Mexico Paint Market Size, Share, Trends and Forecast by Technology, Type of Paint, Resin, End User, and Region, 2025-2033

Mexico Paint Market Overview:

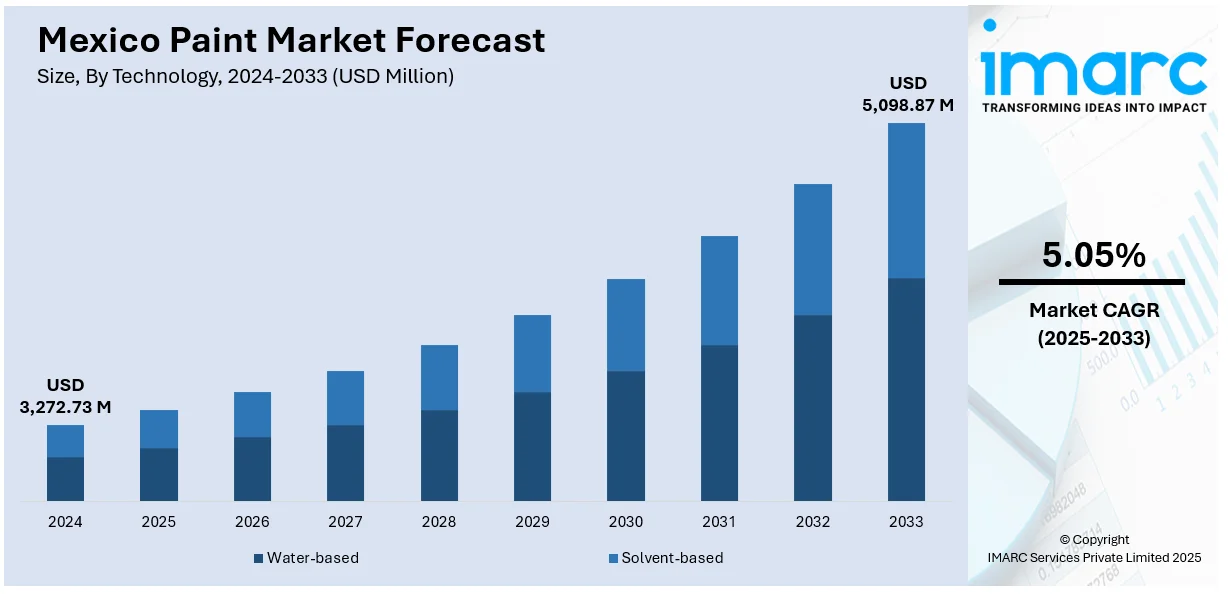

The Mexico paint market size reached USD 3,272.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,098.87 Million by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The market is witnessing steady growth, supported by rising construction activities, increasing automotive production, and growing demand for decorative and protective coatings. The shifting consumer preferences toward eco-friendly and water-based paints, prompting innovation among local and international manufacturers, and industrial and infrastructure developments are further driving product demand across various sectors. Strategic partnerships and product diversification also continue to shape the competitive landscape of the Mexico paint market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,272.73 Million |

| Market Forecast in 2033 | USD 5,098.87 Million |

| Market Growth Rate 2025-2033 | 5.05% |

Mexico Paint Market Trends:

Sustainable and Eco-Friendly Products

The Mexican paint market is witnessing a significant rise in demand for sustainable and eco-friendly products, fueled by stricter environmental regulations and heightened consumer awareness. Water-based paints are gaining popularity because they release fewer volatile organic compounds (VOCs), resulting in a reduced environmental impact and better indoor air quality. These paints are not only safer for consumers but also comply with stricter regulations governing emissions and pollutants. As a result, manufacturers are investing in developing more environmentally friendly coatings that meet these regulatory standards. Consumers, especially in residential and commercial sectors are also shifting towards these eco-friendly alternatives due to concerns over sustainability and health. This trend is expected to continue as eco-consciousness grows with companies increasingly offering low-VOC, biodegradable and non-toxic paint options to meet the evolving market demand for green products.

Automotive and Industrial Expansion

Mexico's growing role as a global manufacturing hub is significantly boosting the demand for high-performance coatings in the automotive and industrial sectors. As automotive production ramps up driven by both domestic and international demand the need for coatings that offer durability, corrosion resistance and aesthetic appeal increases. Mexico's automotive industry including major players like Ford and General Motors is thriving further contributing to this demand. For instance, in May 2024, BASF launched a new automotive paint brand Baslac in Mexico. The solution offers material savings and reduces refinish process time. It includes tools like a WhatsApp bot for queries, an online Formula Finder, and a virtual training center enhancing efficiency for vehicle refinish professionals. In addition, the industrial sector's rapid growth including manufacturing and infrastructure development is also spurring the use of industrial coatings. These coatings are essential for protecting machinery, equipment and infrastructure from wear, corrosion, and harsh environmental conditions. As a result, the expansion of Mexico's automotive and industrial sectors plays a pivotal role impelling the Mexico paint market growth.

Technological Advancements

Technological innovations in the paint sector including UV-cured and antimicrobial coatings are increasingly popular because of their longevity and niche applications. UV-cured coatings are transforming the sector by providing quick curing times which enhances production efficiency and minimizes energy usage. The coatings are extremely resistant to wear and tear making them suitable for automotive, industrial, and architectural use. In line with this, antimicrobial coatings are gaining popularity for applications where there is a need for increased hygiene including healthcare settings, kitchens, and public areas. These coatings inhibit the development of bacteria, fungi, and other microorganisms enhancing surface durability and safety. As both technologies advance their performance and versatility are setting new standards for conventional coatings making them indispensable across various industries. As increasing demand for effective and durable options is arising these technologies are profoundly contributing to the future of the paint industry.

Mexico Paint Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, type of paint, resin, and end user.

Technology Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water-based and solvent-based.

Type of Paint Insights:

- Emulsion

- Enamel

- Distemper

- Textures

- Others

A detailed breakup and analysis of the market based on the type of paint have also been provided in the report. This includes emulsion, enamel, distemper, textures, and others.

Resin Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the resin have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

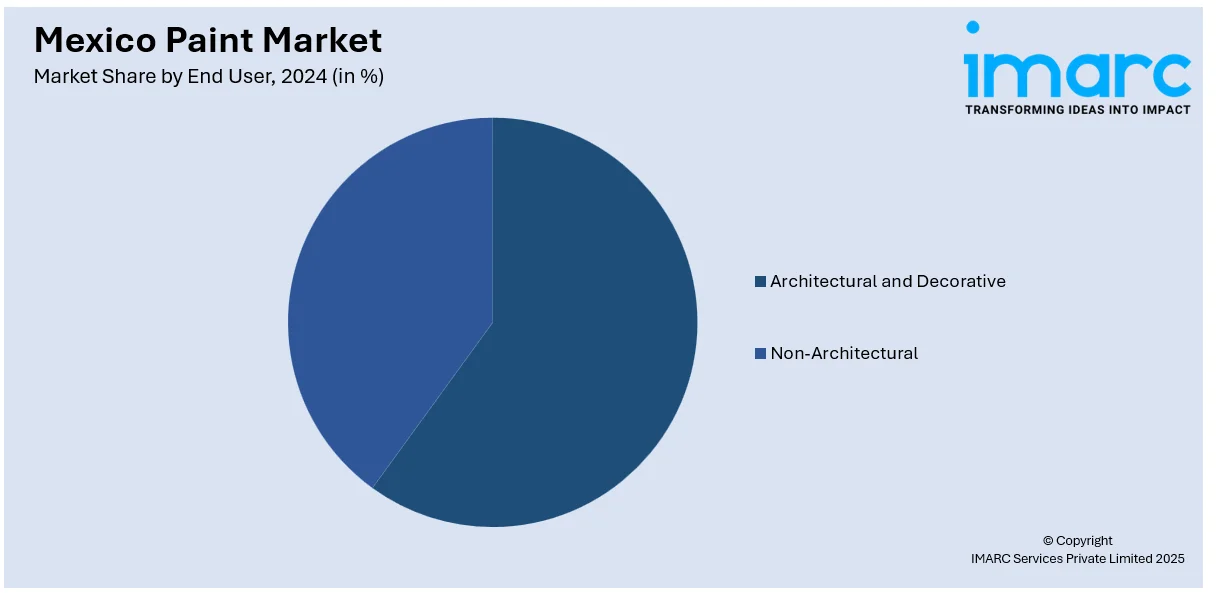

End User Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, and others).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paint Market News:

- In December 2024, WEG announced its plans to invest R$100 million in the construction of a new industrial liquid paint factory in Atotonilco de Tula, Mexico which is scheduled to open in early 2026. This facility is designed to increase production capacity and meet the growing demand for efficient and sustainable coatings in North and Central America.

- In August 2024, Axalta launched its innovative FCLE automotive paint technology in Mexico aiming to reduce energy consumption by up to 58% in paint drying. This advancement aligns with sustainability goals and reduces operating costs for workshops. The company also garnered approvals for its products at the CESVI Expo reinforcing its commitment to efficient technologies.

Mexico Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Water-based, Solvent-based |

| Types of Paint Covered | Emulsion, Enamel, Distemper, Textures, Others |

| Resins Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| End Users Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paint market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paint market on the basis of technology?

- What is the breakup of the Mexico paint market on the basis of type of paint?

- What is the breakup of the Mexico paint market on the basis of resin?

- What is the breakup of the Mexico paint market on the basis of end user?

- What is the breakup of the Mexico paint market on the basis of region?

- What are the various stages in the value chain of the Mexico paint market?

- What are the key driving factors and challenges in the Mexico paint market?

- What is the structure of the Mexico paint market and who are the key players?

- What is the degree of competition in the Mexico paint market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paint market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paint market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paint industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)