Mexico Packaging Machinery Market Size, Share, Trends and Forecast by Machine Type, Technology, End-Use, and Region, 2026-2034

Mexico Packaging Machinery Market Summary:

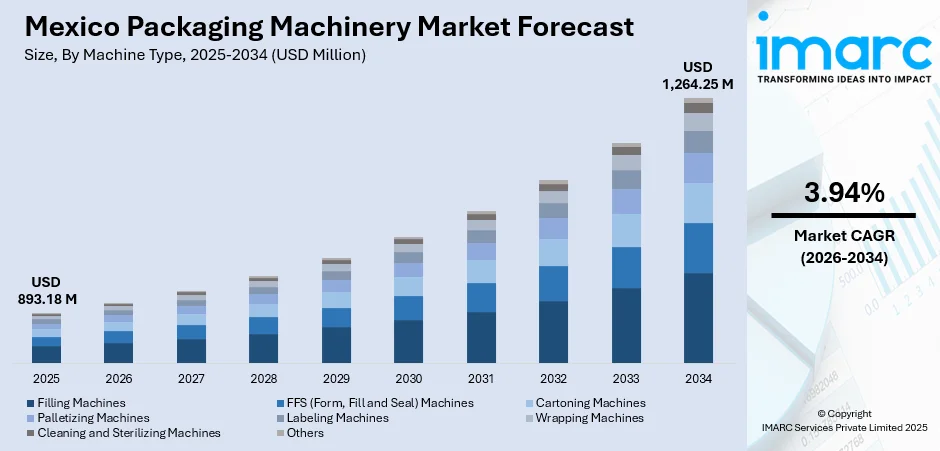

The Mexico packaging machinery market size was valued at USD 893.18 Million in 2025 and is projected to reach USD 1,264.25 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

The market is driven by the expansion of e-commerce and retail logistics, growing food and beverage export activities, increasing automation adoption across manufacturing facilities, and rising sustainability compliance requirements. Additionally, technological advancements in machinery capabilities, modernization of production lines, and stringent environmental regulations are propelling demand for advanced packaging solutions. The continuous push toward operational efficiency and integration of smart technologies further strengthens the Mexico packaging machinery market share.

Key Takeaways and Insights:

- By Machine Type: Filling machines dominates the market with a share of 26% in 2025, driven by demand for liquid and semi-liquid packaging. Their versatility, precision, and container compatibility make them ideal for high-volume, quality-focused production.

- By Technology: General packaging leads the market with a share of 58% in 2025, owing to broad applicability, cost-effectiveness, and adaptability across industries. Its established infrastructure and efficiency make it the preferred choice for manufacturers needing reliable standard packaging solutions.

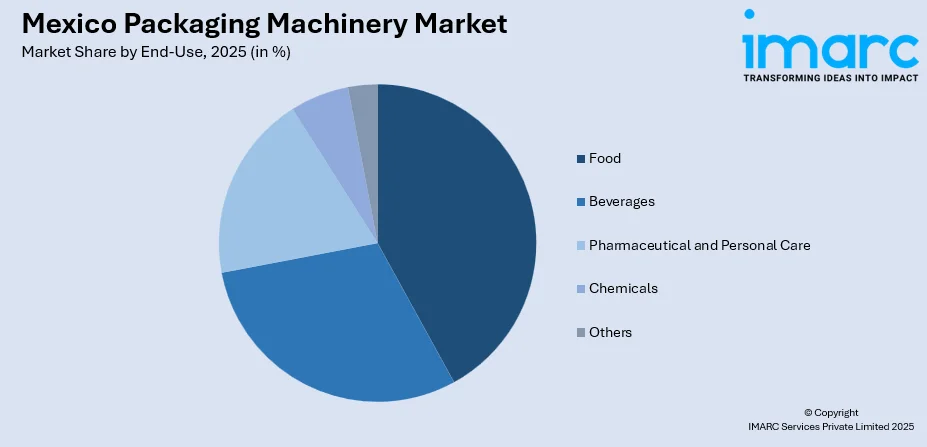

- By End-Use: Food represents the largest segment with a market share of 42% in 2025, driven by Mexico’s agricultural strength, growing processed food consumption, and export activities. Rising convenience foods and safety standards drive demand for advanced packaging machinery.

- Key Players: The market exhibits a moderately fragmented competitive structure, with established multinational equipment manufacturers competing alongside regional suppliers across various price and technology segments. Market participants differentiate through technological innovation, after-sales service networks, and customization capabilities to address diverse end-user requirements.

To get more information on this market Request Sample

The Mexico packaging machinery market is experiencing robust expansion driven by multiple converging factors reshaping the industrial landscape. The rapid growth of e-commerce has created unprecedented demand for versatile packaging solutions capable of handling diverse product assortments and fulfillment requirements. Simultaneously, Mexico's position as a major food and beverage exporter necessitates advanced packaging infrastructure to meet international quality standards and regulatory compliance. The manufacturing sector's ongoing modernization efforts prioritize automation and efficiency improvements, driving replacement of legacy equipment with technologically advanced machinery. Furthermore, sustainability mandates and environmental regulations compel manufacturers to adopt eco-friendly packaging technologies compatible with recyclable and compostable materials. As per sources, in 2025, Mexican companies representing over half of the nation’s plastic packaging market recovered 34 % of packaging in 2024, surpassing the 2025 target of 30%. Moreover, rising consumer expectations for product safety, freshness, and convenience continue accelerating investment in sophisticated packaging systems across all major industries.

Mexico Packaging Machinery Market Trends:

Integration of Smart Manufacturing and Industry Connectivity

The Mexico packaging machinery sector is witnessing accelerated adoption of interconnected manufacturing systems that enable seamless communication between equipment, production lines, and enterprise management platforms. Manufacturers increasingly prioritize machinery featuring advanced sensor technologies and real-time monitoring capabilities to optimize operational performance and minimize unplanned downtime. In June 2025, Mexican manufacturing firms implemented automation, artificial intelligence, and machine learning in preventive maintenance, enabling real-time monitoring and predictive interventions that reduce unplanned downtime. Moreover, this connectivity transformation facilitates predictive maintenance protocols, remote diagnostics, and automated adjustment capabilities that enhance overall equipment effectiveness. The integration of digital technologies enables comprehensive data collection throughout packaging operations, supporting continuous improvement initiatives and quality assurance programs while reducing manual intervention requirements across production environments.

Transition Toward Flexible and Modular Equipment Configurations

Packaging machinery suppliers are increasingly developing flexible equipment architectures capable of accommodating rapid format changes and diverse product specifications without extensive reconfiguration requirements. In October 2024, Nefab opened its León, Mexico facility, the first in the country to offer both heavy-gauge thermoformed and injection-molded packaging, enhancing flexible, modular production for LiB, E-mobility, and automotive sectors. This trend responds to manufacturer demands for agile production capabilities that support shorter production runs, seasonal variations, and expanding product portfolios. Modular equipment designs enable cost-effective scalability and simplified maintenance procedures while reducing capital expenditure for capacity expansions. The flexibility imperative reflects broader market dynamics including retailer requirements for differentiated packaging formats, consumer preferences for varied portion sizes, and the growing importance of customization capabilities in maintaining competitive positioning.

Emphasis on Sustainable Packaging Compatibility and Resource Efficiency

Environmental considerations are fundamentally reshaping packaging machinery development priorities throughout the Mexican market. Equipment manufacturers are engineering solutions optimized for sustainable packaging materials including recyclable films, compostable substrates, and lightweight alternatives that minimize environmental impact. According to reports, in July 2025, Grupo GEPP increased recycled PET content to 26% and recovered six out of every ten bottles produced in Mexico, advancing circular packaging and sustainability practices. Moreover, machinery designs increasingly incorporate energy-efficient components, reduced material waste features, and water conservation capabilities aligned with corporate sustainability objectives. This sustainability orientation reflects regulatory pressures, consumer environmental awareness, and corporate responsibility commitments driving comprehensive transformation across packaging value chains toward circular economy principles and reduced carbon footprint operations.

Market Outlook 2026-2034:

The Mexico packaging machinery market is projected to demonstrate sustained revenue expansion throughout the forecast period, driven by continued industrialization, export growth, and technological modernization across key end-use sectors. Market revenue growth will be supported by increasing automation penetration, sustainability compliance investments, and e-commerce infrastructure development. The convergence of digital transformation initiatives, regulatory requirements, and competitive pressures will accelerate equipment replacement cycles and premium technology adoption, positioning the market for consistent revenue advancement through sustained demand across diverse industrial applications. The market generated a revenue of USD 893.18 Million in 2025 and is projected to reach a revenue of USD 1,264.25 Million by 2034, growing at a compound annual growth rate of 3.94% from 2026-2034.

Mexico Packaging Machinery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Machine Type | Filling Machines | 26% |

| Technology | General Packaging | 58% |

| End-Use | Food | 42% |

Machine Type Insights:

- Filling Machines

- FFS (Form, Fill and Seal) Machines

- Cartoning Machines

- Palletizing Machines

- Labeling Machines

- Wrapping Machines

- Cleaning and Sterilizing Machines

- Others

The filling machines dominates with a market share of 26% of the total Mexico packaging machinery market in 2025.

Filling machines represent the leading segment within Mexico's packaging machinery market, commanding significant market presence due to their essential role across virtually all packaging operations involving liquid, semi-liquid, powder, and granular products. These machines deliver precise volumetric or gravimetric dispensing capabilities critical for maintaining product consistency, minimizing waste, and ensuring regulatory compliance across food, beverage, pharmaceutical, and chemical applications.

The segment's dominance reflects the extensive beverage industry presence in Mexico, pharmaceutical manufacturing expansion, and growing processed food production requiring accurate filling solutions. As per sources, Grupo GEPP reported a 73.3% increase in returnable glass and PET packaging volumes between 2018 and 2023, reflecting expanded sustainable beverage production and reduced raw-material usage in Mexico. Further, equipment innovations focus on enhanced speed, improved accuracy, simplified changeover procedures, and compatibility with diverse container formats, driving continued investment as manufacturers prioritize operational efficiency and product quality assurance across high-volume production environments.

Technology Insights:

- General Packaging

- Modified Atmosphere Packaging

- Vacuum Packaging

The general packaging leads with a share of 58% of the total Mexico packaging machinery market in 2025.

General packaging technology maintains the dominant market position, reflecting its widespread applicability across diverse industries and product categories requiring standard packaging solutions. This technology segment encompasses conventional packaging methodologies delivering reliable performance for applications where specialized atmospheric control or vacuum requirements are unnecessary, offering cost-effective solutions for high-volume operations. In April 2024, PAC Machinery announced to exhibit its fastest automatic bagger, the Rollbag® R785 with Thermal Transfer Printer, and the PVT Plus Vacuum Sealer, highlighting flexible packaging automation solutions and enhanced efficiency for Latin America’s growing packaging industry.

The segment benefits from established equipment availability, lower capital investment requirements, and simplified operational procedures compared to specialized technologies. Manufacturers across food, consumer goods, and industrial sectors continue relying on general packaging systems for routine applications, with ongoing equipment refinements enhancing productivity, reducing material consumption, and improving package quality while maintaining favorable economics for standard packaging requirements.

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverages

- Pharmaceutical and Personal Care

- Chemicals

- Others

Food exhibits a clear dominance with a 42% share of the total Mexico packaging machinery market in 2025.

The food industry represents the largest end-use segment for packaging machinery in Mexico, driven by the nation's substantial agricultural production, expanding processed food manufacturing, and significant export activities. This sector demands diverse packaging solutions addressing requirements from primary packaging of fresh produce through secondary and tertiary packaging for distribution and export applications.

Market growth within food applications reflects increasing consumption of packaged convenience foods, stringent safety and hygiene requirements, and expanding organized retail penetration driving demand for shelf-ready packaging formats. Equipment investments prioritize food safety compliance, extended shelf-life capabilities, portion control accuracy, and sustainable packaging compatibility as manufacturers respond to evolving consumer preferences and regulatory requirements governing food packaging throughout supply chains. According to sources, in 2023, PMMI reported that sustainability, automation, and capacity enhancement were the primary forces shaping machinery investment in Mexico’s packaging sector, reflecting strong industry modernization momentum.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a significant packaging machinery market driven by its extensive manufacturing base, proximity to export markets, and concentration of maquiladora operations. The region's industrial corridors feature substantial food processing, beverage production, and pharmaceutical manufacturing facilities requiring sophisticated packaging infrastructure to support export-oriented production and meet international quality standards.

Central Mexico dominates market activity through its concentration of consumer goods manufacturers, food and beverage producers, and pharmaceutical companies clustered around major metropolitan areas. The region benefits from established logistics infrastructure, skilled workforce availability, and proximity to primary domestic consumption markets driving sustained packaging machinery investment across diverse industries.

Southern Mexico presents emerging market opportunities supported by agricultural processing activities, regional food manufacturing development, and expanding industrial diversification initiatives. The region's packaging machinery demand centers on food preservation, beverage production, and processing facilities serving both domestic markets and growing export channels requiring modern packaging capabilities.

Others collectively contribute to market activity through distributed manufacturing operations, regional food processing facilities, and localized production serving specific geographic markets. These areas demonstrate growing packaging machinery adoption as industrial development initiatives expand manufacturing capabilities beyond traditional industrial corridors, supporting broader economic diversification objectives.

Market Dynamics:

Growth Drivers:

Why is the Mexico Packaging Machinery Market Growing?

Expansion of E-Commerce and Modern Retail Distribution Channels

The transformative growth of electronic commerce and modern retail formats is fundamentally reshaping packaging machinery requirements throughout Mexico's manufacturing landscape. Online retail expansion creates demand for versatile packaging solutions capable of handling diverse product assortments, protecting goods during extended distribution journeys, and supporting accelerated fulfillment operations. According to sources, in 2025, AMVO reported that 16.1% of Mexico’s retail sales occurred online, confirming the country’s position as Latin America’s leading digital commerce market. Moreover, e-commerce logistics require packaging machinery delivering rapid format changeover capabilities, automated case erection and sealing systems, and integrated labeling solutions supporting individualized order processing. Modern retailers similarly drive packaging innovation through requirements for shelf-ready packaging, portion control accuracy, and sustainable packaging formats that enhance merchandise presentation while reducing in-store labor requirements. This channel evolution compels manufacturers to invest in flexible, high-speed packaging equipment supporting diverse packaging configurations.

Manufacturing Sector Modernization and Automation Investment

Mexican manufacturers across industries are undertaking comprehensive modernization initiatives prioritizing automation, efficiency enhancement, and quality improvement to strengthen competitive positioning in domestic and international markets. Aging packaging equipment replacement programs drive demand for technologically advanced machinery incorporating automated controls, enhanced precision, and improved reliability compared to legacy systems. According to reports, IFR reported Mexico added 5,600 industrial robots in 2024, underscoring continued national investment in automation across automotive and advanced manufacturing sectors. Furthermore, automation investments target labor cost reduction, consistency improvement, and capacity expansion without proportional workforce increases, particularly relevant given rising wage pressures and skilled labor availability constraints. Manufacturers additionally seek machinery supporting Industry connectivity enabling real-time performance monitoring, predictive maintenance capabilities, and integration with enterprise management systems optimizing overall operational effectiveness across production environments.

Regulatory Compliance and Sustainability Requirements

Evolving regulatory frameworks and corporate sustainability commitments are creating sustained demand for packaging machinery compatible with environmental compliance objectives. Federal environmental regulations increasingly mandate sustainable packaging materials, waste reduction measures, and extended producer responsibility programs requiring equipment modifications or replacements. As per sources, SEMARNAT began drafting Mexico’s National Circular Economy Policy 2025–2030, introducing a new plastics EPR mandate requiring producers to finance and manage full lifecycle responsibilities. Furthermore, corporate environmental commitments similarly drive investment in machinery supporting recyclable packaging materials, reduced material consumption, energy efficiency improvements, and water conservation measures aligned with sustainability reporting requirements. International export markets impose additional packaging compliance requirements influencing equipment specifications for manufacturers serving global customers. This regulatory environment creates ongoing investment drivers as manufacturers upgrade equipment portfolios to address current and anticipated compliance requirements while maintaining operational efficiency.

Market Restraints:

What Challenges the Mexico Packaging Machinery Market is Facing?

High Capital Investment Requirements for Advanced Equipment

The substantial capital expenditure required for acquiring advanced packaging machinery presents significant barriers, particularly for small and medium enterprises with limited financial resources. Sophisticated automation features, precision controls, and specialized capabilities command premium pricing that extends equipment payback periods and complicates investment justification processes. Financing constraints and economic uncertainties further inhibit equipment acquisition decisions, delaying modernization timelines across price-sensitive market segments.

Technical Workforce Availability and Training Requirements

Advanced packaging machinery operation, maintenance, and optimization require technically skilled personnel whose availability remains constrained across Mexican industrial regions. Sophisticated equipment features including programmable controls, automated diagnostics, and networked connectivity demand operator competencies exceeding traditional machinery requirements. Training program investments and ongoing skill development needs represent additional cost burdens that complicate advanced equipment adoption.

Infrastructure and Utility Service Limitations

Reliable electrical supply, compressed air availability, and supporting utility infrastructure remain inconsistent across certain manufacturing regions, constraining advanced packaging machinery deployment. Equipment performance depends upon stable power quality, adequate utility capacity, and appropriate environmental conditions that some facilities struggle to maintain consistently. Infrastructure limitations particularly affect operations in developing industrial areas outside established manufacturing corridors.

Competitive Landscape:

The Mexico packaging machinery market features a dynamic competitive environment characterized by participation from established international equipment suppliers alongside regional manufacturers serving diverse market segments. Competition centers on technological differentiation, service network coverage, customization capabilities, and total cost of ownership positioning as buyers evaluate equipment alternatives. Market participants pursue varied strategies including specialization in specific machinery categories, comprehensive portfolio approaches, and vertical integration with complementary equipment offerings. After-sales service capabilities, spare parts availability, and technical support responsiveness significantly influence competitive positioning given the critical operational importance of packaging equipment. Emerging sustainability requirements and digital transformation expectations create additional competitive dimensions as manufacturers seek suppliers supporting comprehensive modernization objectives.

Recent Developments:

- In June 2024, Bartelt Packaging, a ProMach brand, unveiled its new BMP‑6 rotary pre‑made pouch machine at EXPO PACK México 2024 in Mexico City. The budget-friendly, compact machine supports production of 1–5 million pouches per year, targeting food, beverage, home, and personal care packaging lines.

Mexico Packaging Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Machine Types Covered | Filling Machines, FFS (Form, Fill and Seal) Machines, Cartoning Machines, Palletizing Machines, Labeling Machines, Wrapping Machines, Cleaning and Sterilizing Machines, Others |

| Technologies Covered | General Packaging, Modified Atmosphere Packaging, Vacuum Packaging |

| End-Uses Covered | Food, Beverages, Pharmaceutical and Personal Care, Chemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico packaging machinery market size was valued at USD 893.18 Million in 2025.

The Mexico packaging machinery market is expected to grow at a compound annual growth rate of 3.94% from 2026-2034 to reach USD 1,264.25 Million by 2034.

Filling machines held the largest market share, driven by extensive demand across food, beverage, pharmaceutical, and chemical industries requiring precise volumetric dispensing capabilities for liquid and semi-liquid products throughout high-volume production operations.

Key factors driving the Mexico packaging machinery market include e-commerce expansion requiring versatile packaging solutions, manufacturing sector modernization and automation investments, sustainability compliance requirements, and growing food and beverage export activities.

Major challenges include high capital investment requirements for advanced equipment, limited availability of technically skilled workforce, infrastructure constraints in certain regions, extended equipment delivery timelines, maintenance complexity, and financing accessibility limitations for smaller enterprises.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)