Mexico Packaged Beverages Market Size, Share, Trends and Forecast by Type, Packaging Type, Distribution Channel, and Region, 2025-2033

Mexico Packaged Beverages Market Overview:

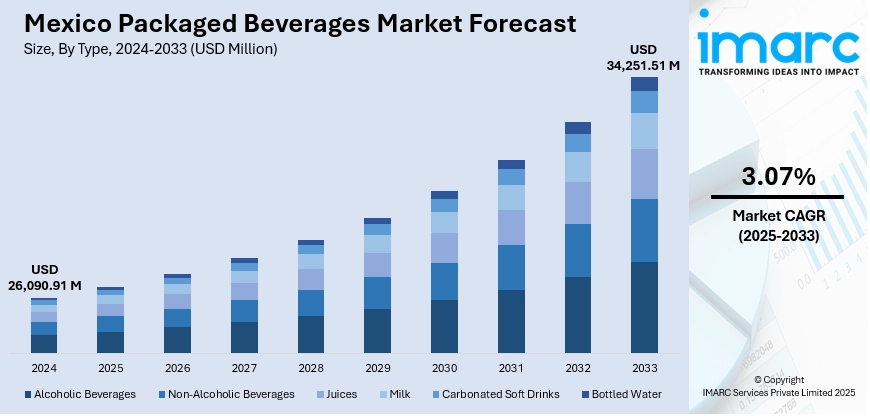

The Mexico packaged beverages market size reached USD 26,090.91 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 34,251.51 Million by 2033, exhibiting a growth rate (CAGR) of 3.07% during 2025-2033. The packaged beverages market is growing because of the rise of e-commerce platforms, offering consumers easier access to diverse beverage options. Additionally, the increasing demand for authentic, nostalgic drinks, particularly among younger generations, is fueling interest in traditional Mexican beverages, driving innovation and contributing to the expansion of the Mexico packaged beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26,090.91 Million |

| Market Forecast in 2033 | USD 34,251.51 Million |

| Market Growth Rate 2025-2033 | 3.07% |

Mexico Packaged Beverages Market Trends:

Rising Demand for Authentic and Nostalgic Beverages

With a growing desire to connect with their cultural roots, many consumers are turning to traditional and locally inspired beverages that evoke memories of past experiences. This tendency is particularly pronounced among demographics, such as Millennials, who are keen on reexploring and celebrating nostalgic tastes. Mexican traditional drinks, including fruit-flavored sodas, aguas frescas, and local specialties, are gaining popularity not only in Mexico but also in global markets with significant Mexican diaspora communities. Businesses are capitalizing on this interest by reviving classic beverages with a contemporary twist or by utilizing regional, handcrafted production techniques. The attractiveness of these drinks stems from their genuine nature, offering consumers a taste of Mexican culture in a convenient, ready to drink (RTD) format. Nostalgic tastes evoke emotional ties, and this feeling resonates especially with families seeking familiar flavors. This trend is broadening the market for conventional drinks while fostering innovation as brands create new versions of classic beverages that attract nostalgic experience seeking individuals and those discovering Mexican tastes for the first time. In 2024, Coca-Cola announced the regional relaunch of Barrilitos, a traditional Mexican fruit-flavored soft drink, in California and Texas. Originally from Monterrey, Barrilitos featured flavors like Mandarin, Apple, Pineapple, and Fruit Punch. The relaunch targeted multicultural Gen Z, Millennials, and families seeking authentic, nostalgic beverages.

To get more information on this market, Request Sample

Expansion of E-commerce and Distribution Channels

The growth of e-commerce and digital distribution networks is swiftly changing the packaged beverages market in Mexico. With the rise of online shopping, people can effortlessly access a broader range of beverages, including health-oriented choices and high-end brands, from their smartphones or computers. The rise of grocery delivery platforms and dedicated online drink sellers is enabling brands to penetrate previously neglected markets, reaching consumers who might lack access to conventional retail stores. Supermarkets and convenience stores continue to hold a crucial position in the market, yet there is a clear shift towards utilizing digital platforms to enhance product visibility and boost sales. The Mexican e-commerce market, which reached USD 47.5 billion in 2024, is expected to grow to USD 176.6 billion by 2033, with a projected CAGR of 14.5% from 2025 to 2033, highlighting the increasing importance of online retail for packaged beverages. Brands are adapting by enhancing their online visibility and upgrading delivery options to meet the growing demand for convenient shopping experiences. This change not only offers broader access to a variety of products but also enables brands to reach new consumer base throughout Mexico. With advancements in logistics and delivery services, businesses are poised to expand their reach, capitalizing on the rapid rise of e-commerce, thereby contributing to the Mexico packaged beverages market growth.

Mexico Packaged Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, packaging type, and distribution channel.

Type Insights:

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Juices

- Milk

- Carbonated Soft Drinks

- Bottled Water

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes alcoholic beverages, non-alcoholic beverages, juices, milk, carbonated soft drinks, and bottled water.

Packaging Type Insights:

- Cartons

- Cans

- Bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes cartons, cans, bottles, and others.

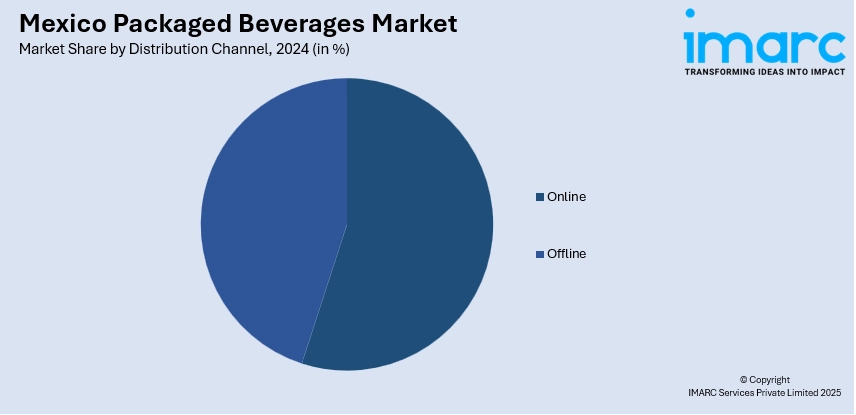

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Packaged Beverages Market News:

- In September 2024, Coca-Cola and Bacardi announced a new canned rum and Coke cocktail, set to launch in Mexico and select European markets in 2025. This move taped into the booming RTD cocktail market.

- In July 2024, Starbucks unveiled new packaging for its México Chiapas whole bean coffee, celebrating the rich coffee heritage of the Sierra Madre region. The design featured a jaguar and jungle imagery, highlighting the biodiversity and traditional farming methods of local coffee growers.

Mexico Packaged Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic Beverages, Non-Alcoholic Beverages, Juices, Milk, Carbonated Soft Drinks, Bottled Water |

| Packaging Types Covered | Cartons, Cans, Bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico packaged beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico packaged beverages market on the basis of type?

- What is the breakup of the Mexico packaged beverages market on the basis of packaging type?

- What is the breakup of the Mexico packaged beverages market on the basis of distribution channel?

- What is the breakup of the Mexico packaged beverages market on the basis of region?

- What are the various stages in the value chain of the Mexico packaged beverages market?

- What are the key driving factors and challenges in the Mexico packaged beverages market?

- What is the structure of the Mexico packaged beverages market and who are the key players?

- What is the degree of competition in the Mexico packaged beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico packaged beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico packaged beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico packaged beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)