Mexico Offshore Support Vessels Market Size, Share, Trends and Forecast by Type, Water Depth, Fuel, Service Type, Application, and Region, 2025-2033

Mexico Offshore Support Vessels Market Overview:

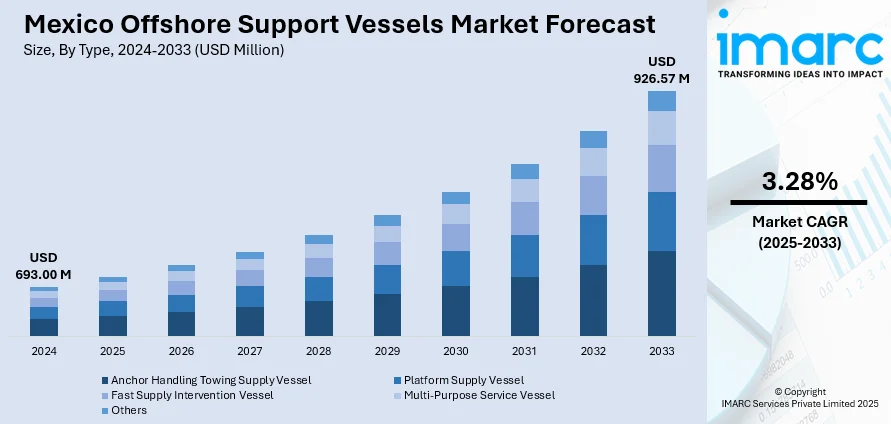

The Mexico offshore support vessels market size reached USD 693.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 926.57 Million by 2033, exhibiting a growth rate (CAGR) of 3.28% during 2025-2033. The market is being driven by increased oil and gas exploration activities in the Gulf of Mexico, particularly with the rise in deepwater drilling, significant investments in offshore infrastructure, and the country’s favorable energy reforms aimed at attracting foreign investments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 693.00 Million |

| Market Forecast in 2033 | USD 926.57 Million |

| Market Growth Rate 2025-2033 | 3.28% |

Mexico Offshore Support Vessels Market Trends:

Deepwater and Offshore Oil and Gas Exploration

A major factor driving the growth of Mexico’s offshore support vessels (OSVs) market is the surge in investment and activity in deepwater and offshore oil and gas exploration, particularly in the hydrocarbon-rich Gulf of Mexico. Following energy reforms that liberalized Mexico’s oil industry, both national and international companies have gained access to offshore exploration opportunities. These projects are expected to boost Mexico’s offshore production. With the surge in exploration and production activities, there has been a heightened demand for OSVs, especially specialized types such as anchor-handling tug supply (AHTS) vessels and platform supply vessels (PSVs). These ships are essential for delivering equipment, supplies, and crew to offshore drilling platforms.

Energy Reforms and Foreign Investment in Mexico’s Offshore Energy Sector

Mexico’s energy reforms, which began in 2013 and were further strengthened over the following years, are a key driver of growth in the OSVs market. These policy changes expanded foreign access to the offshore oil and gas industry, drawing major global players like Shell, Chevron, and ExxonMobil to pursue exploration in the deepwater and ultra-deepwater regions of the Gulf of Mexico. Additionally, the reforms allowed private sector involvement through joint ventures with the state-owned Petróleos Mexicanos (PEMEX), spurring further exploration and production activities. As a result, the demand for OSVs has surged, with the number of OSVs in Mexico’s exclusive economic zone (EEZ) projected to grow substantially in the near-term. This surge is anticipated to boost the demand for specialized offshore support vessels, including platform supply vessels (PSVs), anchor-handling tug supply vessels (AHTS), and subsea support vessels.

Mexico Offshore Support Vessels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, water depth, fuel, service type, and application.

Type Insights:

- Anchor Handling Towing Supply Vessel

- Platform Supply Vessel

- Fast Supply Intervention Vessel

- Multi-Purpose Service Vessel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes anchor handling towing supply vessel, platform supply vessel, fast supply intervention vessel, multi-purpose service vessel, and others.

Water Depth Insights:

- Shallow Water

- Deepwater

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes shallow water and deepwater.

Fuel Insights:

- Fuel Oil

- LNG

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes fuel oil and LNG.

Service Type Insights:

- Technical Services

- Inspection and Survey

- Crew Management

- Logistics and Cargo Management

- Anchor Handling and Seismic Support

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes technical services, inspection and survey, crew management, logistics and cargo management, anchor handling and seismic support, and others.

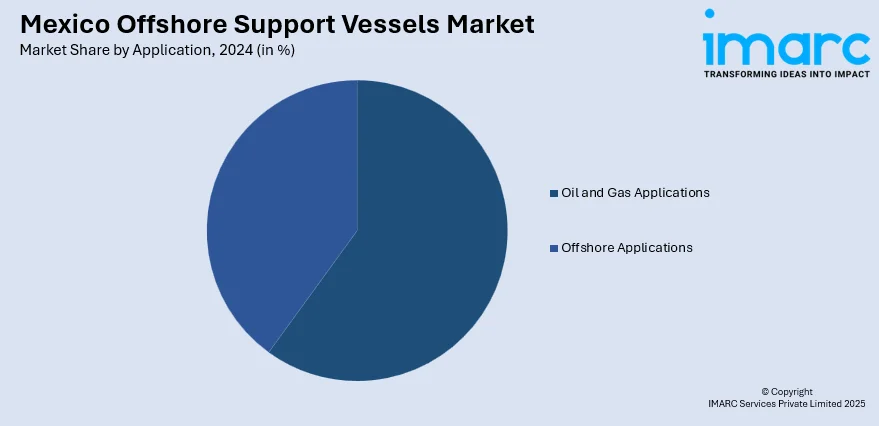

Application Insights:

- Oil and Gas Applications

- Offshore Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes oil and gas applications and offshore applications.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Offshore Support Vessels Market News:

- March 2025: SLB secured a major drilling contract from Woodside Energy for the ultra-deepwater Trion development offshore Mexico. The three-year project is expected to deliver 18 wells, with first oil anticipated in 2028. OSVs will play a vital role in transporting equipment, personnel, and providing logistical support.

- May 2024: The Chouest Group acquired ROVOP, a leading remotely operated vehicle (ROV) company, significantly expanding its subsea capabilities. This acquisition, alongside Chouest's subsea service company C-Innovation, brings the combined fleet to over 100 ROVs and six autonomous underwater vehicles (AUVs). The integration enhances Chouest's offshore support vessel operations, particularly in regions like Mexico, by providing comprehensive subsea services.

- January 2024: SEACOR Marine announced plans to convert four of its platform supply vessels (PSVs) to battery hybrid power. This move aims to enhance efficiency and reduce emissions, aligning with global sustainability trends.

Mexico Offshore Support Vessels Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Anchor Handling Towing Supply Vessel, Platform Supply Vessel, Fast Supply Intervention Vessel, Multi-Purpose Service Vessel, Others |

| Water Depths Covered | Shallow Water, Deepwater |

| Fuels Covered | Fuel Oil, LNG |

| Service Types Covered | Technical Services, Inspection and Survey, Crew Management, Logistics and Cargo Management, Anchor Handling and Seismic Support, Others |

| Applications Covered | Oil and Gas Applications, Offshore Applications |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico offshore support vessels market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico offshore support vessels market on the basis of type?

- What is the breakup of the Mexico offshore support vessels market on the basis of water depth?

- What is the breakup of the Mexico offshore support vessels market on the basis of fuel?

- What is the breakup of the Mexico offshore support vessels market on the basis of service type?

- What is the breakup of the Mexico offshore support vessels market on the basis of application?

- What are the various stages in the value chain of the Mexico offshore support vessels market?

- What are the key driving factors and challenges in the Mexico offshore support vessels?

- What is the structure of the Mexico offshore support vessels market and who are the key players?

- What is the degree of competition in the Mexico offshore support vessels market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico offshore support vessels market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico offshore support vessels market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico offshore support vessels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)