Mexico Off-Grid Solar Power Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Mexico Off-Grid Solar Power Market Overview:

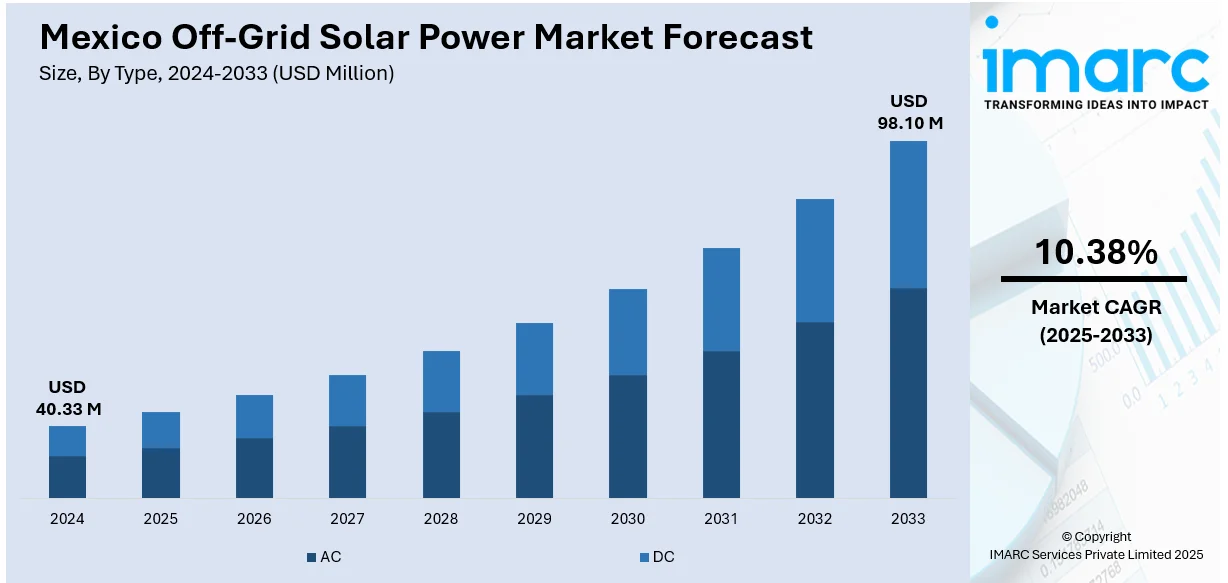

The Mexico Off-Grid Solar Power Market size reached USD 40.33 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 98.10 Million by 2033, exhibiting a growth rate (CAGR) of 10.38% during 2025-2033. The rising need for reliable energy in rural and remote areas, supported by government incentives and declining solar technology costs is impelling the market growth. Increased environmental awareness and the encouragement for sustainable energy solutions further surge the Mexico off-grid solar power market share. Moreover, the adoption of off-grid solar systems are making them a practical and eco-friendly alternative thus aiding the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.33 Million |

| Market Forecast in 2033 | USD 98.10 Million |

| Market Growth Rate 2025-2033 | 10.38% |

Mexico Off-Grid Solar Power Market Trends:

Expansion in Rural and Remote Areas

Off-grid solar energy is becoming more popular in rural and remote areas of Mexico, where access to the national grid is restricted or non-existent. As per the reports, in 2020, an estimated 2.6 million people, or 2of the population, still had no access to electricity, primarily in rural and underserved communities, reports the International Energy Agency (IEA). The absence of a consistent electrical supply is one of the disadvantages in these places, thus solar energy is a practical and sustainable alternative. Moreover, solar systems make it possible for people to obtain necessities like healthcare, education, and illumination. Increasing movement towards the use of solar power comes due to heightened environmental consciousness, economic advantages of clean energy, and a requirement for enhanced energy availability in deprived areas. Mexico aims to raise living standards in off-grid regions by promoting solar energy and reducing energy poverty and local development.

Technological Advancements and Cost Reductions

Solar energy technology has significantly lowered the cost of solar panels and energy storage systems, increasing the affordability and accessibility of off-grid solar power for Mexican users. Solar panel prices have decreased substantially, and enhanced efficiency in solar equipment has increased system performance. Off-grid solar power is starting to look like a good choice for isolated communities since solar panels are now producing more electricity and storage systems are getting more dependable. These developments enable consumers to reap the rewards of longer-lasting, better-performing systems, crucial for reliable power in off-grid regions. Off-grid solar power continues to be a viable, sustainable, and attractive energy source for people without connection to the national grid as solar technology advances.

Government Incentives and Support

The Mexican government has been aggressively promoting off-grid solar energy uptake through several incentives, such as tax credits, renewable energy project subsidies, and net metering laws. The policies allow consumers to sell unused power back to the grid, lowering electricity bills. These policies reduce the initial cost barrier for individuals and organizations interested in solar energy options. According to the sources, in 2023, Mexico's tax relief on solar energy projects had yielded an estimated tax relief of about USD 150 million, further accelerating the development of solar energy in the country. Such efforts are vital in driving the shift to clean energy, promoting both domestic and commercial installations of off-grid solar systems. Furthermore, with ongoing government assistance, Mexico is moving forward with its renewable energy targets, enhancing energy access, and decreasing dependence on fossil fuels.

Mexico Off-Grid Solar Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- AC

- DC

The report has provided a detailed breakup and analysis of the market based on the type. This includes AC and DC.

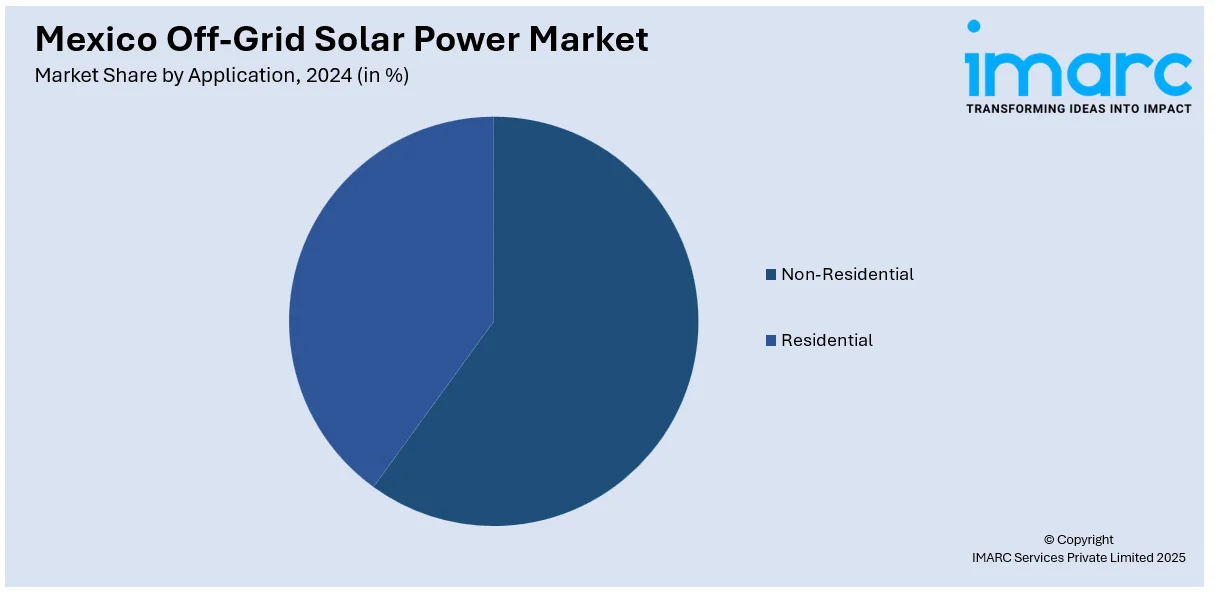

Application Insights:

- Non-Residential

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes non-residential and residential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico off-grid solar power Market News:

- In May 2025, EcoFlow launched the STREAM Series, a plug-and-play home solar system designed for apartments, condos, and single-family homes. The system includes the STREAM Ultra, which combines a solar battery and microinverter, and the standalone STREAM Microinverter for homes without storage needs. Available initially in Utah, the system allows users to reduce electricity bills and provides backup power during blackouts, offering a simple, DIY solar solution with no installation required.

- In March 2025, Mexico has introduced a new policy mandating renewable energy plants to incorporate battery storage systems equivalent to 30% of their capacity, with a minimum of three hours of discharge. By 2028, the country plans to add 574 MW of battery storage. This policy is part of Mexico's broader energy transition, aiming for 80% clean energy by 2030, with a significant portion of new generation coming from both state-owned and private sectors.

Mexico off-grid solar power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AC, DC |

| Applications Covered | Non-Residential, Residential |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico off-grid solar power market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico off-grid solar power market on the basis of type?

- What is the breakup of the Mexico off-grid solar power market on the basis of application?

- What is the breakup of the Mexico off-grid solar power market on the basis of region?

- What are the various stages in the value chain of the Mexico off-grid solar power market?

- What are the key driving factors and challenges in the Mexico off-grid solar power market?

- What is the structure of the Mexico off-grid solar power market and who are the key players?

- What is the degree of competition in the Mexico off-grid solar power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico off-grid solar power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico off-grid solar power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico off-grid solar power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)