Mexico Paper and Paperboard Packaging Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Mexico Paper and Paperboard Packaging Market Overview:

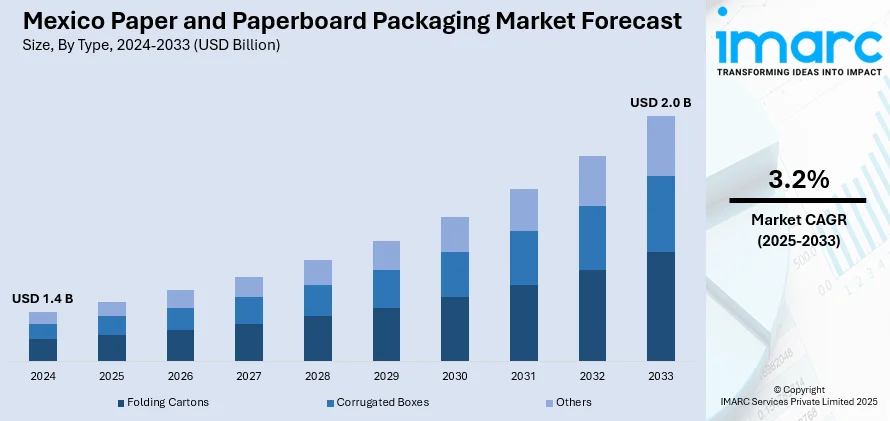

The Mexico paper and paperboard packaging market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033. The market is fueled by growing demand for recyclable and sustainable materials driven by environmental mandates and consumer desires. Furthermore, the expansion of e-commerce activities and nearshoring trends are driving demand for paper-based packaging in many industry sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

Mexico Paper and Paperboard Packaging Market Trends:

Sustainability and Eco-friendly Materials

The need for environmentally-friendly packaging has increased with increased environmental awareness and consumer desire for green products. According to a 2023 Tetra Pak survey, more than 75% of customers take into consideration environmentally-friendly packaging when deciding on beverage brands. Interestingly, two-thirds of respondents are ready to pay extra for green products, and most steer clear of companies with negative environmental impacts. In emerging economies such as India, China, and Turkey, more than 60% of customers actively look for environmental data about products, as opposed to fewer than 25% in the developed world. Consequently, paper and paperboard packaging, as biodegradable and recyclable, are being favored more than plastics. Manufacturers are turning towards recycled paper and sustainable sourcing, including FSC-certified wood pulp, in addition to technologies such as water-based coatings and biodegradable inks thus impelling the Mexico paper and paperboard packaging share.

Digital Printing and Customization

Digital printing technology, which provides more customization, quicker production times, and cost effectiveness especially for small quantities is revolutionizing the packaging of paper and paperboard in Mexico. Digital printing is being used more and more by brands to produce unique packaging that appeals to customers. The trend toward product customization and the need for more focused marketing have been the main drivers of the phenomena. Intricate designs, changeable data printing, and quick design changes are all made feasible by digital printing, which enables a prompt response to consumer requests and market situations. In addition to this, businesses are employing packaging as a significant marketing device, offering customers unique and personalized experiences thus aiding the Mexico paper and paperboard packaging growth.

E-commerce Growth and Packaging Adaptation

As e-commerce has grown, paper and paperboard packaging has adapted to serve new requirements for strength, protection, and efficiency. Packaging now has to deliver products in a complete condition while reducing shipping expenses, causing the introduction of light yet durable paperboard alternatives. Customization, including printed boxes and creative designs, creates an improved unboxing experience and distinguishes brands. Packaging is also designed for improved storage and handling in warehouses, essential for quick-moving e-commerce. A 2024 Shopify survey reported that 72% of consumers would pay more for sustainable packaging, reflecting the move toward sustainable materials. The rise in popularity of subscription services and direct-to-consumer (D2C) shipping has further increased the demand for easy-to-use, protective packaging that fits consumer expectations for product safety and sustainability.

Mexico Paper and Paperboard Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Folding Cartons

- Corrugated Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes folding cartons, corrugated boxes, and others.

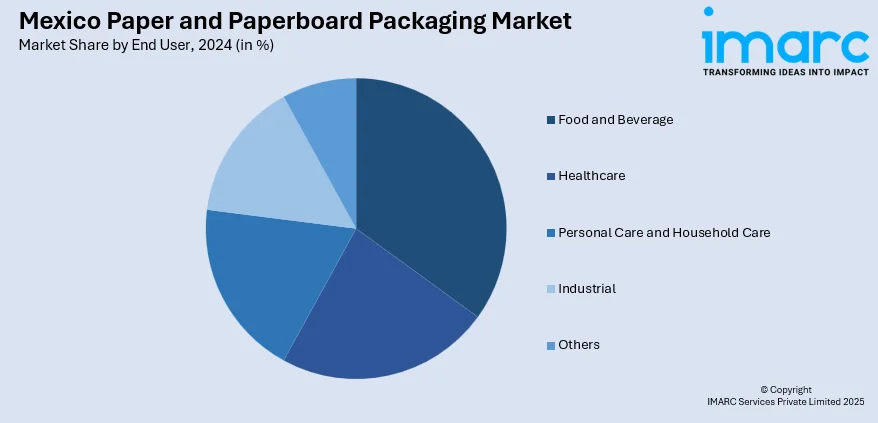

End User Insights:

- Food and Beverage

- Healthcare

- Personal Care and Household Care

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverage, healthcare, personal care and household care, industrial, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Paper and Paperboard Packaging Market News:

- In February 2025, Mexico's Ministry of Economy launched antidumping investigations into Chinese imports of cardboard and polycarbonate sheets on February 13 and 14, 2025. The probes, prompted by claims of unfairly low prices from companies like Productora de Papel and Cartones Ponderosa, aim to assess whether these imports harm domestic producers. The investigation covers imports from August 2019 to July 2024, focusing on coated paper and paperboard products.

- In November 2024, Fastmarkets plans to launch two new price assessments in January 2025: one for Mexico's domestic CRB (coated recycled folding boxboard) kraft/grey back (320-325 g/m2) and another for US export SBS (solid bleached sulfate board) 16-pt folding carton. These prices will be reported monthly in PPI Pulp & Paper Week and PPI Latin America, starting on January 17 and January 21, respectively.

Mexico Paper and Paperboard Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Folding Cartons, Corrugated Boxes, Others |

| End Users Covered | Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico paper and paperboard packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico paper and paperboard packaging market on the basis of type?

- What is the breakup of the Mexico paper and paperboard packaging market on the basis of end user?

- What is the breakup of the Mexico paper and paperboard packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico paper and paperboard packaging market?

- What are the key driving factors and challenges in the Mexico paper and paperboard packaging market?

- What is the structure of the Mexico paper and paperboard packaging market and who are the key players?

- What is the degree of competition in the Mexico paper and paperboard packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico paper and paperboard packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico paper and paperboard packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico paper and paperboard packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)