mix, nuclear power will attract increased attention, spurred by good government incentives, regulatory requirements for safety, and research investments. This pattern reflects an increasing dependence on nuclear energy as a key element of Mexico's clean energy future. Stronger nuclear safety practices and advanced reactor technologies will also spur the market's expansion, inviting private and foreign investment in nuclear plants. The continued regulatory reforms and infrastructure growth, including foreign collaborations, will shape market trends, setting the nation to upgrade and develop its nuclear energy industry, providing long-term prospects for the market.

Mexico Nuclear Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on reactor type and equipment type.

Reactor Type Insights:

- Pressurized Water Reactor (PWR)

- Pressurized Heavy Water Reactor (PHWR)

- Boiling Water Reactor (BWR)

- Light Water Graphite Reactor (LWGR)

- Gas-Cooled Reactor (GCR)

- Others

The report has provided a detailed breakup and analysis of the market based on the reactor type. This includes pressurized water reactor (PWR), pressurized heavy water reactor (PHWR), boiling water reactor (BWR), light water graphite reactor (LWGR), gas-cooled reactor (GCR), and others.

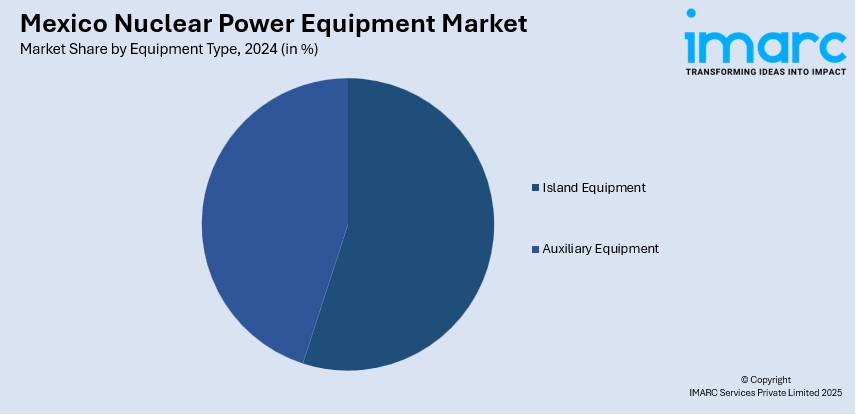

Equipment Type Insights:

- Island Equipment

- Auxiliary Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes island equipment and auxiliary equipment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Nuclear Power Equipment Market News:

- February 2025: Mexico announced the development of 51 energy projects, including the expansion of its nuclear power capacity. With an investment of USD 22.3 Billion, the plan aimed to enhance the country’s energy reliability, boosting demand for nuclear power equipment and strengthening Mexico’s energy sector.

Mexico Nuclear Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Reactor Types Covered | Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Boiling Water Reactor (BWR), Light Water Graphite Reactor (LWGR), Gas-Cooled Reactor (GCR), Others |

| Equipment Types Covered | Island Equipment, Auxiliary Equipment |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico nuclear power equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico nuclear power equipment market on the basis of reactor type?

- What is the breakup of the Mexico nuclear power equipment market on the basis of equipment type?

- What is the breakup of the Mexico nuclear power equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico nuclear power equipment market?

- What are the key driving factors and challenges in the Mexico nuclear power equipment market?

- What is the structure of the Mexico nuclear power equipment market and who are the key players?

- What is the degree of competition in the Mexico nuclear power equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico nuclear power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico nuclear power equipment market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico nuclear power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)