Mexico Organic Packaged Foods Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Mexico Organic Packaged Foods Market Summary:

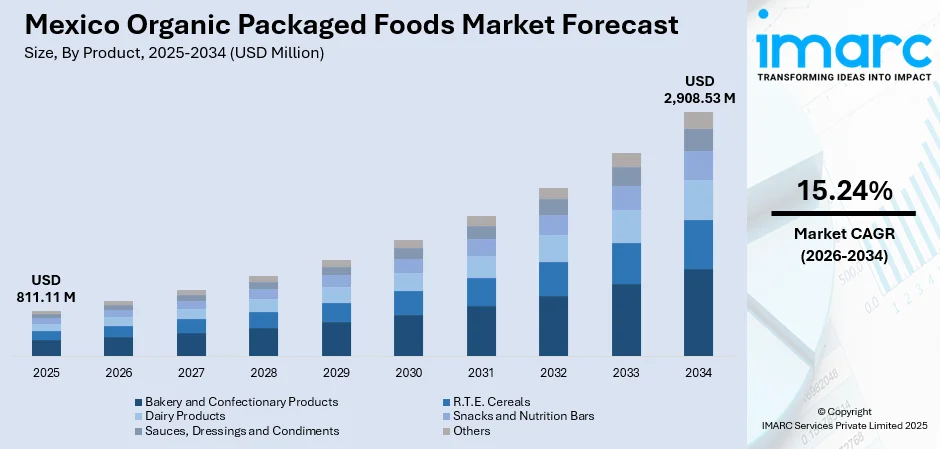

The Mexico organic packaged foods market size was valued at USD 811.11 Million in 2025 and is projected to reach USD 2,908.53 Million by 2034, growing at a compound annual growth rate of 15.24% from 2026-2034.

The Mexico organic packaged foods market is experiencing robust expansion driven by escalating consumer awareness of health and wellness benefits associated with organic consumption. Growing concerns over synthetic additives, pesticides, and processed ingredients are prompting Mexican consumers to seek certified organic alternatives. The market is further propelled by rising disposable incomes among urban middle-class populations, enabling premium organic product purchases. Supportive government initiatives promoting sustainable agricultural practices and stringent organic certification frameworks are strengthening consumer confidence. Additionally, retail modernization and expanding distribution networks are enhancing product accessibility across diverse consumer segments, contributing to sustained Mexico organic packaged foods market share.

Key Takeaways and Insights:

-

By Product: Bakery and confectionary products dominate the market with a share of 38% in 2025, driven by increasing consumer preference for organic baked goods, artisanal products, and clean-label confectionery items.

-

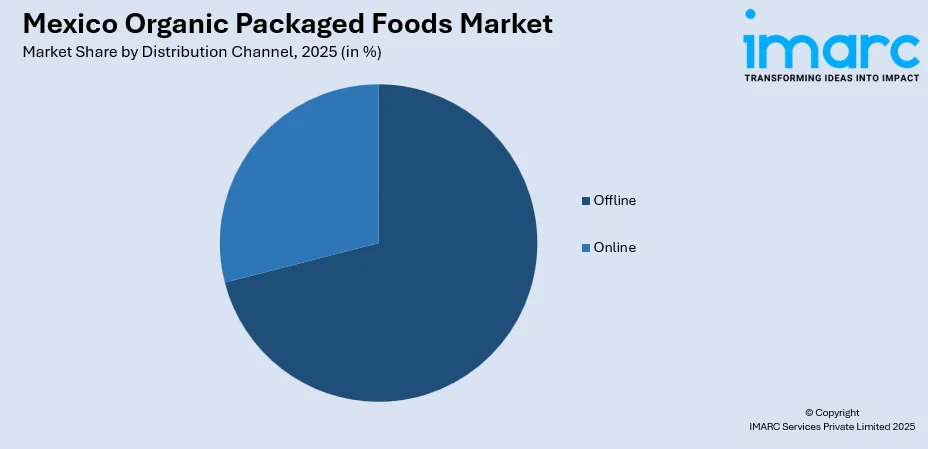

By Distribution Channel: Offline channel leads the market with a share of 71% in 2025, supported by established supermarket networks, specialty organic stores, and consumer trust in physical retail experiences.

-

Key Players: The Mexico organic packaged foods market demonstrates a competitive landscape characterized by a blend of multinational corporations and domestic organic producers. Market participants are focusing on product innovation, sustainable sourcing practices, and strategic retail partnerships to strengthen market positioning and capture evolving consumer preferences.

To get more information on this market Request Sample

The Mexico organic packaged foods market is undergoing significant transformation as sustainability becomes a defining characteristic of consumer purchasing behavior. Mexico has positioned itself as one of the most competitive markets in organic production globally, supported by coordinated efforts between producers and certification bodies. According to government sources, as of January 2025, Mexico maintained 48,874 certified organic producers cultivating 246,899 hectares across all 32 states, demonstrating the country's robust organic agricultural infrastructure. This extensive producer network ensures consistent supply of certified organic ingredients for packaged food manufacturing. Consumer demand is increasingly oriented toward products bearing the official Organic Mexico seal, reflecting heightened awareness regarding food traceability and authenticity. The market benefits from favorable climatic conditions supporting diverse organic crop cultivation, while government-driven initiatives continue advancing sustainable farming technologies and regional agricultural development programs.

Mexico Organic Packaged Foods Market Trends:

Integration of Indigenous Superfoods in Organic Products

Mexican organic packaged food manufacturers are increasingly incorporating traditional indigenous superfoods into modern product formulations, creating distinctive offerings that blend cultural heritage with contemporary nutritional science. Native ingredients such as amaranth, nopal, chia, and maca are gaining prominence in organic product portfolios. In February 2025, Tozi Azteca Superfoods unveiled a comprehensive brand refresh featuring organic, non-GMO products including tortillas, chips, and aguas frescas made from indigenous superfoods. This trend reflects consumer demand for culturally authentic products offering both nutritional benefits and connection to Mexican culinary traditions, supporting Mexico organic packaged foods market growth.

Sustainability and Supply Chain Traceability

Sustainability has emerged as a central theme in the organic packaged foods sector, with consumers demanding transparency regarding production processes and ingredient sourcing. Manufacturers are prioritizing supply chain visibility to authenticate organic claims and build consumer trust. In October 2024, SL Produce launched the Tenderland brand emphasizing traceable, responsible production practices with full farm-to-table transparency. This development reflects broader industry movement toward comprehensive supply chain documentation, enabling consumers to verify organic integrity while providing producers competitive advantages through differentiated sustainability credentials.

Clean Label and Transparency-Driven Consumer Preferences

Mexican consumers are seen flaunting a liking for clean-label foods highlighting fewer ingredients, clearer packaging, and the lack of artificial additives. Mexican millennials who are quite health conscious are leading this movement as they seek healthful and natural foods for their families. As a result of increased incomes, particularly in cities, the demand for high-end wellness foods like organic foods and natural supplements is growing steadily. Organic packaged food brands are modifying their formulation by removing artificial preservatives used in the products but highlighting the authenticity of ingredients and nutritional content.

Market Outlook 2026-2034:

The Mexico organic packaged foods market is positioned for sustained expansion as health consciousness, environmental awareness, and premium product demand continue strengthening among Mexican consumers. Government support through agricultural development programs, certification infrastructure enhancement, and trade facilitation agreements with international partners will further accelerate market development. Retail modernization, expanding distribution networks, and growing e-commerce adoption are enhancing product accessibility across diverse consumer segments. Rising urbanization and evolving dietary preferences toward natural, chemical-free food options are reinforcing long-term market growth prospects. The market generated a revenue of USD 811.11 Million in 2025 and is projected to reach a revenue of USD 2,908.53 Million by 2034, growing at a compound annual growth rate of 15.24% from 2026-2034.

Mexico Organic Packaged Foods Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Bakery and Confectionary Products | 38% |

| Distribution Channel | Offline | 71% |

Product Insights:

- Bakery and Confectionary Products

- R.T.E. Cereals

- Dairy Products

- Snacks and Nutrition Bars

- Sauces, Dressings and Condiments

- Others

The bakery and confectionary products dominate with a market share of 38% of the total Mexico organic packaged foods market in 2025.

The bakery and confectionary products maintain market leadership driven by strong consumer preference for organic bread, pastries, cookies, and confectionery items. Mexican consumers increasingly associate organic bakery products with superior taste profiles, natural ingredients, and health benefits compared to conventional alternatives. According to IMARC Group, the Mexico bakery products market size is expected to reach USD 10.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033, with organic and artisanal variants capturing growing consumer interest. The segment benefits from established bakery traditions within Mexican food culture, where bread consumption remains integral to daily dietary patterns across demographic groups.

Innovations in the area of bakery products focus on whole grain ingredients, lower sugar levels, and the further incorporation of local ingredients like amaranth and chia. There is also innovation in organic cookies, cakes, and sweet bread. The organic bakery products category is seeing healthy sales due to increased awareness among consumers of the health aspects of organic bakery products. Premiumization of the organic bakery products category helps boost sales since consumers show eagerness to pay higher prices for organic bakery items.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline channel leads with a share of 71% of the total Mexico organic packaged foods market in 2025.

The offline distribution channel maintains dominance through established retail infrastructure including supermarkets, hypermarkets, specialty organic stores, and traditional grocery outlets. Mexican consumers demonstrate strong preference for physical retail experiences when purchasing organic products, valuing the ability to examine product labels, verify certifications, and seek recommendations from store personnel. In-store shopping enables consumers to assess product freshness, compare organic alternatives, and make informed purchasing decisions based on direct product interaction. The tactile shopping experience and immediate product availability continue reinforcing offline channel leadership in organic food retail.

Supermarkets and hypermarkets are expanding dedicated organic product sections, improving visibility and accessibility for organic packaged foods. Specialty organic retailers and farmers' markets provide curated organic product assortments attracting health-conscious consumers seeking authentic organic offerings. The offline channel benefits from established supply chain networks ensuring product freshness and availability. Pharmacies and health food stores represent additional distribution points, particularly for organic products positioned around wellness benefits. Retail modernization efforts continue enhancing the offline shopping experience through improved store layouts and expanded organic product ranges.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant market for organic packaged foods, driven by higher disposable incomes, proximity to United States export markets, and established modern retail infrastructure. The region benefits from favorable logistics facilitating organic product distribution and cross-border trade opportunities. Industrial development and urbanization in states like Nuevo León and Baja California have created sophisticated consumer bases seeking premium organic products. The region's agricultural capabilities support organic production particularly for fruits and vegetables entering packaged food supply chains.

Central Mexico, encompassing Mexico City and surrounding metropolitan areas, constitutes the largest consumer market for organic packaged foods owing to substantial population concentration and elevated consumer awareness. The region's diverse retail landscape includes specialty organic stores, premium supermarket chains, and emerging e-commerce platforms targeting health-conscious urban consumers. Government institutions and certification bodies headquartered in this region facilitate organic market development. Consumer sophistication and exposure to international food trends drive demand for innovative organic products.

Southern Mexico serves as a critical organic production hub, with states like Chiapas, Oaxaca, and Michoacán ranking among leading certified organic food producing regions. The area's rich agricultural traditions and biodiversity support organic cultivation of coffee, cacao, tropical fruits, and traditional ingredients entering packaged food formulations. Local cooperatives and indigenous producer organizations contribute significantly to organic supply chains. Emerging domestic consumption combined with export-oriented production positions Southern Mexico as essential to the national organic packaged foods ecosystem.

Market Dynamics:

Growth Drivers:

Why is the Mexico Organic Packaged Foods Market Growing?

Rising Health Consciousness and Wellness Orientation

Mexican consumers are demonstrating heightened awareness regarding connections between dietary choices and overall health outcomes, driving substantial demand for organic packaged food products. Growing concerns over obesity, diabetes, and diet-related chronic diseases are prompting consumers to seek healthier food alternatives perceived as safer and more nutritious than conventional options. According to the IMARC Group, the Mexico health and wellness market size reached USD 52.3 Billion in 2024 and is expected to reach USD 80.9 Billion by 2033. This expanding wellness orientation translates directly into organic food purchasing behavior as consumers prioritize products free from synthetic pesticides, artificial additives, and genetically modified organisms. The trend is particularly pronounced among urban millennials and families with children seeking to reduce chemical exposure through dietary modifications.

Government Regulatory Support and Certification Infrastructure

The Mexican government has established comprehensive regulatory frameworks supporting organic food production and certification, building consumer confidence in organic product authenticity. SENASICA (National Service for Agro-Alimentary Health, Safety and Quality) administers organic certification through authorized certification bodies ensuring compliance with national organic standards. International recognition through equivalence agreements with trading partners strengthens export competitiveness while validating domestic organic certification credibility. Government-driven initiatives focusing on regional agricultural development, financing innovations, and promoting sustainable farming technologies support organic production expansion. These coordinated efforts between regulatory authorities, producers, and certification bodies reinforce market integrity.

E-commerce Expansion and Digital Retail Channels

The rapid expansion of e-commerce platforms is transforming organic packaged food distribution, enabling manufacturers to reach broader consumer segments beyond traditional retail limitations. Mexico has achieved remarkable online retail growth, emerging as one of the fastest-growing digital commerce markets in Latin America. Digital platforms enable organic food brands to provide detailed product information, certification documentation, and transparent sourcing narratives that resonate with health-conscious consumers. Mobile commerce optimization has become essential as smartphone-based transactions continue dominating online purchases. The convenience of home delivery, subscription services, and personalized recommendations are attracting urban consumers seeking premium organic products through digital channels.

Market Restraints:

What Challenges the Mexico Organic Packaged Foods Market is Facing?

Premium Pricing and Affordability Constraints

Organically packed food products attract hefty price supplements over their conventional counterparts, thereby hampering market penetrations among price-conscious consumer groups. This is because the increased costs of productions related to organic food certification, sustainably sourced inputs, and unique food processing methodologies ultimately contribute to higher retail pricing, thus inhibiting the use of organic foods, mainly among the affluent population.

Limited Rural Distribution Infrastructure

The organic packaged food distribution networks are still dominated by the urban areas and lack substantial reach in the rural and semi-urban areas. The infrastructure limitations such as cold storage chains, storage considerations, and transportation cannot support the availability of organic products in the rural areas. The distribution hiatus creates a barrier for organic food manufacturers in reaching a substantial consumer base in the rural areas.

Competition for Conventional and Natural Products

Organically packaged foods are under competitive pressure from conventional foods positioned along natural or health-related positioning at more affordable prices. Consumer confusion between organic labeling and natural labeling poses some difficulties in the marketplace. Pre-existing brands of conventional foods with deep-rooted loyalty in the marketplace and widespread distribution channels can be stiff competition in the organically labeled marketplace.

Competitive Landscape:

The Mexico organic packaged foods market is found to have a moderately fragmented level of competitiveness, which includes participation from MNCs, local food companies, and other organic food sector participants. The market players are noticed for their focus on product development associated with indigenous ingredients, environmentally friendly product packaging, and a clear approach to the entire supply chain. Collaborations for market development for both organic food product manufacturers and market players are noticed for their benefits. The competencies in the market are shifting towards an increased focus on credentials for authenticity, cleanliness, and alignment with consumer demands.

Mexico Organic Packaged Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bakery and Confectionary Products, R.T.E. Cereals, Dairy Products, Snacks and Nutrition Bars, Sauces, Dressings and Condiments, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico organic packaged foods market size was valued at USD 811.11 Million in 2025.

The Mexico organic packaged foods market is expected to grow at a compound annual growth rate of 15.24% from 2026-2034 to reach USD 2,908.53 Million by 2034.

Bakery and confectionary products held the largest revenue share of 38% in 2025, driven by strong consumer preference for organic baked goods, artisanal products, and clean-label confectionery items aligned with health-conscious dietary choices.

Key factors driving the Mexico organic packaged foods market include rising health consciousness among consumers, government regulatory support and certification infrastructure, expanding e-commerce channels, growing disposable incomes, and increasing demand for clean-label and sustainable products.

Major challenges include premium pricing limiting mass market adoption, limited distribution infrastructure in rural areas, competition from conventional products with natural positioning, certification complexity for smaller producers, and supply chain constraints affecting consistent organic ingredient availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)