Mexico Oral Care Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Mexico Oral Care Market Overview:

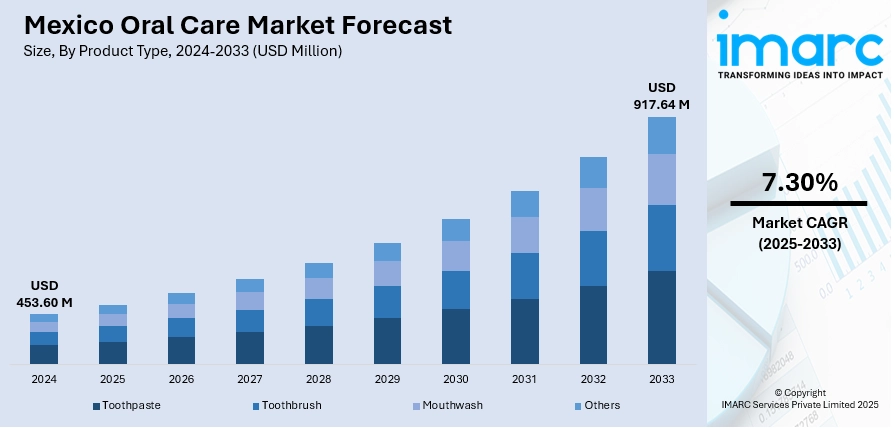

The Mexico oral care market size reached USD 453.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 917.64 Million by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033. The market is driven by growing health awareness, with more consumers prioritizing preventive dental care and hygiene. Technological advancements, such as smart toothbrushes and digital dental services, are enhancing accessibility and personalization. Additionally, there is a rising demand for sustainable and natural oral care products as environmentally conscious consumers seek eco-friendly alternatives. Together, these factors are fueling Mexico oral care market share by encouraging better oral health habits, expanding product choices, and pushing innovation within the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 453.60 Million |

| Market Forecast in 2033 | USD 917.64 Million |

| Market Growth Rate 2025-2033 | 7.30% |

Mexico Oral Care Market Trends:

Technological Advancements and Digital Transformation

Mexico's oral healthcare market is changing with swift technological development to improve both professional dental services and home care. Developments like intelligent toothbrushes, mobile applications, and AI-based devices are reshaping the way people keep their mouths clean. These devices provide real-time feedback on brushing, reminders, and even remote access to dental consultations. Simultaneously, the digital landscape and e-commerce have transformed access to oral care products, enabling consumers to scan for personalized choices with ease. Brands are increasingly making a move toward online interaction and virtual dentistry to address the needs of technology-loving users. This digital revolution is not only enhancing the efficiency of the product but also enabling users to develop healthier oral care habits. All together, these technologies are developing a more educated, more connected, and more proactive consumer segment, which is playing an important role in driving the Mexico oral care market growth and innovation within Mexico's oral health sector.

To get more information on this market, Request Sample

Rising Health Awareness and Preventive Care

Dental caries affect over 90% of the Mexican population, highlighting the urgent need for preventive oral health measures. In response, a growing emphasis on wellness and self-care is encouraging more people in Mexico to prioritize their oral hygiene. As awareness spreads about the link between oral health and overall wellbeing, consumers are shifting towards preventive care rather than waiting for problems to arise. Regular brushing, flossing, and professional cleanings are increasingly integrated into daily routines. Educational campaigns by dental professionals and community groups reinforce the importance of early intervention and consistent maintenance. This cultural shift is driving demand for preventive products like fluoride toothpaste, antibacterial mouthwashes, and gentle dental tools, alongside increased use of professional checkups. Together, these changes promote proactive oral health behaviors that benefit both consumers and the oral care market through sustained engagement and growth.

Sustainability and Natural Product Demand

Sustainability is becoming a defining factor in consumer choices within Mexico’s oral care market. As environmental awareness grows, many individuals are seeking alternatives to traditional products that often contain plastics and synthetic chemicals. This shift is inspiring brands to develop eco-friendly and natural oral care solutions, including biodegradable toothbrushes, plant-based toothpastes, and recyclable packaging. These products appeal to consumers who are mindful of their environmental footprint and prefer ingredients perceived as safer or more transparent. In addition to reducing environmental impact, natural and organic oral care products often market themselves as gentler for sensitive mouths, attracting health-conscious users. The move toward greener options is not just a trend but part of a broader lifestyle changes that influences buying habits. Mexico oral care market trends clearly reflect this shift, as companies that align with these values are gaining traction, signaling a meaningful transformation in both product development and consumer expectations across the oral care landscape in Mexico.

Mexico Oral Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Toothpaste

- Toothbrush

- Mouthwash

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes toothpaste, toothbrush, mouthwash, and others.

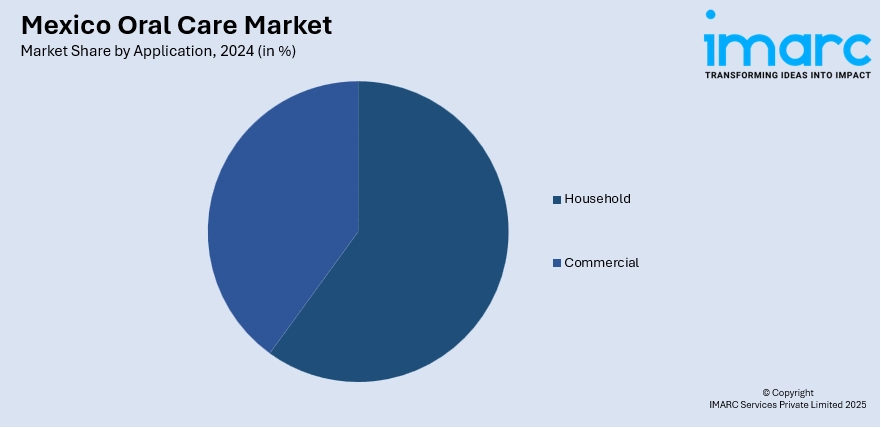

Application Insights:

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household, and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Sales Channels

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, convenience stores, online sales channels, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Oral Care Market News:

- In December 2024, Smile4EverMexico, a Tijuana-based dental clinic specializing in border dentistry, now offers complete tooth restoration in a single visit. Using advanced digital dentistry and Neo Dent implant technology, the clinic provides affordable, high-quality full-mouth restorations—like the All-on-4 procedure—at a fraction of U.S. costs. This innovation reduces treatment time and travel expenses for international patients, reinforcing Smile4EverMexico’s reputation as a leader in efficient, cost-effective dental care.

- In December 2024, Colgate-Palmolive India has launched a new MaxFresh range featuring heart-shaped cooling crystals and vibrant packaging. Powered by Ultrafreeze Technology, the toothpaste offers 10X longer-lasting freshness with fruity flavors like Watermelon Blast and Rainbow Fresh. Designed to appeal to millennials and Gen Z, the range transforms oral care into a fun, refreshing experience. Available nationwide through e-commerce and retail, this launch continues Colgate’s focus on innovation and oral health.

Mexico Oral Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Toothpaste, Toothbrush, Mouthwash, Others |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Sales Channel, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico oral care market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico oral care market on the basis of product type?

- What is the breakup of the Mexico oral care market on the basis of application?

- What is the breakup of the Mexico oral care market on the basis of distribution channel?

- What is the breakup of the Mexico oral care market on the basis of region?

- What are the various stages in the value chain of the Mexico oral care market?

- What are the key driving factors and challenges in the Mexico oral care market?

- What is the structure of the Mexico oral care market and who are the key players?

- What is the degree of competition in the Mexico oral care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico oral care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico oral care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico oral care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)