Mexico Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End User, and Region, 2025-2033

Mexico Online Education Market Overview:

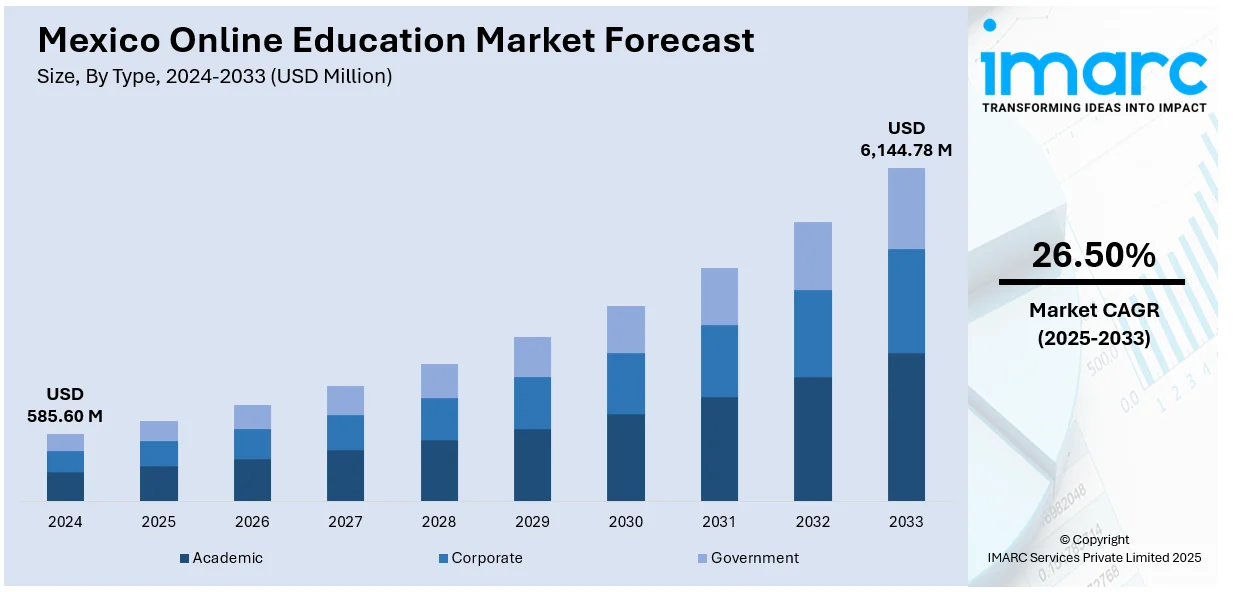

The Mexico online education market size reached USD 585.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,144.78 Million by 2033, exhibiting a growth rate (CAGR) of 26.50% during 2025-2033. The market is witnessing significant growth driven by increased internet access, digital transformation in schools and universities, and growing demand for flexible, skill-based learning. Government initiatives supporting digital inclusion and private sector investment in e-learning platforms are enhancing accessibility. Rising interest in language learning, professional certifications, and STEM education is further accelerating adoption, contributing to the overall rise in the Mexico online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 585.60 Million |

| Market Forecast in 2033 | USD 6,144.78 Million |

| Market Growth Rate 2025-2033 | 26.50% |

Mexico Online Education Market Trends:

Expansion of Government Digital Education Initiatives

Government support for digital education is significantly advancing the growth of online learning in Mexico. Authorities are prioritizing remote education by promoting initiatives that enhance digital access and improve learning continuity, particularly in underserved regions. These efforts include distributing online learning tools, developing centralized platforms, and encouraging schools to integrate virtual content into their curricula. Public institutions are also focusing on teacher training and resource development to ensure effective digital delivery. The aim is to reduce disparities in education quality and expand opportunities beyond traditional classrooms. For instance, in August 2024, the Mexican Ministry of Economy and Kyndryl launched a Digital Education program aimed at empowering women, youth, indigenous communities, and MSMEs with digital skills. The initiative includes free workshops and virtual training to promote sustainable economic growth and bridge the digital divide, enhancing MSMEs' competitiveness in the digital economy. Such initiatives are fostering a more inclusive learning environment, making online education a viable alternative for a broader population. As digital infrastructure strengthens and awareness increases, the shift toward virtual learning models is becoming more permanent, contributing steadily to the Mexico online education market growth.

Rising Demand for Skill-Based and Vocational Training

There is a noticeable shift in learner preferences in Mexico toward online education that delivers practical, employment-oriented skills. Individuals are increasingly seeking out programs that offer certifications and training in areas such as information technology, digital marketing, language proficiency, and specialized trades. This trend is driven by the need to improve job prospects, stay competitive in a rapidly evolving labor market, and access flexible learning formats that accommodate working schedules. For instance, in August 2024, Cisco Systems Mexico announced its partnership with government ministries to launch the "Relocation in Mexico" program to enhance digital skills for nearshoring. The initiative will provide free online training in technology fields, aiming to boost employability and competitiveness, supporting an estimated 297,000 new jobs in the coming years. Online platforms offering short-term, modular courses are particularly appealing due to their affordability and direct link to career outcomes. Employers are also recognizing the value of these credentials, further validating non-traditional learning paths. As digital adoption rises and workforce development becomes a national priority, this demand for skill-based learning is expected to play a critical role in Mexico online education market growth across both urban and rural demographics.

Mexico Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

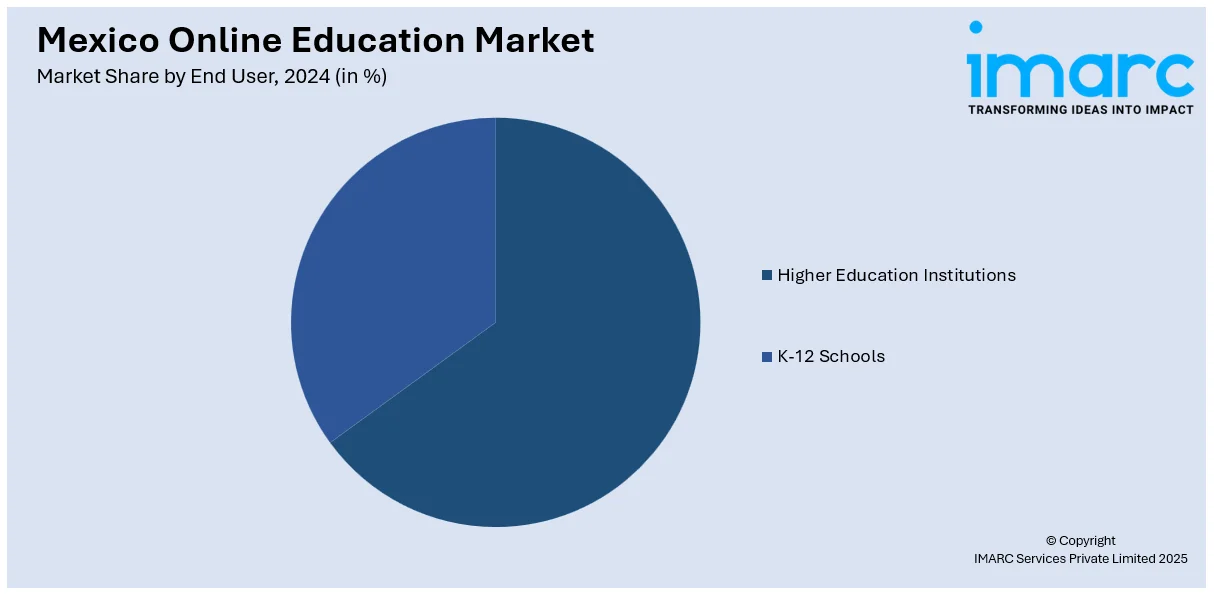

End User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes higher education institutions and K-12 schools.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Online Education Market News:

- In April 2025, Coursera announced the launch of AI-dubbed courses in Spanish to enhance access to education in Mexico, its third-largest market. Utilizing generative AI, over 100 courses will mimic original speakers and synchronize lip movements, aiming to improve learning outcomes for non-English speakers and boost engagement in technical content.

- In July 2024, Coursera launched initiatives in Mexico to boost Generative AI skills amid a 95% rise in AI job opportunities. Courses and certificates from various institutions focus on software development, AI programming, marketing, and responsible AI, aiming to equip individuals for the evolving labor market.

Mexico Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico online education market on the basis of type?

- What is the breakup of the Mexico online education market on the basis of provider?

- What is the breakup of the Mexico online education market on the basis of technology?

- What is the breakup of the Mexico online education market on the basis of end user?

- What is the breakup of the Mexico online education market on the basis of region?

- What are the various stages in the value chain of the Mexico online education market?

- What are the key driving factors and challenges in the Mexico online education market?

- What is the structure of the Mexico online education market and who are the key players?

- What is the degree of competition in the Mexico online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)