Mexico Patient Handling Equipment Market Size, Share, Trends and Forecast by Product, Type of Care, End User, and Region, 2025-2033

Mexico Patient Handling Equipment Market Overview:

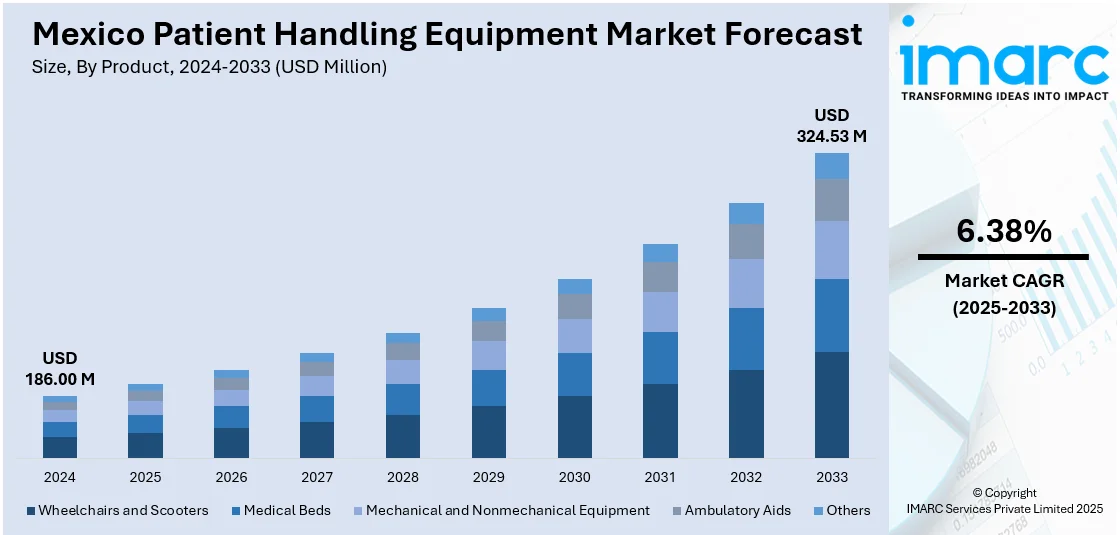

The Mexico patient handling equipment market size reached USD 186.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 324.53 Million by 2033, exhibiting a growth rate (CAGR) of 6.38% during 2025-2033. Rising elderly population, increasing chronic disease burden, growing focus on healthcare infrastructure, and stricter workplace safety regulations are major drivers of the market. The push toward reducing caregiver injuries, expanding hospital networks, and adoption of assistive technologies also contribute to Mexico patient handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 186.00 Million |

| Market Forecast in 2033 | USD 324.53 Million |

| Market Growth Rate 2025-2033 | 6.38% |

Mexico Patient Handling Equipment Market Trends:

Integration of IoT and Sensor-Based Monitoring Systems

One of the emerging trends in Mexico’s patient handling equipment market is the integration of Internet of Things (IoT) and sensor technologies to enhance operational safety and real-time patient monitoring. Equipment such as ceiling lifts and hospital beds are being embedded with motion detectors and weight sensors, enabling automated alerts for fall prevention, improper positioning, or excessive strain on equipment. These features improve patient safety and assist caregivers in responding swiftly to critical situations. Additionally, hospitals and long-term care facilities are leveraging these smart systems for data analytics, which support maintenance schedules and inform clinical decisions. As Mexico continues to modernize its healthcare infrastructure, especially in urban centers, the demand for intelligent patient mobility solutions is anticipated to rise steadily. For instance, in April 2024, Joerns Healthcare and ONDO Systems announced a strategic partnership to enhance long-term post-acute care through the Connexio Platform for Connected Care. This collaboration integrates Joerns’ healthcare equipment expertise with ONDO’s cloud-based, IoT-enabled dashboard system. The goal is to reduce caregiver burden, lower operational costs, and improve care delivery. The platform enables real-time data insights for clinical and workflow efficiency, addressing evolving healthcare needs with scalable, value-based solutions tailored to the long-term care environment.

Expansion of Home Healthcare Services

The rapid expansion of home healthcare services is a major driver for Mexico patient handling equipment market growth. For instance, as per industry reports, Mexico’s home healthcare market is projected to grow at a compound annual rate of 10.3% between 2024 and 2030. With rising preference for in-home care among aging populations and patients with mobility challenges, there is a notable increase in the use of portable hoists, transfer slings, and adjustable hospital beds designed for residential settings. Affordability, convenience, and the comfort of familiar environments are key factors driving this transition. Furthermore, health insurers and public health initiatives are promoting home-based care to alleviate hospital overcrowding. This has led to more manufacturers tailoring their offerings for compact, user-friendly, and easily serviceable devices suitable for home use. The growth of this segment also supports Mexico’s broader healthcare cost-containment efforts while ensuring quality patient care outside clinical environments.

Mexico Patient Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, type of care, and end user.

Product Insights:

- Wheelchairs and Scooters

- Medical Beds

- Mechanical and Nonmechanical Equipment

- Ambulatory Aids

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wheelchairs and scooters, medical beds, mechanical and nonmechanical equipment, ambulatory aids, and others.

Type of Care Insights:

- Bariatric Care

- Fall Prevention

- Critical Care

- Wound Care

- Others

A detailed breakup and analysis of the market based on the type of care have also been provided in the report. This includes bariatric care, fall prevention, critical care, wound care, and others.

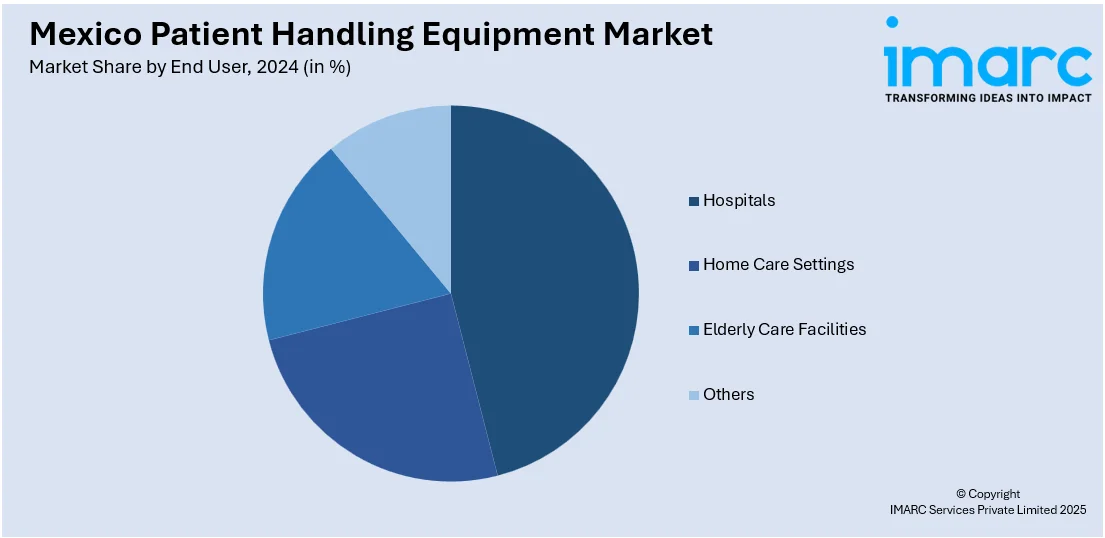

End User Insights:

- Hospitals

- Home Care Settings

- Elderly Care Facilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, home care settings, elderly care facilities, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Patient Handling Equipment Market News:

- In April 2025, Arjo, which is operational in Mexico through its subsidiary, Arjo México Equipos Médicos, S.A. de C.V., launched the Maxi Move 5, a next-generation mobile patient floor lift aimed at improving patient care and reducing caregiver strain. Building on five decades of innovation, this advanced lift features Arjo Motion Assist and a Powered Dynamic Positioning System to support safer, more efficient transfers. An independent study showed it reduces caregiver exertion by up to 68%.

Mexico Patient Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs and Scooters, Medical Beds, Mechanical and Nonmechanical Equipment, Ambulatory Aids, Others |

| Types of Care Covered | Bariatric Care, Fall Prevention, Critical Care, Wound Care, Others |

| End Users Covered | Hospitals, Home Care Settings, Elderly Care Facilities, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico patient handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico patient handling equipment market on the basis of product?

- What is the breakup of the Mexico patient handling equipment market on the basis of type of care?

- What is the breakup of the Mexico patient handling equipment market on the basis of end user?

- What is the breakup of the Mexico patient handling equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico patient handling equipment market?

- What are the key driving factors and challenges in the Mexico patient handling equipment market?

- What is the structure of the Mexico patient handling equipment market and who are the key players?

- What is the degree of competition in the Mexico patient handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico patient handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico patient handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico patient handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)