Mexico Paper Packaging Products Market Size, Share, Trends and Forecast by Product Type, Material Type, End-Use Industry, and Region, 2025-2033

Mexico Paper Packaging Products Market Overview:

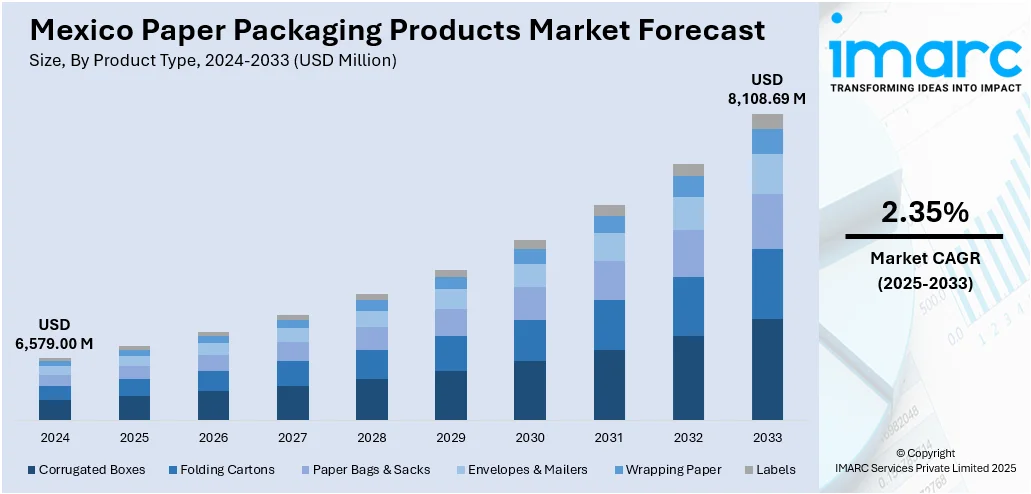

The Mexico paper packaging products market size reached USD 6,579.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,108.69 Million by 2033, exhibiting a growth rate (CAGR) of 2.35% during 2025-2033. The market is being driven by the rapid progress of e-commerce and retail sectors demanding sustainable delivery solutions, alongside stringent government regulations and bans on single-use plastics, which are compelling industries to adopt recyclable and eco-friendly paper-based packaging alternatives across various applications and supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,579.00 Million |

| Market Forecast in 2033 | USD 8,108.69 Million |

| Market Growth Rate 2025-2033 | 2.35% |

Mexico Paper Packaging Products Market Trends:

Growth of the E-commerce and Retail Sector

The rapid growth of Mexico's organized retail and e-commerce sectors is a key factor driving the market for paper packaging products in the country. Mexico's e-commerce retail sales have experienced significant growth in recent years, driven by increasing internet penetration, rising mobile phone usage, and improved payment gateways. This digital transformation has significantly altered packaging needs, as products sold online must be shipped in safe, frequently branded, and sustainable packaging: functions that paper-based materials are well-suited to perform. Paper packaging offers several benefits in this regard: it is lightweight, affordable, easily branded, and recyclable, which resonates with companies and consumers who prioritize sustainability. Corrugated boxes, kraft paper wraps, and paperboard envelopes are among the most popular paper packaging forms used in e-commerce. In addition, physical stores in the FMCG, fashion, electronics, and food categories are also increasingly using paper substitutes for plastic as a result of changing consumer behavior and environmental legislation.

To get more information on this market, Request Sample

Government Regulations and Ban on Single-Use Plastics

Another factor driving the growth of Mexico's paper packaging market is the growing regulatory pressure against single-use plastics at both state and federal levels. Various Mexican states, including Mexico City, Oaxaca, and Querétaro, have imposed bans or restrictions on single-use plastic bags, straws, containers, and other disposable items. The Mexico City prohibition, in place since January 2021, was particularly effective, banning the sale of a wide range of plastic products and compelling companies to transition to biodegradable or recyclable substitutes—most commonly paper-based packaging solutions. This policy-led change has triggered demand across a broad range of industries, including food and beverage, personal care, retail, and manufacturing. Paper packaging has become the natural alternative with its minimum environmental footprint, recyclability, and consumer favor. Regulatory requirements have compelled both large corporations and small enterprises to reassess their packaging value chains, driving innovation in paper-based alternatives, such as molded fiber boxes, paper straws, and coated paper wraps.

Mexico Paper Packaging Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material type, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Cartons

- Paper Bags & Sacks

- Envelopes & Mailers

- Wrapping Paper

- Labels

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding cartons, paper bags & sacks, envelopes & mailers, wrapping paper, and labels.

Material Type Insights:

- Virgin Paper

- Recycled Paper

- Kraft Paper

- Coated Paper

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes virgin paper, recycled paper, kraft paper, and coated paper.

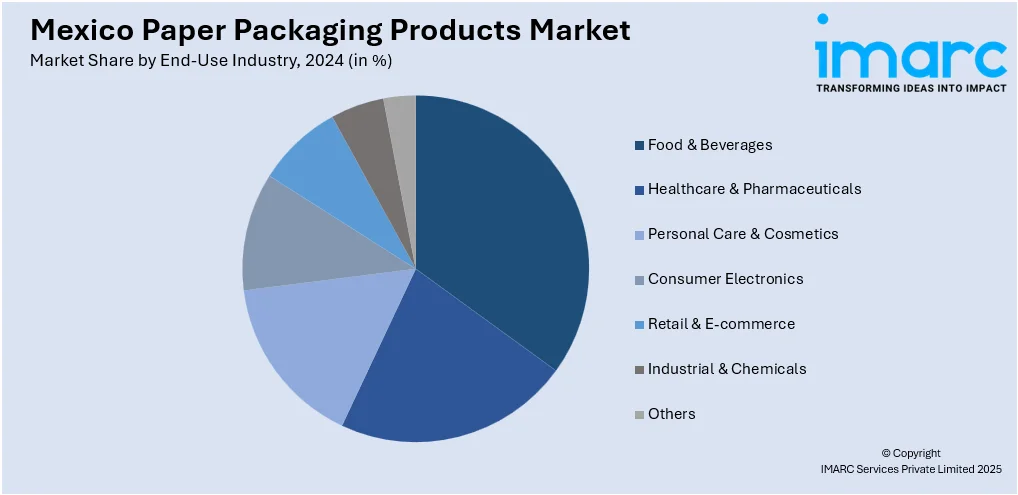

End-Use Industry Insights:

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Consumer Electronics

- Retail & E-commerce

- Industrial & Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes food & beverages, healthcare & pharmaceuticals, personal care & cosmetics, consumer electronics, retail & e-commerce, industrial & chemicals, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paper Packaging Products Market News:

- January 2025: Albéa Tubes launched its ‘Metamorphosis’ paper-based cosmetic tube at its Queretaro, Mexico facility, as part of a strategic move to meet the escalating local demand for sustainable packaging solutions. The innovative tube integrates up to 50% FSC-certified paper and is complemented by the EcoFusion Top, which combines the tube head and cap into a single, streamlined component for enhanced eco-efficiency.

- January 2025: Balaji JMC Paper Mill, a subsidiary of JMC Paper Tech Private Limited, established a 200 TPD Kraft test liner facility in Ciudad Juárez, Mexico. Equipped with an advanced wastewater treatment system, the plant is designed to produce 100% recycled test liner paper.

Mexico Paper Packaging Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Envelopes & Mailers, Wrapping Paper, Labels |

| Material Types Covered | Virgin Paper, Recycled Paper, Kraft Paper, Coated Paper |

| End-Use Industries Covered | Food & Beverages, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Consumer Electronics, Retail & E-commerce, Industrial & Chemicals, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paper packaging products market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paper packaging products market on the basis of product type?

- What is the breakup of the Mexico paper packaging products market on the basis of material type?

- What is the breakup of the Mexico paper packaging products market on the basis of end-use industry?

- What is the breakup of the Mexico paper packaging products market on the basis of region?

- What are the various stages in the value chain of the Mexico paper packaging products market?

- What are the key driving factors and challenges in the Mexico paper packaging products market?

- What is the structure of the Mexico paper packaging products market and who are the key players?

- What is the degree of competition in the Mexico paper packaging products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paper packaging products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paper packaging products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paper packaging products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)