Mexico Particle Board Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

Mexico Particle Board Market Overview:

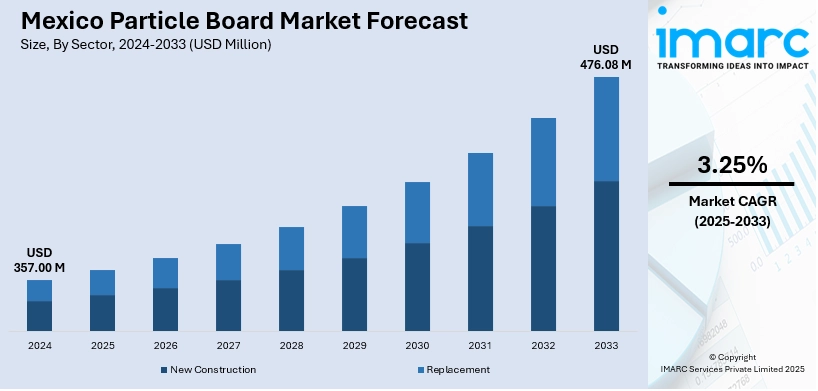

The Mexico particle board market size reached USD 357.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 476.08 Million by 2033, exhibiting a growth rate (CAGR) of 3.25% during 2025-2033. Increasing demand from construction and furniture industries, rising urbanization, and government initiatives promoting sustainable building materials are key drivers. Growing exports and adoption of advanced manufacturing technologies also boost production efficiency. These factors collectively enhance the Mexico particle board market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 357.00 Million |

| Market Forecast in 2033 | USD 476.08 Million |

| Market Growth Rate 2025-2033 | 3.25% |

Mexico Particle Board Market Trends:

Growing Construction Sector Boosts Mexico Particle Board Market Growth

The rapid expansion of Mexico’s construction industry, driven by urbanization and infrastructure development, is significantly propelling the particle board market growth. Residential and commercial construction projects require cost-effective, durable, and eco-friendly materials, leading to increased particle board consumption. For instance, industry reports stat that in April 2025, U.S. exports of MDF panels to Mexico surged 66% year-on-year, reaching 19,000 cubic meters. This uptick in exports underscores the increasing demand for MDF panels in Mexico, contributing to the overall expansion of the Mexico particle board market growth. Additionally, government housing programs and investments in public infrastructure contribute to sustained demand. This trend encourages manufacturers to scale production and innovate product lines to meet evolving standards, thus strengthening the Mexico particle board market growth.

To get more information on this market, Request Sample

Adoption of Sustainable and Eco-Friendly Materials Fuels Market Expansion

Environmental concerns and regulatory pressures in Mexico are driving demand for sustainable building products, including particle boards made from recycled wood and agricultural residues. For instance, according to recent market trends, the Mexico green building materials market recorded revenue of USD 4,260.7 Million in 2024 and is projected to grow to USD 7,290.0 Million by 2030. Manufacturers are increasingly adopting green technologies and eco-friendly adhesives to reduce formaldehyde emissions and carbon footprints. This shift aligns with global sustainability goals and attracts environmentally conscious consumers and builders. Consequently, this trend supports the Mexico particle board market growth by differentiating products and expanding their market appeal.

Mexico Particle Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/region level for 2025-2033. Our report has categorized the market based on application and sector.

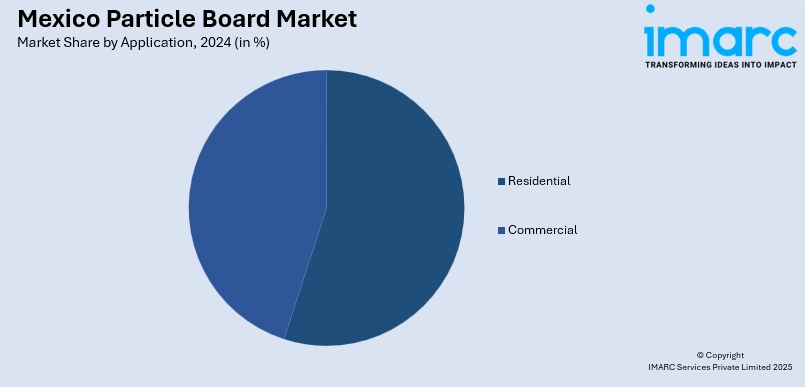

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Particle Board Market News:

- In May 2024, Kronospan, with a significant presence in Mexico, announced the acquisition of Woodgrain’s particleboard facility in Island City, Oregon. This acquisition strengthens Kronospan’s presence in the North America wood panel market. Kronospan plans to modernize the plant and retain its 124 employees, aligning with its growth strategy and commitment to stakeholders.

- In January 2024, Duraplay acquired Masisa’s particleboard plant in Chihuahua, Mexico, for USD 18 Million. The deal includes the land, buildings, machinery, and equipment associated with the plant. Masisa will continue its presence in the Mexican market through a renewed direct sales model from Chile, focusing on value-added products and services.

Mexico Particle Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico particle board market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico particle board market on the basis of application?

- What is the breakup of the Mexico particle board market on the basis of sector?

- What is the breakup of the Mexico particle board market on the basis of region?

- What are the various stages in the value chain of the Mexico particle board market?

- What are the key driving factors and challenges in the Mexico particle board market?

- What is the structure of the Mexico particle board market and who are the key players?

- What is the degree of competition in the Mexico particle board market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico particle board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico particle board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico particle board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)