Mexico Pain Management Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, Distribution Channel, and Region, 2025-2033

Mexico Pain Management Drugs Market Overview:

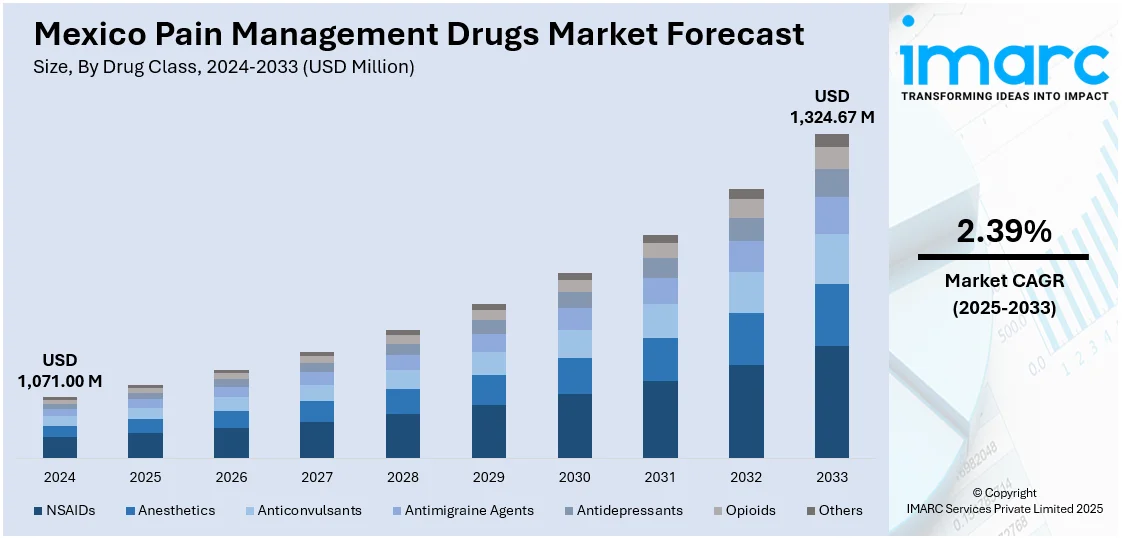

The Mexico pain management drugs market size reached USD 1,071.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,324.67 Million by 2033, exhibiting a growth rate (CAGR) of 2.39% during 2025-2033. The market is experiencing significant growth driven by rising chronic disease cases, aging population, and increased demand for non-opioid alternatives. In line with this, growing healthcare access and ongoing pharmaceutical innovation continue to support long-term market stability and development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,071.00 Million |

| Market Forecast in 2033 | USD 1,324.67 Million |

| Market Growth Rate 2025-2033 | 2.39% |

Mexico Pain Management Drugs Market Trends:

Rising Prevalence of Chronic Conditions

The rising prevalence of chronic health conditions in Mexico is significantly influencing the demand for pain relief medications. Conditions such as arthritis, cancer, fibromyalgia, and neuropathic disorders are becoming more common, contributing to steady Mexico pain management drugs market growth. These long-term illnesses often require consistent and varied pain management solutions, including NSAIDs, opioids, antidepressants, and topical agents. According to the reports published by OECD, cancer remains a major public health issue in Mexico, being the fourth leading cause of mortality. Between 2023 and 2050, it will account for 30% of one in 14 premature deaths, totaling 46,200 annually. Health spending on cancer is projected to rise by 106%, costing MXN 10.6 billion extra each year. With more patients seeking sustained relief, healthcare providers are increasingly focused on personalized treatment approaches and long-term medication plans. This growing patient pool is also pushing pharmaceutical companies to introduce more advanced and better-tolerated formulations. Public healthcare programs and private sector expansion are working in tandem to improve access to pain therapies, especially in rural and aging populations. As the healthcare infrastructure continues to evolve and awareness around chronic pain increases, the Mexico pain management drugs market outlook remains strong and positive.

Rise in Geriatric Population

Mexico’s expanding elderly population is becoming a key factor in the rising demand for pain management drugs. With age-related conditions such as osteoporosis, arthritis, and post-operative pain becoming more prevalent, the need for consistent and effective pain relief is increasing across both public and private healthcare settings. According to the data published by Pan American Health Organization, in 2024, Mexico’s population reached 130 861 007, a 32.7% increase since 2000. Those aged 65 and older comprised 8.2% of the population, up 3.2 percentage points. The dependency ratio was 48.7 per 100 active individuals. Older adults often require tailored treatment strategies, as they may face complications from drug interactions or chronic comorbidities. As a result, physicians are relying more on a combination of pharmacological and non-opioid alternatives to manage pain safely. Additionally, longer life expectancy and increased surgical interventions among the elderly have led to sustained prescription volumes for both short-term recovery and long-term pain management. This demographic trend is prompting pharmaceutical companies to focus on safer, senior-friendly formulations and delivery methods, further enhancing accessibility and compliance. The aging population continues to significantly influence Mexico pain management drugs market share.

Mexico Pain Management Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on drug class, indication, and distribution channel.

Drug Class Insights:

- NSAIDs

- Anesthetics

- Anticonvulsants

- Antimigraine Agents

- Antidepressants

- Opioids

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes NSAIDs, anesthetics, anticonvulsants, antimigraine agents, antidepressants, opioids, and others.

Indication Insights:

- Musculoskeletal Pain

- Surgical and Trauma Pain

- Cancer Pain

- Neuropathic Pain

- Migraine Pain

- Obstetrical Pain

- Fibromyalgia Pain

- Burn Pain

- Dental/Facial Pain

- Pediatric Pain

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes musculoskeletal pain, surgical and trauma pain, cancer pain, neuropathic pain, migraine pain, obstetrical pain, fibromyalgia pain, burn pain, dental/facial pain, pediatric pain, and others.

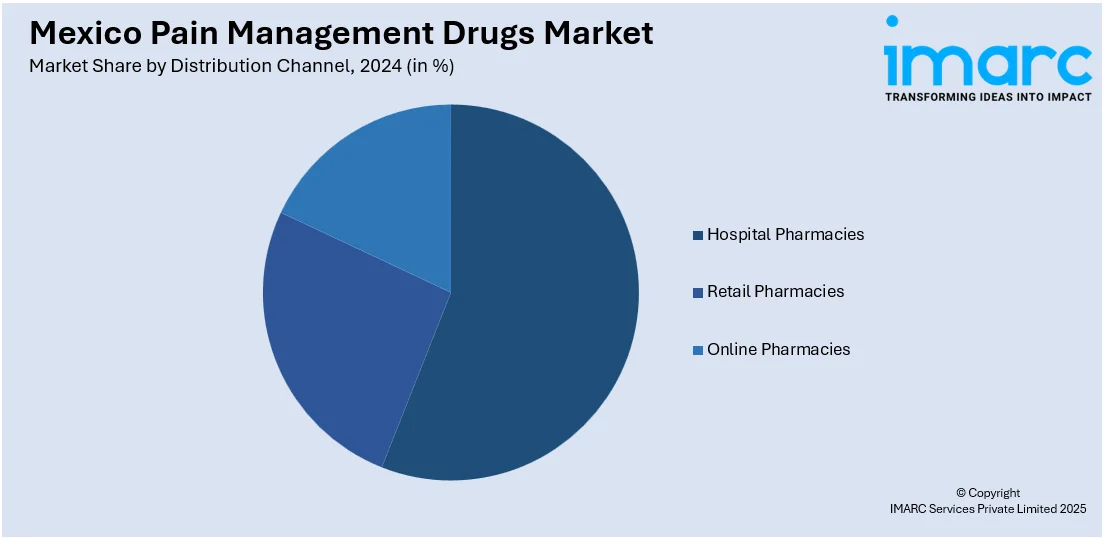

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico Region, Central Mexico Region, Southern Mexico Region, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Pain Management Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | NSAIDs, Anesthetics, Anticonvulsants, Antimigraine Agents, Antidepressants, Opioids, Others |

| Indications Covered | Musculoskeletal Pain, Surgical and Trauma Pain, Cancer Pain, Neuropathic Pain, Migraine Pain, Obstetrical Pain, Fibromyalgia Pain, Burn Pain, Dental/Facial Pain, Pediatric Pain, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Northern Mexico Region, Central Mexico Region, Southern Mexico Region, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico pain management drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico pain management drugs market on the basis of drug class?

- What is the breakup of the Mexico pain management drugs market on the basis of indication?

- What is the breakup of the Mexico pain management drugs market on the basis of distribution channel?

- What is the breakup of the Mexico pain management drugs market on the basis of region?

- What are the various stages in the value chain of the Mexico pain management drugs market?

- What are the key driving factors and challenges in the Mexico pain management drugs?

- What is the structure of the Mexico pain management drugs market and who are the key players?

- What is the degree of competition in the Mexico pain management drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico pain management drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico pain management drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico pain management drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)