Mexico Organic and Natural Pet Food Market Size, Share, Trends and Forecast by Ingredient, Pet Type, Product Type, Packaging Type, Distribution Channel, and Region, 2025-2033

Mexico Organic and Natural Pet Food Market Overview:

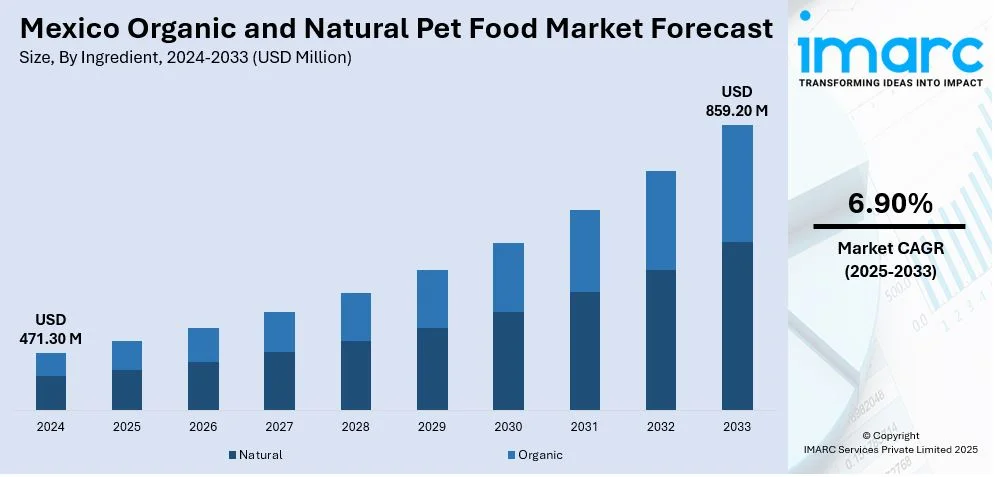

The Mexico organic and natural pet food market size reached USD 471.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 859.20 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. Rising pet humanization, growing health awareness, surging urban disposable income, increasing vet influence, expanding e-commerce, premiumization trends, younger pet-owning demographics, escalating demand for clean-label ingredients, and greater product availability are some of the factors accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 471.30 Million |

| Market Forecast in 2033 | USD 859.20 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Mexico Organic and Natural Pet Food Market Trends:

Rising Pet Humanization

The concept of pet humanization is playing a pivotal role in shaping consumer behavior in Mexico’s pet food sector. Pets are increasingly viewed as family members, which has led to heightened sensitivity regarding their health, nutrition, and emotional well-being. This cultural shift is influencing purchasing decisions, with owners opting for food products that mirror human dietary preferences, organic, natural, and free from synthetic components. Rapid urbanization, along with greater exposure to global lifestyle trends through social media, has reinforced this sentiment, which is boosting the market growth. In line with this, key players have responded by offering tailored pet diets featuring functional ingredients such as probiotics, omega fatty acids, and plant-based proteins, which is creating a positive Mexico organic and natural pet food market outlook. Moreover, they are also adopting new packaging and marketing strategies, showcasing trust, quality, and transparency, which is supporting the market growth. This growing emotional bond between pet and owner is translating into increased spending on higher-value products, thereby expanding the demand base for organic and natural pet food in the Mexican market.

Health Awareness Among Pet Owners

A growing number of pet owners in Mexico are prioritizing health and wellness in their dietary choices for pets, which is significantly influencing the organic and natural pet food segment. In 2024, approximately 80 million pets were living in Mexican households, with dogs being the most common, owned by about 91% of respondents, followed by cats at 61%. In line with this, increasing incidences of pet obesity, allergies, and digestive issues have led consumers to scrutinize ingredient lists and switch to cleaner, more digestible options, which is fueling the market growth. Veterinary professionals and pet nutritionists are playing a crucial role in advocating for natural diets as part of preventive healthcare. The COVID-19 pandemic further accelerated this trend, as people became more conscious of health-related issues and extended that concern to their pets. As a result, the demand for formulations that avoid artificial colors, flavors, fillers, and preservatives is rising steadily, which is propelling the Mexico organic and natural pet food market growth. Brands are responding with offerings that include limited ingredients, grain-free products, and organic certifications.

Growing Disposable Income in Urban Households

The rise in disposable income across Mexico’s urban households is contributing significantly to the uptake of organic and natural pet food. In 2024, Mexico's disposable income per capita was approximately USD 16,269, positioning it as the 12th highest globally, fueling demand for premium lifestyle categories, including pet care. As more dual-income families and middle-class consumers attain financial stability, their spending patterns are shifting from basic necessities to lifestyle-enhancing products, including premium pet food. Cities like Monterrey, Guadalajara, and Mexico City are at the forefront of this shift, with consumers willing to pay a higher price for quality, safety, and health benefits. These households are more likely to explore niche offerings and experiment with novel formats such as freeze-dried, raw, and superfood-infused meals. Additionally, surging access to pet-related content and consumer education via digital platforms is enabling informed decisions backed by financial capacity, which is boosting the Mexico organic and natural pet food market share. Retailers and e-commerce platforms are recognizing this opportunity by expanding their organic and natural product lines.

Mexico Organic and Natural Pet Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on ingredient, pet type, product type, packaging type, and distribution channel.

Ingredient Insights:

- Natural

- Organic

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes natural and organic.

Pet type Insights:

- Dog Food

- Cat Food

- Others

A detailed breakup and analysis of the market based on the pet type have also been provided in the report. This includes dog food, cat food, and others.

Product Type Insights:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dry pet food, wet and canned pet food, and snacks and treats.

Packaging Type Insights:

- Bags

- Cans

- Pouches

- Boxes

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes bags, cans, pouches, and boxes.

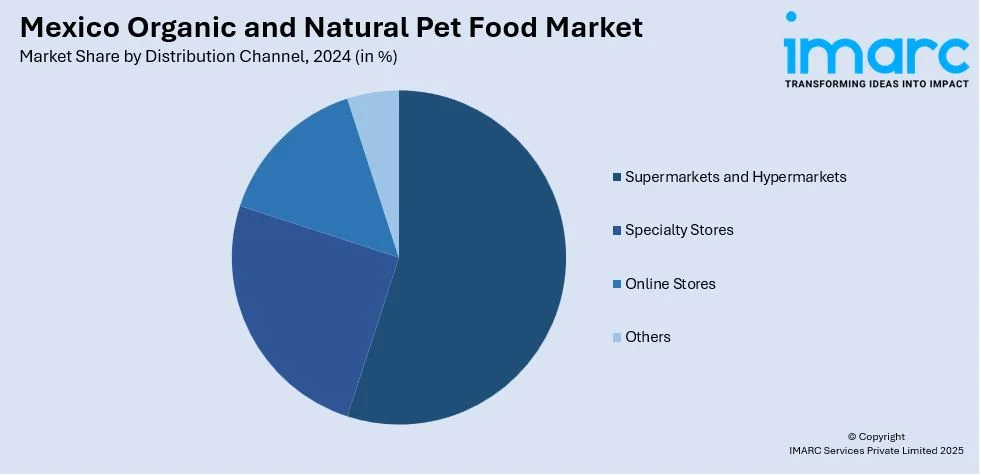

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Organic and Natural Pet Food Market News:

- In May 2024, Nestlé Purina announced an approximately USD 221 million (CHF 200 million) investment to expand its pet food production facility in Silao, Guanajuato. This expansion includes adding a third line for wet pet food and a fourth for dry pet food, aiming to make the Silao plant the largest pet food manufacturing facility in Latin America.

Mexico Organic and Natural Pet Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Natural, Organic |

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Packaging Types Covered | Bags, Cans, Pouches, Boxes |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico organic and natural pet food market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico organic and natural pet food market on the basis of ingredient?

- What is the breakup of the Mexico organic and natural pet food market on the basis of pet type?

- What is the breakup of the Mexico organic and natural pet food market on the basis of product type?

- What is the breakup of the Mexico organic and natural pet food market on the basis of packaging type?

- What is the breakup of the Mexico organic and natural pet food market on the basis of distribution channel?

- What is the breakup of the Mexico organic and natural pet food market on the basis of region?

- What are the various stages in the value chain of the Mexico organic and natural pet food market?

- What are the key driving factors and challenges in the Mexico organic and natural pet food market?

- What is the structure of the Mexico organic and natural pet food market and who are the key players?

- What is the degree of competition in the Mexico organic and natural pet food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico organic and natural pet food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico organic and natural pet food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico organic and natural pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)