Mexico Offshore Wind Power Market Size, Share, Trends and Forecast by Installation, Water Depth, Capacity, and Region, 2026-2034

Mexico Offshore Wind Power Market Summary:

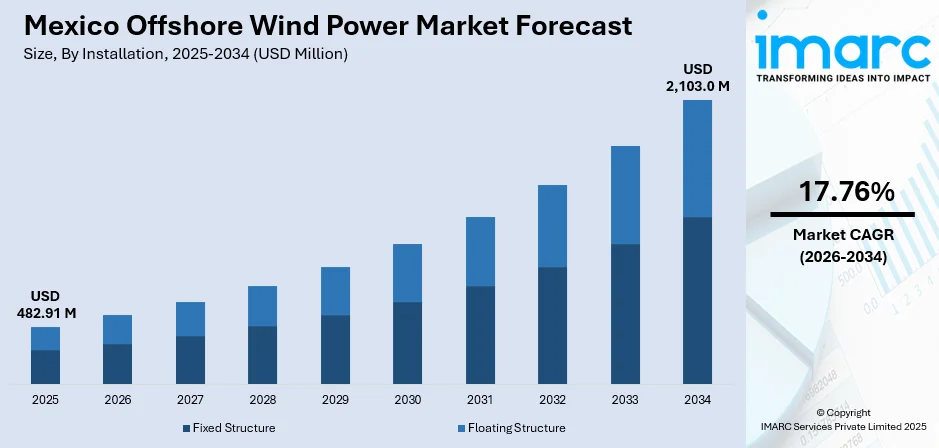

The Mexico offshore wind power market size was valued at USD 482.91 Million in 2025 and is projected to reach USD 2,103.0 Million by 2034, growing at a compound annual growth rate of 17.76% from 2026-2034.

Mexico's offshore wind power sector is gaining significant momentum driven by the country's commitment to generating clean energy and reducing greenhouse gas emissions. The government's ambitious renewable energy targets are accelerating interest in offshore wind development. Abundant wind resources along extensive coastlines spanning both the Gulf of Mexico and Pacific Ocean, combined with technology cost reductions and growing private sector investment, are supporting the expansion of the market share.

Key Takeaways and Insights:

- By Installation: Fixed structure dominates the market with a share of 85% in 2025, driven by proven technology reliability in shallow water deployments, lower capital expenditure requirements compared to floating alternatives, and the prevalence of suitable shallow-water sites along Mexico's continental shelf.

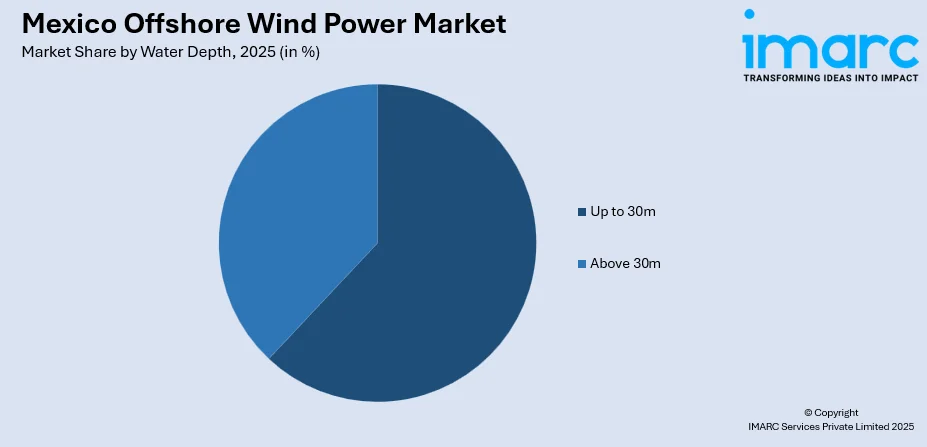

- By Water Depth: Up to 30m leads the market with a share of 62% in 2025, owing to significantly reduced installation complexity using monopile foundations, established supply chain infrastructure, and favorable seabed conditions along key coastal development zones.

- By Capacity: Above 5MW represents the largest segment with a market share of 70% in 2025, attributable to superior energy capture efficiency, lower levelized cost of energy per megawatt-hour generated, and growing manufacturer focus on larger turbine platforms for commercial-scale projects.

- Key Players: The Mexico offshore wind power market exhibits emerging competitive dynamics, with international energy developers and various turbine manufacturers positioning for future project opportunities as the regulatory framework continues to evolve.

To get more information on this market Request Sample

Mexico has tremendous offshore wind energy potential, with an estimated 487.3 gigawatts of capacity that can be installed in viable development areas in the Gulf of Mexico, Gulf of Tehuantepec, and Baja California coastal regions. Research published in 2024 indicated that this potential signified five times more capacity than Mexico's total power generation installed in 2023 and sixty-one times the onshore wind capacity in place by the end of 2024. Advancements in turbine technology, including larger turbines and floating platforms, improve feasibility in deeper waters, strengthening project viability. Growing private sector interest and international collaboration also support development through financing and technical expertise. In addition, industrial users are showing interest in renewable power procurement to meet sustainability goals. Over time, improvements in grid connectivity and policy clarity are expected to accelerate project implementation, supporting steady growth of the market.

Mexico Offshore Wind Power Market Trends:

Enhanced Focus on Grid Infrastructure Development

Transmission infrastructure planning has emerged as a critical trend shaping Mexico's offshore wind development trajectory. Research conducted by the National Renewable Energy Laboratory (NREL) in 2024 identified that coordinated transmission planning is essential for effectively connecting offshore wind resources to onshore end users. The existing oil and gas industry infrastructure positioned in the Gulf of Mexico offers potential for shared transmission systems and workforce utilization.

Growing emphasis on sustainability

Rising focus on sustainability is driving the market growth in Mexico as industries and authorities look to reduce carbon emissions and dependence on fossil fuels. In March 2024, Sempra Infrastructure announced a positive final investment decision for the Cimarron wind project, a 320 Megawatt facility representing the third phase of the Energía Sierra Juarez (ESJ) wind complex in Baja California, Mexico. The project has a complete contract under a twenty-year power purchase agreement and signifies an investment of around USD 550 Million. Offshore wind is seen as a clean, long-term energy solution that supports climate goals and environmental protection. Companies increasingly prefer renewable power for operations to improve brand image and meet global sustainability commitments.

Accelerating Adoption of High-Capacity Turbine Technology

The Mexico offshore wind power market is witnessing increasing preference for high-capacity turbines, as developers prioritize energy efficiency and cost optimization. Larger turbine platforms enable greater electricity generation per installation, reducing the overall number of units required for commercial-scale projects while improving capacity factors. The technological progression enables Mexico's emerging offshore wind sector to leverage cutting-edge generation capacity that maximizes energy production from available maritime space while reducing per-megawatt installation costs.

Market Outlook 2026-2034:

Market expansion will be driven by government renewable energy mandates requiring significant clean electricity generation, growing private sector investment interest, and declining technology costs that improve project economics. The market generated a revenue of USD 482.91 Million in 2025 and is projected to reach a revenue of USD 2,103.0 Million by 2034, growing at a compound annual growth rate of 17.76% from 2026-2034. International developer interest and improving project financing mechanisms are expected to accelerate the transition from planning phases to active construction. Regional developments in the Gulf of Mexico, combined with advancement of feasibility assessments in the Gulf of Tehuantepec, will diversify the geographic footprint of installations, supporting consistent market revenue growth throughout the forecast period.

Mexico Offshore Wind Power Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Installation | Fixed Structure | 85% |

| Water Depth | Up to 30m | 65% |

| Capacity | Above 5MW | 70% |

Installation Insights:

- Fixed Structure

- Floating Structure

Fixed structure dominates with a market share of 85% of the total Mexico offshore wind power market in 2025.

Fixed structure offshore wind installations dominate the market owing to their proven technological maturity and economic advantages in the country's prevalent shallow-water coastal zones. These foundations, including monopiles, jackets, and gravity-based structures, provide stable platforms that withstand environmental forces while enabling relatively straightforward installation processes using established construction methodologies.

The preference for fixed structure installations in Mexico reflects both the favorable bathymetric conditions along key development corridors and the cost efficiencies achieved through standardized manufacturing and installation approaches. Fixed offshore wind foundations represent one of the cheapest methods of constructing offshore wind farms in suitable water depths. Mexico's Gulf coastline and portions of the Pacific shelf offer extensive areas within optimal depth ranges for fixed-bottom deployment, enabling developers to leverage proven technology while minimizing project execution risks. The established supply chain for fixed foundation components and vessels further supports market dominance.

Water Depth Insights:

Access the comprehensive market breakdown Request Sample

- Up to 30m

- Above 30m

Up to 30m leads with a share of 62% of the total Mexico offshore wind power market in 2025.

Shallow water installations up to 30m depth hold dominance in the market due to significantly reduced foundation complexity and installation costs compared to deeper water alternatives. Monopile and gravity-based foundations designed for these depths utilize established construction techniques with lower material requirements, enabling faster project execution and improved economic returns.

Construction in shallow waters requires smaller vessels and lighter equipment, reducing overall project complexity. Proximity to the shore also lowers the cost of submarine cabling and makes grid connection easier. Maintenance operations are safer and cheaper, improving long-term project economics. In addition, environmental assessments and approvals are generally easier in shallow zones compared to deep-sea installations. These areas also allow developers to test projects at lower risk before expanding into deeper waters. As a result, shallow-water locations offer faster returns on investment and higher commercial attractiveness for offshore wind development in Mexico.

Capacity Insights:

- Up to 3MW

- 3MW to 5MW

- Above 5MW

Above 5MW exhibits a clear dominance with a 70% share of the total Mexico offshore wind power market in 2025.

Above 5MW dominates the market, as developers maximize energy production efficiency and economic returns from maritime installations. Larger turbine platforms capture substantially more wind energy per unit, reducing the number of foundations, electrical connections, and maintenance requirements for equivalent generation capacity.

The market preference for higher capacity installations reflects the technological trajectory of the global offshore wind industry toward increasingly powerful generation platforms. For Mexico's emerging offshore wind sector, selecting high-capacity turbines enables efficient utilization of permitted development areas while achieving economies of scale that reduce the levelized cost of energy. The trend of larger turbines also supports project bankability by improving capacity factors and annual energy production metrics that underpin financing arrangements.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico is emerging as a promising region for offshore wind development due to strong coastal wind resources and proximity to industrial hubs. The region benefits from growing electricity demand from manufacturing zones and export-oriented industries. Its closeness to the United States also encourages cross-border infrastructure development and technology collaboration. Ports and logistics facilities in the north support equipment movement and construction planning.

In Central Mexico, rising urban power usage and industrial activity encourage investments in renewable power sources to stabilize electricity supply. Proximity to financial institutions and policymakers also supports project development. Grid upgrades and transmission expansion projects will improve future offshore wind integration, increasing the region’s importance as an economic driver.

Southern Mexico offers strong offshore wind potential because of favorable coastal geography and consistent wind patterns. The region experiences growing energy needs from expanding industrial activity and tourism-driven development. Local governments encourage renewable projects to boost economic development and employment. As grid reliability improves, Southern Mexico is expected to attract more offshore wind investment.

Market Dynamics:

Growth Drivers:

Why is the Mexico Offshore Wind Power Market Growing?

National Renewable Energy Targets and Policy Mandates

In Mexico, the offshore wind power market is expanding substantially due to government commitments establishing mandatory clean energy generation targets under national law and international climate agreements. Clear, clean-energy goals push utilities and private developers to explore large-scale renewable options beyond onshore wind and solar. The Energy Transition Law requires the country to generate thirty-five percent of electricity from clean sources by 2024. These targets motivate grid operators to plan future infrastructure that can handle offshore power integration. Developers respond by accelerating feasibility studies and site assessments along suitable coastlines. In addition, long-term policy direction lowers perceived market risk, supporting financing and international partnerships. As sustainability commitments remain a priority, offshore wind is increasingly viewed as a strategic solution for Mexico to meet regulatory targets while ensuring reliable, large-scale clean power generation.

Abundant Maritime Wind Resources Along Extensive Coastlines

Abundant maritime wind resources along Mexico’s long coastlines are a major driver of the market expansion by providing strong natural suitability for large-scale projects. Coastal wind patterns are generally more consistent and powerful than onshore winds, allowing offshore turbines to generate higher and more stable electricity output. Mexico’s access to both the Pacific Ocean and the Gulf of Mexico creates multiple development zones with different wind profiles, reducing concentration risk for investors. Large offshore areas offer space for utility-scale wind farms without competing with urban or agricultural land. Reliable wind speeds improve capacity utilization and project revenue potential, making projects more attractive to developers and financiers. In addition, coastal proximity to growing cities and industrial zones helps reduce transmission distances. Together, favorable wind conditions and vast maritime areas position offshore wind as a high-potential renewable energy solution for Mexico.

Growing Electricity Demand and Urbanization

Mexico’s rapid urban growth and industrial expansion are increasing national electricity consumption. As per macrotrends, in Mexico, the urban population for 2023 reached 105,844,290. Cities, manufacturing hubs, and commercial zones require reliable, large-scale power supply, making offshore wind an attractive option due to its high generation capacity. Onshore renewable resources alone may not meet future demand, especially during peak periods. Offshore wind offers consistent power generation because ocean winds are stronger and more stable. This reliability supports grid stability and long-term planning. As urban areas are growing, pressure is increasing to secure sustainable energy sources that can scale quickly. Offshore wind projects can deliver large volumes of electricity from a single installation. The ability to support expanding infrastructure, industrial operations, and residential power needs makes offshore wind increasingly attractive. Developers view high power demand growth as a strong business case for investing in offshore wind infrastructure in Mexico.

Market Restraints:

What Challenges the Mexico Offshore Wind Power Market is Facing?

Electrical Grid Infrastructure Limitations

Electrical grid infrastructure limitations slow the growth of the Mexico offshore wind power market by restricting the ability to transmit electricity from coastal generation sites to inland consumption centers. Inadequate transmission capacity, limited grid interconnections, and slow upgrades increase project timelines and costs. Developers also face difficulties securing grid access approvals, reducing investor confidence. Weak coastal substations and storage integration make power evacuation unreliable. These barriers delay commissioning, lower returns, and discourage large-scale offshore wind investments in Mexico.

Regulatory Framework Uncertainty and Permitting Complexity

The offshore wind sector confronts regulatory uncertainties stemming from evolving energy policy priorities and complex permitting requirements across multiple government agencies. Policy changes under successive administrations have created inconsistency regarding private sector participation in renewable energy generation. Major systematic reviews cite inconsistent or unclear governmental policies regarding renewable energy incentives and regulatory uncertainties as primary obstacles hampering wind energy development in Mexico.

High Initial Capital Investment Requirements

Offshore wind projects require substantial upfront capital investment for foundation construction, turbine procurement, electrical infrastructure, and specialized installation vessels. The capital intensity of offshore development presents financing challenges, particularly for initial projects that lack operational track records in Mexican waters. Installation and foundation design costs for offshore wind turbines are higher than onshore equivalents, requiring robust financing structures and creditworthy offtake arrangements.

Competitive Landscape:

The Mexico offshore wind power market competitive landscape is characterized by emerging positioning among international energy developers, turbine manufacturers, and infrastructure companies anticipating market growth. The sector exhibits early-stage dynamics with limited operational capacity but growing developer interest as regulatory frameworks mature and feasibility assessments demonstrate project viability. International offshore wind specialists bring global deployment experience while domestic energy companies contribute local market knowledge and grid integration expertise. Competition centers on securing favorable development positions, establishing relationships with government entities, and building supply chain capabilities to support future construction phases. Strategic partnerships between foreign developers and Mexican partners are anticipated to intensify as project opportunities advance toward procurement stages. The competitive environment will likely consolidate around developers demonstrating strong execution capabilities and financial strength to manage extended development timelines.

Mexico Offshore Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Fixed Structure, Floating Structure |

| Water Depths Covered | Up to 30m, Above 30m |

| Capacities Covered | Up to 3MW, 3MW to 5MW, Above 5MW |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico offshore wind power market size was valued at USD 482.91 Million in 2025.

The Mexico offshore wind power market is expected to grow at a compound annual growth rate of 17.76% from 2026-2034 to reach USD 2,103.0 Million by 2034.

Fixed structure dominates the market with 85% share, driven by proven technology reliability, lower capital requirements compared to floating alternatives, and favorable shallow-water site availability along Mexico's continental shelf.

Key factors driving the Mexico offshore wind power market include government renewable energy mandates, abundant offshore wind resources, rising focus on sustainability, and declining technology costs improving project economics.

Major challenges include electrical grid infrastructure limitations constraining offshore wind integration, regulatory framework uncertainty affecting permitting processes, high initial capital investment requirements for project development, extended development timelines, and the need for specialized installation vessels and supply chain capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)