Mexico OSS & BSS Market Size, Share, Trends and Forecast by Component, OSS & BSS Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Mexico OSS & BSS Market Overview:

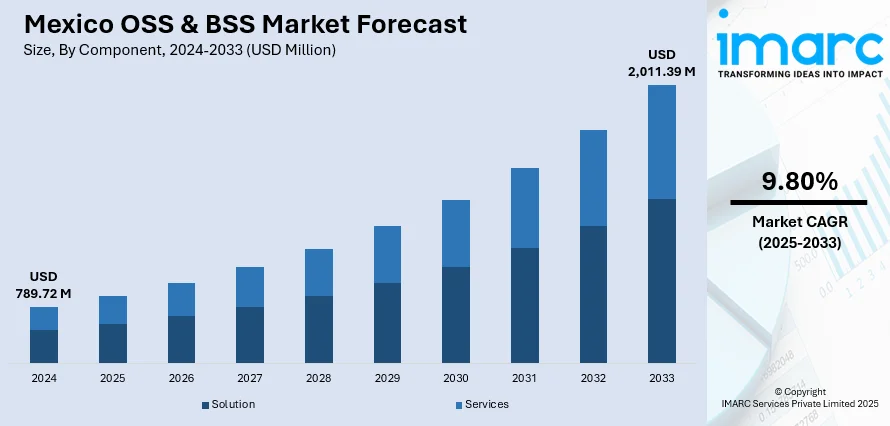

The Mexico OSS & BSS market size reached USD 789.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,011.39 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market is being driven by increasing demand for efficient telecom network management, the rise of 5G technologies, digital transformation initiatives, investments in automation, cloud computing, and the growing need for data-driven decision-making.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 789.72 Million |

| Market Forecast in 2033 | USD 2,011.39 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Mexico OSS & BSS Market Trends:

5G Deployment and Network Automation

The rapid deployment of 5G technology is a major driver of growth in Mexico’s OSS & BSS market. Telecom operators are making major investments in 5G infrastructure, resulting in a high demand for advanced network management systems capable of handling the complexity and size of these networks. OSS solutions aid with network administration, whereas BSS systems enable customer invoicing, service provisioning, and revenue management. The complexity of 5G networks, with their high-speed needs and large number of connected devices, necessitates advanced automation and real-time monitoring. By 2025, Mexico is expected to have more than 30 million 5G subscribers, according to the National Institute of Telecommunications (IFT), highlighting the necessity for effective network management and billing systems. Incorporating AI and machine learning into OSS/BSS systems is essential for network optimization and cost reduction, which will propel industry expansion.

Digital Transformation and Cloud Migration

Digital transformation is another critical driver of fostering the market growth. Cloud-based OSS and BSS solutions are being widely utilized by telecom operators and service providers to improve customer experience, save costs, and increase scalability. Operators can now effectively handle the exponential increase in data traffic and satisfy the need for real-time service delivery owing to the transition to the cloud. In today's ever changing telecom sector, cloud-based systems provide more flexible operations, quicker time-to-market for new services, and the ability to grow resources as needed. An increasing number of Mexican telecom operators are moving their OSS/BSS systems to the cloud. This transition is driven by the need for increased flexibility, cost efficiency, and improved customer service management. Concurrent with this, the incorporation of AI and data analytics into BSS systems, which enables telecom firms to provide individualized services and make choices instantly, is also acting as a significant growth-inducing factor.

Mexico OSS & BSS Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, OSS & BSS solution type, deployment mode, organization size, and industry vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

OSS & BSS Solution Type Insights:

- Network Planning and Design

- Service Delivery

- Service Fulfillment

- Service Assurance

- Billing and Revenue Management

- Network Performance Management

- Customer and Product Management

- Others

A detailed breakup and analysis of the market based on the OSS & BSS solution type have also been provided in the report. This includes network planning and design, service delivery, service fulfillment, service assurance, billing and revenue management, network performance management, customer and product management, and others.

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

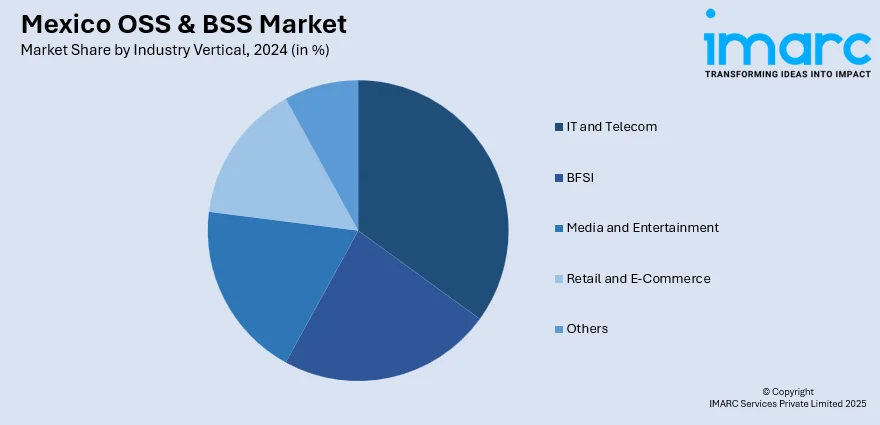

Industry Vertical Insights:

- IT and Telecom

- BFSI

- Media and Entertainment

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, BFSI, media and entertainment, retail and e-commerce, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico OSS & BSS Market News:

- February 2025: Movistar, Telefónica’s mobile carrier in Mexico, partnered with Helium to roll out a decentralized wireless network, granting over 2.3 million subscribers access to the Helium Network. By deploying Helium Mobile Hotspots—community-powered mini-cell towers—Movistar aims to enhance coverage and reduce infrastructure costs. This initiative also optimizes OSS and BSS by introducing new revenue models through decentralized infrastructure and potential collaborations with local Mobile Virtual Network Operators (MVNOs).

- June 2024: AT&T Mexico migrated its Amdocs Customer Experience Suite (CES) systems to Oracle Cloud Infrastructure (OCI). This strategic move enhances the efficiency of its OSS and BSS, providing improved scalability, flexibility, and cost-effectiveness.

Mexico OSS & BSS Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| OSS & BSS Solution Types Covered | Network Planning and Design, Service Delivery, Service Fulfillment, Service Assurance, Billing and Revenue Management, Network Performance Management, Customer and Product Management, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | IT and Telecom, BFSI, Media and Entertainment, Retail and E-Commerce, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico OSS & BSS market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico OSS & BSS market on the basis of component?

- What is the breakup of the Mexico OSS & BSS market on the basis of OSS & BSS solution type?

- What is the breakup of the Mexico OSS & BSS market on the basis of deployment mode?

- What is the breakup of the Mexico OSS & BSS market on the basis of organization size?

- What is the breakup of the Mexico OSS & BSS market on the basis of industry vertical?

- What are the various stages in the value chain of the Mexico OSS & BSS market?

- What are the key driving factors and challenges in the Mexico OSS & BSS?

- What is the structure of the Mexico OSS & BSS market and who are the key players?

- What is the degree of competition in the Mexico OSS & BSS market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico OSS & BSS market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico OSS & BSS market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico OSS & BSS industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)