Mexico Office Supplies Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Office Supplies Market Overview:

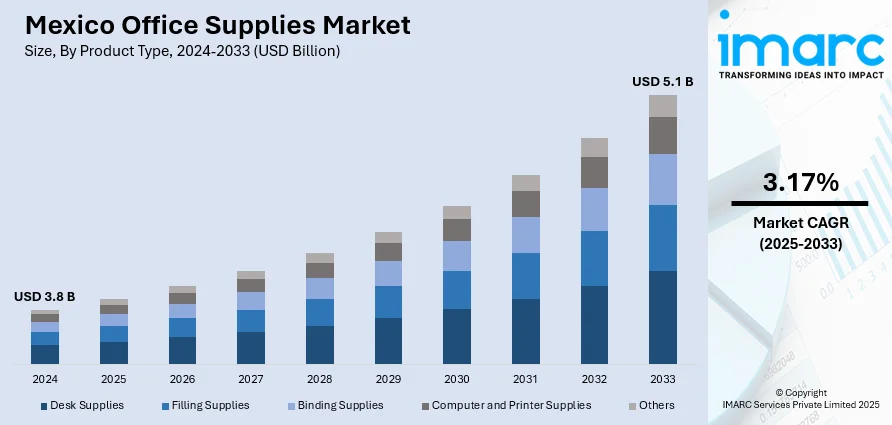

The Mexico office supplies market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 3.17% during 2025-2033. The market is driven by increasing corporate growth, rising remote and hybrid work models, expanding educational institutions, and e-commerce penetration. Additionally, rising demand for sustainable products, technological advancements in stationery, and government investments in education further contribute to the Mexico office supplies market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Market Growth Rate 2025-2033 | 3.17% |

Mexico Office Supplies Market Trends:

Corporate Growth and Business Expansion

The increasing number of businesses, startups, and multinational companies in Mexico is a key driver of the office supplies market. As companies expand, they require a steady supply of essential office products, including stationery, printers, paper, and ergonomic furniture. The growing corporate sector, particularly in financial services, IT, and manufacturing, fuels demand for both traditional and digital office solutions. Additionally, government initiatives supporting business growth and foreign investments contribute to market expansion. Companies are also focusing on improving workplace efficiency, leading to higher spending on high-quality and innovative office supplies to enhance productivity and employee satisfaction, thereby creating a positive impact on the Mexico office supplies market outlook. For instance, in February 2025, WWEX Group, the second-biggest privately owned logistics firm in the U.S., boasting over $4.4 billion in total revenue, revealed the launch of its new office and operations center in Monterrey, Mexico. This strategic growth signifies the next phase in the company's ongoing development and dedication to delivering top-tier logistics and supply chain solutions for clients across North America.

Rise of Remote and Hybrid Work Models

The shift toward remote and hybrid work has significantly impacted the office supplies market in Mexico. According to industry reports, 42.1% of employed tech professionals in Mexico favor remote work. Approximately 26.6% favor hybrid arrangements, while 24.7% choose flexible work options. This means that just 6.6% of tech employees favor a completely on-site office setup. Employees working from home require office essentials such as ergonomic chairs, desks, printers, and digital tools to create a functional workspace. The demand for home office supplies surged post-pandemic as businesses adopted flexible work arrangements, which is further fueling the Mexico office supplies market share. Additionally, companies are providing reimbursements or allowances for remote work setups, further boosting sales. This trend is expected to continue as organizations embrace hybrid models, ensuring steady demand for office products tailored for both home and traditional office environments.

Mexico Office Supplies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Desk Supplies

- Filling Supplies

- Binding Supplies

- Computer and Printer Supplies

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes desk supplies, filling supplies, binding supplies, computer and printer supplies, and others.

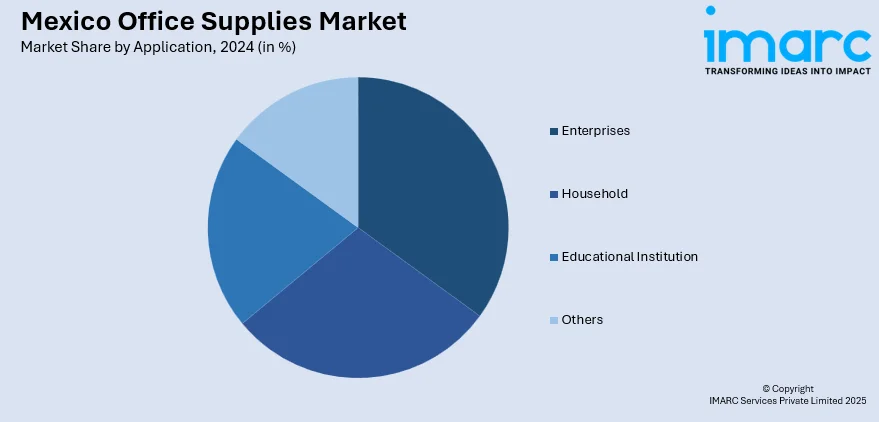

Application Insights:

- Enterprises

- Household

- Educational Institution

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes enterprises, household, educational institution, and others.

Distribution Channel Insights:

- Supermarket and Hypermarket

- Stationery Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket and hypermarket, stationery stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Office Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Desk Supplies, Filling Supplies, Binding Supplies, Computer and Printer Supplies, Others |

| Applications Covered | Enterprises, Household, Educational Institution, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Stationery Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico office supplies market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico office supplies market on the basis of product type?

- What is the breakup of the Mexico office supplies market on the basis of application?

- What is the breakup of the Mexico office supplies market on the basis of distribution channel?

- What is the breakup of the Mexico office supplies market on the basis of region?

- What are the various stages in the value chain of the Mexico office supplies market?

- What are the key driving factors and challenges in the Mexico office supplies market?

- What is the structure of the Mexico office supplies market and who are the key players?

- What is the degree of competition in the Mexico office supplies market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico office supplies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico office supplies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico office supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)